Valkyrie Investments has laid out a proposal to take up the reins of troubled bitcoin belief GBTC.

“We perceive that Grayscale has performed an necessary position within the improvement and development of the bitcoin ecosystem with the launch of GBTC, and we respect the staff and the work that they’ve performed,” Valkyrie’s co-founder and CIO, Steven McClurg, mentioned in a press release posted to the corporate’s web site. “Nevertheless, in mild of latest occasions involving Grayscale and its household of affiliated firms, it’s time for a change. Valkyrie is the most effective firm to handle GBTC to make sure its traders are handled pretty.”

McClurg instructed Bitcoin Journal that the proposal can be for present GBTC shareholders to vote on by way of proxy. If chosen by the shareholders, Valkyrie would develop into the sponsor.

The method isn’t as simple because it appears, nevertheless. As highlighted on a Bloomberg report, “Grayscale filings state that shareholders take no half within the administration or management of the belief, and have restricted voting rights. As well as, no amendments to the belief settlement that would materially have an effect on the pursuits of shareholders will be made with a vote of not less than a majority — which means 50% — of the shares.”

McClurg defined to Bitcoin Journal that Valkyrie is conscious of these points, and has deliberate forward. He declined to touch upon any specifics of what that plan would possibly entail, however hinted that this wouldn’t be their first time reaching such a objective. In terms of the plans for after an eventual takeover, McClurg has it laid out.

The primary motion Valkyrie would take within the occasion that it turns into GBTC’s sponsor and supervisor can be to “instantly file for Reg M exemption,” the chief defined. Grayscale CEO Michael Sonnenshein instructed Yahoo Finance earlier this month that the belief not permitting redemptions is a results of a U.S. Securities and Change Fee (SEC) shutdown in 2014, who discovered GBTC redemptions to be in violation of Reg M. In response to FINRA, the SEC’s Regulation M “is designed to forestall manipulation by people with an curiosity within the consequence of an providing, and prohibits actions and conduct that would artificially affect the marketplace for an supplied safety.”

“If permitted by the SEC, [the exemption] would permit us to redeem shares at par worth for shareholders who wish to redeem,” McClurg instructed Bitcoin Journal.

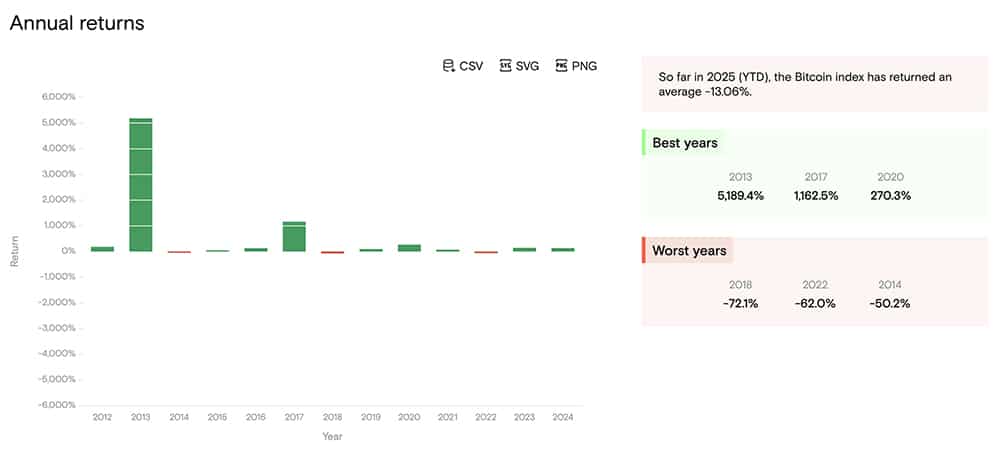

The transfer would allegedly assist alleviate what would possibly at present be GBTC’s most urgent situation: a whopping 47% low cost of its shares in comparison with the worth of the underlying property held.

“Redemptions usually trigger a reduction to slim because of means of market makers to arbitrage,” Valkyrie’s government added.

McClurg mentioned the agency would additionally cut back the administration charge to 75 foundation factors, down from the 200 foundation factors at present levied by Grayscale.

It isn’t clear whether or not Grayscale has sought Reg M exemption but, and McClurg instructed Bitcoin Journal that “nothing is stopping Grayscale from doing this themselves.” GBTC’s present supervisor is searching for a conversion of the belief right into a spot bitcoin exchange-traded fund –– one thing it claims would eradicate the low cost given the power of an ETF to create and redeem shares on demand. It has gone so far as to sue the SEC beneath the premise that the regulator allowed the itemizing of futures-based merchandise and would not have the grounds to disclaim related spot choices. This might seemingly assist clarify the agency’s reluctance to use for Reg M exemption, as an eventual exemption from the SEC may cut back the low cost to close zero and kill its leverage for the ETF transfer. It isn’t clear whether or not that’s the case, nevertheless. Valkyrie would nonetheless pursue the conversion if turned GBTC’s supervisor.

“We might nonetheless try a conversion, however would work with regulators for an orderly conversion on their time,” McClurg mentioned.

Discover extra particulars of Valkyrie’s proposal right here.