AAVE value crawled again previously few days even because the variety of every day variety of customers dropped. The token was buying and selling at $87.38, which was a couple of factors above this week’s low of $83.44. It has jumped by about 70% from the bottom degree in 2022.

AAVE blended statistics

Aave is a number one non-custodial monetary platform that makes it doable for individuals to deposit funds and earn curiosity. It exists throughout a number of chains like Ethereum, Avalanche, Polygon, Optimism, Arbitrum, Concord, and Fantom. Its most energetic platform is about $6.1 billion.

AAVE V2 has a complete worth locked (TVL) of over $6.2 billion whereas V3 has a TVL of over $997 million. V1 is far smaller with its TVL of greater than $30.6 million. A fast have a look at on-chain knowledge exhibits that the community will not be doing extraordinarily nicely.

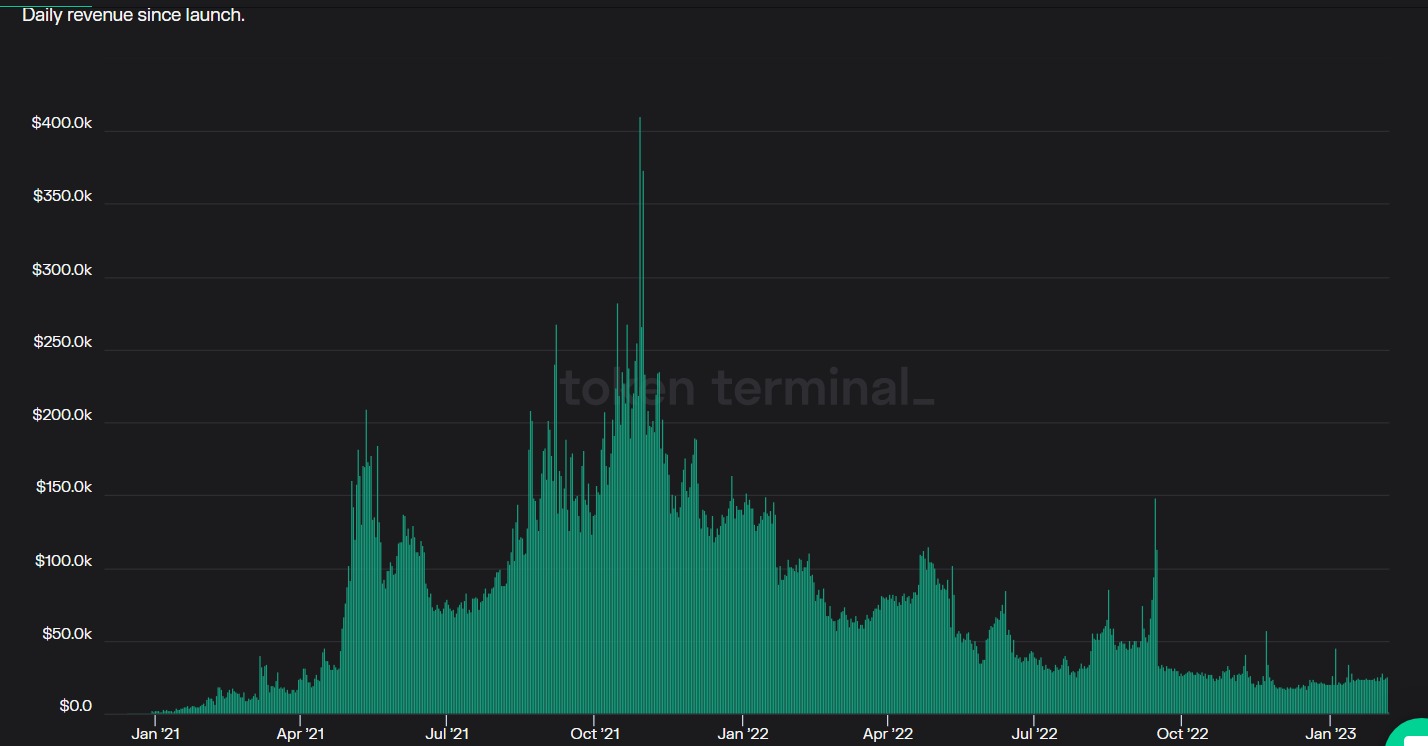

For instance, the variety of every day energetic customers soared to greater than 12 million in June 2021. The variety of customers has dropped to a low of two.8k. On the similar time, as proven beneath AAVE’s income has been in a downward development. Its every day income peaked at $266k in October 2021 to the present $26.2k.

Different numbers are comparatively adverse. In accordance with TokenTerminal, the borrow quantity in AAVE peaked at $12.1 billion to the present $2.2 billion. This is likely one of the important the reason why the income within the community has dropped. Provide-side charges have additionally been in a downward development.

On the constructive aspect, the variety of energetic token holders has been rising. Knowledge exhibits that there at the moment are over 153.1k token holders for the reason that launch. Inflows have been falling. In accordance with IntoTheBlock, the focus of huge holders stands at about 81%, with 65% of all holders being within the loss-making territory.

AAVE value prediction

The four-hour chart exhibits that the AAVE crypto value has shaped an ascending channel proven in pink. It’s now barely above the decrease aspect of the channel. AAVE is consolidating on the 50-day shifting common and has moved barely above the 23.6% Fibonacci Retracement degree.

Due to this fact, there’s a probability that AAVE crypto will proceed rising as consumers goal the higher aspect of the channel at $92. A break beneath the help at $83 will invalidate the bullish view.