sponsored

In January 2023, ViaBTC Capital and CoinEx collectively launched the 2022 Crypto Annual Report to supply knowledge evaluation and insights into 9 sectors, together with Bitcoin, Ethereum, stablecoins, NFT, public chains, DeFi, SocialFi, GameFi and regulatory insurance policies. This report additionally predicts the crypto pattern in 2023.

In line with the report, affected by components such because the macro setting and bull-to-bear transition, the entire cryptocurrency business turned bearish in 2022. Specifically, following the Terra meltdown in Could, most cryptocurrency sectors have been hit by the bearish impression. Under is the overview of every phase.

1. Bitcoin

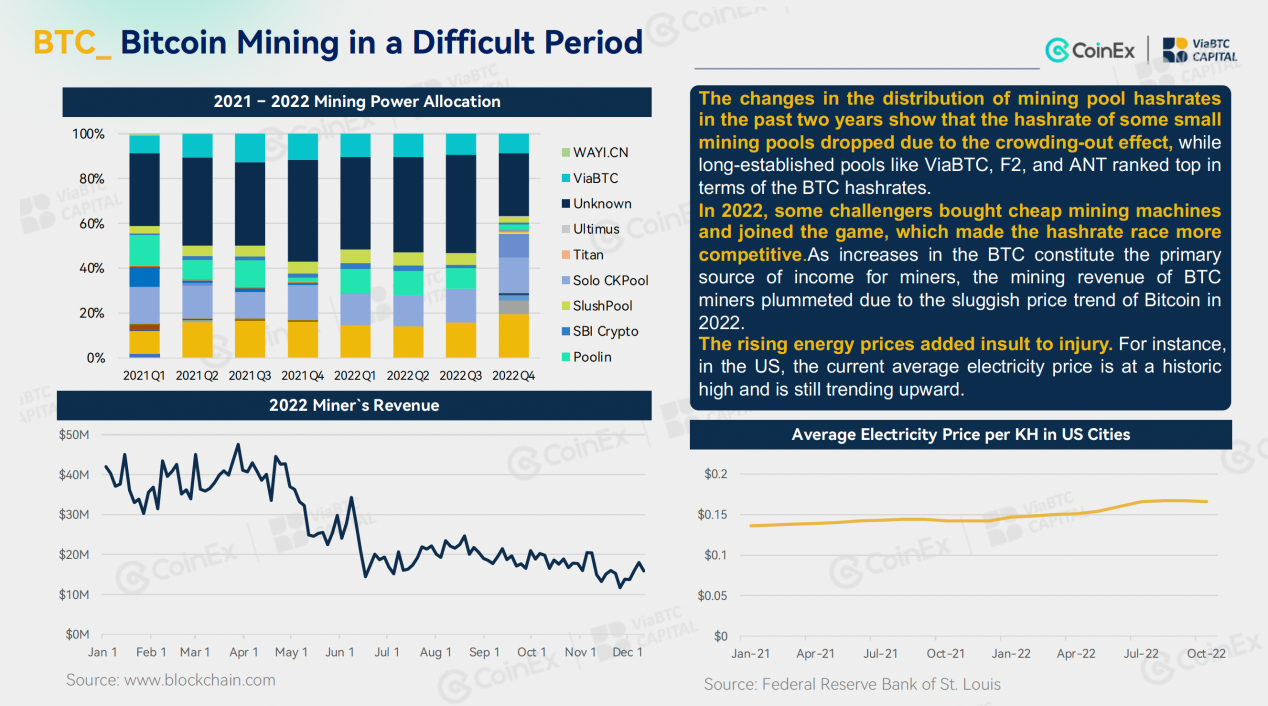

In 2022, the general efficiency of Bitcoin remained sluggish, with vital declines in worth and buying and selling quantity in comparison with 2021. The value on the finish of 2022 even fell under the height of the final bull market. The value pattern of Bitcoin all year long is clearly influenced by the tempo of US rate of interest hikes, however because the US rate of interest hike coverage continues to advance, its impression on the value of bitcoin is progressively diminished. Concerning BTC mining, the community issue remained at a historic excessive. In the meantime, the mining income plummeted, and miners have needed to shut down their previous fashions. Affected by a number of components, the mining business witnessed a robust crowding-out impact, which drove homeowners of small mining farms out of the marketplace for numerous causes. On the similar time, long-established mining swimming pools and mining farms managed to take care of a sure stage of stability.

