109 years in the past, the U.S. Federal Reserve was created and ever since that day, the buying energy of the U.S. greenback has dropped an important deal. Because the Fed began, greater than 96% of the buck’s buying energy has been erased by way of inflation.

The Buying Energy of the U.S. Greenback After the Creation of the Federal Reserve on Dec. 24, 1913 Dwindles Decrease

Over the last hundred years, economists have blamed the U.S. Federal Reserve for an excessive amount of America’s rising inflation. American economist and social theorist Thomas Sowell referred to the Fed as a “most cancers,” and former politcians like Ron Paul have referred to as on the plenty to abolish the Fed. Previous to the creation of the Consumed Dec. 23, 1913, America had two central banks the preceded the present U.S. central financial institution.

The primary U.S. central financial institution began in 1791 which was the First Financial institution of the USA, a monetary establishment charted by Congress on the time. The second try to create a central financial institution in America was in 1816 with the formation of the Second Financial institution of the USA. The third central financial institution is the present monetary establishment we all know of immediately referred to as the Federal Reserve and it was formally created 109 years in the past simply earlier than Christmas Eve.

Due to the Panic of 1907, People on the time had been satisfied {that a} central financial institution was wanted. A secret set of conferences on Jekyll Island that included America’s prime monetary elites and the so-called ‘Cash Belief’ crafted the foundations of the Federal Reserve system. The American folks had been saved at nighttime concerning the conferences between senator Nelson Aldrich and the ‘Home of Morgan.”

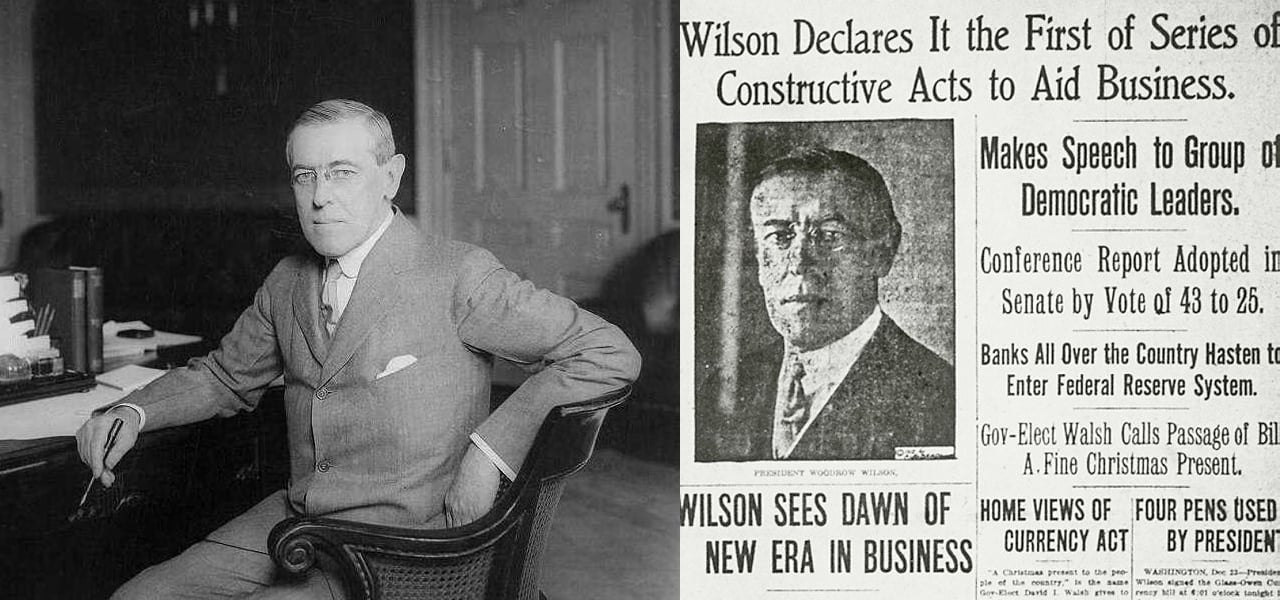

The key Jekyll Island conferences befell on Nov. 20, 1910 and Nov. 30, 1910. The Home of Representatives voted on the Federal Reserve Act on December 22, 1913, the U.S. Senate voted on the act the following day, and President Woodrow Wilson signed the act into regulation on Christmas Eve. Ever since this level, the bucks People use that declare to be a ‘promissory observe’ backed by the U.S. Federal Reserve, have misplaced appreciable worth.

Moreover, some would say that “provided that the tempo of cash enlargement surpasses the tempo of enhance within the manufacturing of products will we’ve got a common enhance in costs.” Nonetheless, some people would additionally insist that different forms of authorities interference like irrational spending, sanctions, and laws could make the worth of products and providers rise unnaturally.

