That is an opinion editorial by Level39, a researcher centered on Bitcoin, know-how, historical past, ethics and vitality.

On December 14, the U.S. Senate Committee on Banking, Housing & City Affairs acquired inaccurate testimony relating to Bitcoin from actor Ben McKenzie and Professor Hillary J. Allen. The listening to, entitled “Crypto Crash: Why the FTX Bubble Burst and Hurt to Shoppers,” had all of the markings of political theater and supplied a stage to misinform senators and the general public. It coincided with Elizabeth Warren’s new monetary surveillance invoice, which is a catastrophe for privateness and civil liberties. On December 18, the Senate Banking Committee Chair Senator Sherrod Brown divulged on “Meet The Press” that the listening to was supposed to “educate the general public” on the risks of cryptocurrencies and floated the thought of banning them altogether.

Mr. McKenzie Goes To Washington

Actor Ben McKenzie, who has starred in “The O.C.,” “Gotham” and “Southland,” lacks the {qualifications} and experience one would anticipate for being referred to as earlier than the U.S. Senate Banking Committee to testify on the interior workings of economic know-how. It ought to subsequently come as no shock that he made fundamental errors in his testimony, and will have been prevented altogether had witnesses with precise experience been referred to as. In line with Mr. McKenzie:

“Bitcoin can’t work as a medium of trade as a result of it can’t scale. The Bitcoin community can solely course of 5 to 7 transactions a second. By comparability, Visa can deal with tens of 1000’s. To facilitate that comparatively trivial quantity of transactions, Bitcoin makes use of an unlimited quantity of vitality. In 2021, Bitcoin consumed 134 TWh in whole, similar to {the electrical} vitality consumed by the nation of Argentina. Bitcoin merely can’t ever work at scale as a medium of trade.

–Written testimony of Ben McKenzie Schenkkan, December 14, 2022, U.S. Senate Banking Committee

McKenzie’s testimony leaves one with the impression that he deliberately sought out probably the most biased and unreliable sources to verify his personal predetermined conclusions. Sadly, it was false data.

Leaving apart the truth that he referenced Digiconomist, an unreliable, exaggerated and critically flawed electrical energy consumption estimate from a Dutch central financial institution worker’s private weblog that lacks peer evaluation (Cambridge College’s information is effectively revered and estimates that Bitcoin consumed 105 terawatt hours (TWh), or roughly 22% much less vitality than Digiconomist estimated, for 2021), McKenzie is successfully evaluating a automotive engine to a wheel and never realizing how they relate to one another.

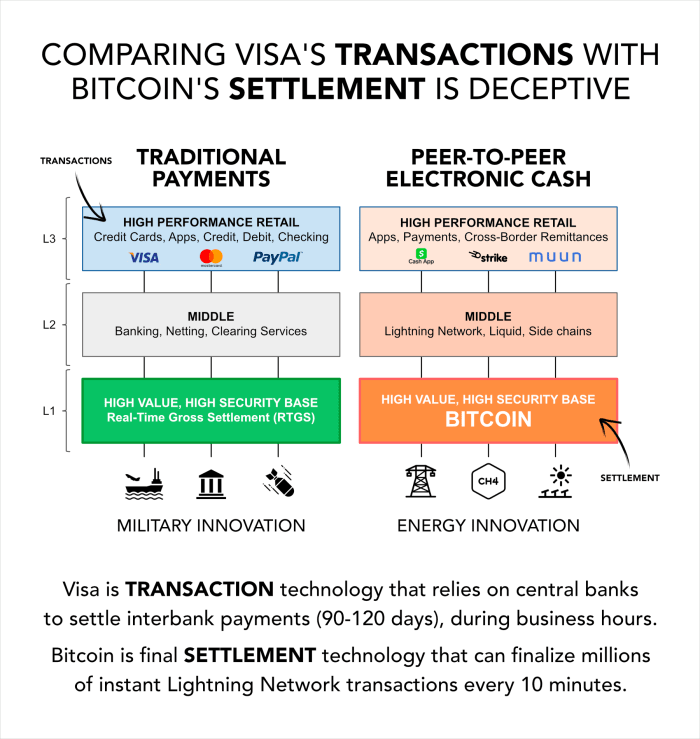

In technical phrases, McKenzie conflated Visa’s transaction community with Bitcoin’s closing settlement community, to make the illogical declare that Bitcoin can’t scale. It is a novice mistake. One might use the identical defective logic to make the inaccurate declare that thousands and thousands of retail funds throughout the banking system ought to be unattainable as a result of banks usually wait till the top of the enterprise day to settle funds with one another. That, in fact, just isn’t true, as gross settlement is exactly how high-volume retail funds are batched between banks.

