Bitcoin’s previous efficiency can assist you perceive the place its worth is heading. Right here’s bitcoin’s value historical past delineated since its inception.

Introduction

What number of occasions has bitcoin been declared lifeless? At the least 463 occasions. And it’s by no means been due to its financial system failing or its technical operation breaking down, however due to its value crashing.

Some might argue that these two issues — tech improvement and value actions — are inherently related, however that’s not the case.

Value swings in bitcoin are primarily pushed by its personal halving cycles in addition to macroeconomic occasions. Because it roared into life from humble beginnings, bitcoin has had a turbulent historical past. Its notorious volatility has resulted in a number of appreciations of 1,000% in worth, solely to later drop by as a lot as 80% and even 90% — resembling in 2014.

Each single time, although, it has bounced again, recovered its earlier highs and gone on to set new ones. This resilience has confirmed a number of the most seasoned traders unsuitable and received new supporters alongside the best way.

On this article, we take you thru bitcoin’s value historical past intimately, yr after yr, across the essential occasions that formed it as an revolutionary financial system.

Value Historical past

Bitcoin was created in 2008 to problem the present system of centralized, credit-based cash issued by bureaucrats and unstable banks. By trusting code as an alternative of human vulnerabilities, bitcoin supplied a means out of that debacle.

At first the brand new invention was nothing greater than an experiment, however those that learn the white paper and have been educated of cryptography, cash and finance, may already see it turning into one thing a lot larger than a easy cryptographic toy.

For the primary yr, bitcoin didn’t have a market value; it had no premine or any rounds of funding from huge enterprise capital companies. One thing modified in 2010 when it began to be traded for items and companies which might set it on the trail towards as we speak’s revolutionary and different foreign money system — a journey from $0 in 2009 to $68,000 in solely 13 years.

Subsequent, we’ll discover how bitcoin grew from a tech plaything with lofty ambitions to a bona fide financial asset that’s persevering with to ship on its promise.

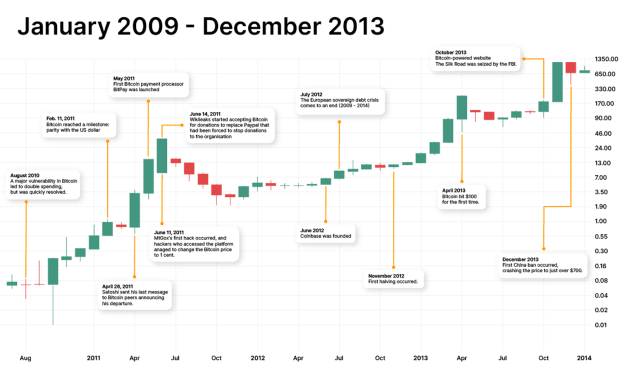

January 2009-December 2013

Bitcoin’s proof-of-concept was emphasised within the white paper printed on October 31, 2008, by Satoshi Nakamoto. All by way of 2009, anybody may be a part of the community by mining blocks of Bitcoin with their computer systems’ CPUs with out a lot effort. All issues thought-about, the value was nonetheless $0.

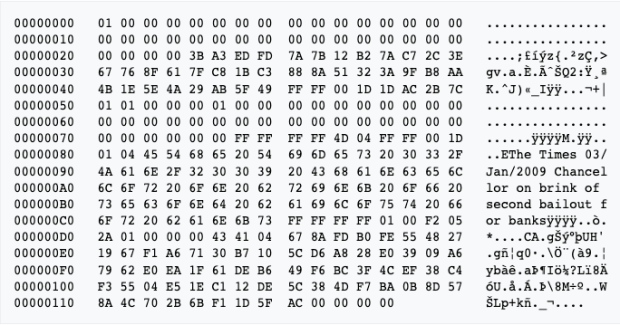

2009: Genesis

Value Vary $0-$.0009

Satoshi mined the genesis block with the well-known textual content be aware and headline from the London Instances, “Chancellor on Brink of Second Bailout for Banks” — a transparent reference to the 2008-2009 monetary disaster.

The block reward was 50 bitcoin and other people have been mining 1000’s of bitcoin each day. The New Liberty Commonplace Change recorded the primary change of bitcoin for {dollars} in late 2009, although individuals have been largely buying and selling bitcoin over the BitcoinTalk discussion board.

