Cryptocurrencies

have grown in reputation as an funding possibility in recent times. Though

Bitcoin is essentially the most well-known cryptocurrency, there are quite a few different digital

currencies often known as “altcoins” that present a wide range of funding

alternatives and dangers.

We are going to examine

Bitcoin and altcoins on this article to assist traders make knowledgeable choices

about their crypto investments.

Bitcoin

is the unique cryptocurrency

Bitcoin was the

first cryptocurrency, created in 2009 by an unknown particular person or group of

people often known as Satoshi Nakamoto. Bitcoin is decentralized, which suggests

that no authorities or monetary establishment controls it. Transactions are

recorded on a public ledger often known as the blockchain, which is maintained by a

world community of computer systems.

Bitcoin

Funding Prospects

For years,

Bitcoin has been the preferred and well-known cryptocurrency, making it a

fashionable funding possibility. Bitcoin has steadily elevated in worth over the

years, reaching an all-time excessive of practically $65,000 in 2021.

The worth of

Bitcoin is primarily decided by demand, and it’s broadly accepted as a

cost methodology by many retailers around the globe.

Dangers

Bitcoin is a

risky asset, with fast fluctuations in worth. Except for market volatility,

there are dangers related to expertise itself. As a result of Bitcoin transactions

are irreversible, there isn’t any technique to get well your funds when you ship Bitcoin to

the mistaken handle or fall sufferer to a rip-off.

Moreover,

as a result of lack of regulation surrounding Bitcoin and different cryptocurrencies,

traders have little safety within the occasion of fraud or hacking.

Various

cryptocurrencies, or altcoins, are any digital currencies apart from Bitcoin.

There are millions of altcoins, every with its personal set of traits and

functions. Ethereum, Binance Coin, Cardano, and Dogecoin are among the many most

fashionable altcoins.

Altcoin

Funding Prospects

Altcoins

present various funding alternatives to Bitcoin. Some altcoins are

supposed to be extra environment friendly or practical than Bitcoin, whereas others are

supposed for particular functions, corresponding to decentralized finance (DeFi) or

non-fungible tokens (NFTs). Some altcoins, corresponding to Ethereum, have seen

important progress in recent times and have the potential for future positive factors.

Dangers

Investing in

altcoins entails the identical dangers as investing in Bitcoin, corresponding to market

volatility and technological dangers. Moreover, as a result of altcoins aren’t as

broadly accepted as Bitcoin, there’s much less liquidity, making it harder

to purchase or promote altcoins at an inexpensive worth.

Moreover,

as a result of there are such a lot of altcoins to select from, figuring out which of them have

long-term potential and that are scams or haven’t any actual worth could be troublesome.

Bitcoin

and Altcoin Comparability

There are

a number of elements to think about when evaluating Bitcoin and altcoins:

Adoption

Bitcoin is the

most generally used cryptocurrency, with many retailers accepting it and plenty of

traders utilizing it as a retailer of worth. Whereas some altcoins have gained

reputation, none are as well-known as Bitcoin.

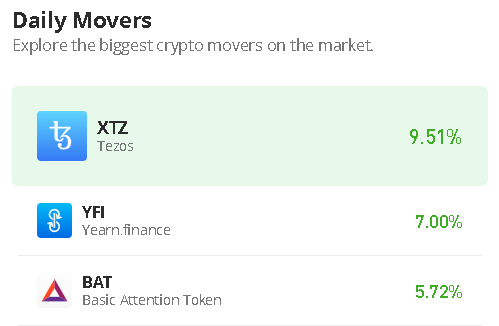

Volatility

Though

Bitcoin is a risky asset, some altcoins are much more so. It’s crucial to

be ready for fast worth fluctuations when investing in altcoins.

Case

Research

The first utility

of Bitcoin is as a retailer of worth and a method of cost. Altcoins have a

numerous set of use circumstances, starting from DeFi to NFTs, so it’s crucial to

analysis every altcoin’s particular use case and potential.

Know-how

Bitcoin is a

well-established expertise with a big and lively developer group. Some

altcoins have progressive applied sciences, however it’s crucial to analyze the

technical particulars to find out whether or not they’re viable and safe.

Ought to

I purchase altcoins? Are altcoins a secure funding or pure hypothesis?

Many have questioned

if altcoins are a secure funding. Over the previous years, altcoins have come and

gone whereas BTC stays because the “one true king of cryptocurrencies”.

In actual fact, there

are many Bitcoin maximalists who consider BTC is the one funding one ought to

have within the crypto universe as it would most likely be the one digital foreign money

which we’ll want sooner or later. Nonetheless, even when they consider that they could be

on the appropriate aspect of issues over on the long run, for now, surprisingly, they

would possibly lacking the forest for the bushes.

