That is an opinion article by Guglielmo Cecero, the authorized supervisor of European bitcoin funding app Relai, and Raphael Schoen, the content material lead at Relai.

Bitcoin is underneath assault. It’s more and more seen as a “soiled forex.” Elon Musk’s Tesla, Wikipedia, Greenpeace and different organizations have stopped accepting BTC for his or her merchandise or as a way to donate cash.

Musk, who shouldn’t be solely one of many richest but in addition one of the crucial controversial folks on this planet, has stated: “Cryptocurrency is a good suggestion on many ranges, and we consider it has a promising future, however this can’t come at nice price to the setting.” Ouch.

And it’s not simply Musk. Politicians have additionally taken goal at Bitcoin.

Earlier than the European Fee’s Markets in Crypto-Asset Regulation (MiCA) regulation was handed, it precipitated fairly a stir inside the Bitcoin group, particularly as a result of left-wing factions of the EU Parliament that have been against proof of labor (PoW) and the ability consumption of the Bitcoin community. Within the trilogue, a model of MiCA was lastly handed that didn’t ban PoW or mining.

As turned recognized in April 2022, some members of the European Parliament (MEPs) tried to push by a ban on bitcoin mining and one on BTC buying and selling in the middle of the draft legislation. Fortunately, they failed.

Nonetheless, the foundations for additional steps have been laid. For instance, the issuers of cryptocurrencies, which we all know are largely merely tech startups, will likely be obliged to ship some sort of report on the vitality consumption and the related carbon footprint of the respective asset. Brokers and exchanges, in flip, should inform their prospects about these precise figures after they buy crypto property.

The rising aversion to Bitcoin additionally gained traction by an anti-Bitcoin Greenpeace USA marketing campaign launched in March, which was financed by Ripple co-founder Chris Larsen, amongst others. Curiously, Greenpeace accepted bitcoin donations between 2014 and 2021 till they have been placed on maintain as a result of environmental issues.

Practically Half Of The EU Parliament Doesn’t Like Bitcoin

As talked about, a mining or buying and selling ban for Bitcoin didn’t make it into the MiCA laws. Nonetheless, it is rather unlikely that members of the EU parliament who tried to implement this in MiCA will hand over — we are able to assume the opposite.

In March 2022, the financial and financial affairs (ECON) committee within the EU parliament voted in opposition to a ban on PoW. Thirty-two members voted in opposition to it, 24 in favor. The subject appears to develop into increasingly ideologically pushed, because the Social Democrats, the Greens, and the left largely wished a PoW ban, whereas the Conservatives, the Liberals and right-wing factions tended to vote in opposition to it.

The ultimate MiCA draft created by conservative MEP Stefan Berger included a compromise: As a substitute of a ban on PoW, they agreed on together with a ranking system for cryptocurrency to evaluate their environmental impacts (extra on that later).

In an e-mail dialog with Politico, the Spanish Inexperienced EU parliament member Ernest Urtasun defined:

“Creating an EU labeling system for crypto is not going to resolve the issue so long as crypto-mining can proceed exterior the Union, additionally pushed by EU demand… The Fee ought to somewhat concentrate on growing minimal sustainability requirements with a transparent timeline to conform.”

And he added:

“Ethereum’s current improve simply confirmed that phasing out from environmentally dangerous protocols is definitely possible, with out inflicting any disruption to the community.”

The ECB Doesn’t Like Bitcoin — At All

Whereas we see totally different opinions on Bitcoin within the European Parliament, the alerts we’re getting from the European Central Financial institution (ECB) are very clear. The ECB is issuing warnings about cryptocurrencies frequently, naming their “exorbitant carbon footprint” as “grounds for concern”.

Only in the near past, on November 30, 2022, the ECB printed a weblog submit titled “Bitcoin’s Final Stand.” In it, ECB’s Market Infrastructure And Funds Director Common Ulrich Bindseil and advisor Jürgen Schaff argue that, “Bitcoin’s conceptual design and technological shortcomings make it questionable as a way of fee.”

In line with Bindseil and Schaff, Bitcoin transactions are “cumbersome, sluggish and costly,” which they are saying explains why the world’s largest cryptocurrency — created to beat the present financial and monetary system — “has by no means been used to any important extent for authorized real-world transactions.” Bindseil and Schaff added that since Bitcoin is neither an efficient fee system nor a type of funding, “it ought to be handled as neither in regulatory phrases and thus shouldn’t be legitimized.”

Whereas it might appear paradoxical to very vocally assault one thing that’s on the “street to irrelevance,” it’s not the primary time that the ECB has attacked Bitcoin.

In July 2022, the ECB singled out Bitcoin in a analysis article and in contrast proof of labor to fossil gas vehicles whereas contemplating proof of stake as extra akin to electrical automobiles. Let’s ignore for a minute that this doesn’t make sense and take a look at what it wrote intimately:

“Public authorities mustn’t stifle innovation, as it’s a driver of financial development. Though the profit for society of bitcoin itself is uncertain, blockchain expertise in precept might present but unknown advantages and technological functions. Therefore, authorities may select to not intervene with a view to supporting digital innovation. On the similar time, it’s troublesome to see how authorities may decide to ban petrol vehicles over a transition interval however flip a blind eye to bitcoin-type property constructed on PoW expertise, with country-sized vitality consumption footprints and yearly carbon emissions that presently negate most euro space international locations’ previous and goal GHG saving. This holds particularly on condition that an alternate, much less energy-intensive blockchain expertise exists.”

