Decentralized finance (defi) has continued to stay deeply ingrained within the cryptocurrency economic system because the ecosystem offers customers with a non-custodial method to trade digital belongings, lend cryptocurrencies, difficulty stablecoins, and methods to revenue from arbitrage. Within the lending sector of defi, lots has modified over the past 12 months as lending purposes like Terra’s Anchor Protocol bit the mud, and 71.95% of the whole worth locked in defi lending protocols evaporated.

From $37 Billion to $10 Billion: The High 5 Defi Lenders Then and Now

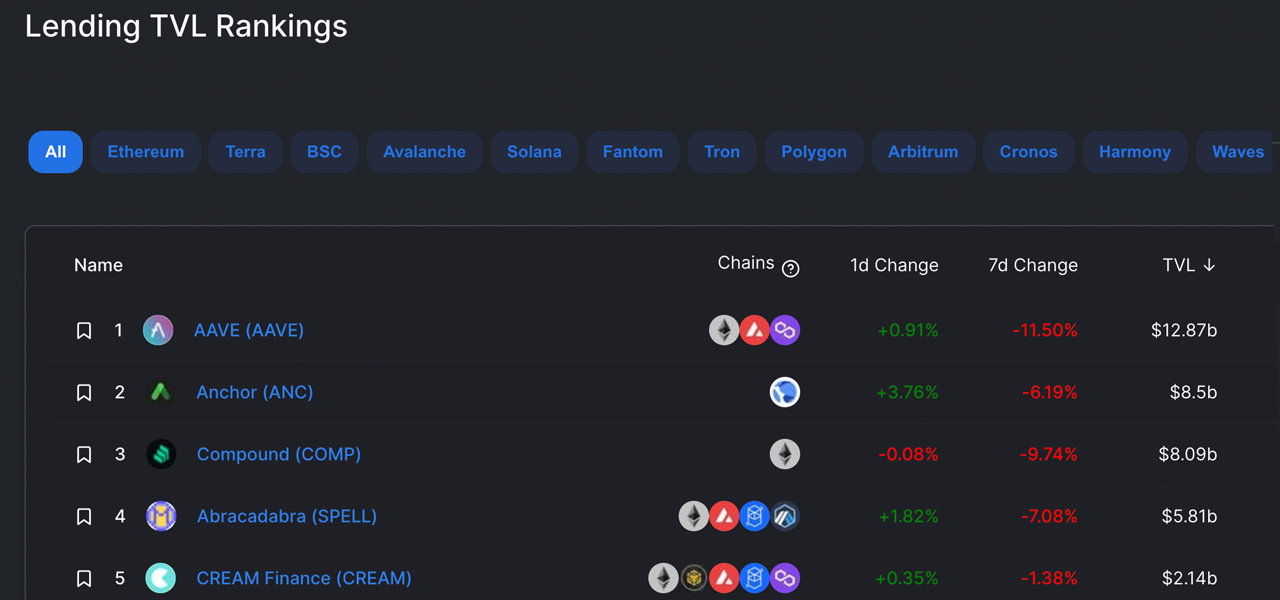

Final 12 months round this time, decentralized finance lending protocols held $37.41 billion in whole worth locked (TVL), and the defi protocol Aave dominated with $12.87 billion. An archive.org snapshot from Jan. 10, 2022, exhibits that Aave’s $12.87 billion TVL was bigger than the TVL the highest 5 defi lending protocols held on Jan. 17, 2023.

Information exhibits that the highest 5 defi protocols in mid-Jan. 2023 embody Aave ($4.58 billion), Justlend ($3.02 billion), Compound ($1.85 billion), Venus ($813.63 million), and Morpho ($221.59 million). At present, all 5 of the aforementioned defi protocols have a mixed TVL of round $10.49 billion.

On Jan. 10, 2022, Terra’s Anchor Protocol held roughly $8.5 billion in worth, however now the defi protocol is in ashes. Anchor was one of many fundamental elements within the Terra ecosystem as terrausd (UST) holders deposited UST for a 20% annual proportion charge return that compounded every day.

However in Could 2022, UST depegged from its $1 parity, and Anchor holds solely round $2 million right now. Compound held the third-largest TVL by way of defi lending protocols with $8.09 billion on the time. On Jan. 17, 2023, Compound’s TVL has shrunk to $1.85 billion.

The second-largest defi lending protocol right now is Justlend with $3.03 billion. The Tron-based Justlend moved from the seventh-largest defi lending protocol TVL to the second by leaping from $1.72 billion to the present $3 billion. Justlend is likely one of the solely decentralized finance lending purposes that noticed a rise over the past 12 months.

The fourth and fifth-largest defi lenders final 12 months, Abracadabra and Cream Finance, are now not within the prime 5 standings and have been changed by Venus and Morpho. Cream Finance is now within the twentieth place, dropping from $2.14 billion to the present $42.94 million.

What do you consider the defi lending protocol shake-up during the last 12 months? Tell us your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.