Visa is a credit-based transaction community. It’s not a monetary establishment, so it doesn’t really switch cash and can’t carry out closing settlement like Bitcoin can. Visa is successfully an IT firm that informs its member banks the best way to clear and carry out gross settlement with one another throughout enterprise hours. If you happen to’ve ever waited a couple of days for a verify to clear, you recognize that funds between two financial institution accounts are usually not instantaneous. Bank card transactions take one to a few days to publish. And 90 to120 days to settle.

The Visa system works effectively and gives providers comparable to danger evaluation, fraud prevention and clawbacks, however can incur excessive charges from the banks and intermediaries alongside the way in which. Member banks aren’t really sending one another tens of 1000’s of funds each second. As a substitute, they batch thousands and thousands of transactions collectively right into a small variety of closing settlement funds. The settlements are usually routed via lower-volume real-time gross settlement (RTGS) networks operated by central banks, comparable to Fedwire within the U.S. or TARGET2 within the EU.

Bitcoin and Fedwire can carry out about the identical variety of transactions per 12 months. In December of 2020, Bitcoin performed 26 million transfers (counting a number of outputs) throughout 9.6 million transactions, whereas Fedwire settled 18 million transactions throughout the identical time interval. Simply as Visa operates on transactional layers that batch transactions into gross settlement layers, Bitcoin is designed to scale in the same method.

Bitcoin’s Lightning Community was formally theorized as a scaling answer at MIT in 2016 and at the moment is a burgeoning Layer 2 open funds protocol, layered on high of Bitcoin. The Lightning Community allows immediate funds, and micropayments all the way down to a fraction of a penny, and might scale as much as all the world. Micropayments alone might change e-commerce and the web itself as we all know it. Think about machines or individuals streaming fractions of pennies for content material or APIs and you may already start to see a brand new future for the web rising. Conventional finance merely can’t obtain this.

The Lightning Community permits excessive throughput Layer 3 retail fee apps and providers comparable to Money App, Strike and plenty of different apps to effectively batch transactions into Bitcoin’s “blocks” for closing settlement. Providers on Layer 3 can provide the identical protections we’re used to within the legacy monetary system, however anybody can freely entry Bitcoin’s Layer 2 or Layer 1 every time they need.

“Whereas it could require time and funding, Visa’s fee community might sit on high of the bitcoin community to satisfy funds a lot the identical approach it sits on high of the present banking system.”

–Parker Lewis

Whereas Fedwire adheres to restricted working hours, shutting down on weekends and holidays, Bitcoin by no means shuts down and it continues settling transactions roughly each 10 minutes — 24 hours a day, seven days every week, three hundred and sixty five days a 12 months. Bitcoin has achieved the same uptime to Fedwire since Bitcoin’s inception and has demonstrated higher uptime than Fedwire since 2013. Fedwire skilled a significant outage in 2021.

There isn’t any doubt that the bigger cryptocurrency business has turn into rife with fraud, scams and deception and it is commendable that McKenzie makes an effort to warn the general public about these risks. Nevertheless, in his haste to sentence all the business, he did not essentially perceive what units Bitcoin other than the seemingly countless “crypto” scams and fraud which have sprung up round Satoshi Nakamoto’s invention.

Bitcoin’s Lightning Community has a theoretical throughput of 40 million transactions per second. Simply because the web took greater than a technology to realize at the moment’s ranges of connectivity and attain, the Lightning Community would wish time to develop its liquidity for it to realize this theoretical most throughput. The efficiency of the Lightning Community is already astounding and is faster than traditional contactless payments. Thus, the testimony McKenzie supplied to the U.S. Senate Banking Committee that, “Bitcoin merely can’t ever work at scale as a medium of trade” was not solely deceptive, it was false.

Bitcoin makes use of multi-layered structure, modeled after the present monetary system and banking techniques going again to at least the 15th century. Layered structure is a perfect sample for well-built data know-how techniques — together with cellular networks and the web itself. This sort of deliberate and clever structure is what allows Bitcoin to turn into a decentralized medium of trade for all the planet.