Generally, the ECB believes it’s extremely unlikely that the European Union will not take motion when it comes to carbon emissions on PoW-based property like bitcoin. The authors of the paper argue that of their view it’s seemingly that the EU will take related steps on phasing out PoW as they’re doing with fossil gas vehicles. Particularly since, in accordance with them, an “different, much less energy-intensive” expertise like PoS exists.

“To proceed with the automotive analogy, public authorities have the selection of incentivising the crypto model of the electrical automobile (PoS and its varied blockchain consensus mechanisms) or to limit or ban the crypto model of the fossil gas automotive (PoW blockchain consensus mechanisms). So, whereas a hands-off method by public authorities is feasible, it’s extremely unlikely, and coverage motion by authorities (e.g. disclosure necessities, carbon tax on crypto transactions or holdings, or outright bans on mining) is possible. The value affect on the crypto-assets focused by coverage motion is prone to be commensurate with the severity of the coverage motion and whether or not it’s a world or regional measure.”

The overwhelming majority of residents are used to pondering of cash as one thing apart from what it truly is, and the ECB can also be in charge for this. Cash is perceived as one thing that has worth by itself, as an alternative of one thing whose worth comes from the interplay between the individuals who use it.

The euro is topic to each fixed modifications (common inflation) and traumatic occasions (devaluations, pressured alternate charges, and so forth.), however these are ignored or in any other case underestimated. Individuals consider they personal it, though they’ll solely alternate it for different issues.

For what number of and for what issues will 100 euros be exchanged in a single yr, 5 years or ten years? That is, by no means, as much as us.

Its alternate operate is continually altering as a result of components we can’t management. The interplay between those that use it’s the principal issue and, in flip, this interplay relies on financial and financial coverage guidelines that few folks learn about.

Bitcoin escapes these guidelines (and that is the explanation why the ECB desires to ban it), it’s simply code that the ECB and the regulators are attempting to make ineffective. Bitcoin additionally and above all expresses its worth by options which can be completely unbiased of a authorities’s energy and, subsequently, the ECBs.

What Will Occur Subsequent?

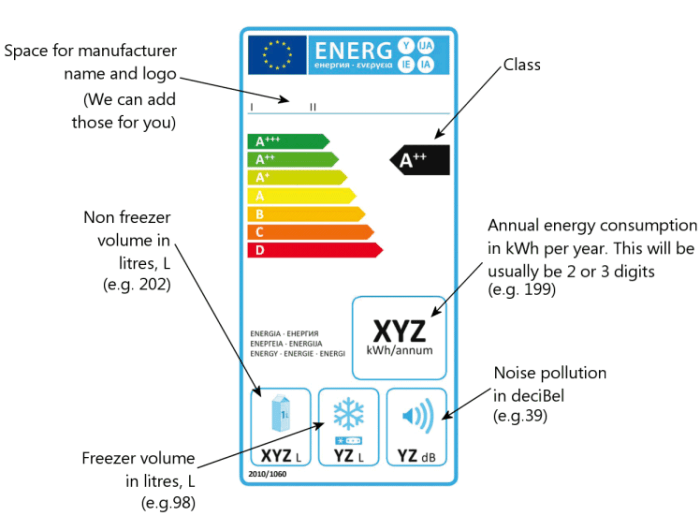

In 2025, we are going to see a ranking system for cryptocurrencies in accordance with their environmental affect inside the European Union — assume vitality labels for fridges or TVs. You’ll be able to already count on that bitcoin will get the worst classification. This step will primarily be optimistic for Ethereum and dangerous for Bitcoin.

It’s fairly unlikely that such a label will scare off traders from shopping for bitcoin, particularly because the Bitcoin group is saying that the Bitcoin community shouldn’t be an impediment however an answer for extra inexperienced vitality.

Due to this fact, the Bitcoin mining trade has the inducement to develop into greener: The fossil gas analogy within the ECB paper is unnecessary. The vitality mixture of a PoW community like Bitcoin can come solely from renewable, inexperienced sources. Bitcoin can function a technique to instantly monetize vitality, as is already taking place with flared fuel that may be flared anyway. Nonetheless, it’s questionable how briskly and efficient this effort will likely be to policymakers, particularly since fossil vitality firms like Exxon are actually mining Bitcoin utilizing flared fuel.

The authors of the ECB paper are already implying {that a} larger bitcoin value equals extra vitality consumption, as extra miners will take part. Destroying demand for bitcoin would therefore be an efficient answer to convey down the hash charge. At the least in idea.

Conclusion

The tutorial and political consensus appears to level towards one thing like attempting to retire the “previous” PoW, and shifting in the direction of the “new” PoS customary. Significantly since Ethereum’s current merge, many bystanders consider this might be a viable path for the Bitcoin community. We doubt that and plan to elaborate on that in a future submit. As we’ve seen in numerous situations, banning Bitcoin is tough, if not inconceivable. The Nigerian authorities tried, failed and finally gave up, for example.

Will probably be fairly some time till 2025, and with an vitality disaster, elevated concentrate on carbon emission in addition to world uncertainty general, the one factor we are able to do at this level is to count on the surprising.

Even when the worst-case situation occurs, and we see a Bitcoin ban of some kind occur within the EU, we doubt that this may maintain eternally. Bitcoin doesn’t ask for permission. Bitcoin is one thing that ontologically struggles to remain inside a fence. It’s not an thought derived from anarchist positions, it’s an argument derived from the inherent traits of the expertise launched by Satoshi Nakamoto. The regulators work in an authorizing logic and so it’s clear that they battle to intercept the Bitcoin phenomenon, which capabilities no matter another person’s permission.

It is a visitor submit by Guglielmo Cecero and Raphael Schoen. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.