2. Ethereum

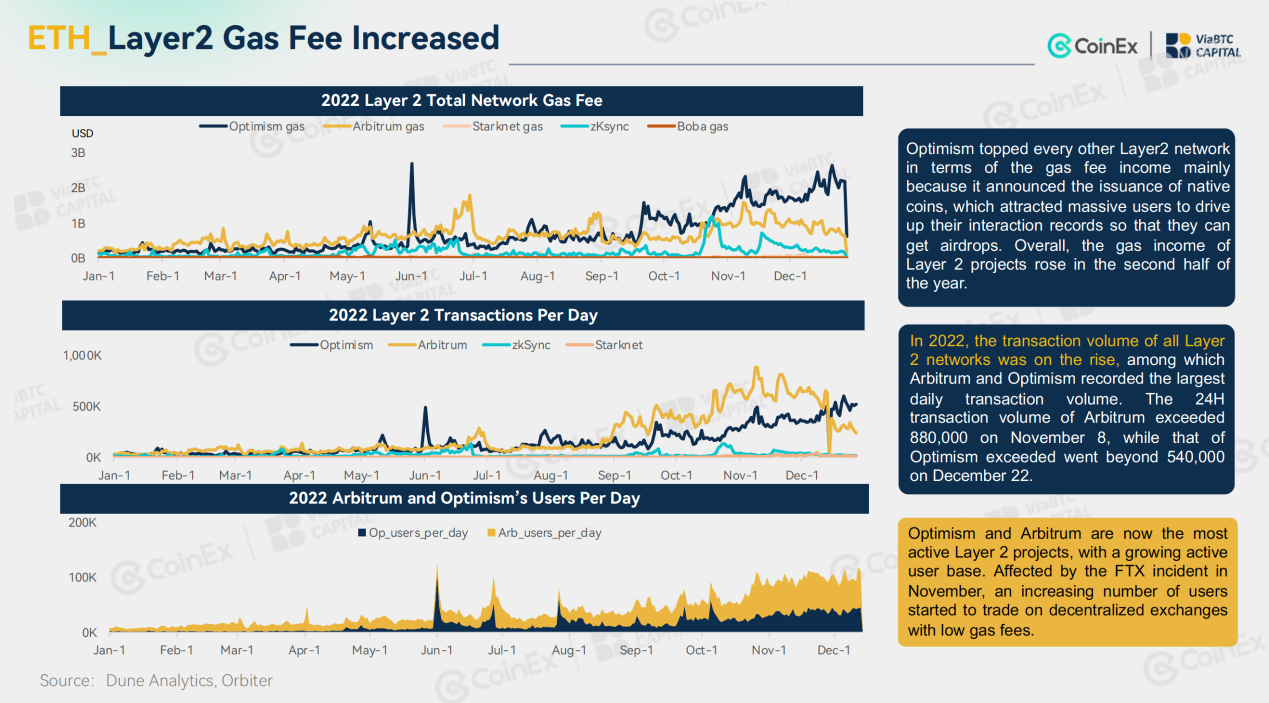

The first statistics of Ethereum trended downward in 2022. Along with the secondary market worth and transaction quantity, the on-chain knowledge, together with TVL, transaction price, energetic deal with and burning quantity additionally took a plunge. Regardless of that, the community did obtain loads of progress in 2022. On September 15, Ethereum accomplished the historic transition from PoW to PoS. The Merge considerably reduce the community’s power consumption and day by day output, thereby decreasing the dumping stress from secondary markets. In the meantime, Layer 2 tasks reminiscent of Arbitrum, Optimism, zkSync, and Starknet launched their mainnet both in entire or partially. Though their day by day transaction quantity was far lower than Ethereum mainnet, the tasks exceeded Ethereum by way of the variety of addresses. Furthermore, their fuel price was usually 1/40 of that charged by Ethereum. On the similar time, the community additionally noticed an exponential improve in fuel charges throughout 2022.