The European sovereign debt disaster started in November when Greece revealed that its price range deficit was almost double the prior estimates. Whereas this occasion was too early in Bitcoin’s historical past to have an effect on the value in any significant means, indebted sovereigns would proceed to be a fear within the legacy financial system in opposition to which bitcoin in contrast itself.

On October twelfth, 2009 a member of the BitcoinTalk discussion board traded 5050 BTC for a sum of $5.02 through Paypal, which means a value of $0.00099 per coin and one of many lowest costs per BTC ever recorded. This transaction kicked off a sequence of OTC purchases within the succeeding months.

2010: Bitcoin Begins Buying and selling

Value Vary $.00099-$0.4

On the twentieth of February, an individual on reddit utilizing the username theymos claims to have bought 160 BTC for $.003, which might make it the bottom ever value recorded.

On Could 22, Laszlo Hanyecz purchased two pizzas for 10,000 bitcoin which is held as an iconic first change of bitcoin for a real-world product; Bitcoin Pizza Day was born.

The primary large-scale bitcoin change, Mt. Gox, made its look on July 18.

In August, probably the most vital vulnerability within the historical past of the Bitcoin community was exploited when an attacker managed to spend billions of bitcoin they didn’t personal. The bug was noticed and stuck inside hours, and miners needed to fork the community and launch a brand new, up to date Bitcoin protocol with out the malicious transaction included.

2011: Greenback Parity

Value Vary $0.4-$4.70

Bitcoin achieved a milestone in February when it reached parity with the U.S. greenback for the primary time. On April 26, 2011, Satoshi Nakamoto despatched his last e mail to fellow builders stating he had “moved on to different tasks” — and was by no means heard from once more.

Bitcoin fee processor BitPay was based in Could to permit corporations to simply accept bitcoin as a type of fee. By June, the value of 1 bitcoin had reached $30 however slowly dropped again to the $2-$4 vary that it sustained for the remainder of the yr.

Nonprofits just like the Digital Frontier Basis and WikiLeaks started taking bitcoin in donations, the latter turning to bitcoin after PayPal had frozen WikiLeaks’ accounts in December 2010.

In June of 2011, Mt. Gox skilled its first hack wherein hackers managed to entry the corporate auditors’ laptop and alter the value of bitcoin to 1 cent.

2012: European Debt Disaster

Value Vary: $4-$13.50

The start of 2012 was nonetheless marked by the European sovereign debt disaster, with some member states turning into extremely depending on the European Central Financial institution and the Worldwide Financial Fund to service their money owed. Cyprus was notably onerous hit, with incremental demand for bitcoin coming from the areas most affected by the Cypriot monetary disaster.

Coinbase was based in June 2012, providing a brand new means to purchase and promote cryptocurrencies.

On the ninth of August, a Mt. Gox glitch precipitated bitcoin to be priced at $1B a chunk on the change. 11 days in a while the twentieth of August, the value tumbled 50% from $15.28 to $7.60 as information of a doubtful Bitcoin financial savings and belief fund scheme providing a 7% weekly rate of interest was closed. The operator of the fund, Trendon Shavers would later be sentenced within the first Bitcoin securities-fraud case.

Bitcoin spent the rest of the yr consolidating, and in November it went by way of its first Halving. The value on the finish of the yr was $13.50.

2013: The Silk Street Seizure

Value Vary: $13-$755

Bitcoin skilled its first post-halving bull run. The yr began with a value of simply above $13, rallying to $26 over the course of a month. The rally continued in April and rapidly rose to $268, earlier than crashing 80% to $51 from the tenth to the thirteenth of the identical month.

In June Mt. Gox stopped processing US withdrawals and by July, the value had retraced again to $68.50. It continued to commerce at simply above $100 when Silk Street was seized by the FBI in October.

On the twelfth of August, the German regulators formally declared Bitcoin a unit of account.

By December, it had spiked to a brand new all-time excessive of $1,163, rising 840% in 8 weeks after which fell again to $687 solely days later. In December, the Individuals’s Financial institution of China (PBOC) prohibited Chinese language monetary establishments from utilizing bitcoin, leading to a drop to simply above $700. It wouldn’t be the final time China “banned” bitcoin.

