The under is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The subsequent FOMC assembly is on February 1, the place the Federal Reserve will decide their subsequent coverage resolution concerning rates of interest. This text covers how the market expects the Fed to reply, what readers ought to look ahead to concerning adjustments within the anticipated path and the potential second-order results of stated adjustments.

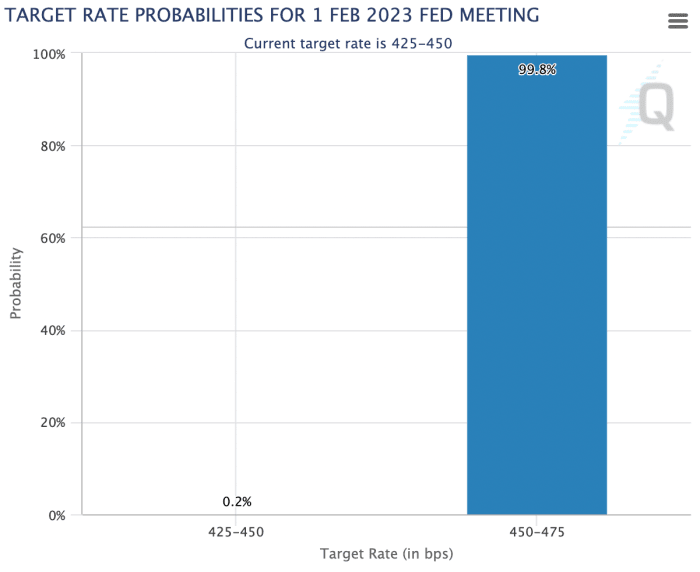

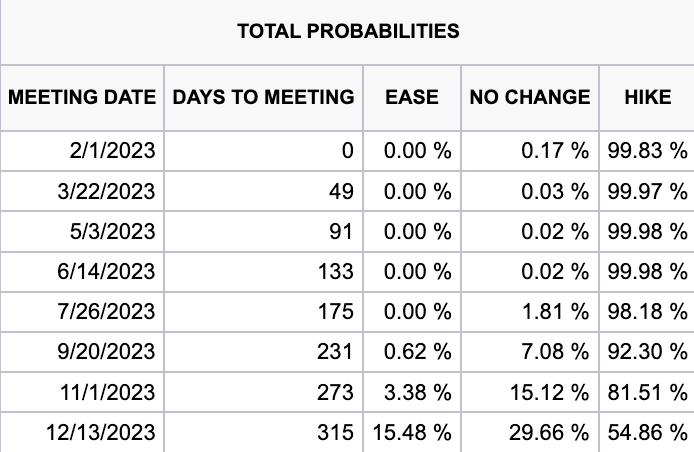

The present expectation is an rate of interest hike of +0.25%, with the market assigning a close to 100% certainty of this consequence, setting the coverage fee to 4.5%-4.75%.

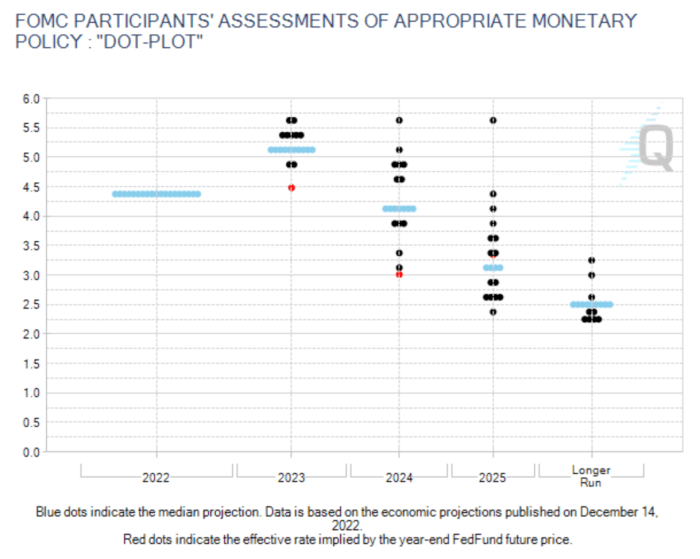

The Fed’s anticipated course for 2023 is to maintain charges elevated, with a number of Fed Governors not too long ago stressing the necessity to maintain coverage charges sufficiently restrictive with the intention to ensure inflation doesn’t stage a comeback after preliminary indicators of slowing, prefer it did within the Nineteen Seventies.