3. Stablecoins

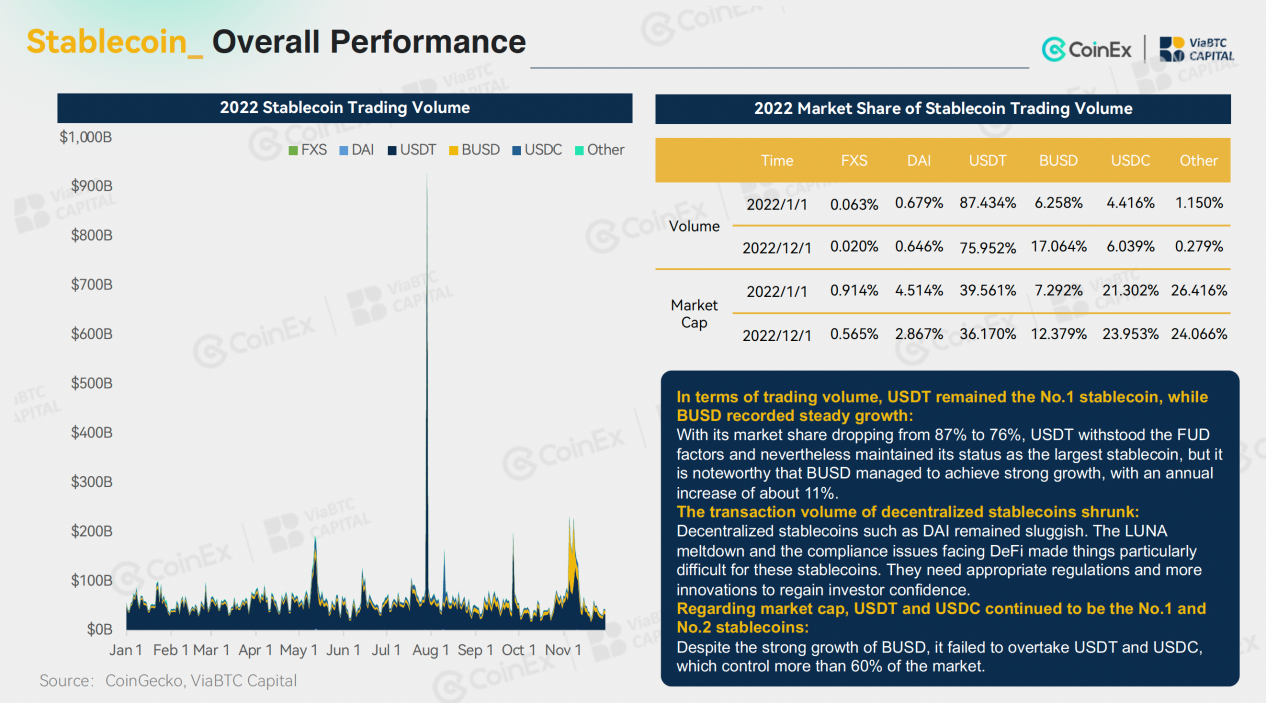

The stablecoin market as an entire was steady in 2022. Particularly, all year long, the availability of stablecoins fell from $157 billion to $148 billion, a 6% drop. On this regard, the autumn was not substantial. With respect to centralized stablecoins, USDT maintained its dominance, whereas BUSD is rising quickly on Binance’s again. Against this, algorithmic stablecoins have been hit onerous by the autumn of LUNA, which shattered the religion in decentralized stablecoins and lowered buying and selling volumes. In consequence, there was a transparent drop within the variety of new decentralized stablecoins.