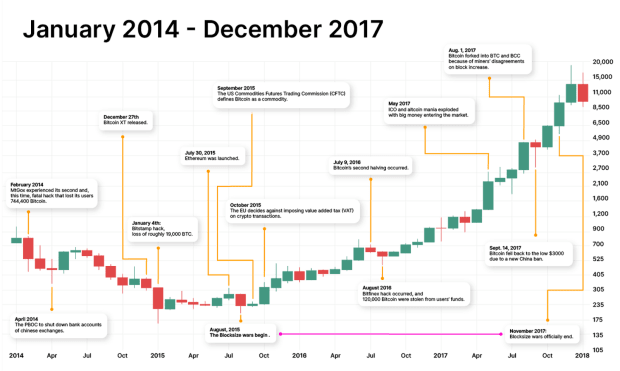

January 2014-December 2017

This era is recognized by the arrival of altcoins and the injection of huge funds into the cryptocurrency market, parts of the ICO mania of 2017. Bitcoin went from simply over $800 in 2014 to buying and selling at near $20,000 in 2017.

With huge cash got here higher consideration from the media and monetary establishments, and governments began to watch Bitcoin and its phenomena extra carefully — typically placing stress in the marketplace by way of strict laws, particularly in China.

2014: Mt. Gox Is Hacked

Value Vary: $767-$321

Bitcoin’s notorious volatility was very excessive in 2014. The yr began with a value restoration to above $1,000, however by the tip of February, it had already retraced again to underneath $600 with a flash crash all the way down to $111 (a 90% drop from its $1,000 excessive!) as a result of troubles at Mt. Gox. — the hack concerned person funds of round 750,000 bitcoin. The change needed to file for chapter following the episode.

The PBOC instructed home lenders to shut the accounts of Chinese language bitcoin exchanges by April 15.

Bitcoin spent the turbulent remainder of the yr recovering and crashing shortly thereafter and closed 2014 at simply over $300.

In December, the primary Bitcoin onerous fork, Bitcoin XT, was launched by Mike Hearn, who aimed to extend most transactions per second from 7 to 24. Such a rise meant the block measurement needed to be expanded from one megabyte to eight megabytes.

2015: The Starting Of The Blocksize Wars

Value Vary: $314-$431

On January 4, Bitstamp suffered a critical safety breach, dropping roughly 19,000 BTC, with a market worth of about $5.1m on the time.

Bitcoin began the brand new yr at $314 and saved on comparatively quiet in comparison with 2014, with little volatility and extra consolidation. Ethereum was launched on July 30, and its platform triggered the creation of 1000’s of recent cryptocurrencies desirous to compete with Bitcoin within the years to come back.

On June 22, 2015, Gavin Andresen printed BIP 101 which known as for a rise to the block measurement. The Blocksize Wars continued in August with Gavin Andresen and Mike Hearn proposing to extend the block measurement restrict to twenty MB.

In September, the U.S. Commodities Futures Buying and selling Fee (CFTC) outlined bitcoin as a commodity. In distinction, the EU determined in opposition to imposing worth added tax (VAT) on crypto transactions in October. This successfully outlined bitcoin as a foreign money.

2016: Value Restoration

Value Vary: $434-$966

The second Bitcoin Halving occurred on July 9, and all year long the value of bitcoin was comparatively steady, buying and selling between $350 and $700 in the summertime months, solely to hit $966 on the finish of the yr.

2016 was marked by the hack of the bitcoin change Bitfinex in August, which resulted in almost 120,000 BTC stolen from customers.

2017: Crypto and ICO Mania

Value Vary: $998-$14,245

Like 2013, the yr that adopted the primary Bitcoin Halving, 2017 was additionally historic for bitcoin. To start with of the yr, the value hovered round $1,000, broke $2,000 in mid-Could and skyrocketed to $19,892 on December 15, recording a 20x rise in lower than 12 months.

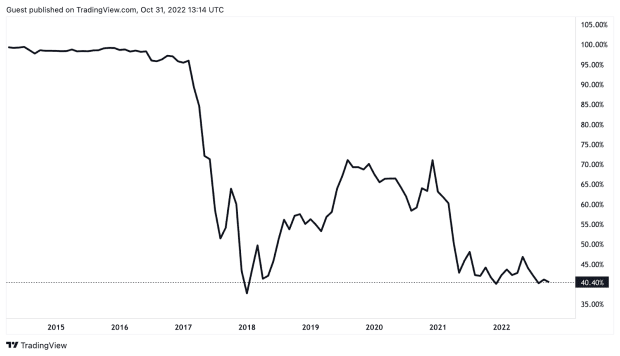

The chart above refers to bitcoin’s dominance within the cryptocurrency market. With the creation of 1000’s of recent cryptocurrencies, and the explosion of the ICO mania, bitcoin’s dominance fell dramatically, as investor funds and playing cash made their means from bitcoin into the altcoin markets.