In his written testimony, McKenzie highlighted the problems plaguing El Salvador’s Bitcoin banking system, Chivo — a privately-built, government-controlled Layer 3 system that plugs into the Lightning Community. Nevertheless, he failed to tell senators that customers in El Salvador are free to make use of high-quality open-source wallets, comparable to Muun or Bitcoin Seaside pockets and a variety of others. Extra importantly, the know-how is beginning to make a distinction within the lives of those that would in any other case be unbanked, as journalist Sharyn Alfonsi of “60 Minutes” found on a go to to El Salvador earlier this 12 months.

McKenzie, who after getting excessive one night determined to jot down a guide on the rampant fraud within the crypto business, has since begun a collaboration with journalist Jacob Silverman on the endeavor. McKenzie earned his bachelor of arts diploma from the College of Virginia in 2001, majoring in international affairs and economics. That the U.S. Senate Banking Committee felt that an actor with an atrophied undergraduate diploma in economics would by some means make an professional witness for a very difficult monetary innovation means that the listening to was solely supposed as political theater.

Senators Regurgitate Ben McKenzie’s Fallacious Testimony

When it was Senator Mark Warner’s flip to ask questions, he remarked:

“I do suppose it’s curious that China made the choice to mainly take that form of danger, to ban crypto, due to their, not less than, danger/reward evaluation… The clunkiness of the know-how behind Bitcoin, it might by no means go to scale it doesn’t matter what! If you happen to can solely do 5 or 6 transactions per second, that’s not a scalable software and clearly a know-how at an influence and environmental price. It simply doesn’t make sense to me.”

Ignoring for a second that Senator Warner thought it was “curious” that an authoritarian nation made the chance/reward calculation to ban free speech of code and software program — which is protected underneath the First Modification — McKenzie’s false testimony had misinformed the senator into pondering that Bitcoin can’t scale when it’s in actual fact already quickly scaling.

The Vitality Debate

Earlier this 12 months, McKenzie toured Riot Blockchain’s Whinstone U.S. — North America’s largest Bitcoin mining facility, positioned about an hour outdoors Austin, Texas. When it was Senator Tina Smith’s flip to ask questions, she turned to McKenzie and, doing her greatest to behave confused, asked what appeared to be a series of pre-scripted questions:

SMITH: As I perceive it, crypto mining is constructed on a course of that turns into an increasing number of vitality intensive, over time. Is that appropriate?

MCKENZIE: Sure.

SMITH: So, it is inherently inefficient. Is that appropriate?

MCKENZIE: The know-how is dangerous.

SMITH: And so, the place is the advantage of this type of innovation? How ought to we take into consideration the impacts with regards to the local weather and vitality impacts? As a result of when crypto mines are positioned in communities, these communities typically see their vitality costs go up — their vitality charges go up — is that appropriate?

MCKENZIE: That is proper. I visited the most important crypto mine within the nation, Whinstone, which is in Rockdale, Texas, simply outdoors of my hometown of Austin, Texas. Native residents are upset. It raises the price of electrical energy for all residents. And it additionally makes use of an unlimited quantity of vitality. It took over a former Alcoa aluminum smelting plant that had been deserted and now we’re utilizing it to mine ephemeral digital belongings of no productive worth.

Whereas it is handy that McKenzie simply occurred to have visited a mining operation and will present Smith with the precise solutions that confirmed her biases, sadly he has zero experience on vitality markets, demand response packages, energy engineering or mining and has no {qualifications} to tell congress or coverage on the matter.

The concept that Bitcoin mining is an “inefficient” know-how and subsequently wants the federal government to reign it in is nonsensical. If it have been as inefficient as claimed, there can be no have to cease it, since extra environment friendly applied sciences would be capable of outcompete it and simply substitute it. That is exactly the rationale we now have markets — to let probably the most environment friendly and most cost-effective applied sciences win over the inefficient and costly applied sciences that may fail. Those that are keen to take the chance on these applied sciences are both rewarded or bear the results.

McKenzie does not reveal that ERCOT, the Texas grid, is remoted and subsequently is required to have extra dispatchable vitality for excessive climate occasions. That extra vitality must be consumed by massive scale versatile clients who’re keen to pay for it’s an open market when it’s not wanted. Shopping for vitality that may in any other case go wasted, for computation, retains dispatchable vitality worthwhile and formally classifies Bitcoin miners as helpful massive versatile masses (LFLs) by the ERCOT grid. A latest ERCOT research confirmed miners are important to its demand response technique.

