Information from Santiment reveals these altcoins have seen elevated whale exercise lately, which can make them ones to look at for within the coming days.

Polygon (MATIC), Aave (AAVE), And Dydx (DYDX) See Elevated Whale Transactions

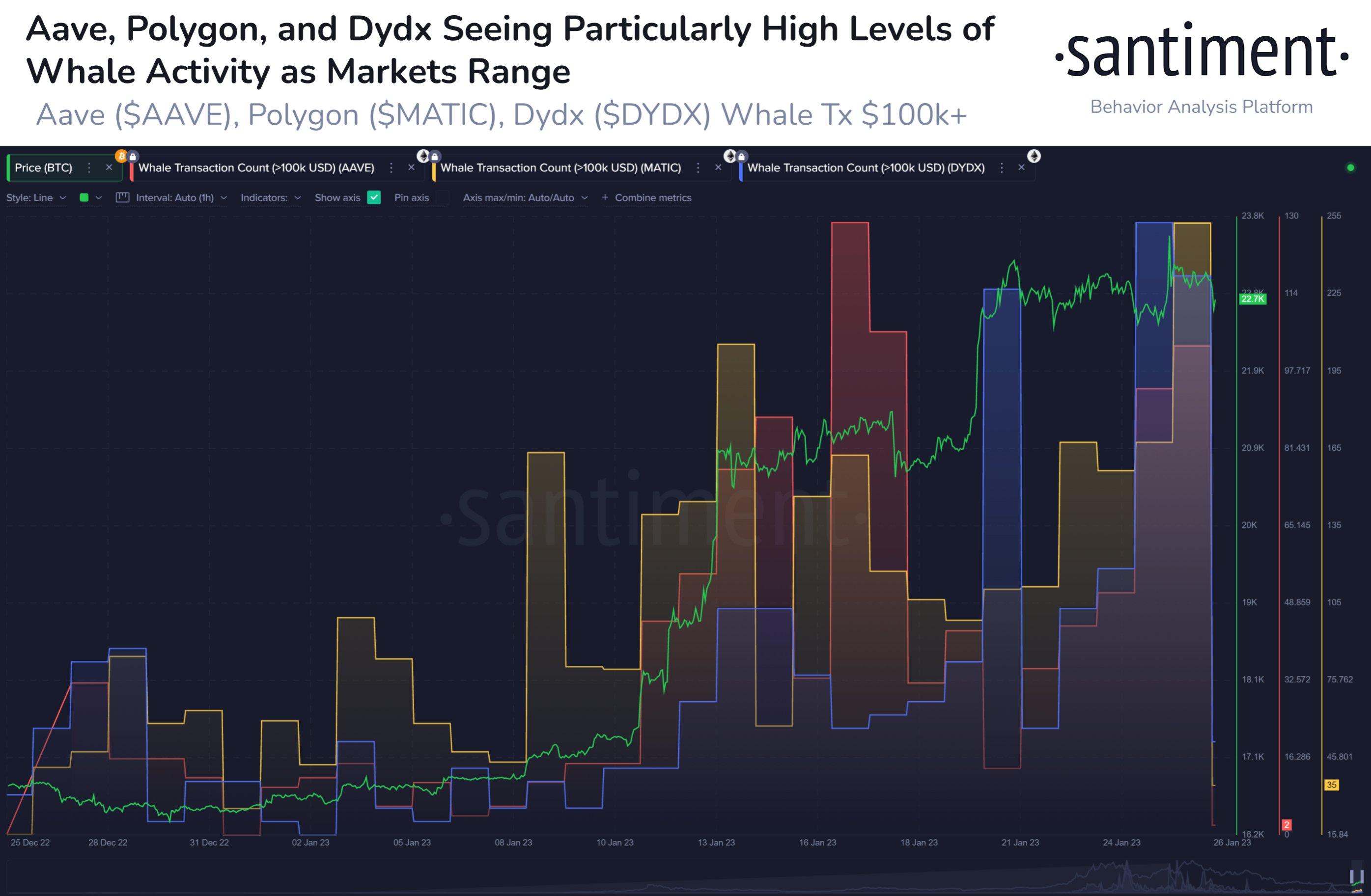

In line with knowledge from the on-chain analytics agency Santiment, Polygon, Aave, and Dydx have all rallied together with excessive whale exercise lately. The related indicator right here is the “whale transaction depend,” which measures the whole variety of transfers that whales are making proper now.

Within the context of those altcoins, the situation for a transaction to depend as one coming from whales is that it ought to contain a motion of cash price at the least $100,000.

When the worth of this metric is excessive for any coin, it means whales are making numerous transactions of that specific crypto at present. This development suggests these humongous holders are actively buying and selling the precise coin in the mean time.

Since whale transactions contain the motion of huge scales of capital, a major variety of them collectively can typically noticeably impression the market. Due to this, the whale transaction depend being at sizeable values can lead to elevated volatility within the worth of the crypto in query.

Now, here’s a chart that reveals the development within the whale transaction depend for 3 totally different altcoins (Polygon, Aave, and Dydx) over the previous month:

The values of all of the three metrics appear to have been excessive in current days | Supply: Santiment on Twitter

As displayed within the above graph, Polygon, Aave, and Dydx have all noticed some fairly excessive whale exercise through the previous month. On this interval, these altcoins have additionally proven some important rallies (AAVE has climbed 56%, MATIC 35%, and DYDX 94%).

Curiously, essentially the most important spikes within the whale transaction depend for these cryptos got here when the market was ranging (as will be seen from the BTC worth curve within the above graph) between January 13 and January 18. Following this extraordinary burst of exercise, the rally (which had come to a short lived halt) resumed its momentum and the altcoins sharply elevated of their worth.

In the previous few days, the indicator’s values have once more been at comparable (if not outright larger) ranges as seen through the aforementioned elevated whale exercise interval earlier within the month. As was the case final time round, the costs are curiously ranging proper now as nicely.

Whereas excessive whale transaction counts will be each bearish or bullish for the costs of those cash (because the elevated exercise alone doesn’t inform us if the transfers are being performed for purchasing or promoting functions), the truth that the present sample is much like that earlier within the month, when excessive exercise from this cohort was actually bullish, may suggest the percentages could also be within the favor of those altcoins.

Both approach, as Santiment suggests, “the elevated giant deal with curiosity in these property must be watched intently.”

MATIC Value

On the time of writing, Polygon is buying and selling round $1.0955, up 14% within the final week.

Appears like the worth of the altcoin has surged prior to now day | Supply: MATICUSD on TradingView

Featured picture from Artwork Rachen on Unsplash.com, charts from TradingView.com, Santiment.web