4. Public chains

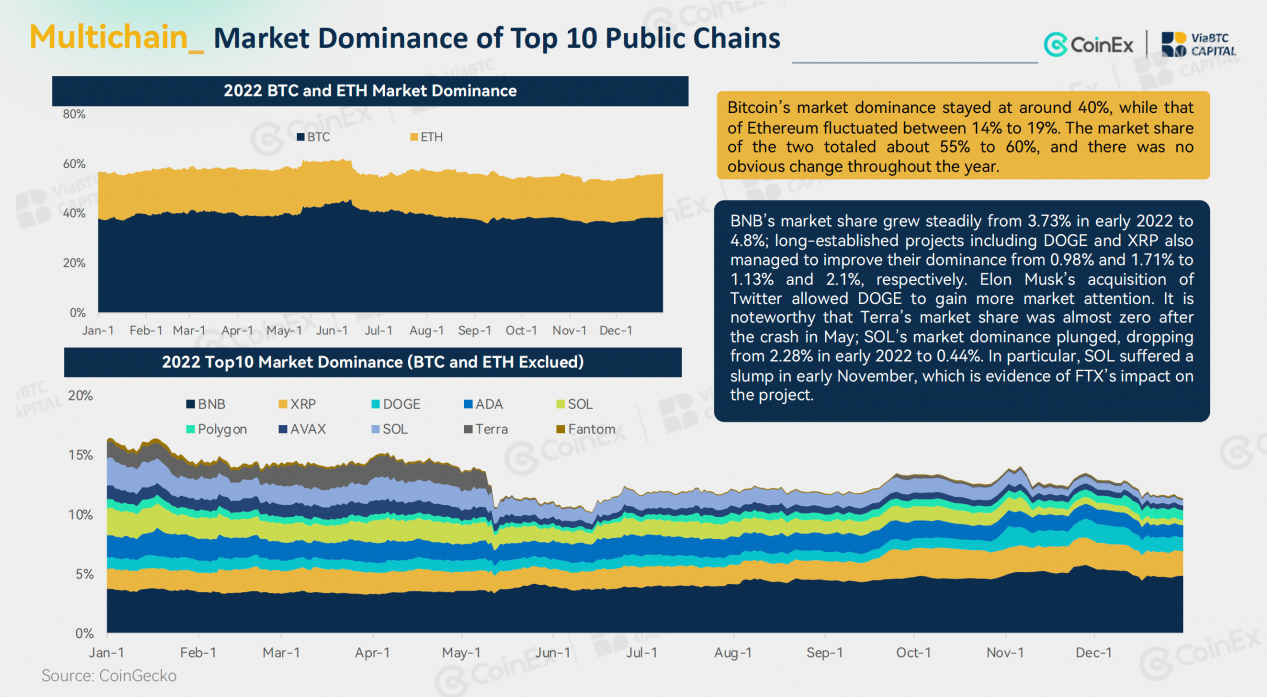

Regardless of the tough market situations in 2022, public chains remained a aggressive sector. Because of the overflow of demand brought on by the congestion of the Ethereum community, the brand new public chain with low charges maintained a shiny efficiency earlier than Could. Nevertheless, as numerous unhealthy information brewed and fermented, a collection of bankrupt occurred one after one other. Many public chains have been tremendously impacted, and the decline was even worse than that of Ethereum. In Could, Terra collapsed in just a few days, making it the primary well-known public chain to fall. Moreover, the Terra meltdown was additionally a sign that the market turned absolutely bearish. In November, hit by the autumn of FTX and Alameda Analysis, Solana’s token worth and TVL took one other plunge, and the tasks inside its ecosystem have been additionally damage. Different new chains reminiscent of Fantom and Avalanche have been additionally struggling. On the similar time, various new public chains, together with Layer 2 tasks like Arbitrum and Optimism and Meta-related chains reminiscent of Aptos and Sui, made their debut in 2022.

5. NFT

Final yr, the NFT sector declined after its preliminary growth. In April, the market cap of the NFT reached $4.15 billion, a historic excessive; In Could, pushed by the growth of Otherside, a metaverse NFT assortment developed by Yuga Labs, the buying and selling quantity of the sector hit a report excessive of $3.668 billion. However quickly afterward, because the NFT market turned sluggish, the buying and selling quantity declined. In the meantime, the value of blue-chip NFTs, in addition to the ETH worth, plummeted, which each negatively affected the market. Then again, the variety of NFT holders stored rising and reached a historic excessive in December.