The ICO mania signaled that enterprise capital companies had arrived and 1000’s of crypto tasks started to get funding, turning the crypto market right into a on line casino of kinds. By the way, the misinformation and FUD round Bitcoin elevated round this time.

On August 2, a significant bitcoin change, Bitfinex, was hacked and almost 120,000 BTC (round $60m on the time) was stolen by hackers. The bitcoin value instantly tumbled 14% to $214 in a interval of simply half-hour, earlier than it rebounded upwards the exact same day — a typical flash crash.

In August, a significant improve — SegWit — was applied on the Bitcoin community, which introduced some reduction to Bitcoin’s scalability problem and enabled the implementation of the Lightning Community.

After breaking $5,000 at first of September, information that China needed to crack down on bitcoin and cryptocurrencies crashed the value all the way down to the $3,600 vary. By October, the cryptocurrency had already recovered to $5,000, and the next epic surge to $20,000 awaited.

Bitcoin futures contracts have been first launched in December, buying and selling on the Chicago Mercantile Change (CME).

2017 was the yr everybody took discover of bitcoin, from institutional and retail traders to governments and economists. All of them began their very own battle to again or oppose Bitcoin.

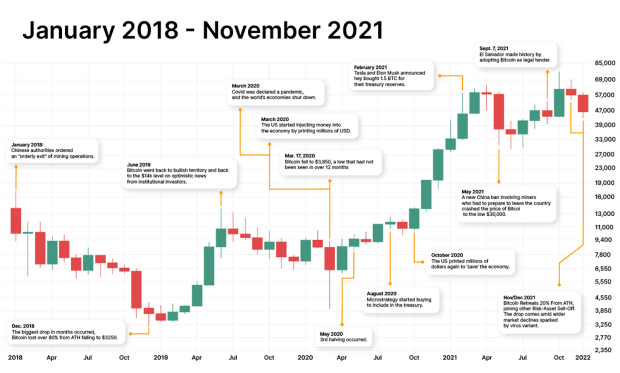

January 2018-November 2021

After the earlier period of failed ICOs, the altcoin market tried different methods to lift capital, together with STOs (“safety token providing”) and IEOs (“preliminary change providing”) — all with poor outcomes. Within the meantime, Bitcoin was making ready for a sequence of technological advances that will profit its scalability and safety, culminating within the Taproot implementation in November 2021.

This was the Covid period, when the world and its financial system shut down for almost two years, bringing dramatic penalties to monetary markets and bitcoin. But, this was additionally the period when bitcoin hit the present all-time excessive of over $69,000 — in opposition to all odds.

2018: Bear Territory

Value Vary: $14,093-$3,809

After the bullish motion on the finish of 2017, bitcoin spent 2018 in bear territory, and by the tip of the primary quarter, its value had already retraced nearly 50% from January’s worth.

In January, Chinese language authorities ordered the closing of mining operations. The discover known as for an “orderly exit” with out setting a deadline.

On the 18th of June, Fb announce their cryptocurrency undertaking, Libra. The announcement prompted a swift response from authorities regulators worldwide. The announcement didn’t impression the value of bitcoin an excessive amount of.

For a lot of the yr, bitcoin traded throughout the $6,000 and $8,000 vary, hitting a backside of $3,250 in December and shutting the yr at simply over $3,700, down 73% from the start of the yr.

2019: Leaving The Bear Behind

Value Vary: $3,692-$7,240

Bitcoin primarily moved sideways throughout 2019, with a big spike in June when constructive information about institutional traders and wider adoption of cryptocurrencies converged and triggered a constructive transfer upwards.

Bakkt, the lengthy awaited and far hyped futures contracts was launched on the twenty second of September.

For the remainder of the yr, bitcoin value hovered across the $7,000 mark, ending 2019 at simply over $7,200.

2020: Covid Surge

Value Vary: $7,194-$28,841

2020 will likely be remembered because the yr of Covid, which affected many facets of life, together with monetary markets and bitcoin. When the lethal flu was declared a pandemic in March 2020, markets went into vital turmoil, crashing to cost ranges that had not been seen for the reason that 2008 financial disaster.

Bitcoin crashed to a low of $4,000 on March 17, because the world witnessed the occasions unfolding. In Could, the third Halving in Bitcoin’s historical past occurred, and the value slowly recovered, pushing as much as over $10,000 once more.

