On-chain knowledge exhibits Bitcoin exchanges have registered essentially the most vital outflows for the reason that collapse of the crypto change FTX again in November.

Associated Studying: Bitcoin Traders Flip Grasping For First Time Since March 2022

Bitcoin Alternate Netflow Reveals Deep Unfavourable Values

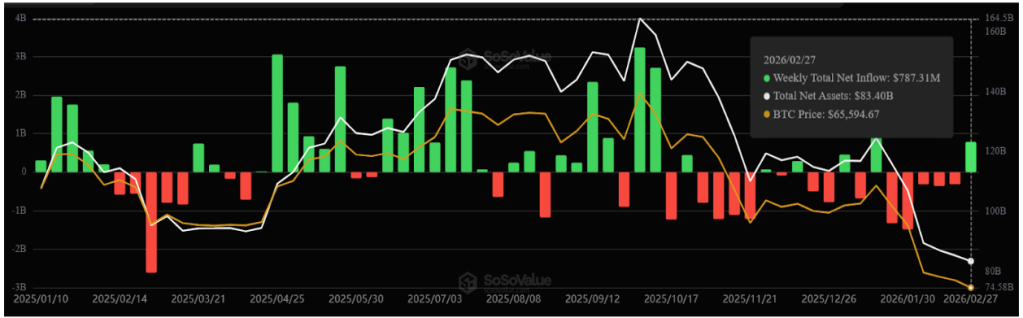

As an analyst in a CryptoQuant publish identified, round 7,000 cash have left the change on this newest spike. The related indicator right here is the “all exchanges netflow,” which measures the web quantity of Bitcoin exiting or coming into into the wallets of all centralized exchanges. The metric’s worth is calculated by taking the distinction between the inflows (the cash moving into) and the outflows (the cash shifting out).

When the indicator has a optimistic worth, the inflows overwhelm the outflows, and a internet variety of cash are deposited to exchanges. As one of many predominant causes traders deposit to exchanges is for promoting functions, this pattern can have bearish implications for the value of the crypto.

Then again, detrimental values indicate {that a} internet quantity of provide is at the moment being pulled off these platforms. Usually, holders withdraw their cash from exchanges to carry onto them for prolonged intervals in private wallets. Thus, such metric values can sign that traders are accumulating for the time being, which can have a bullish impression on the value.

Now, here’s a chart that exhibits the pattern within the Bitcoin all change’s netflow over the previous couple of months:

Seems to be like the worth of the metric has been fairly detrimental just lately | Supply: CryptoQuant

As proven within the above graph, the Bitcoin change netflow recorded a deep detrimental spike through the previous day. This outflow amounted to round 7,000 BTC, leaving the wallets of those platforms the most important worth the metric has seen for the reason that FTX crash again in November of final yr.

From the chart, it’s obvious that the aftermath of FTX’s collapse noticed some substantial outflow values. The explanation behind that’s {that a} identified change like FTX going stomach up instilled concern amongst traders and made them extra conscious of the dangers of retaining their cash in centralized platforms.

Naturally, these holders fled exchanges in lots (inflicting the netflow to plunge into crimson values) in order that they might retailer their Bitcoin in offsite wallets, the keys they personal.

Curiously, the most recent detrimental netflow spike was recorded whereas Bitcoin has been observing a pointy rally. Normally, inflows are extra generally seen in intervals like now, as traders rush to take some earnings.

Thus, as a substitute of constructing these giant outflows, traders are exhibiting indicators that they’re bullish on Bitcoin in the long run and really feel that the present rally has extra to supply nonetheless.

That will be provided that these traders made the withdrawals with accumulation in thoughts. Within the state of affairs that they transferred out these cash for promoting by over-the-counter (OTC) offers as a substitute, Bitcoin may as a substitute really feel a bearish impulse.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $23,100, up 8% within the final week.

BTC strikes sideways | Supply: BTCUSD on TradingView

Featured picture from Thought Catalog on Unsplash.com, charts from TradingView.com, CryptoQuant.com