The U.Ok. has unveiled “bold plans” to “robustly regulate” numerous crypto actions, whereas looking for to guard prospects and develop its financial system. Within the subsequent three months, British authorities will settle for public suggestions on the brand new regulatory proposals designed to manipulate digital belongings like conventional finance.

British Authorities Units Out to Regulate Crypto Market, Stays Dedicated to Innovation

The manager energy in London has introduced plans to control a variety of crypto-related actions by way of new guidelines for the younger trade that might be in step with Britain’s laws for the normal monetary sector.

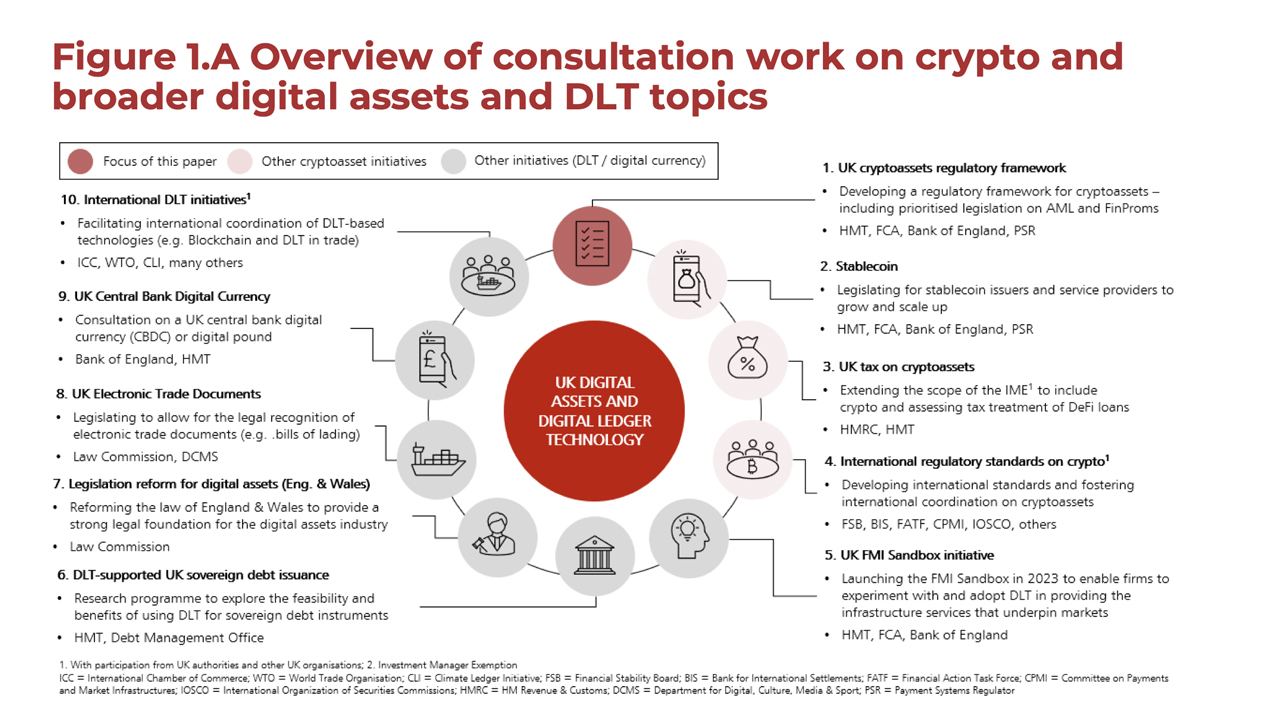

A public session on the proposals has been launched and can proceed till the tip of April. Within the printed paper, the U.Ok. Treasury reaffirms its perception that “crypto applied sciences can have a profound influence throughout monetary providers.” The doc supplies an summary of the session work forward.

The British authorities additionally insisted its strategy to regulation “mitigates probably the most vital dangers, whereas harnessing some great benefits of crypto applied sciences” and expressed hopes to allow the crypto trade to increase, make investments, and create jobs. Financial Secretary to the Treasury Andrew Griffith emphasised:

We stay steadfast in our dedication to develop the financial system and allow technological change and innovation – and this contains crypto-asset know-how. However we should additionally shield customers who’re embracing this new know-how.

The draft guidelines goal to make sure that crypto exchanges “have honest and strong requirements.” They are going to be liable for “defining the detailed content material necessities for admission and disclosure paperwork,” an announcement revealed on Wednesday.

Officers additionally indicated they wish to strengthen the foundations for intermediaries and custodians that facilitate cryptocurrency transactions and retailer buyer digital belongings. They consider this may assist to determine a “world-first regime” for crypto lending.

The transfer comes within the aftermath of a number of high-profile failures that shook the crypto house, together with the collapse of main crypto trade FTX. The British authorities has beforehand mentioned that it intends to undertake laws that might forestall market abuses.

Majority of Crypto Asset Firms within the UK Fail to Obtain Regulatory Approval

The regulatory proposals comply with final week’s announcement by the U.Ok.’s Monetary Conduct Authority (FCA) that almost all entities that wish to do enterprise with crypto belongings in Nice Britain, 85% of all candidates, have didn’t persuade regulators they will meet the nation’s minimal anti-money laundering (AML) necessities.

The regulator mentioned it had recognized vital failures in spheres reminiscent of due diligence, danger evaluation, and transaction monitoring. “In lots of instances, key personnel lacked applicable data, abilities and expertise to hold out allotted roles and management dangers successfully,” the FCA mentioned.

In the meantime, the Treasury Committee on the Home of Commons remains to be wanting into the potential threats and alternatives related to crypto belongings and the necessity for regulation. “We’re in the course of an inquiry into crypto regulation and these statistics haven’t disabused us of the impression that components of this trade are a ‘Wild West,’” Harriett Baldwin, chair of the choose committee, was quoted as stating.

What impact do you assume the upcoming U.Ok. guidelines can have on the event of the nation’s crypto trade? Share your expectations within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.