MicroStrategy was the primary publicly traded firm to start out accumulating bitcoin in its money reserves. Micheal Saylor, who had as soon as fiercely opposed Bitcoin, admitted that he didn’t perceive Bitcoin on the time and he had now realized that bitcoin was the world’s solely conceivable secure haven and sound cash. The corporate went on to buy in extra of 130,000 BTC and is exhibiting no indicators of stopping.

From the tip of August, the sequence of constructive information round bitcoin adoption began to push the value up, in addition to the U.S. authorities’s makes an attempt to assist the financial system get better by extra money printing — bringing the quantity of {dollars} in circulation from 15 to 19 trillion over only a few months. Extra money printing led many to consider that their {dollars} have been not a secure haven, and so they began trying on the sound cash qualities that bitcoin may provide.

By the tip of the yr, bitcoin value was again to its earlier ATH of $20,000 and surpassed it, closing on December 31 at over $29,000.

2021: From Hope To Despair

Value Vary: $29,022-$47,191

After an thrilling finish to 2020, bitcoin began 2021 with nice optimism and had a wild first quarter culminating with the primary all-time excessive of the yr in mid-April, at $64,594. Such a bullish motion was doubtless triggered by claims of steady liquidity injection within the markets by the Federal Reserve, coupled with information that Elon Musk, Tesla and different companies had began allocating bitcoin as an alternative of USD of their treasuries. Tesla introduced in February that it had acquired $1.5 billion value of bitcoin — 10% of its treasury — for “extra flexibility to additional diversify and maximize returns on our money.”

In Could, a brand new China restriction hit Bitcoin, saying that monetary establishments and fee platforms have been prohibited from transacting in cryptocurrencies. Moreover, all of the bitcoin mining vegetation needed to shut down. Bitcoin crashed to $32,450 on Could 23 and to a brand new low of $29,970 on July 21. This China ban additionally had repercussions on the mining business, with the hash fee dropping considerably within the following months, as miners relocated their ASICs primarily to Russia, Kazakhstan and North America.

In September, renewed optimism adopted a sequence of occasions, together with the hash fee restoration, the information that El Salvador had made bitcoin authorized tender and the primary futures-based Bitcoin ETF launching in October — which led to the second all-time excessive for the yr at $68,789, on November 10, 2021.

Bitcoin closed out the yr by retreating 20% from that all-time excessive. This decline in bitcoin’s value occurred together with broader market declines that have been triggered by considerations over a brand new COVID-19 virus variant.

Imminent rate of interest hikes, hovering inflation and bulletins that the Fed would start to cut back its bond purchases and slowly drain liquidity from monetary markets, have been all indicators that the world financial system was going into recession mode.

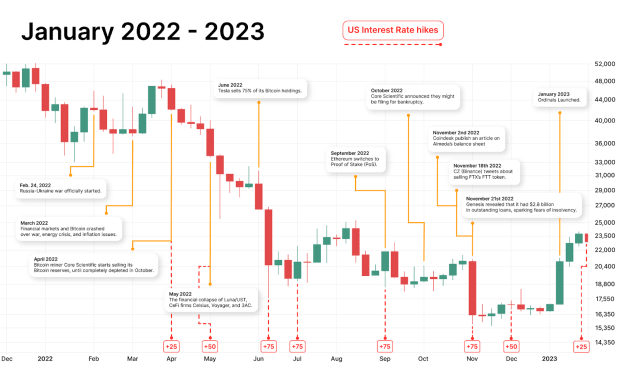

January 2022-Current

2022: Liquidity Is Drained and Insolvencies Start

Value Vary: $46,319-$16,537

The world’s financial and monetary turmoil continued in 2022, made worse by a brand new struggle on Europe’s doorstep, the elimination of Russia from world fee programs like Visa and SWIFT, rising rates of interest (.75 foundation factors every month — totaling 4.25% by year-end), Financial institution of England bailout, rising inflation, fuel and power disaster and a common recession looming over a lot of the Western world.

Stricter laws on Bitcoin and cryptocurrencies known as for by governments and regulators added further FUD to the overall temper, additional distancing traders from riskier property.

By January, bitcoin had dropped to $35,000 over the surging risk of an imminent Russia-Ukraine struggle, which promptly erupted on the finish of February. By March, bitcoin had recovered to $47,459, however the world geopolitical and financial disaster precipitated a brand new and extra sturdy crash all the way down to the $20,000 vary, a stage that bitcoin saved for months because the financial system tried to seek out reduction.

