As the top of 2022 approaches, a large number of bitcoin proponents are questioning whether or not or not the underside is in so far as the official finish of the crypto winter is anxious. The present bitcoin bear run simply entered the longest backside formation for the reason that 2013-2015 bitcoin bear market. Furthermore, analysts be aware that a lot of the technical backside indicators used to foretell bitcoin costs have did not forecast whether or not or not the underside is in.

Rainbows and S2F: The Listing of Technical Indicators That Didn’t Predict Bitcoin’s Backside

A month in the past, crypto supporters celebrated enduring one of many longest and harshest bitcoin bear markets for the reason that 2013-2015 bitcoin bear market. On the time, the 2013-2015 bitcoin bear run was the longest downturn however right now, the present crypto financial system’s contraction interval is about to surpass the 2013-2015 crypto retrenchment.

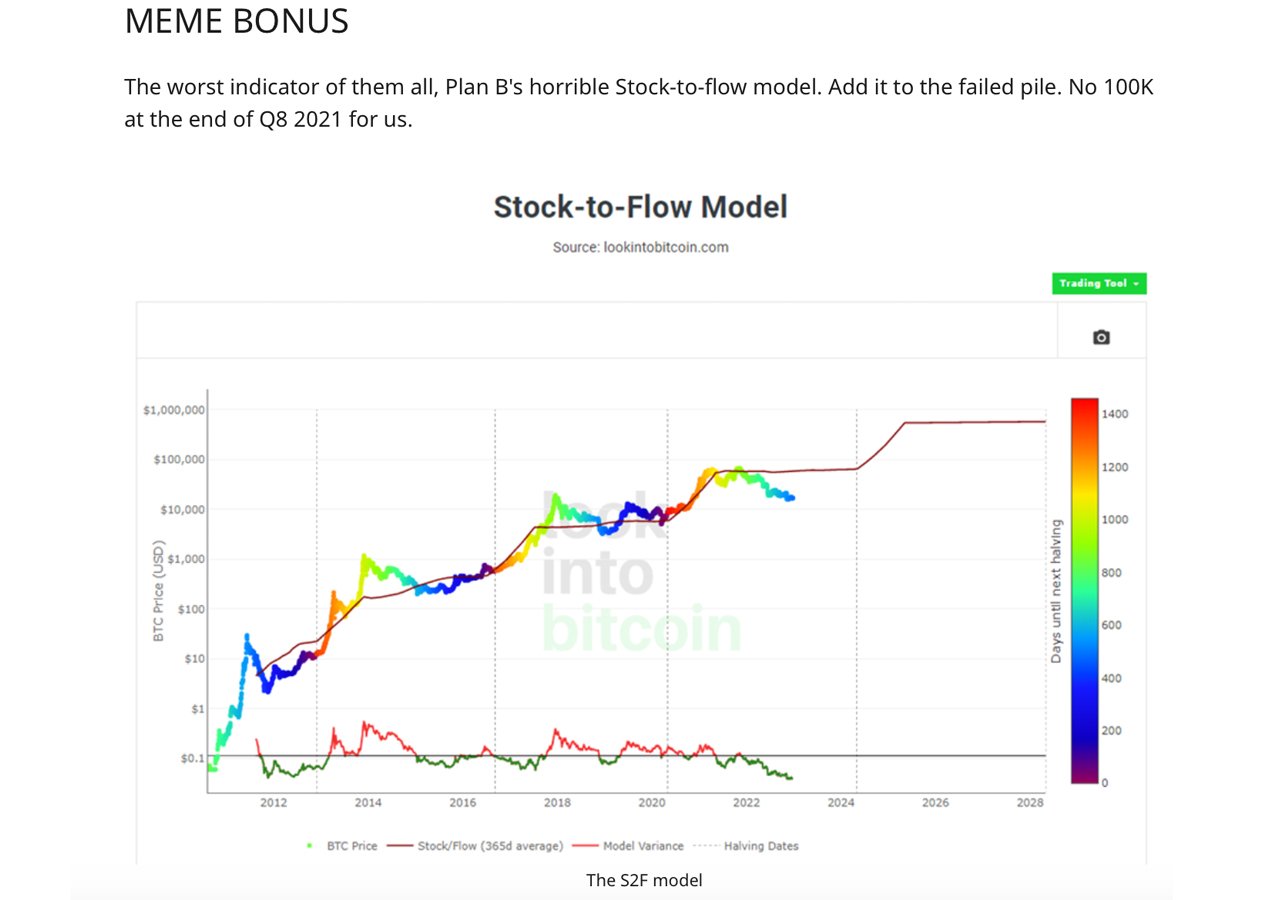

Along with the longest bottom phase, Bitcoin.com Information reported 144 days in the past how quite a lot of technical indicators failed this 12 months to foretell bitcoin’s future U.S. greenback worth. One of many greatest worth mannequin failures talked about this 12 months was the stock-to-flow (S2F) mannequin, which was denounced by Ethereum advocate Anthony Sassano and ETH-co-founder Vitalik Buterin final June.

“We want extra ache earlier than we make a backside”

My man, we have seen:

– a high 3 trade collapse

– 2 high VCs within the area get liq’d

– 2 high 10 cash w/ a $60B+ mcap go to zero

– lending market worn out

– Bitcoin down ~80% from ATH

– alts down 90-99% from ATHWhat extra would you like?

— Okay A L E O (@CryptoKaleo) December 22, 2022

With all of the so-called ‘best’ technical indicators failing miserably, many crypto proponents are nonetheless writing discussion board posts and social media threads about bitcoin’s confounded backside. As an example, on Dec. 27, the Twitter account Crypto Noob tweeted: “Bitcoin is presently buying and selling within the oversold zone. Which is traditionally the place the underside types. Do you assume BTC has bottomed out?”