As demand response customers, miners buy wholesale vitality upfront and purchase personal insurance coverage merchandise that incentivize them to show off their machines when costs rise in periods of elevated client demand — thus balancing the grid and its prices, while increasing grid reliability. The concept that McKenzie or any critic might isolate escalating energy costs to a single client in a deregulated wholesale market is extraordinarily doubtful. Such a declare ignores the latest tripling in pure gasoline costs, in addition to the latest construct out of over 10 gigawatts of solar energy and Texas load progress from non-mining clients, such because the Tesla Gigafactory.

Whereas the Tesla Gigafactory could also be thought-about a extra productive use of vitality, it isn’t practically as versatile at demand response as miners. Miners de-risk extra renewable energy and can immediately shut down for prime client demand when costs rise. Actually, opposite to what McKenzie claims, The U.S. Division of Vitality explains that demand response applied sciences are helpful for “balancing provide and demand” and says “such packages can decrease the price of electrical energy in wholesale markets, and in flip, result in decrease retail charges.”

Whereas McKenzie might have come throughout native residents of Rockdale, Texas who have been “upset” concerning the Whinstone mining operation changing the city’s deserted Alcoa aluminum plant. In actuality, the brand new mining facility is a internet optimistic for the struggling group, boosting its financial system, native tax assortment and grid stability.

Senator Smith and McKenzie’s suggestion that mining turns into “an increasing number of vitality intensive over time” is very deceptive and exhibits a lack of know-how of the know-how. Like all publicly-traded commodity comparable to bitcoin, the vitality required is economically linked to the general public’s demand for its declining issuance, and unfolds in a highly-competitive open vitality market. There’s nothing concerning the know-how that requires the consumption of an increasing number of vitality over time. Bitcoin’s four-year “halving” cycle reduces the rewards that miners obtain to buy vitality. Actually, Bitcoin’s critics declare that miners might not be capable of afford to purchase as a lot vitality, many years from now — a subject which is hotly debated. Ultimately, critics might want to get their tales straight. Both miners may have the cash to buy vitality sooner or later or they received’t, nevertheless, each outcomes can’t be true.

Utilizing vitality to take away the necessity for equity-based governance just isn’t “dangerous.” Fairness-based governance was a standard criticism of proof-of-stake “crypto” networks within the listening to. Utilizing vitality for issuance and safety is breakthrough know-how that has many applications for energy innovation that we’re solely simply starting to find.

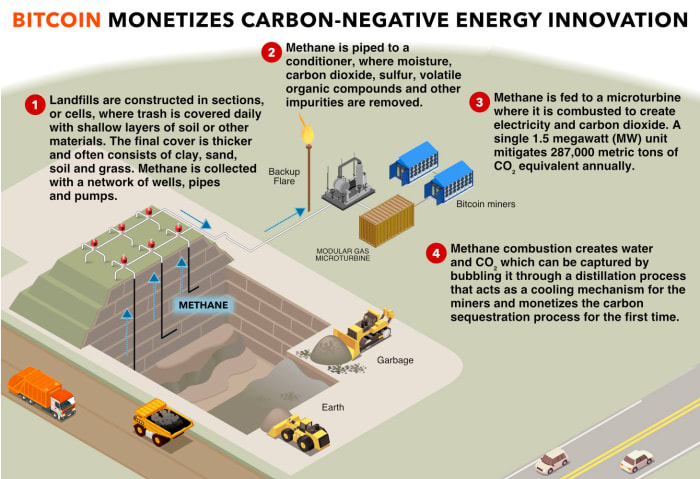

Not one of the witnesses or senators have been even conscious, or cared, that Bitcoin is on track to becoming CO₂e carbon negative by 2024, by mitigating CH₄ methane emissions. Nor have been they conscious that Bitcoin can monetize new sources of carbon-negative vitality manufacturing, comparable to monetizing landfill gasoline and carbon seize. Or that Bitcoin can convey clear baseload energy to at least one billion individuals in growing nations by monetizing stranded pilot vegetation that may be too costly to check, show and scale on a highly-competitive grid. In time, these stranded sources of vitality will merge with our future grid.

