Bitcoin inscriptions have been out for just a few extra weeks, so we comply with up on the charge market and block utilization to watch what’s modified after 100,000 inscriptions.

The under is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Addressing Bitcoin Decentralization & Block House Issues

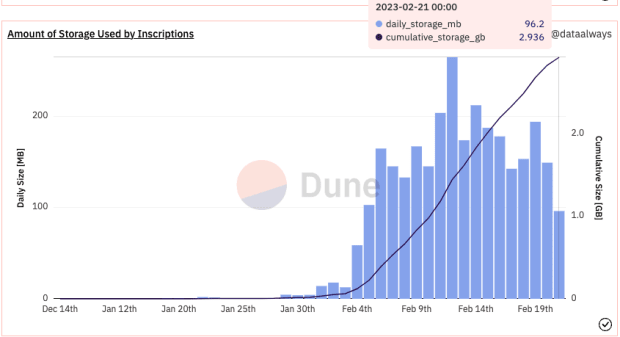

New customers have been flocking to Bitcoin to create what are generally known as inscriptions — typically referred to as NFTs (non-fungible tokens) on different blockchains. These principally picture information had been growing demand for Bitcoin block house, which brought about some community individuals to fret about Bitcoin’s future decentralization. If the fee to run a full node will increase considerably as a consequence of customers needing the space for storing and bandwidth to obtain all this knowledge that’s unrelated to financial transactions, fewer folks may run full archival nodes, centralizing Bitcoin’s ledger.

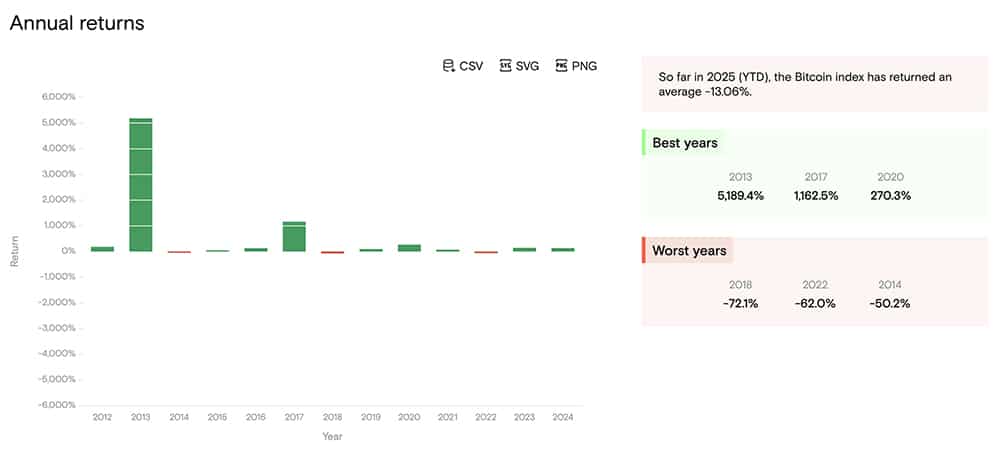

The quantity of cumulative storage utilized by inscriptions continues to climb with nearly 3 GB of storage particularly associated to inscriptions on the time of writing.

Ought to the block house constantly be used to its full extent of 4 MB, it can add roughly 210.24 GB of information to the chain annually, which isn’t a serious price hindrance for operating a full node however can nonetheless be thought-about expensive in locations the place know-how isn’t as cheaply accessible. There may be the flexibility to run a pruned node which doesn’t require storage of any of this witness knowledge and solely retains monitor of Bitcoin’s financial transaction knowledge. Nevertheless, as a way to create a pruned node, customers nonetheless should obtain all of the info initially. That is the place the considerations for inadequate bandwidth come into play. In areas of the world the place there isn’t entry to high-speed web, the preliminary block obtain may take so lengthy that it received’t be attainable to sync to the chaintip.

That being mentioned, the expectation for Bitcoin’s block house was at all times that it will be full in some unspecified time in the future, which is partially why there’s a cap on the block measurement. This cover was raised in the course of the SegWit gentle fork and included the charge low cost for witness knowledge — like inscriptions — that’s unrelated to Bitcoin’s monetary ledger and its unspent transaction output (UTXO) set.

