On-chain information reveals traders withdrew a considerable amount of Ethereum throughout 2022 because the ETH reserves have fallen by greater than 30%.

Ethereum Trade Reserves Sharply Down This Yr

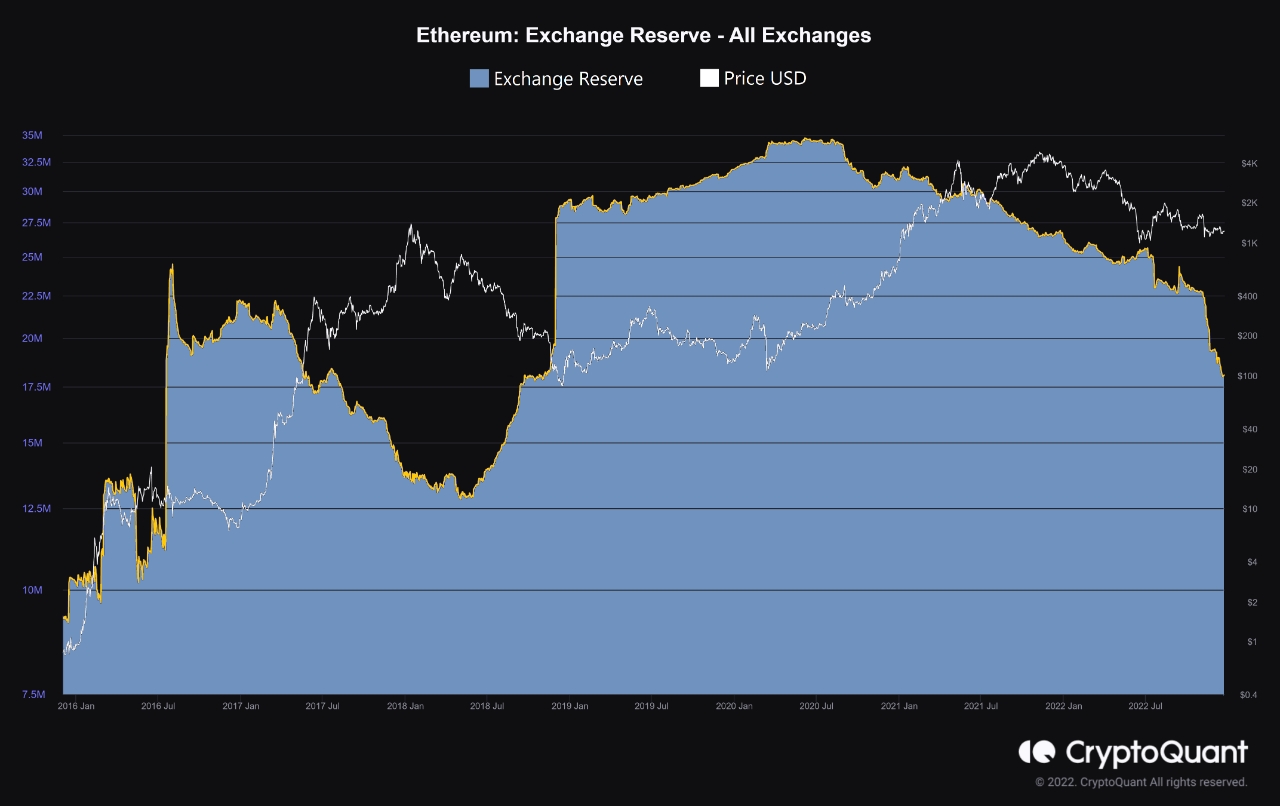

As identified by an analyst in a CryptoQuant put up, these traders might have been withdrawing with the intention of holding in the long run. The “alternate reserve” is an indicator that measures the full quantity of Ethereum at the moment being saved within the wallets of all centralized exchanges.

When the worth of this metric goes up, it means holders are depositing their cash to exchanges proper now. One of many important causes traders use exchanges is for swapping their ETH to a different crypto or for cashing out in fiat. Thus, the alternate reserve can act because the promoting provide of the asset, and so any will increase in it may possibly have bearish results on the value.

Then again, a lower within the indicator’s worth implies traders are transferring out their cash in the meanwhile, which suggests the promoting provide goes down. Extended alternate withdrawals is usually a signal that holders are accumulating at the moment, which means that they’re bullish on the crypto.

Now, here’s a chart that reveals the development within the Ethereum alternate reserve over the previous few years:

Seems like the worth of the metric has been taking place in current months | Supply: CryptoQuant

Because the above graph shows, the Ethereum alternate reserve already noticed some decline throughout 2021, however the downtrend has been even sharper in 2022. The indicator used right here is the “all exchanges” model, which means that it covers information associated to each spot and by-product exchanges.

An fascinating development to note is that the lower within the metric’s worth has been particularly fast because the collapse of FTX. It is because a well known alternate like FTX taking place made traders extra fluctuate of centralized platforms than ever, resulting in them withdrawing their cryptocurrencies in mass from exchanges in order that they’ll maintain onto them in private wallets, the keys to which they personal.

In complete, the Ethereum alternate reserve has gone down by greater than 30% over the course of 2022. “Among the finest issues within the 12 months has been the opportunity of having a deflationary ETH,” says the quant. “Plainly traders imagine it too and have withdrawn giant quantities of CEX with the most certainly function of holding them for the long run.”

ETH Worth

On the time of writing, Ethereum’s value floats round $1,200, up 1% within the final week.

ETH has been transferring sideways in the previous few days | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, CryptoQuant.com