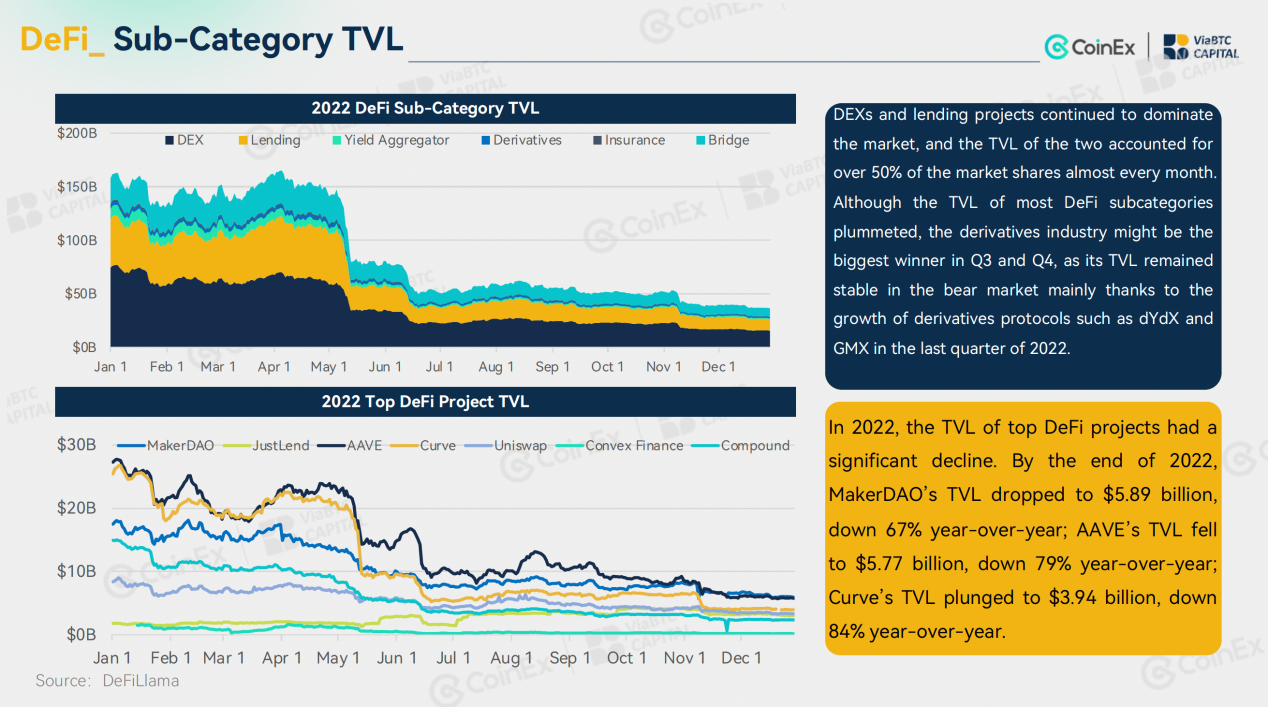

6. DeFi

DeFi’s TVL additionally trended downward in 2022. Specifically, in the course of the LUNA/UST meltdown in Could, mainstream cash witnessed probably the most spectacular crash within the historical past of cryptocurrencies, which was adopted by a TVL collapse. Moreover, over the yr, DeFi additionally suffered frequent hacks, which raised safety considerations for DeFi. When it comes to innovation, though the primary two quarters of 2022 noticed trending hypes about DeFi 2.0 every so often, together with the stoop of OHM and the (3, 3) meme, DeFi 2.0 was virtually confirmed to be a totally false narrative, and the market shifted its consideration again to DeFi 1.0 infrastructure tasks reminiscent of Uniswap, Aave, and MakerDAO. Regardless of the bearish situations, mainstream DeFi tasks together with AAVE and Compound managed to take care of regular operations and attracted many new customers from sure CeFi tasks (e.g. Celsius and FTX).