Questions and posts like these are littered throughout crypto-focused boards and social media platforms like Fb and Twitter. On Reddit, the subreddit discussion board r/cryptocurrency incorporates a put up that highlights how technical backside indicators have failed, and the creator of the put up particulars that the analysts have “no clue” and this time “IS completely different.”

The put up’s creator “u/Beyonderr” explains how eight technical indicators weren’t dependable to bitcoin merchants this 12 months. For instance, the weekly RSI (relative power index) was imagined to sign oversold ranges and bitcoin’s backside, however Beyonderr says “this was not true this 12 months.”

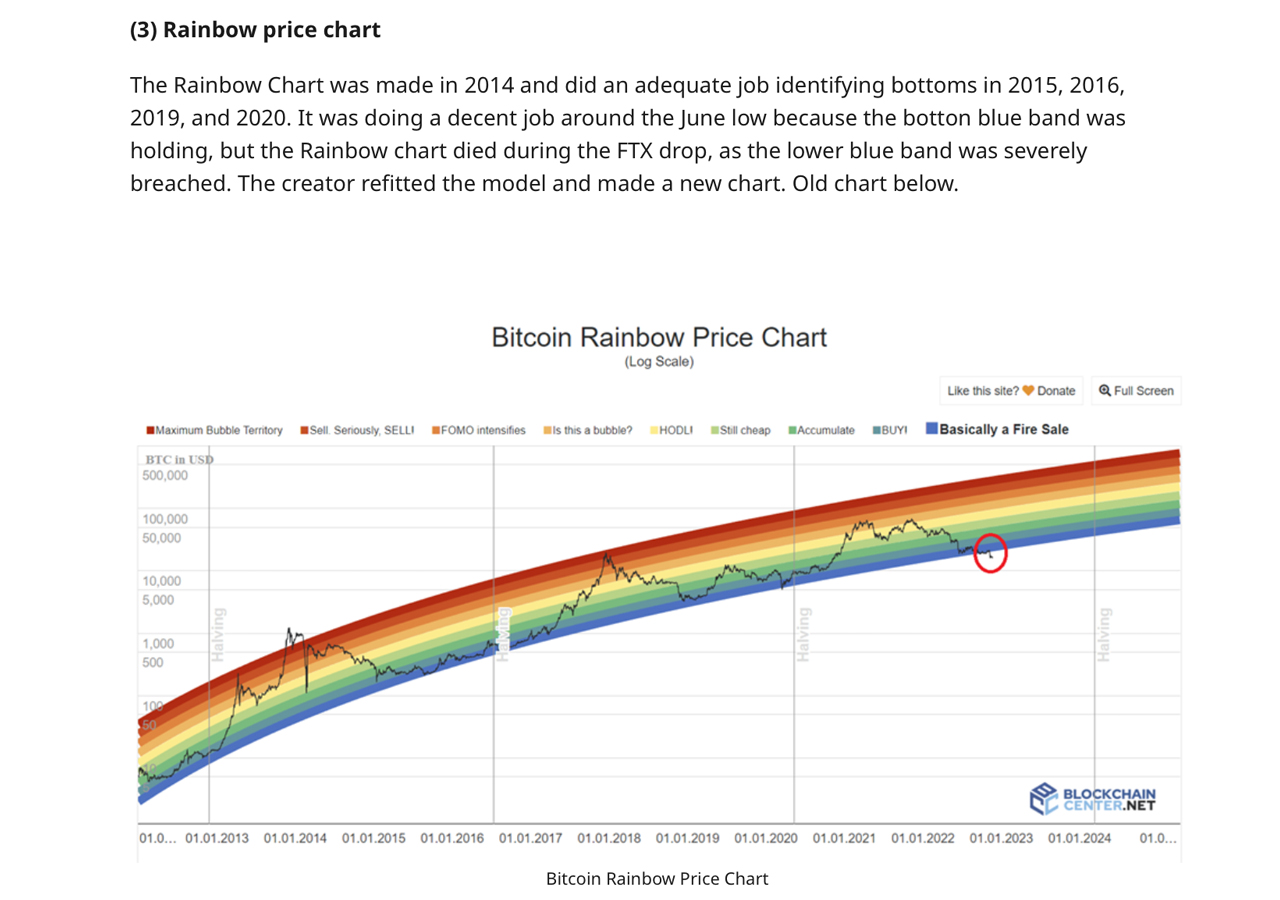

Different unreliable technical indicators Beyonderr talked about embrace the month-to-month MACD (transferring common convergence/divergence), the Rainbow worth chart, the 200-week transferring common, the 100-week transferring common X 20-week transferring common, the Pi cycle indicator, the Hash ribbons indicator, and the common share drawdown from a cycle’s excessive.

Furthermore, Beyonderr mocked the S2F worth mannequin by calling it the “Meme bonus” indicator. “The worst indicator of all of them, Plan B’s horrible Inventory-to-flow mannequin. Add it to the failed pile,” Beyonderr wrote. The put up on r/cryptocurrency additionally talked about that there could also be 4 indicators that recommend the underside “may be in,” no less than in response to Beyonderr.

The indications Beyonderr cited embrace indicators like “time out there,” the “Puell A number of,” the “Mayer A number of,” and the “MVRV Z-score.” In the meantime, a large number of individuals on social media platforms like Twitter wholeheartedly consider the underside is very near being in, however thus far most technical indicators have simply been unreliable deviations.

What do you consider the failed technical indicators that might not predict bitcoin’s backside? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.