Uniswap value has crawled again in 2023, helped by the robust efficiency of digital currencies and elevated quantity in its ecosystem. UNI token jumped to a excessive of $7.55 on Friday, the best level since November 7. It has jumped by greater than 44% from the bottom level in 2023.

Uniswap quantity and charges rising

Uniswap had a combined efficiency in 2022 as cryptocurrency costs plunged. As a decentralized alternate (DEX), the decline meant that extra individuals pulled their cash out of the trade. Due to this fact, day by day buying and selling quantity slumped, pushing complete income sharply decrease.

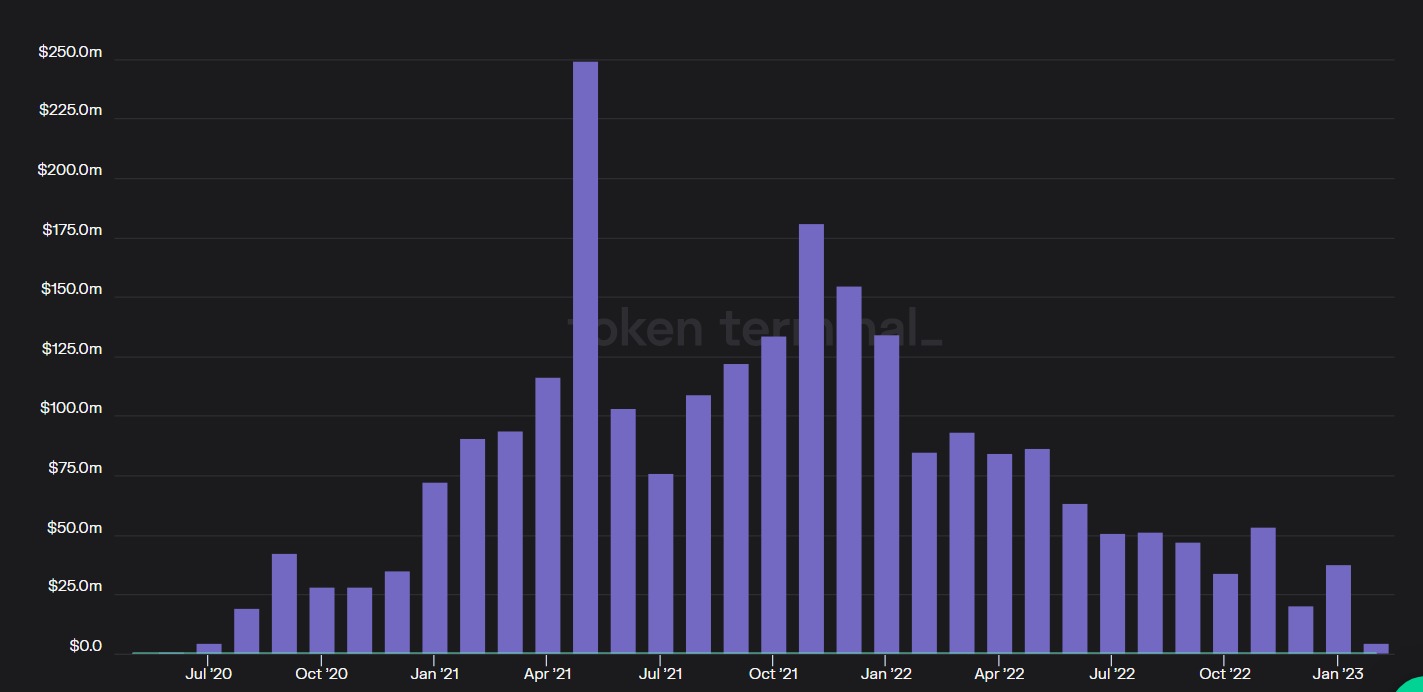

In response to Token Terminal, Uniswap’s finest month ever was in Could 2022 when it collected charges value over $224 million. It was adopted by November 2021 when charges rose to $181 million. Since then, charges crashed frequently in 2023 and reached a yearly low of $20.6 million.

There are indicators that Uniswap’s charges are bouncing again. As proven under, the community’s income rose to $37.8 million in January as the quantity processed rose.

Different knowledge reveals that the scenario is encouraging. For instance, the variety of lively customers within the ecosystem has bounced again in 2023. It had over 57k customers on Thursday, the best level since November 2021.

The largest problem for Uniswap is that the aggressive panorama is rising by the day. In style DEX protocols like dYdX are regularly taking market share. For instance, dYdX dealt with transactions value over $1.35 billion up to now 24 hours in comparison with Uniswap’s Ethereum model’s $1.1 billion.

One other problem is that the extremely hyped NFTs in Uniswap didn’t have a serious impression since launch. Information by Dune Analytics reveals that the quantity of NFTs traded in Uniswap has been in a powerful downward pattern. The variety of distinctive sellers and consumers in Uniswap have been simply 61 and 23, respectively.

Uniswap value prediction

The UNI crypto value has made a sluggish bullish breakout up to now few weeks. It has jumped above the ascending trendline proven in black. It has moved above the 25-day and 50-day shifting averages. The coin is approaching the essential resistance level at $7.80, the best level on November 6.

Due to this fact, there’s a chance that the coin will proceed rising as consumers goal the important thing resistance level at $9.7, the best level on July 9. The stop-loss of this commerce will probably be at $6.