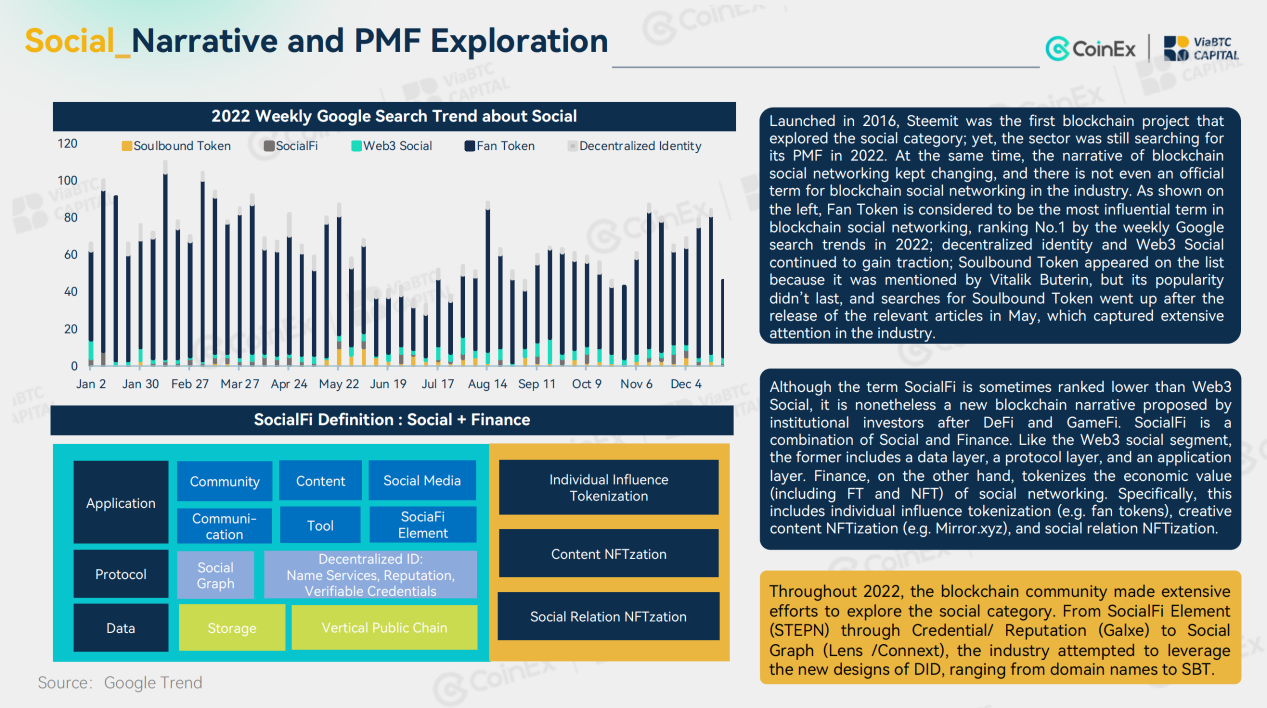

7. SocialFi

In 2022, the blockchain business continued to discover new potentialities for SocialFi. Over the yr, we noticed the looks of iconic phrases like Fan Token, Soulbound Token (SBT), Web3 Social, and Decentralized Identification (DID), however the PMF (Product- Market Match) was by no means recognized. Regardless of that, the SocialFi nonetheless managed to current us with various star tasks, together with Web3 way of life app STEPN that includes SocialFi components, credential community Galxe, BNB Chain area identify service SPACE ID, social graph Lens Protocol, and Web3 gamified social studying platform Hooked Protocol. Aside from that, the 2022 Qatar World Cup additionally helped Fan Tokens entice in depth market consideration. In consequence, as an alternative of plummeting because of the bearish impression, the Fan Tokens additionally carried out barely higher in 2022 than in 2021.

