Buying and selling desk QCP Capital lately revealed its 2023 crypto forecast on their newest version of “Simply Crypto.” The agency highlighted this previous 12 months’s key moments, their potential affect going into a brand new 12 months, and attainable future digital property and the worldwide market.

The report factors out 2022’s year-to-date return for world property. The market has skilled its worst-performing 12 months for benchmark property, resembling Bitcoin, the S&P 500, the Nasdaq 100, and others.

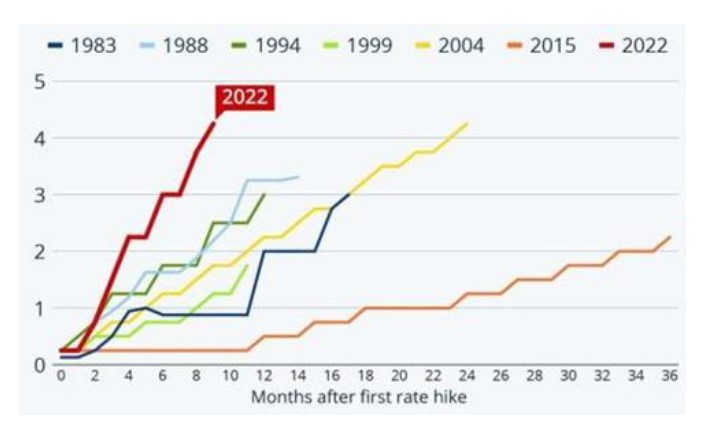

Apart from Pure Fuel, different property noticed their worst losses for the reason that Nineteen Seventies. Bitcoin (BTC) alone crashed over 70% from its all-time excessive, whereas Ethereum (ETH) noticed a 72% loss. This unfavourable efficiency “was a by-product of the sharpest price hike cycle in latest historical past” by the U.S. Federal Reserve (Fed).

Crypto Forecast: What You Want To Pay Consideration To

In response to QCP Capital’s crypto forecast, the Fed will probably proceed to strain the markets. The monetary establishment is making an attempt to deliver down inflation from a 9% excessive to its goal of about 2%. Thus, the Fed hikes rates of interest and unwinds its steadiness sheet.

Whereas inflation in all probability peaked at these ranges, QCP Capital believes the market will see “sticky” or persistent inflation. So as phrases, the monetary establishment may have problem reducing inflation to its goal.

This situation might worsen if commodities costs, resembling oil costs, push again above $100. Per the buying and selling desk’s report, this isn’t the primary time the Fed would face an identical situation.

Within the Nineteen Seventies, the monetary establishment hiked rates of interest and introduced down inflation, however the metric rebounded when oil costs trended to the upside. The struggle between Ukraine and Russia might have comparable penalties to the Nineteen Seventies and function as gasoline for inflation.

Consequently, the upside potential for Bitcoin and risk-on property is likely to be capped so long as inflation stays “sticky.” Moreover, QCP Capital believes the Fed’s Federal Open Market Committee (FOMC) is unaware of the risks of an uptick in inflation.

Due to this fact, the monetary establishment will embrace a crash in risk-on property, resembling crypto, and ignore traders’ ache. QCP Capital stated the next on what might be one of many important gadgets for his or her crypto forecast:

This may cause them to settle for a recession quite than threat a rebound in inflation, even when the inflation spike is once more resulting from provide facet shocks. When it comes to recession chances, we at the moment are above the 2020 Covid highs, and quick approaching 2008 GFC and 2001 Dot.com ranges.

Crypto’s Hope At The Finish Of The Tunnel

There’s potential for an upside if the Fed rushes to ease its financial coverage. Up to now months, some monetary establishment representatives hinted at this risk.

If this faction succeeds, the worldwide market may see a pointy rebound, together with Bitcoin and different cryptocurrencies. The U.S. Greenback, represented by the DXY Index, will proceed to function as a direct impediment for digital property.

Concerning technical evaluation, the DXY Index has seen some losses prior to now six weeks however is more likely to bounce off its present ranges. This upside worth motion may take the greenback again to 120, punishing world currencies, equities, and threat on property. A break under these ranges may set off an reverse situation.

As of this writing, Bitcoin (BTC) trades at $16,600 with sideways motion on the every day chart. BTC/USDT chart from Tradingview.