That is an opinion editorial by Will Szamosszegi, founder and CEO of bitcoin mining internet hosting service Sazmining.

Cash and vitality are two of probably the most elementary facets of an economic system as a result of each are common. Vitality is required to rework uncooked supplies into ultimate shopper items and providers. Cash is required to retailer wealth, calculate income and losses and commerce for items and providers that you simply could not purchase by way of barter.

Though Bitcoin drastically improves humanity’s relationship with each vitality and cash, the issues that plague each vitality and cash are prone to survive a Bitcoin customary, even when they grow to be lesser in severity. With respect to vitality, authorities rules, subsidies and bans will proceed to have sway. With respect to cash, governments will, in all probability, proceed to make use of second-layer fiat cash that residents are pressured to make use of.

Authorities Meddling In Vitality

America authorities has been attempting to centrally plan the vitality sector since 1789, effectively earlier than fiat forex reached its “ultimate type” within the fateful 12 months of 1971. In intensive analysis on the subject of the U.S. authorities’s historical past of subsidizing the vitality sector, DBL Buyers managing associate Nancy Pfund and economics graduate pupil Ben Healey made a number of sober discoveries (although they favor authorities intervention within the vitality sector, to make sure):

Though not a direct subsidy, the U.S. authorities raised a tariff on the sale of British coal in 1789 to profit the American coal business. This was solely two years after delegates on the Constitutional Conference explicitly fought to incorporate the “gold and silver clause” within the U.S. Structure. This clause made its means into Article One of many founding doc, the place it lives on as stating that particular person states weren’t allowed to “make any Factor however gold and silver Coin a Tender in Cost of Money owed.” In different phrases, the political equipment of the time, although much more monetarily constrained than our present-day Leviathan State, was nonetheless in a position to exert its will over the vitality sector.

To be truthful, tariffs are simpler for a authorities to enact than subsidies, since solely the latter requires the federal government to have cash to spare. However historical past exhibits subsidies, too, have existed earlier than the fiat customary went into full impact in 1971. For instance, the Value-Anderson Act of 1957 pressured the federal authorities to subsidize nuclear vitality by paying for the damages incurred by a nuclear catastrophe.

Hydropower, too, has been federally sponsored since at the least the Eighteen Nineties, although quantifying the dimensions of those subsidies is difficult. Earth Monitor, a suppose tank that works to standardize vitality subsidy information, estimates that the U.S. federal authorities has offered about $2.7 billion (in 2010 {dollars}) to hydropower from the nation’s inception till 2010. Naturally, this timespan covers a variety of various financial regimes.