The Senate’s thespians do not care that Bitcoin mitigates waste methane emissions from oil and natural gas exploration the place there isn’t any different use for waste CH₄, which might in any other case be vented into the ambiance and would closely contribute to warming forces. To them, Bitcoin is “dangerous” just because individuals having the voluntary possibility for a digital sound cash, with out counterparty danger, threatens their politics.

Professor Allen Fails Bitcoin 101

Professor Allen, an affiliate professor at American College Washington Faculty of Regulation, made a fallacious declare about Bitcoin’s decentralization throughout her testimony:

“It isn’t decentralized… Bitcoin is managed by a couple of core software program builders — fewer than 10. And so they could make modifications to the software program and that software program is applied by mining swimming pools and there is just some of them.”

Allen’s assertion is factually incorrect and exhibits a essentially flawed understanding of how Bitcoin works and why it’s valued for being extraordinarily tough to alter. Even for those who consider that the challenge’s maintainers, who’ve the elevated commit and publishing privileges, might persuade the most important mining swimming pools to assist their very own whims, they might nonetheless want to steer a majority of the world’s unbiased miners to remain loyal to current mining swimming pools. Creating new competing swimming pools is trivial and any software program replace supported by swimming pools that miners disagreed with might simply be prevented by creating new swimming pools for defectors to affix.

And what if miners unanimously supported a software program replace that customers did not need? In 2017, 83% of the worldwide hash charge tried to pressure an replace to extend Bitcoin’s block measurement and failed as a result of the customers, who’re really accountable for propagating and interacting with the Bitcoin community via their very own full nodes, refused to put in the brand new software program. The Bitcoin community merely does not exist or propagate with out the person nodes, so miners defecting to their very own community is pointless until they persuade customers to return with them. The historical past of this essential take a look at for Bitcoin was fastidiously documented by Jonathan Bier in his guide, “The Blocksize Conflict: The Battle Over Who Controls Bitcoin’s Protocol Guidelines.”

Working a full node is pretty straightforward. At minimal, all it takes is a tough drive, a Raspberry Pi and an web connection. Since Bitcoin updates with gentle forks (backwards-compatible software program updates), customers who discover themselves within the minority all the time have the precise to dissent and oppose contentious updates by simply persevering with to run the software program with the principles they signed up for. Moreover, even when all the Bitcoin Core staff went rogue, customers would be capable of set up different competing shoppers of their nodes, with out forking the blockchain.

Different so-called progressive “crypto” tasks use coercive methods to pressure updates whereas they attempt to quickly innovate like software program firms. No different challenge gives the form of person rights that Bitcoin gives. As such, there isn’t any incentive for Bitcoin customers to run a fork that essentially modifications Bitcoin’s properties — its resistance to alter is the core worth proposition that its customers are drawn to and demand.

Is it believable that Bitcoin could possibly be examined once more and fail the identical take a look at sooner or later? After all. However for Professor Allen to disregard the truth that customers in the end determine Bitcoin’s destiny — in addition to its well-documented historical past proving its resilience to undesirable modifications from miners and builders — exhibits Allen was both woefully unprepared to be discussing such technical facets of Bitcoin or is deliberately deceptive senators and the general public together with her testimony.

A Efficiency Of Misinformation

If something was evident from the listening to, it was that there was zero effort to establish nuance or fact — the listening to was political theater. Sadly, having an undergraduate diploma in economics, or reaching the upper echelons of Bitcoin-resenting academia, doesn’t robotically qualify one to have the experience to tell the Senate on how Bitcoin works. If solely it have been that straightforward. Understanding Bitcoin requires an open, multidisciplinary thoughts and hours upon hours of analysis simply to start scratching the floor. Maybe Kanye West’s latest public assertion on Bitcoin might have gone a good distance for McKenzie and Allen.

“So far as Bitcoin, I am simply not educated sufficient to talk on that topic.”

Warren’s rapid-fire query and reply session with Allen showed Allen nervously reading, verbatim, pre-scripted answers to Warren’s questions. McKenzie alternatively had the self-discipline to memorize and carry out his traces with poise and confidence. If solely they every had the experience required to handle the united statesSenate Banking Committee on Bitcoin — a know-how that fairly actually allows self custody and solves the breaches of belief that the listening to was ostensibly involved with.