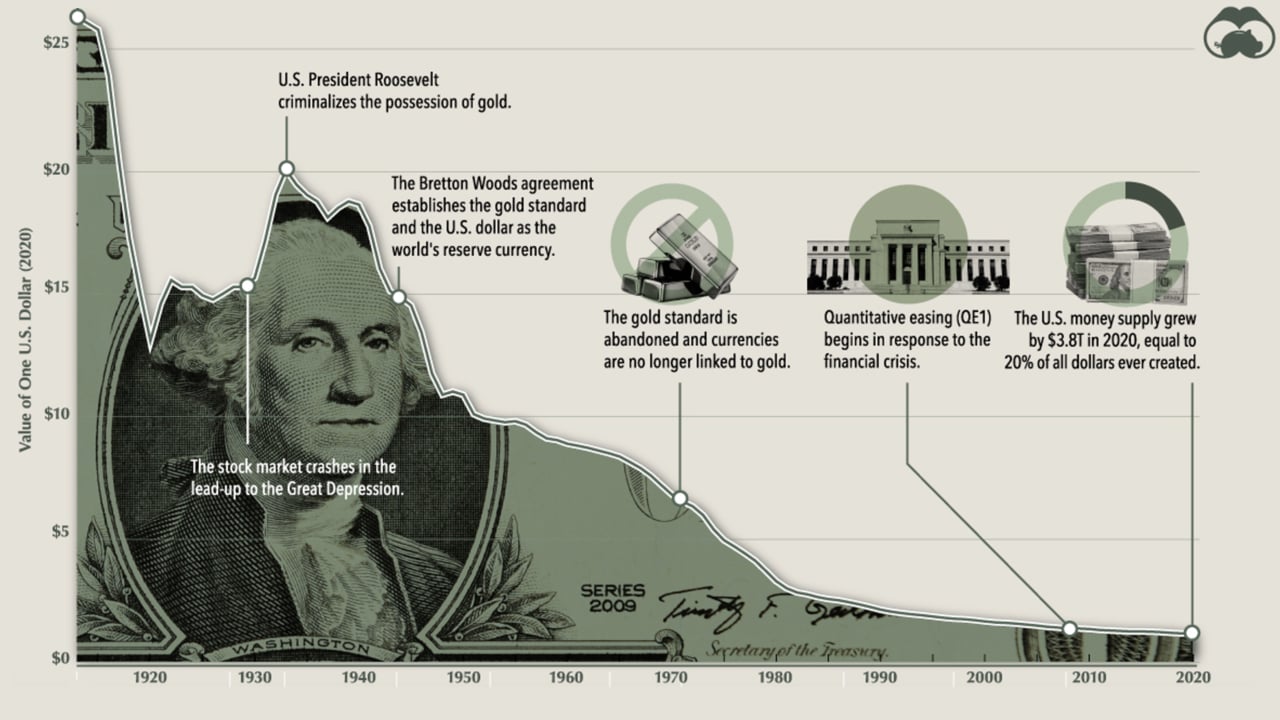

Statistics present that between 1913 to 2017, the U.S. greenback has misplaced greater than 96% of its buying energy, in accordance with the American Enterprise Institute. 2022 metrics present that $1 in 1913 equates to roughly $30.07 in buying energy immediately. One report says: “The greenback had a mean inflation price of three.17% per 12 months between 1913 and immediately, producing a cumulative worth enhance of two,907.18%.”

A report revealed by visualcapitalist.com final 12 months explains how you can buy ten bottles of beer again in 1933 with a single buck and immediately, you’d be fortunate to get a small espresso for that $1. Since 2020, inflation has soared because the U.S. Federal Reserve elevated the financial provide by a substantial quantity over the last three years.

Visualcapitalist.com’s creator Govind Bhutada defined the “cash provide (M2) within the U.S. has skyrocketed during the last 20 years, up from $4.6 trillion in 2000 to $19.5 trillion in 2021.” He added that the “results of the rise in cash provide had been amplified by the monetary disaster of 2008 and extra not too long ago by the COVID-19 pandemic — In truth, round 20% of all U.S. {dollars} within the cash provide, $3.4 trillion, had been created in 2020 alone.”

The Ukraine-Russia struggle has prompted vitality costs to leap lots increased as a large number of Western international locations like the USA have imposed sanctions on Russia. The sanctions, in flip, made oil and pure gasoline costs rise an important deal, as a result of Russia is without doubt one of the largest suppliers of fossil fuels on the planet. Moreover, U.S. authorities officers have imposed an excessive amount of crimson tape on companies that don’t observe together with the so-called local weather change reform.

Between the U.S. authorities’s navy spending, the Fed’s huge financial M2 enhance since 2020, and the sweeping local weather change laws have all contributed to the rising costs throughout the nation. That is the explanation why free market advocates like alternate options like valuable metals and cryptocurrencies. Treasured metals, as an illustration, are scarce and so they can’t be printed on a whim like fiat currencies.

Metals like gold and silver have intrinsic worth as effectively, as they’re used extensively for issues like jewellery, pc components, and cash. Though, each valuable metals and fiat currencies may be cumbersome in bodily type, as holding an excessive amount of gold or stacks of U.S. {dollars} requires safety and secrecy of some type. Cryptocurrencies like bitcoin (BTC) are additionally scarce and can’t be printed on a whim like promissory notes both.

Crypto property like bitcoin are extra transportable and whereas they want safety and secrecy, the price to take action is negligible. Each of all these different monies haven’t eroded in worth like fiat currencies all internationally have in the course of the previous 100 years. Information clearly reveals the U.S. greenback can’t be a retailer of worth for an extended time period. Just like the economist Friedrich A. Hayek as soon as stated, good cash can’t exist till it’s faraway from the state.

“I don’t consider we will ever have an excellent cash once more earlier than we take the factor out of the fingers of presidency, that’s, we will’t take them violently out of the fingers of presidency, all we will do is by some sly roundabout manner introduce one thing that they will’t cease,” Hayek stated.

What do you concentrate on the U.S. greenback dropping greater than 96% of its buying energy for the reason that day the Fed was created? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.