The easy truth

is that altcoins could be seen in many various methods and thru many various

lenses.

Every altcoin has

its personal underlying initiatives, its downside that’s attempting to unravel throughout the

cryptocurrency panorama, and so forth.

As such, one

can consider an altcoin as a long-term funding an purchase them as an investor

who believes in its undertaking, or, as many do, as a speculative play.

No matter your

causes, there are specific parts you do must be involved about.

First and

foremost, it’s best to outline how a lot of your funding portfolio goes to

be allotted to altcoin funding.

Following that,

you will need to do your personal due diligence and completely perceive the what

the undertaking is, what it’s attempting to do, and who the crew behind engaging in

stated targets.

Following that

popularity threat evaluation, additionally it is necessary to observe by means of with a market

entry threat evaluation, that means that it would be best to keep away from obscure cash

which aren’t offered on respected exchanges.

Lastly, it’s

extraordinarily necessary that you just perceive the technical threat behind your

potential altcoin funding, specifically its code and if it has been audited by a reputable

third celebration.

So, briefly, sure,

altcoins can current themselves as unimaginable funding alternatives if approached

with care and correct due diligence.

Wrapping

Up

Investing in

cryptocurrencies, whether or not Bitcoin or altcoins, entails dangers in addition to

rewards. Due to Bitcoin’s dominance as the unique cryptocurrency, it’s a

safer and extra secure funding, whereas altcoins supply greater potential

returns however at a better threat.

Earlier than

investing, it’s crucial to know the assorted funding alternatives

and dangers related to every cryptocurrency.

One of the vital

important advantages of cryptocurrencies is their decentralization, which suggests

they don’t seem to be managed by the federal government or central banks. Nonetheless, as a result of

they don’t seem to be backed by tangible belongings or authorities ensures, they’re a

extra speculative funding.

When investing

in cryptocurrencies, it’s important to know the underlying expertise and

fundamentals that drive their worth. It is also crucial to remain present on

market information and regulatory developments, as these can have a major influence

on cryptocurrency worth.

To summarize,

Bitcoin and altcoins present distinct funding alternatives and dangers, and

traders ought to fastidiously take into account their funding goals and threat

tolerance earlier than investing in both.

Whereas Bitcoin

is a safer and extra secure funding, altcoins supply greater potential returns

however at a better threat. Traders can navigate the advanced world of

cryptocurrencies and doubtlessly reap the advantages with cautious analysis and a

long-term funding technique.

Cryptocurrencies

have grown in reputation as an funding possibility in recent times. Though

Bitcoin is essentially the most well-known cryptocurrency, there are quite a few different digital

currencies often known as “altcoins” that present a wide range of funding

alternatives and dangers.

We are going to examine

Bitcoin and altcoins on this article to assist traders make knowledgeable choices

about their crypto investments.

Bitcoin

is the unique cryptocurrency

Bitcoin was the

first cryptocurrency, created in 2009 by an unknown particular person or group of

people often known as Satoshi Nakamoto. Bitcoin is decentralized, which suggests

that no authorities or monetary establishment controls it. Transactions are

recorded on a public ledger often known as the blockchain, which is maintained by a

world community of computer systems.

Bitcoin

Funding Prospects

For years,

Bitcoin has been the preferred and well-known cryptocurrency, making it a

fashionable funding possibility. Bitcoin has steadily elevated in worth over the

years, reaching an all-time excessive of practically $65,000 in 2021.

The worth of

Bitcoin is primarily decided by demand, and it’s broadly accepted as a

cost methodology by many retailers around the globe.

Dangers

Bitcoin is a

risky asset, with fast fluctuations in worth. Except for market volatility,

there are dangers related to expertise itself. As a result of Bitcoin transactions

are irreversible, there isn’t any technique to get well your funds when you ship Bitcoin to

the mistaken handle or fall sufferer to a rip-off.

Moreover,

as a result of lack of regulation surrounding Bitcoin and different cryptocurrencies,

traders have little safety within the occasion of fraud or hacking.

Various

cryptocurrencies, or altcoins, are any digital currencies apart from Bitcoin.

There are millions of altcoins, every with its personal set of traits and

functions. Ethereum, Binance Coin, Cardano, and Dogecoin are among the many most

fashionable altcoins.

Altcoin

Funding Prospects

Altcoins

present various funding alternatives to Bitcoin. Some altcoins are

supposed to be extra environment friendly or practical than Bitcoin, whereas others are

supposed for particular functions, corresponding to decentralized finance (DeFi) or

non-fungible tokens (NFTs). Some altcoins, corresponding to Ethereum, have seen

important progress in recent times and have the potential for future positive factors.

