Key Takeaways

- Coinbase is halting all operations in Japan, citing “market circumstances”

- Final week it reduce 20% of its workforce, having already reduce 18% final June

- Inventory value is up practically 50% on the yr amid crypto rally, however continues to be 85% off its peak

- Issues are aplenty on the firm, whereas CEO Armstrong offered 2% of his stake in October

Coinbase has been in a world of ache not too long ago.

Simply final week, the trade introduced it was shedding 20% of its workforce, having already reduce 18% final June. I wrote a chunk analysing what this meant for the corporate, which was buying and selling at a market cap beneath $10 billion, 90% down from the value at which it went public in April 2021.

This got here after CEO Brian Armstrong unloaded 2% of his stake within the firm in October, after which I wrote a deep dive analysing what all of it meant for an organization that has been considered because the torch-bearer to hold crypto into mainstream circles as soon as and for all following its high-profile floating on the Nasdaq.

However at the moment, extra unhealthy information got here. The trade introduced it’s halting all operations in Japan, citing “market circumstances”.

Coinbase inventory value on the up

Regardless of the onslaught of unhealthy information, Coinbase’s share value has been a giant winner within the early weeks of 2023, up 48% in simply 18 days.

This comes amid the largest crypto rally in 9 months, which has seen costs surge throughout the board. Whereas the bounceback in Coinbase’s share value is nice information for buyers, it additionally mockingly sums up precisely what the issue is – Coinbase’s correlation to the crypto market.

There are few issues extra unstable than crypto, so it isn’t excellent news to be tied on the hip to its value motion. However Coinbase’s efficiency relies on the crypto market as a result of as the value falls, transaction volumes and curiosity within the trade, and by extension Coinbase, plummets.

Through the pandemic, this was a fantastic factor. The cash printer was on most energy, rates of interest had been low and retail buyers had been all aboard the FOMO prepare, armed with a wholesome curiosity about crypto and a fats stimulus cheque.

However with the altering macro setting, the crypto trade has freefallen from $3 trillion to $800 billion, earlier than this current surge popped it again above $1 trillion.

Why are Japanese operations ceasing?

Regardless of the nice pump this previous few weeks, zooming out tells you that Coinbase has shed 85% of its worth since going public, gone by means of two rounds of layoffs, seen its CEO promote 2% of his inventory in October and now’s ceasing operations in Japan.

All Japanese Coinbase prospects can have till February 16th to withdraw their holdings from the platform. In the event that they fail to take action, the remaining belongings will likely be transformed to Japanese yen. Coinbase had labored laborious throughout the earlier crypto winter to develop into the Japanese market, so the abrupt departure is a disgrace.

However Coinbase will not be the one trade to make this transfer, with rival Kraken additionally asserting it was ceasing Japanese operations final month. Additionally like Coinbase, Kraken had reduce a big chunk of its workforce, shedding 30% of workers after the FTX collapse shook the market. The plight of Coinbase’s excessive correlation with the crypto market is as soon as going through exchanges throughout the trade.

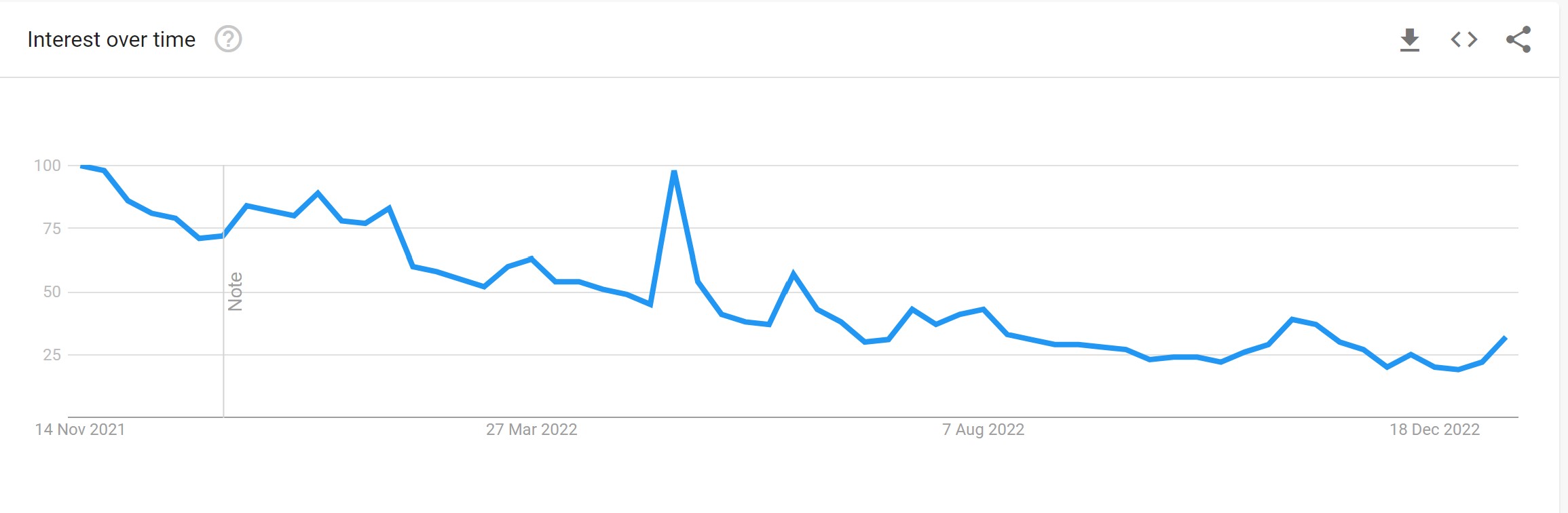

Coinbase Q3 outcomes revealed that transaction quantity fell 44% from Q2. The autumn in quantity and curiosity in the end is what has brought on the plummeting share value, layoffs, and now ceasing of Japanese operations, with a look at Google Tendencies all you might want to see the size of the dropoff within the public’s consideration to the trade.

For $COIN buyers, they are going to hope that the previous couple of weeks of softer macro information and a crypto bounceback are an omen of issues to return, in any other case this share value rally will likely be short-lived.

For $COIN buyers, they are going to hope that the previous couple of weeks of softer macro information and a crypto bounceback are an omen of issues to return, in any other case this share value rally will likely be short-lived.