Authorities Meddling In Cash

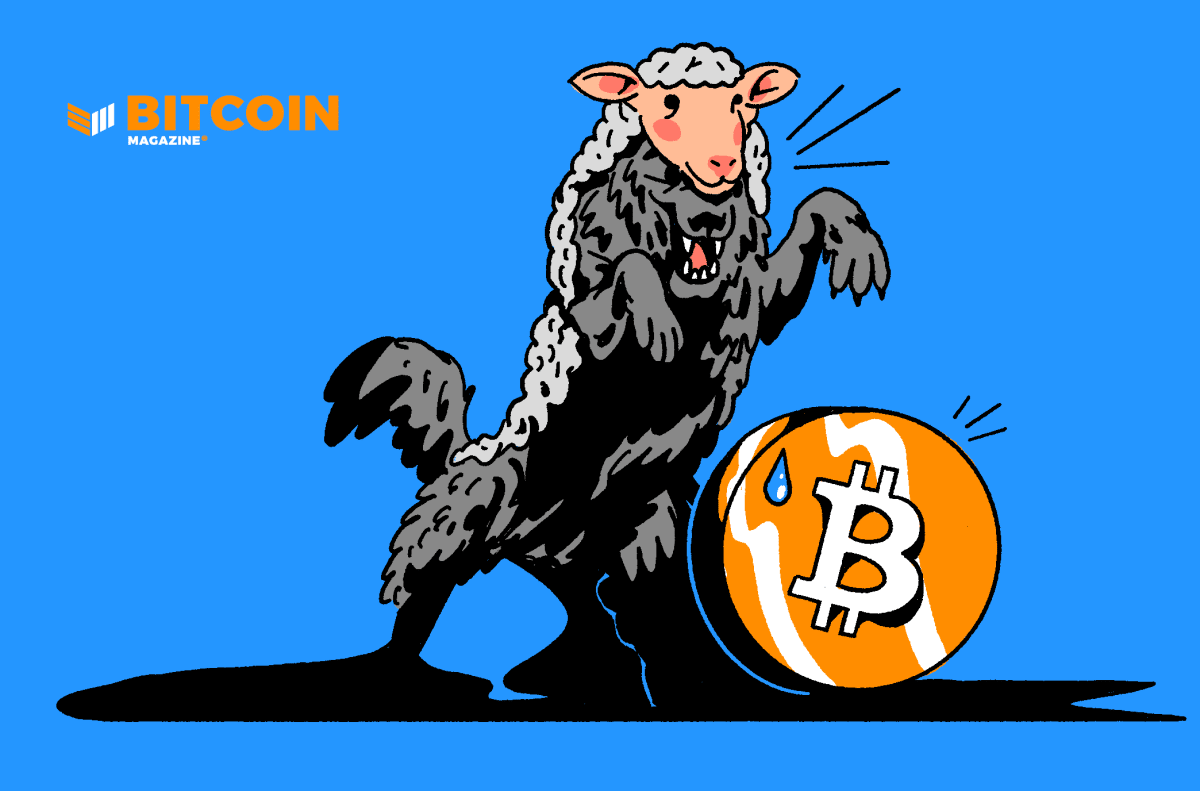

As a lot certainty as many within the Bitcoin group have about bitcoin turning into the subsequent international reserve asset, governments are distinctive establishments and may harm our relationship with cash, even after bitcoin turns into the brand new gold.

Governments additionally wield the specter of violence and incarceration by way of the military-industrial complicated to retain financial energy.

For instance, think about that the U.S. authorities/central financial institution accepts the brand new bitcoin financial regime and even holds it on its steadiness sheet. Certainly by this time, the worldwide financial order could have vastly modified for the higher — nonetheless, if governments are nonetheless round, they’re probably nonetheless utilizing the specter of violence and/or incarceration to gather taxes. To maintain some Layer 2 fiat forex alive, all they should do is mandate that taxes be paid in stated fiat forex. Individuals will then haven’t any selection however to acquire this forex to be able to hand it over to the tax man.

To make certain, there are a number of causes that such a scheme might not work. For one, “competitors” between governments would possibly strain them to ease up on forcing fiat currencies on residents who’re utilizing Bitcoin and Bitcoin-based Layer 2 applied sciences of their day by day lives. Secondly, ideological strain from residents would possibly strain politicians to surrender on creating their very own fiat currencies for concern of profession suicide. And at last, governments themselves might view such a scheme as being extra hassle than it’s price, since a Bitcoin-based economic system has the potential to develop at a a lot better price than a Bitcoin-fiat hybrid economic system would.

We Should Stay Vigilant

With respect to each vitality and cash, the federal government should intervene after bitcoin has grow to be the subsequent international reserve asset and after Bitcoin mining has endlessly improved our relationship with cash. On this sense, Bitcoin’s inevitable victory is just the start — we should should fend off meddling bureaucrats. To make certain, freedom-loving Bitcoiners can be in a a lot better place to take action then than we at the moment are. However, we should not relaxation on our laurels.

What can we do to actually exorcize the State from cash and vitality? The identical factor that we do now: clarify our concepts.

We wish a free market in vitality in order that probably the most cost-effective types of vitality are found and made worthwhile over inefficient alternate options. Moreover, subsidies, tariffs and rules within the vitality sector hamper innovation. For all we all know, absent a lot intervention all through the centuries, our world can be powered by chilly fusion, oceans and nuclear vitality by now.

And government-imposed cash, even when by some means backed by bitcoin, would throw sand within the gears of capital accumulation and financial calculation. The price of accumulating capital would rise, since we’d have to preserve some rubbish cash in our again pocket for tax season. In different phrases, the manufacturing of all types of products and providers would by no means come to go, since they’d now not be inexpensive. And entrepreneurs’ skill to calculate income or losses turns into tougher, since there isn’t a longer a single immutable measuring stick (bitcoin), but in addition an unpredictable fiat forex nonetheless buying and selling alongside Satoshi Nakamoto’s creation.

Our job won’t be completed, even after Bitcoin wins the cash sport and Bitcoin mining wins the vitality sport, as governments gained’t stop. However our concepts can be a lot simpler to promote by that time, that I, for one, am trying ahead to the battles forward.

This can be a visitor publish by Will Szamosszegi. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.