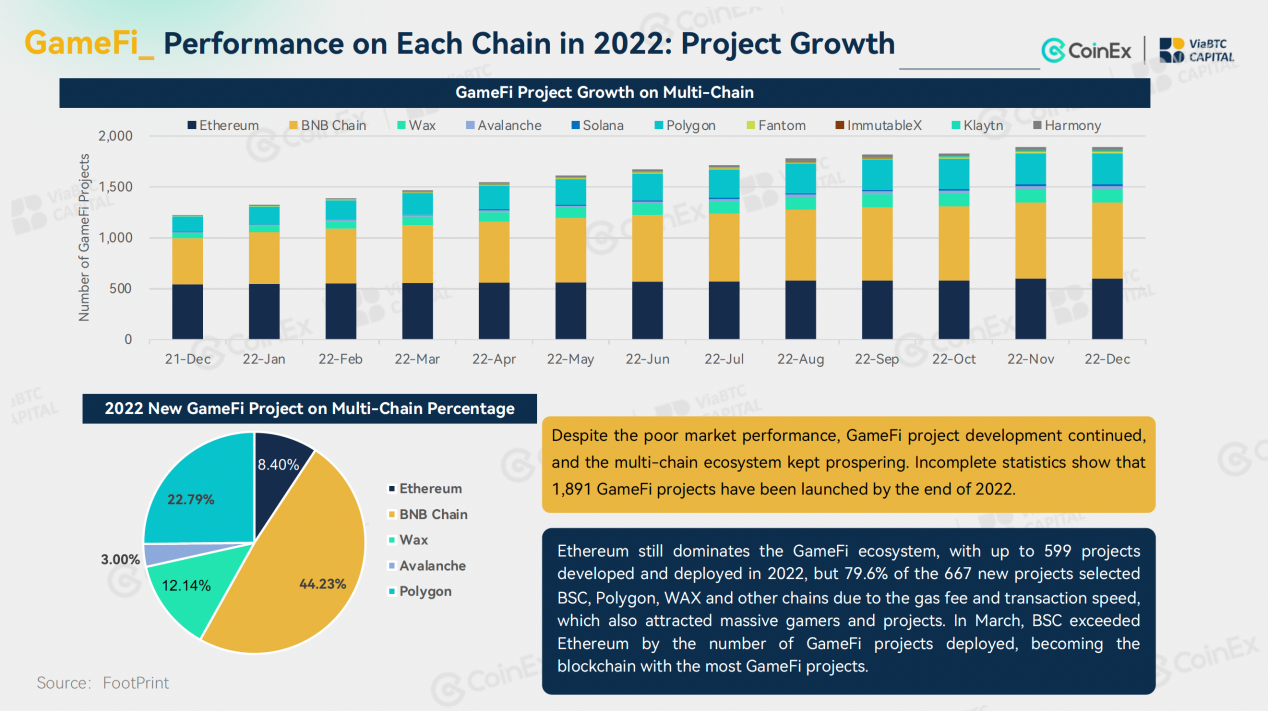

8. GameFi

2022 was additionally the start of the GameFi bear. There was no vital innovation in P2E blockchain recreation mannequin. As the expansion of customers and buying and selling volumes dwindled, institutional buyers seemed away from the P2E mannequin. Within the first half of the yr, the Transfer-2-Earn mannequin created by STEPN captured the highlight with its progressive twin tokenomics and advertising and marketing strategy, bringing new dynamics to GameFi. Final yr, blockchain tasks raised the biggest funds in April, with blockchain investments totalling $6.62 billion. Nevertheless, the market didn’t reply to different venture groups specializing in the truth plus token mannequin. Because the multi-chain ecosystem gained rising reputation, Ethereum maintained its dominance within the GameFi ecosystem, however the development price of tasks on Ethereum did not match that of BNB Chain and Polygon. As well as, most chains relied closely on their prime tasks, and there have been nonetheless loads of low-quality GameFi tasks with a small consumer base, subpar interactions and low buying and selling volumes.