Starting in March, the Luna Basis Guard purchased bitcoin as a reserve asset meant to help the Terra Community’s algorithmic stablecoin, UST, in case of “unstable market circumstances.” The corporate acquired 80,000 bitcoin within the course of, value almost $3 billion on the time.

On Could 7, there have been early indicators of a capital flight from UST as $85 million UST was swapped for $84.5 million USDC, inflicting UST to lose its peg to the greenback within the course of. By the 14th, the Luna Basis Guard had bought all however 313 of their 80,000 bitcoin in an unsuccessful try and defend the stablecoin peg. The bitcoin value was severely affected, dropping 44% between Could 6 and Could 18.

The autumn of Terra precipitated contagion available in the market, resulting in the collapse of main CeFi companies Celsius, Voyager and hedge fund Three Arrows Capital (3AC). 3AC was unable to fulfill obligations towards its companions and collectors, and the default on its loans created a domino impact on all events concerned. FTX rescued these corporations in an obvious present of power.

Tesla bought 75% of its bitcoin holdings in Q2 after the autumn in worth in earlier months.

Mining agency Core Scientific additionally started promoting their bitcoin stack in June, bringing the variety of BTC held from 9,618 BTC in April to solely 24 on the finish of the yr. Core Scientific’s liquidity issues solely emerged in October, and the corporate raised the opportunity of submitting for chapter, itemizing among the many causes for its struggles the monetary publicity to Celsius and its associates.

One other bitcoin miner, Argo Blockchain, additionally skilled monetary troubles in October, failing to lift $27 million from a strategic investor and its inventory dropping over 41% of its worth on Nasdaq.

In September, Ethereum differentiated itself farther from Bitcoin by switching to proof-of-stake.

At first, November offered respite for the bitcoin value — till Coindesk printed a revealing article on Almeda’s steadiness sheet and the collapse of FTX started. A number of days later, Binance’s Chengpeng Zhao (CZ) ignited an change struggle by tweeting his intention to promote $2.1 billion USD equal in money (BUSD and FTT), which triggered a 27% crash over the course of the next two days.

With rumors circulating wildly about Grayscale’s insolvency, Grayscale was pressured to release a statement on the 18th declaring that their cash have been secure with Coinbase. The markets remained on tenterhooks, and so forth the twenty first, bitcoin reached a brand new low of $15,477 as rumors of Genesis insolvency continued.

Bitcoin closed the yr at $16,537, down 64% from 12 months earlier.

2023: Value Restoration

Value Vary: $16,537 –

With the brand new yr got here some recent optimism as traders started to consider the U.S. Federal Reserve’s rate of interest will increase would decelerate. The bitcoin value broke out on January 10, growing 24% over the course of 4 days.

On January 21, Casey Rodomor launched Ordinals, which enabled on-chain Bitcoin native digital artifacts. The value elevated 45% in January, closing out the month at $23,150 and exhibiting indicators of a powerful restoration from a tough bear market.

FAQs

How a lot was bitcoin when it first got here out?

Bitcoin didn’t have a value when it was first launched into the world. For a number of years, there have been no exchanges the place customers may commerce it for fiat cash and it was solely potential to build up bitcoin by way of mining — or shopping for it peer-to-peer from somebody who had mined it.

What’s bitcoin’s highest-ever value?

Bitcoin’s highest-ever value is $68,789, reached on November 10, 2021.

Is now a great time to purchase bitcoin?

The perfect time to purchase bitcoin relies on the investor’s scenario; nonetheless, when the value is low, it’s cheaper to build up extra. This text explores bitcoin’s value patterns and the macro atmosphere round it, which ought to make it simpler for traders to extra conveniently determine when it’s the very best time to purchase or promote bitcoin.

Conclusion

It must be clear by now that bitcoin is an asset like no different. Its ecosystem tends to function on four-year cycles, whereas its value could also be outlined by elements regarding financial coverage, such because the implementation of quantitative easing or quantitative tightening insurance policies.

In simply 14 years, bitcoin’s unimaginable progress has established it as a brand new asset class everybody began to concentrate to.

Bitcoin Journal supplies quite a lot of assist for individuals who’d love to do their homework to raised find out about bitcoin’s value actions and make knowledgeable funding selections.

Think about schooling as a device to know why Bitcoin has gone to this point in simply over a decade, and also you might be able to shift to a longer-term imaginative and prescient past its day-to-day volatility.