Binance USD (BUSD) has suffered a steep decline in energetic addresses following the regulatory crackdown by U.S. authorities. This improvement continues a collection of dips throughout the Binance ecosystem in current weeks.

BUSD Energetic Handle Exhibits Regression

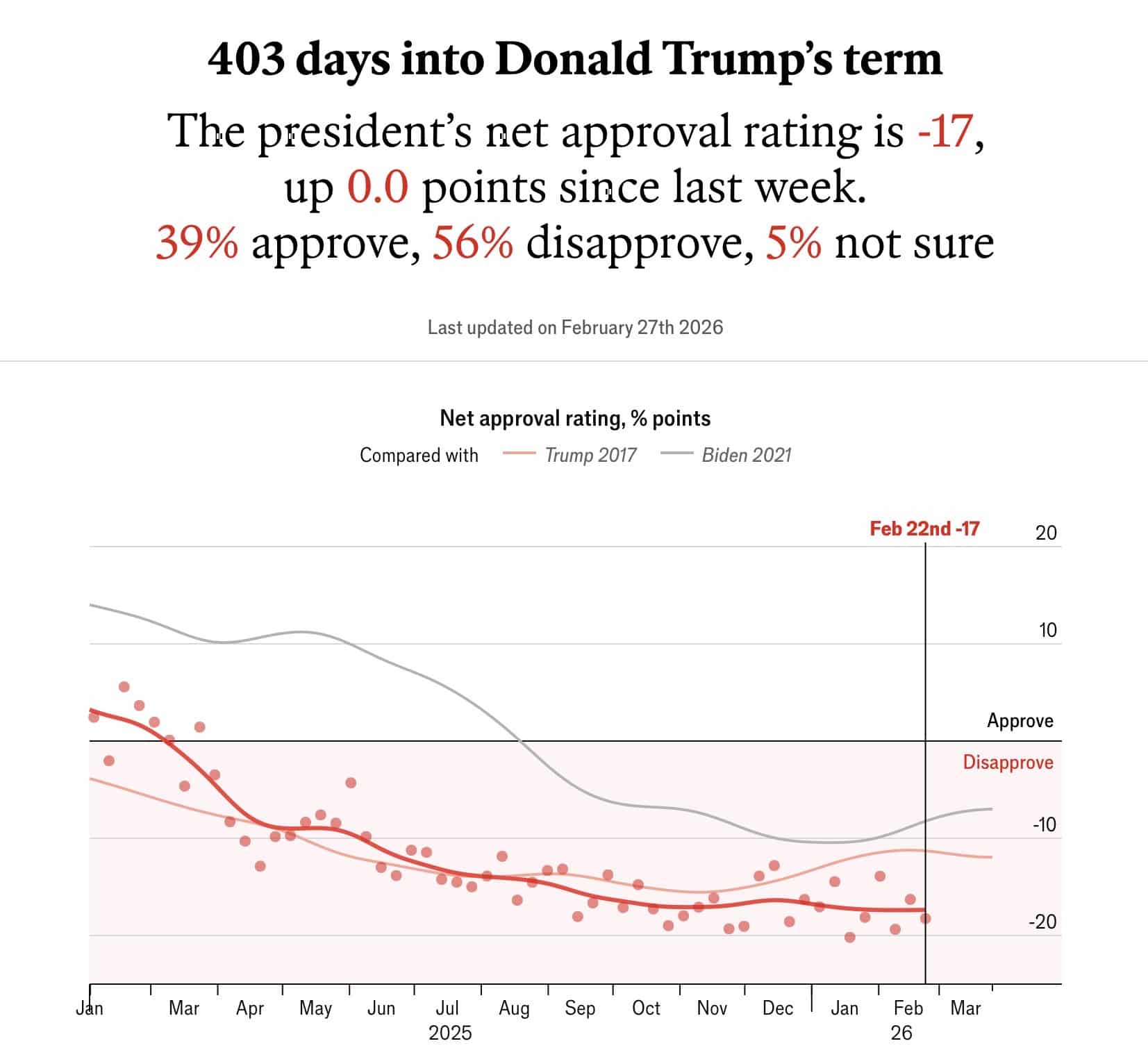

In keeping with information from Glassnode, the variety of energetic BUSD addresses, based mostly on its seven-day hourly transferring common, has dropped to ranges not seen since October 23, 2022.

At present, BUSD is averaging 94 energetic addresses per hour in comparison with the top of 2022, when it averaged greater than 250 energetic addresses hourly. This represents a lower of 60% and is a big downturn for the token.

In the meantime, exercise on the 2 largest stablecoins, USDT and USDC, has witnessed a milder dip. USDT and USDC are down to five,242 and a couple of,291, respectively. BUSD reducing energetic tackle signifies the bearish sentiments trailing the Binance ecosystem.

Binance USD Going through Potential Regulatory Lawsuits

The Binance ecosystem has been rocked in current weeks. In February, the US Securities and Trade Fee (SEC) ordered Paxos to cease issuing BUSD. It was additionally confirmed that the SEC is planning a serious lawsuit in opposition to Paxos for violating investor safety legal guidelines, with the regulator alleging that BUSD is an unregistered safety.

This brought on ripples within the crypto trade as Paxos is a serious issuer of BUSD in partnership with the Binance alternate. U.S.-based alternate Coinbase adopted go well with by saying on February 27 that it will cease buying and selling BUSD from March 13. In keeping with the alternate, the asset not meets their requirements. Customers would not be capable to commerce the stablecoin, however their funds can be accessible for withdrawal anytime.

Associated Studying: Paxos On Hit Listing – Why SEC Plans To Slap Stablecoin Issuer With A Lawsuit

Given the scenario, Changpeng Zhao, the CEO of Binance, estimated that BUSD volumes can be significantly lowered. On February 17, he indicated that capital was starting to go away BUSD, and most of it was moved to USDT, and he was not fallacious. Because the issuance of the cease order for BUSD was introduced, its market capitalization has fallen by 40% from $16 billion to $9 billion, in accordance with information from Coingecko.

These destructive developments have contributed to the bearish development of BUSD, with the coin among the many high most dumped tokens. In the meantime, Tether (USDT) seems to have benefited from BUSD’s present regulatory issues. Its market cap quantity has grown by over 3%, with buyers changing their BUSD to USDT lately. Information evaluation agency Santiment additionally indicated this trend, with the variety of long-term USDT holders rising by 16% for the reason that starting of the yr.

Associated Studying: Binance CEO “CZ” Denies Rumors And Backs Voyager Deal

BUSD Struggles Felt In The Crypto Market

BUSD troubles have cascaded into the crypto market, with a number of cash in pink this week. The main cryptocurrency Bitcoin is down by 4% this week, and analysts have predicted that the bearish development might proceed for a couple of weeks.

Featured picture from Binance.com, charts from TradingView, Glassnode.com and Coingecko.com