The beneath is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

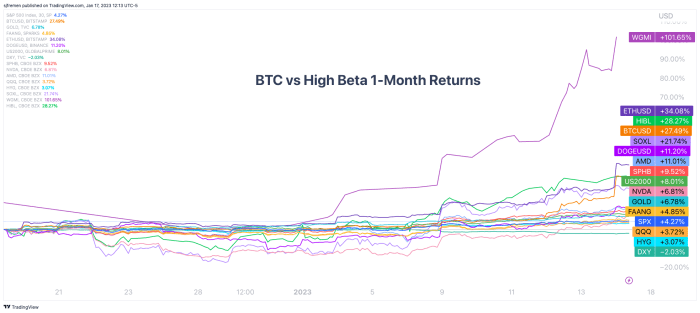

An impartial bitcoin rally or a high-beta transfer? Both manner, bitcoin holders are celebrating the most recent motion to start out 2023. Bitcoin has proven some vital momentum and has powered by means of each key short-term value stage throughout every day transferring averages and on-chain realized costs. In actual fact, each main high-beta play available in the market is displaying the identical energy which supplies us extra warning than confidence on this newest quick squeeze highlighted final week in “Bitcoin Rips To $21,000, Shorts Demolished In Largest Squeeze Since 2021.”

As a lot as we wish to see an impartial bitcoin transfer greater, there’s loads of indicators available in the market displaying the alternative is probably going. We’ve seen a comparatively significant bounce in essentially the most oversold names of 2022, with a brief squeeze and subsequent spherical of FOMO off the 2022 lows.

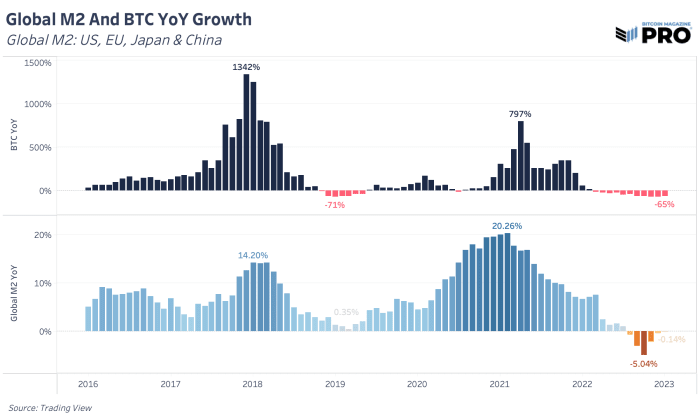

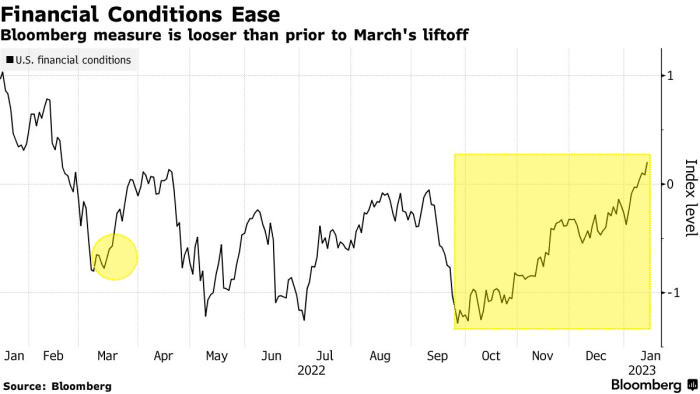

This latest danger rally has seen implied fairness market volatility drift to new lows because the U.S. greenback continues to weaken over the short-term, Nationwide Monetary Circumstances Index (NFCI) loosens and international M2 cash provide contracts at a a lot slower tempo relative to the previous couple of months.

Web liquidity, a mannequin we highlighted in our earlier piece, exhibits a contraction in comparison with final 12 months however hasn’t modified a lot over the previous couple of months. If we’re to see a sustained rally proceed, we’d wish to see development in web liquidity over the following couple of months to be the principle driver accompanying this transfer.

Of their latest assembly minutes, members of the Federal Reserve expressed concern in regards to the “unwarranted easing in monetary circumstances” attributable to the run-up in dangerous property and subsequently hindering their efforts to chill inflation.

With the Financial institution of Japan deciding on whether or not to loosen their financial coverage, this might trigger the carry commerce to unwind. We view this to be one of many few methods the place each the greenback may fall similtaneously international fairness markets weaken, with equities repricing attributable to rising prices of U.S. capital.

Like this content material? Subscribe now to obtain PRO articles instantly in your inbox.

![[LIVE] July 31 Crypto Updates – Bitcoin Holds $118K as Powell Freezes Rates Despite Trump’s Pressure: Best Crypto to Buy Now? [LIVE] July 31 Crypto Updates – Bitcoin Holds $118K as Powell Freezes Rates Despite Trump’s Pressure: Best Crypto to Buy Now?](https://sbcryptogurunews.com/wp-content/themes/jnews/assets/img/jeg-empty.png)