In Jerome Powell’s December 14 press convention, he stated the next (emphasis added):

“So, as I discussed, it will be significant that general monetary circumstances proceed to replicate the coverage restraint that we’re setting up to convey inflation all the way down to 2 p.c. We predict that monetary circumstances have tightened considerably previously yr. However our coverage actions work via monetary circumstances. And people, in flip, have an effect on financial exercise, the labor market, and inflation. So what we management is our coverage strikes within the communications that we make. Monetary circumstances each anticipate, and react to, our actions.

“I might add that our focus shouldn’t be on short-term strikes, however on persistent strikes. And lots of, many issues, in fact, transfer monetary circumstances over time. I might say it’s our judgment in the present day that we’re not at a sufficiently restrictive coverage stance but, which is why we are saying that we’d count on that ongoing hikes could be applicable.”

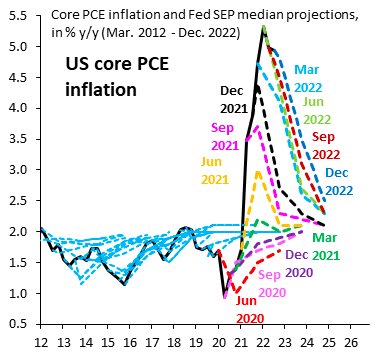

Pricing In The Transitory Inflation

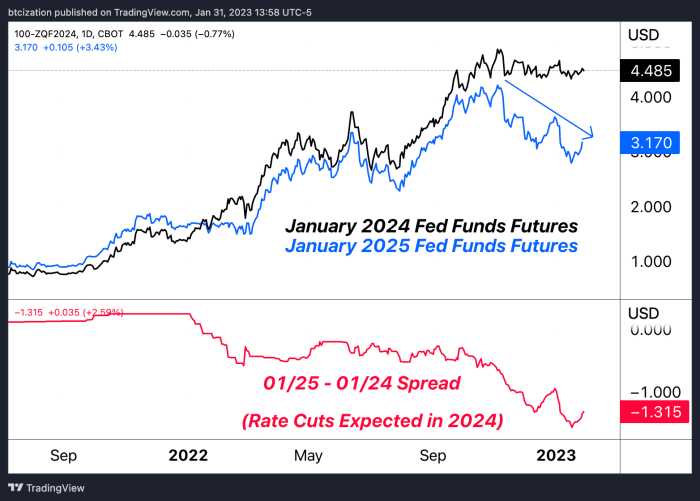

World danger belongings have been in rally mode to start out the yr, as market members more and more count on the inflationary scare that rattled monetary belongings in 2022 to abate in 2023 and past. Whereas the optimistic expectations for abating inflation will surely be bullish for risk-assets — provided that it might result in the return of decrease rates of interest — one could be smart to bear in mind the frivolous nature of inflation forecasting from the Fed, as proven under. A return to the two% goal is sort of all the time the expectation.

Supply: Robin Brooks

With inflation abating and coverage charges staying elevated, the market believes {that a} “sufficiently restrictive” coverage will manifest in 2023, with 1.31% price of cuts coming in 2024.

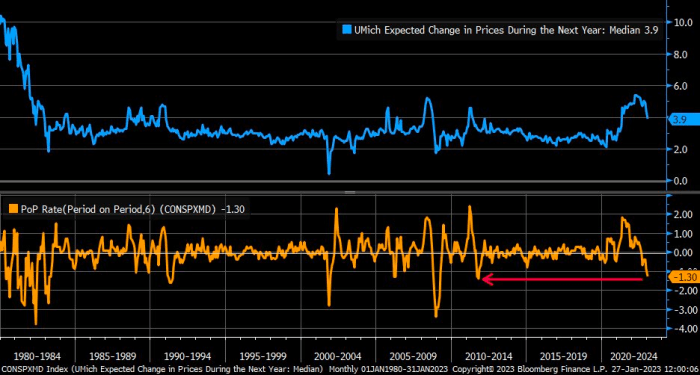

As soon as inflation turns into entrenched into client expectations and labor markets, historical past has proven that it takes a monumental effort from central banks tightening coverage charges with the intention to squash the inflation.

As famous by Liz Ann Sonders of Charles Schwab, the 6-month change in inflation expectations is the most important it’s been since 2011, a sign that financial tightening has begun to work its method into the actual financial system.

Supply: Liz Ann Sonders

With a fee hike of 25 foundation factors all however confirmed tomorrow, the market pays shut consideration to the content material and tone of Chairman Powell’s speech regarding the future path of coverage charges. We imagine that “increased for longer” is a tone that the Fed will proceed to speak with the market.

Nonetheless, on an extended sufficient timeline, the inevitable consequence is obvious. Simply ask the U.S. Treasury for his or her projections…

Supply: U.S. Treasury

Like this content material? Subscribe now to obtain PRO articles straight in your inbox.