That is an opinion editorial by Dillon Healy, a member of the institutional partnerships crew at Bitcoin Journal and The Bitcoin Convention.

A subject that has received increased attention currently is the priority round Bitcoin’s future “safety funds.”

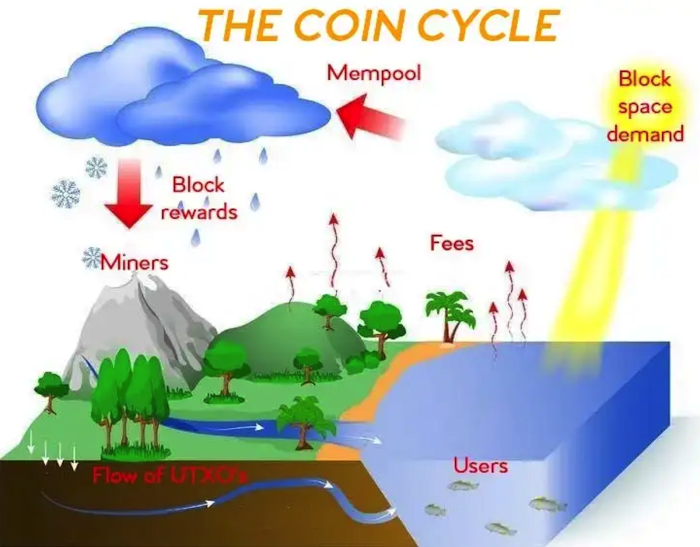

This primarily stems from the concern that miner income is not going to be sufficient to supply enough safety sooner or later, submit block subsidy. Bitcoin miners play an important half in securing the community by proposing blocks of transactions which nodes then confirm, settle for and replace to the Bitcoin ledger. Competing towards different miners to suggest this new block to the chain, miners use intense computing energy to finish the proof-of-work consensus algorithm, and win the proper to suggest the brand new block.

For this service, the profitable miner receives a block reward, which is made from two parts: the block subsidy and the transaction charges. The block subsidy is the quantity of recent bitcoin minted in every block (at the moment 6.25 bitcoin), this subsidy of recent bitcoin launched from the whole provide of 21 million is lower in half about each 4 years with the halving. The block subsidy at the moment makes up the overwhelming majority of whole miner income.

Simplified, the priority is that the transaction price portion of the miner rewards is not going to be raised sufficient to make up for the lack of the block subsidy, leading to decreased safety for the Bitcoin community and an elevated chance in assaults as miners are not incentivized to take part. My view, although, is that almost all who’re nervous about this are misunderstanding Bitcoin’s long-term sport concept, incentive mechanisms, scalability and adoption potential.

With that being stated, it is a subject that ought to most likely be mentioned extra publicly and never shrugged off as a non-issue. There are folks advocating for tail emissions to be added, creating a rise to Bitcoin’s 21 million provide as an answer to the safety funds (settlement finality) difficulty, which is regarding.

I consider the answer (when you can name it that) is already baked into the Bitcoin incentive construction and adoption curve. There are two components: one, transaction charges scaling with Bitcoin adoption and as a safety measure and two, Bitcoin mining transitioning to an auxiliary device.

Transaction Payment Scaling

When this difficulty is raised, it often comes from any person with a misunderstanding of how or why transaction charges will improve or advocating for proof of stake (here’s an example). Mockingly, one of many causes for elevated transaction charges could possibly be a pure defensive response to an assault from a nasty actor mining empty blocks to forestall customers from transacting. If empty blocks are being mined, the mempool will fill with Bitcoin transactors which can be elevating charges, competing with one another to get within the subsequent block. Riot Blockchain and Blockware Options launched an unimaginable report outlining how this and comparable assaults could be met with naturally-occuring protection mechanisms from the Bitcoin immune system, most leading to a lot larger transaction charges:

“Beneath an empty block assault or different assaults making an attempt to cease customers from transacting, it’s within the self-interest of Bitcoin customers to boost their transactions’ charges to get into the subsequent block. The extra empty blocks (the longer the assault lasts), the extra pending transactions within the mempool. Transaction charges might soar from 1 sat/vbyte to 1,000+ sats/vbyte. The reward for one block might go from near 0 BTC to 10+ BTC assuming the present most block dimension of 1,000,000 vbytes. The system is antifragile, and an empty block assault could be met by an countless market primarily based counterattack of excessive transaction charges. And information of this counterattack would possible deter the attacker from this assault within the first place.”

One other instance of charges elevating on account of the community defending itself could be a response to miners making an attempt to censor retailers. This instance is roofed extra in depth on this article:

“If a majority miner is just not accepting transactions from retailers then the censored retailers should both improve their charges or not transact in any respect. If a service provider can’t transfer their bitcoins then they successfully haven’t any worth for the period through which they’re being censored. We will deduce that, resulting from private time choice, a service provider who’s being censored will probably be keen to pay a better affirmation price proportional to the period through which they’re being censored, as much as the theoretical most through which the price is everything of the transaction.”

Along with naturally-occuring defensive incentives that may end in elevated transaction charges, there are additionally numerous arguments for transaction charges rising on account of Bitcoin adoption, particularly as a medium of alternate.