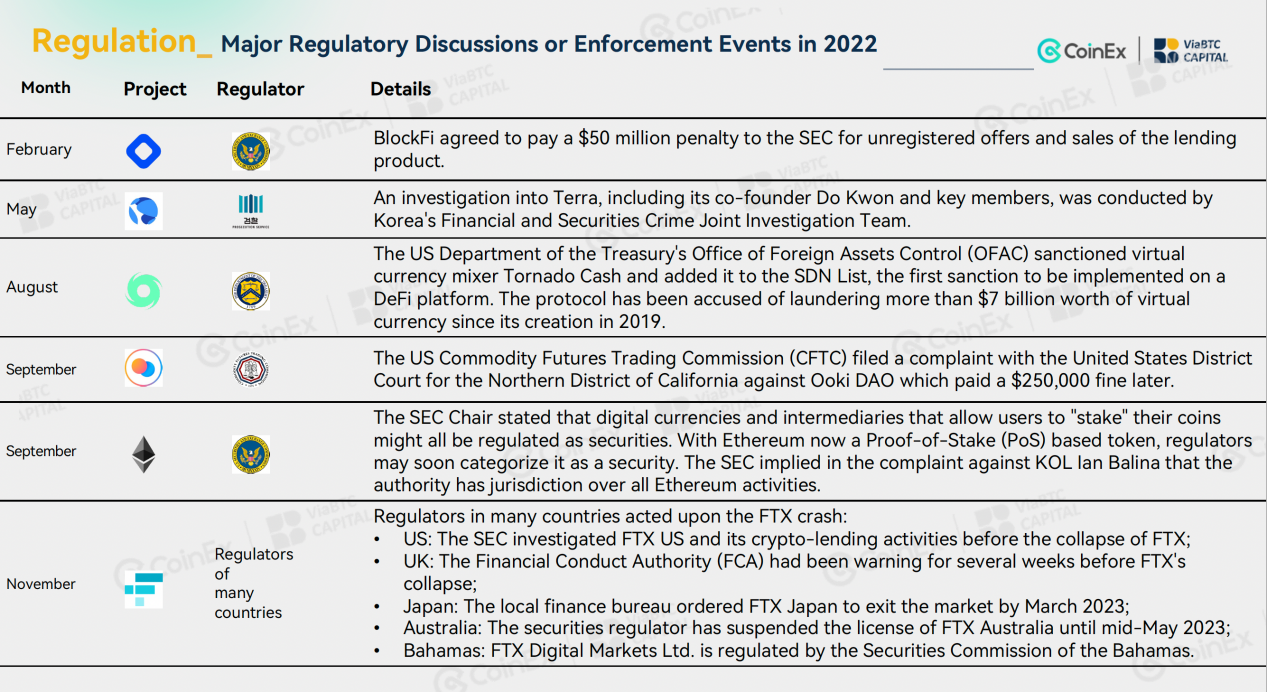

9. Regulatory insurance policies

Typically talking, for the cryptocurrency business, 2022 was filled with ups and downs, however rules are headed in the correct course. Over the previous yr, regulators within the developed world achieved loads of progress. America launched a regulatory framework for cryptocurrencies; the European Union initially authorized the MiCA Act and the TFR Act; the UK and South Korea made progress within the institution of the related organizations; Russia and Hong Kong promoted the dialogue and implementation of insurance policies for cryptocurrency mining and digital asset securities. The turbulence that occurred within the cryptocurrency business in 2022 was partially the results of the sharp drop in funds and partially the results of regulatory loopholes and crackdowns. Final yr, the chapter of Terra and FTX, two prime cryptocurrency tasks, prompted nationwide regulators and regulation enforcement companies to additional improve their cryptocurrency oversight and investigations.

For extra particulars, please go to the ViaBTC Capital web site through the hyperlink:

For extra particulars, please go to the ViaBTC Capital web site through the hyperlink:

https://capital.viabtc.com/weblog/ViaBTC-Capital:-2022-Evaluate-and-2023-Forecast-in-Crypto-Trade-193?class=0&lang=en_US

It is a sponsored publish. Learn to attain our viewers right here. Learn disclaimer under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.