Bitcoin’s mining problem fell 3.6% at 3:49 a.m. UTC on Jan. 3.

The issue change suggests {that a} fraction of Bitcoin (BTC) miners withdrew from the community — probably resulting from lowered mining profitability, in line with the most recent information from Bitrawr.

Fluctuations within the worth of BTC are unlikely to be the explanation behind this most up-to-date adjustment. Regardless of this 12 months’s market crash, BTC worth remained regular because the blockchain’s final problem adjustment two weeks in the past. The worth of BTC is down 0.7% over the past seven days and three.64% over the previous 30 days.

Final week a lot of U.S. BTC mining companies — most notably the bankrupt Core Scientific — complied with current local energy curtailments which concerned increased winter electrical energy costs and energy outages. In consequence, miners confronted elevated electrical prices and, in some circumstances, restricted entry to power.

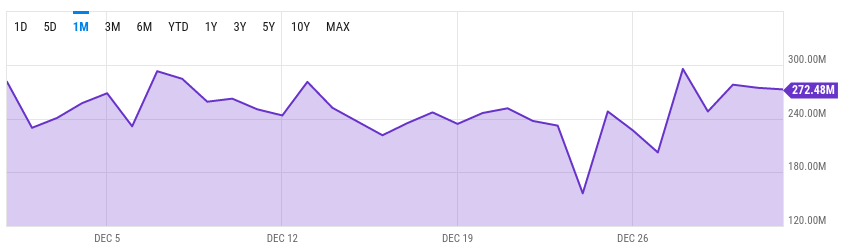

Bitcoin Community Hashrate

In gentle of the aforementioned power curtailments, BTC total mining hash fee fell briefly to 156.46M on Dec. 24, 2022, from 232.05M on Dec. 23, 2022, in line with YCharts.

Although BTC has since recovered a lot of its hash fee, restricted entry to power continues to be impacting participation in BTC mining.

Bitcoin’s mining problem is adjusted regularly each 2,016 blocks (or roughly each two weeks). Bitcoin’s earlier problem adjustment on Dec. 19 elevated the blockchain’s problem by about 3%.

The lowered profitability of mining extends past the most recent adjustment as information exhibits that mining income was down 37.5% year-over-year in 2022.