As adoption will increase, competitors so as to add transactions to Bitcoin’s scarce block house will improve, and this will increase present charges, which then creates additional demand for scaling options. The market will proceed to current these scaling options as demanded — some in style options now embrace exchanges batching transactions, the Lightning Community and different Layer 2 and Layer 3 developments that may in the end bundle hundreds of Bitcoin transfers into one transaction that settles on-chain.

While you perceive Bitcoin’s adoption curve, it’s fully affordable to imagine that almost all of regular person transactions will happen on extra layers or sidechains. Ultimate settlement of those extra efficiently-bundled transfers will happen on-chain, together with transactions that need elevated safety or establishments transferring giant values. The ultimate settlement would warrant a a lot larger transaction price.

The second route that ought to decrease concern round miners dropping offline and decreasing the general safety of the community is elevated effectivity and a more recent realization that Bitcoin miners can act as an auxiliary device for different enterprise practices. A highly-overlooked improvement within the mainstream currently has been the Bitcoin miners’ incentive to pursue stranded, wasted or extra vitality.

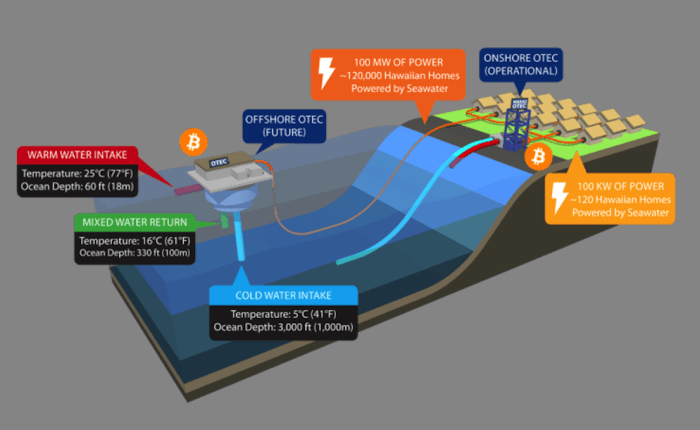

Bitcoin mining gives a singular and new proposal for society, the place untapped or un-transportable vitality can now be immediately offered to the Bitcoin community on-site through mining. One of the vital attention-grabbing improvements on this sector is ocean thermal vitality conversion (OTEC) merging with Bitcoin.

There may be an extremely in depth article on how OTEC and Bitcoin can additional vitality manufacturing and effectivity right here:

“Bitcoin has the potential to assist unlock between 2 to eight terawatts of unpolluted, steady and year-round baseload energy — for one billion folks — by harnessing the thermal vitality of the oceans. that turns Earth’s oceans into an infinite renewable photo voltaic battery.

“It does this by combining heat tropical floor water and deep chilly seawater to create a traditional warmth engine. This straightforward thought is completely suited to be expanded to a planetary scale by Bitcoin’s distinctive urge for food for buying and consuming stranded vitality from the prototypes and pilot crops that will probably be required to show it really works. Moreover, by harnessing just about limitless portions of chilly water for cooling co-located ASIC miners, OTEC might very properly be probably the most environment friendly and most ecological technique to mine Bitcoin.”

This is only one instance of how mining can change into much more environment friendly over time, and with elevated effectivity comes continued community safety because it makes much less sense for miners to go offline.

Bitcoin mining can be now changing into an auxiliary device for different industrial processes. Bitcoin miners can pair with totally different industries and companies and supply monumental advantages to seemingly-normal enterprise practices. One mind-blowing instance: ASICs used to mine Bitcoin generate warmth, this warmth can be utilized to boil water and create steam, condensing the water once more is a type of purification, and in the end this can lead to water distillation that was backed by mining, as was mentioned in a latest Troy Cross interview.

These ASICs that generate warmth additionally have to be cooled with followers. One other mind-blowing idea is combining mining with companies or industries that naturally create cool air. An instance that Cross mentioned was carbon seize amenities, which combine monumental fan banks as a part of their regular enterprise operations. Pairing these fan banks with a mining operation subsidizes the price of ASIC cooling.

As these improvements get extra developed, merely including Bitcoin mining to numerous unrelated industries and companies that generate cooling or want heating will enhance effectivity and cut back prices. Bitcoin mining is already heating greenhouses and distilling whiskey, whereas on the identical time monetizing stranded or wasted vitality.

Over time, Bitcoin mining will proceed to be paired with industries that make mining or regular enterprise operations extra worthwhile. Ultimately will probably be ridiculous to not use your companies’ naturally-generated warmth or wasted vitality on Bitcoin miners, or if your small business occurs to have monumental fan banks, it’s going to change into ridiculous to not level them at ASICs. All of this ends in extra positively-incentivized miners over time which maintains community safety and has the potential to counterbalance the shrinking block subsidy.

The mix of Bitcoin’s adoption naturally resulting in elevated transaction charges over time and Bitcoin mining shifting into an auxiliary device for a variety of unbiased industries reveal how the long-term safety of the community is one thing to be optimistic about.

It is a visitor submit by Dillon Healy. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.