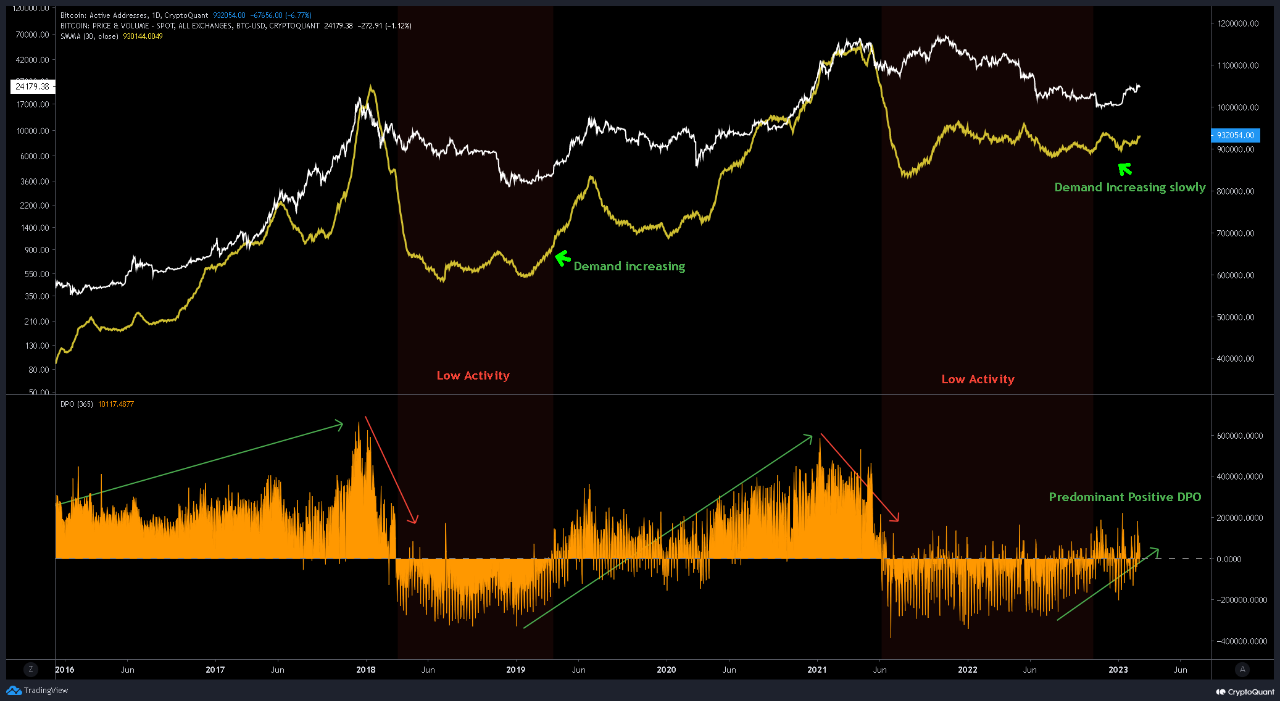

On-chain knowledge exhibits demand for Bitcoin has been returning just lately, however the rise has been slower than what earlier cycles noticed at an identical stage.

Bitcoin Lively Addresses Haven’t Grown A lot Not too long ago

As identified by an analyst in a CryptoQuant submit, the market exercise quickly modified after the underside fashioned throughout the earlier cycles. The related indicator right here is the “lively addresses,” which measures the day by day whole quantity of Bitcoin addresses which can be collaborating in some transaction exercise on the chain.

The metric solely measures distinctive addresses, that means that if an deal with takes half in a number of transfers in a single day, it’s nonetheless counted solely as soon as. The indicator additionally accounts for each senders and receivers on this measurement.

When the worth of this metric is excessive, it means numerous addresses are making transactions on the community proper now. Such a development means that the cryptocurrency is actively attracting customers to commerce on the chain at the moment.

Then again, low values indicate not many customers are making transfers on the blockchain in the mean time. This type of development can recommend that demand for the asset is low at the moment.

Now, here’s a chart that exhibits the development within the Bitcoin lively addresses over the previous few years:

Seems like the worth of the metric hasn't moved a lot in current weeks | Supply: CryptoQuant

As proven within the above graph, the Bitcoin lively addresses had come all the way down to a comparatively low worth throughout the bear market, however just lately some enchancment has been registered within the indicator.

In bear markets, the value is normally endlessly consolidating, so not many customers discover the coin that attention-grabbing to commerce. Throughout risky strikes, nonetheless, traders rush to commerce, therefore why the metric can present elevated values.

A current instance of exercise out of the blue coming again like this may be seen across the time of the FTX collapse within the chart. As the value started to maneuver sideways once more following the crash, the lively addresses additionally as soon as once more sank down.

The metric has seen some improve with the most recent rally within the value of Bitcoin, however the rise has nonetheless not been too vital. Compared, the 2018-2019 cycle noticed the exercise quickly going up following the bear market backside formation.

The quant has additionally connected the annual lively addresses detrended value oscillator (DPO) to higher illustrate the distinction between the present and the earlier cycle. As is seen within the graph, the development within the DPO is simply displaying early indicators of the bear market exit up to now within the present cycle.

“Right now, fears exterior to the community could also be impacting full demand returns and delaying a sharper enchancment in community fundamentals,” explains the analyst. “The understanding of a attainable turbulent yr by way of macroeconomic situations has not but enabled a sense of larger danger urge for food and traders stay cautious.”

BTC Value

On the time of writing, Bitcoin is buying and selling round $23,700, down 1% within the final week.

BTC has declined just lately | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com