Whereas Allen, McKenzie and the senators who invited them to testify have been desirous to carry out their anti-technology, anti-free speech propaganda, the remainder of the world is capitalizing Bitcoin for vitality innovation. Simply final week, Japan’s TEPCO introduced it’s mining Bitcoin with surplus vitality. And now Russia is about to cross a invoice to legalize Bitcoin mining. In the meantime, a distinguished U.S. nationwide protection fellow is advising the White House on the strategic benefits of Bitcoin.

Whether or not the hearings members realized they have been being manipulated by politicians or not, collaborating in political theater means they’re normalizing the lack of privateness rights as they foyer for laws to restrict the precise to self custody digital property and one’s id. Such motion not solely empowers governments to enact larger monitoring controls, set up social credit score techniques and strip private freedoms, nevertheless it additionally exposes customers to the prying eyes of firms and any hackers that may infiltrate highly-centralized information. Satirically, such restrictions will empower their political opponents when our political pendulums invariably swing within the different course.

Whereas these unfamiliar with Bitcoin might consider they’re siding with a morally superior authorities, Satoshi Nakamoto’s invention is seen by many as American know-how that digitally enshrines private freedoms afforded to People by the Founding Fathers.

In the meantime, Warren is headed in the other way. She not too long ago launched a bipartisan invoice with Senator Roger Marshall to aggressively shut crypto cash laundering loopholes by imposing Orwellian controls on all customers. The invoice seeks to make self-custody know-how unlawful — a harmful coverage that may expose People to mandated government surveillance and solely enhance the probabilities of the fraud that FTX dedicated towards its customers when funds have been rehypothecated and stolen via their custodial platform. Stopping this type of fraud was what the listening to was imagined to be about and is strictly the form of safety that Bitcoin already empowers via self custody.

Warren argues that “rogue nations, oligarchs and drug lords are utilizing crypto to launder billions, evade sanctions and finance terrorism.” That is worry mongering. The fact is that public, immutable ledgers are too clear for many crimes. Bodily money is much better. Corporations that do on-chain evaluation for legislation enforcement have documented that cryptocurrency utilization for legal exercise is relatively low and is trending downwards. Warren’s eagerness to make self-custody know-how unlawful can be like banning the web as a result of phishing scams exist.

“Regardless, the excellent news is two-fold: Cryptocurrency-related crime is falling, and it nonetheless stays a small a part of the general cryptocurrency financial system.”

–The Chainalysis 2022 Crypto Crime Report

Nevertheless, this isn’t to say that crypto doesn’t have an issue with fraud. To Allen and McKenzie’s credit score, 99.99% of the “crypto” market is certainly scams, and they need to be counseled for calling them out. But, to blindly name Satoshi Nakamoto’s invention a rip-off exhibits an absence of essential pondering and experience. To assault Bitcoin — an open, international and impartial financial protocol layer for the web with no issuer and no central management — just because one doesn’t prefer it or perceive it, exhibits an absence of humility and unwillingness to acknowledge real-world advantages with an open thoughts.

If they’re keen to interact in considerate and significant dialogue, Professor Allen and Mr. McKenzie would seemingly discover numerous widespread floor with members of the Bitcoin group, who commonly criticize the scams in addition to the shortage of ethics and integrity that pervade the business. If not, it suggests they’ve an agenda.

If the U.S. Senate Banking Committee has any want to protect freedoms and hold the USA from falling behind different nations, it could do effectively to hunt out precise consultants who work in Bitcoin mining, vitality markets and those that are utilizing its layered funds structure to construct the following technology of commerce. Political theater will solely trigger the U.S. to fall additional behind the remainder of the world in all of those areas.

Alas, the U.S. Senate Banking Committee, led by Warren’s disdain for technology, appears extra excited by preserving the facility of huge banks and mandating government surveillance. Progressives, comparable to Warren, ought to love Bitcoin as an open fee rail that empowers the liberty of financial expression, monetary inclusion and circumvents predatory banking practices — one thing that progressives might one day find themselves in need of.

As a substitute, they look like flirting with the authoritarian playbook of China and its social credit score system. Maybe it’s simply as effectively that the committee was misinformed by its unqualified witnesses, as they now do not know how to stop a technology that manifests itself as free speech. Info needs to be free, a lesson the USA and its misinformed senators might want to be taught a method or one other.

It is a visitor publish by Level39. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.