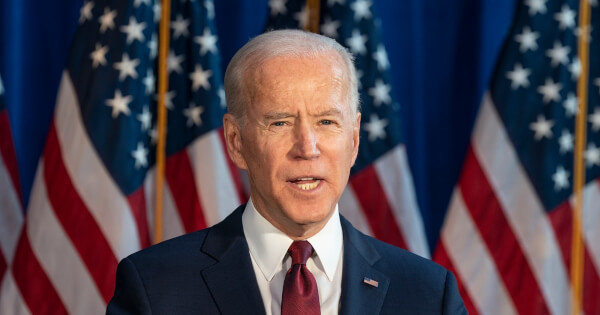

On Thursday, March 9, U.S. President Biden revealed his finances proposal for 2024. Underneath the Biden Price range, the U.S. Treasury Division is seeking to introduce a 30% excise tax on crypto mining operations.

In accordance with a piece within the Treasury division’s 2024 income proposals doc, the Biden administration advances the movement that “Any agency utilizing computing assets, whether or not owned by the agency or leased from others, to mine digital belongings could be topic to an excise tax equal to 30 p.c of the prices of electrical energy utilized in digital asset mining.”

For full implementation of this tax charge, all crypto mining companies can be required to submit reviews detailing their electrical energy consumption quantity and its worth. Due to this fact, this proposal may even cowl crypto-mining companies which purchase energy from off-grid sources like energy producing crops, with the 30% tax calculated based mostly on estimated electrical energy price.

New Tax Goals To Cut back Crypto Mining Exercise – Says U.S. Treasury

Asides from income era, the U.S. Treasury states new tax proposal goals to discourage crypto-mining actions in the USA on account of its dangerous environmental results, electrical energy value hikes, and potential dangers to “native utilities and communities”. Following approval by the U.S. Congress, this proposal will come into impact after December 31, 2023.

Nevertheless, the excise tax can be launched over an area of three years at a price of 10% per 12 months; thus, attaining the proposed 30% tax price by 2026.

Biden Price range Outlines Different Plans For The Crypto Area

Except for the proposed 30% tax price on mining companies, President Biden’s finances proposal listed different tax modifications for the crypto trade. For instance, the finances goals to extend the capital features tax price from 20% to 39.6% on all long-term investments – crypto belongings included – producing not less than $1 million in curiosity.

Moreover, the Biden finances proposal for 2024 additionally plans to get rid of crypto wash gross sales. To this finish, they intend to cease “tax-loss harvesting” in crypto transactions, a preferred tax evasion follow whereby merchants promote their crypto belongings at a loss to scale back their capital features tax earlier than continuing to right away buy these belongings again.

Presently, wash guidelines within the U.S. are solely relevant to shares, shares, and bonds. Nevertheless, approval of The Biden finances will place all digital belongings on that very same record.

In essence, the Biden finances is projecting that these crypto tax modifications might generate about $24 billion from the trade, particularly as the USA goals to lower its fiscal deficit by $3 trillion throughout the subsequent 10 years.

In different information, the crypto market continues to be experiencing a downward spiral as a result of ongoing liquidation saga of Silvergate financial institution. In accordance with knowledge by Coingecko, the market’s complete cap has declined by 7.75% within the final 24 hours.

Crypto Complete Market Cap valued at $894.77B | Supply: TOTAL Chart on Tradingview.com

Featured Picture: Axios, chart from Tradingview