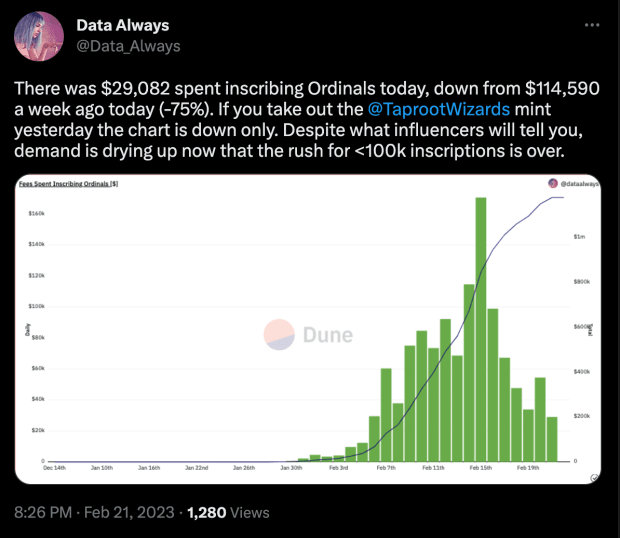

Bitcoin has been in comparison with a decentralized clock due to the best way it retains monitor of the order of transactions as they occur world wide. The character of inscriptions on Bitcoin makes use of this ordering to quantity the inscriptions as they’re written onto the blockchain, aka timechain. Because the inscription depend approached 100,000, folks rushed to get their inscriptions confirmed earlier than or precisely at that quantity. We noticed the most important improve in charges round this time, which is proven above in darkish inexperienced. By shortly glancing on the charge charge chart, it’s clear when the 100,000th inscription was made due to essentially the most quantity of charges higher than 25 sat/vByte.

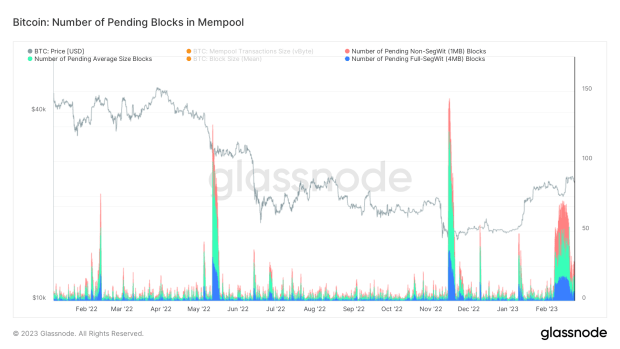

After this monumental inscription quantity, the frenzy to create NFTs on Bitcoin has drastically decreased. Whereas there may be nonetheless a backlog of transactions within the mempool, the charges required to get a transaction confirmed within the subsequent block have dropped significantly and the every day complete charges spent on creating inscriptions is “down solely.”

Though the charges are down together with the entire sum of money being spent on inscriptions per day, the variety of pending transactions within the mempool stay excessive and fixed, with no indicators of letting up within the brief time period.

On this previous mining epoch, blocks are being mined so shortly that there’s an anticipated problem adjustment of almost +11%.

“The anticipated ratchet upward in mining problem will take away among the aid that operations had been feeling in latest weeks, because of the improve in USD-denominated income. Miner income denominated in bitcoin phrases will as soon as once more head to new lows.” — State Of The Mining Business: Public Miners Outperform Bitcoin

This speedy charge of mining blocks has allowed for among the inscription transactions with decrease charge charges to be mined as a result of blocks had been getting mined sooner than new transactions had been being broadcast to the community.

Now that the preliminary rush to be an early inscriber is probably going over, one concept for inscriptions is that they may develop into a purchaser of final resort for block house in instances when charges are low and fewer persons are transacting on chain.

We’ll see if this thesis performs out. It’s attainable that instances of decrease charges might be utilized by folks opening up Lightning channels as properly, which is without doubt one of the arguments in opposition to inscriptions as they probably crowd out Bitcoin’s monetary use instances.

Closing Be aware

There are unanswered questions in regards to the bandwidth necessities for downloading an archival full node in addition to the cultural questions of whether or not these non-monetary transactions ought to be occurring on Bitcoin’s base layer or if it’s even attainable to maneuver them to a Layer 2.

Like this content material? Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

- Payment Market Competitors: Bitcoin Ordinals And Inscriptions

- State Of The Mining Business: Public Miners Outperform Bitcoin

- Earlier Than You Suppose: An Goal Look At Bitcoin Adoption

- State Of The Mining Business: Survival Of The Fittest

- Bitcoin Sellers Exhausted, Accumulators HODL The Line