Dangers

Investing in

altcoins entails the identical dangers as investing in Bitcoin, corresponding to market

volatility and technological dangers. Moreover, as a result of altcoins aren’t as

broadly accepted as Bitcoin, there’s much less liquidity, making it harder

to purchase or promote altcoins at an inexpensive worth.

Moreover,

as a result of there are such a lot of altcoins to select from, figuring out which of them have

long-term potential and that are scams or haven’t any actual worth could be troublesome.

Bitcoin

and Altcoin Comparability

There are

a number of elements to think about when evaluating Bitcoin and altcoins:

Adoption

Bitcoin is the

most generally used cryptocurrency, with many retailers accepting it and plenty of

traders utilizing it as a retailer of worth. Whereas some altcoins have gained

reputation, none are as well-known as Bitcoin.

Volatility

Though

Bitcoin is a risky asset, some altcoins are much more so. It’s crucial to

be ready for fast worth fluctuations when investing in altcoins.

Case

Research

The first utility

of Bitcoin is as a retailer of worth and a method of cost. Altcoins have a

numerous set of use circumstances, starting from DeFi to NFTs, so it’s crucial to

analysis every altcoin’s particular use case and potential.

Know-how

Bitcoin is a

well-established expertise with a big and lively developer group. Some

altcoins have progressive applied sciences, however it’s crucial to analyze the

technical particulars to find out whether or not they’re viable and safe.

Ought to

I purchase altcoins? Are altcoins a secure funding or pure hypothesis?

Many have questioned

if altcoins are a secure funding. Over the previous years, altcoins have come and

gone whereas BTC stays because the “one true king of cryptocurrencies”.

In actual fact, there

are many Bitcoin maximalists who consider BTC is the one funding one ought to

have within the crypto universe as it would most likely be the one digital foreign money

which we’ll want sooner or later. Nonetheless, even when they consider that they could be

on the appropriate aspect of issues over on the long run, for now, surprisingly, they

would possibly lacking the forest for the bushes.

The easy truth

is that altcoins could be seen in many various methods and thru many various

lenses.

Every altcoin has

its personal underlying initiatives, its downside that’s attempting to unravel throughout the

cryptocurrency panorama, and so forth.

As such, one

can consider an altcoin as a long-term funding an purchase them as an investor

who believes in its undertaking, or, as many do, as a speculative play.

No matter your

causes, there are specific parts you do must be involved about.

First and

foremost, it’s best to outline how a lot of your funding portfolio goes to

be allotted to altcoin funding.

Following that,

you will need to do your personal due diligence and completely perceive the what

the undertaking is, what it’s attempting to do, and who the crew behind engaging in

stated targets.

Following that

popularity threat evaluation, additionally it is necessary to observe by means of with a market

entry threat evaluation, that means that it would be best to keep away from obscure cash

which aren’t offered on respected exchanges.

Lastly, it’s

extraordinarily necessary that you just perceive the technical threat behind your

potential altcoin funding, specifically its code and if it has been audited by a reputable

third celebration.

So, briefly, sure,

altcoins can current themselves as unimaginable funding alternatives if approached

with care and correct due diligence.

Wrapping

Up

Investing in

cryptocurrencies, whether or not Bitcoin or altcoins, entails dangers in addition to

rewards. Due to Bitcoin’s dominance as the unique cryptocurrency, it’s a

safer and extra secure funding, whereas altcoins supply greater potential

returns however at a better threat.

Earlier than

investing, it’s crucial to know the assorted funding alternatives

and dangers related to every cryptocurrency.

One of the vital

important advantages of cryptocurrencies is their decentralization, which suggests

they don’t seem to be managed by the federal government or central banks. Nonetheless, as a result of

they don’t seem to be backed by tangible belongings or authorities ensures, they’re a

extra speculative funding.

When investing

in cryptocurrencies, it’s important to know the underlying expertise and

fundamentals that drive their worth. It is also crucial to remain present on

market information and regulatory developments, as these can have a major influence

on cryptocurrency worth.

To summarize,

Bitcoin and altcoins present distinct funding alternatives and dangers, and

traders ought to fastidiously take into account their funding goals and threat

tolerance earlier than investing in both.

Whereas Bitcoin

is a safer and extra secure funding, altcoins supply greater potential returns

however at a better threat. Traders can navigate the advanced world of

cryptocurrencies and doubtlessly reap the advantages with cautious analysis and a

long-term funding technique.