A lot has occurred within the final week that it could be useful to take a look at the totality of those occasions in relation to bitcoin.

This is an opinion editorial by Dillon Healy, institutional partnerships at Bitcoin Journal and Bitcoin 2023.

The largest information of the final week has been the banking sector collapses, particularly crypto-friendly banks. On March 2, in their very own SEC submitting, Silvergate raised issues round their solvency and talent to proceed working. This was, in my view, undeniably a results of direct and/or oblique publicity to the persevering with contagion throughout the crypto business created by collapses of Luna, 3AC, and FTX. As anticipated, a financial institution run adopted from Silvergate companions to distance themselves and withdraw property.

Silvergate’s inventory ($SI) instantly tumbled over 50% as experiences piled up of shoppers shifting elsewhere.

“It’s now getting more and more tough for crypto corporations to ascertain or maintain relationships with a U.S. financial institution,” mentioned Ivan Kachkovski, FX and crypto strategist at UBS.

Hypothesis piled up round how a Silvergate unwind would have an effect on stablecoins and different crypto-servicing banks. Silvergate has been the principle issuer of the second hottest secure coin USDC.

Contagion issues then shifted to Signature Financial institution, the opposite well-liked crypto-servicing financial institution.

“Signature famous that it had beforehand acknowledged as of Feb. 1, it could now not assist any of its crypto trade clients in shopping for and promoting quantities of lower than $100,000. Signature mentioned in December that it could be decreasing its publicity to the crypto sector, though not eliminating it totally.”

On March 8, Silvergate formally introduced that they had been unwinding operations and liquidating property by way of a press launch.

The official collapse of Silvergate meant extra wide-spread contagion and elevated uncertainty and worry of banking clients and USDC customers. On March 9 and 10, Silicon Valley Financial institution suffered a basic financial institution run. Billions in withdrawals piled up from the fractional reserve financial institution, many withdrawals from their core clientele, startup corporations.

SVB inventory crashed 60% and by the top of the day regulators had shut down the financial institution and property had modified fingers to the FDIC. The SVB unwind was the second largest financial institution collapse in U.S. historical past.

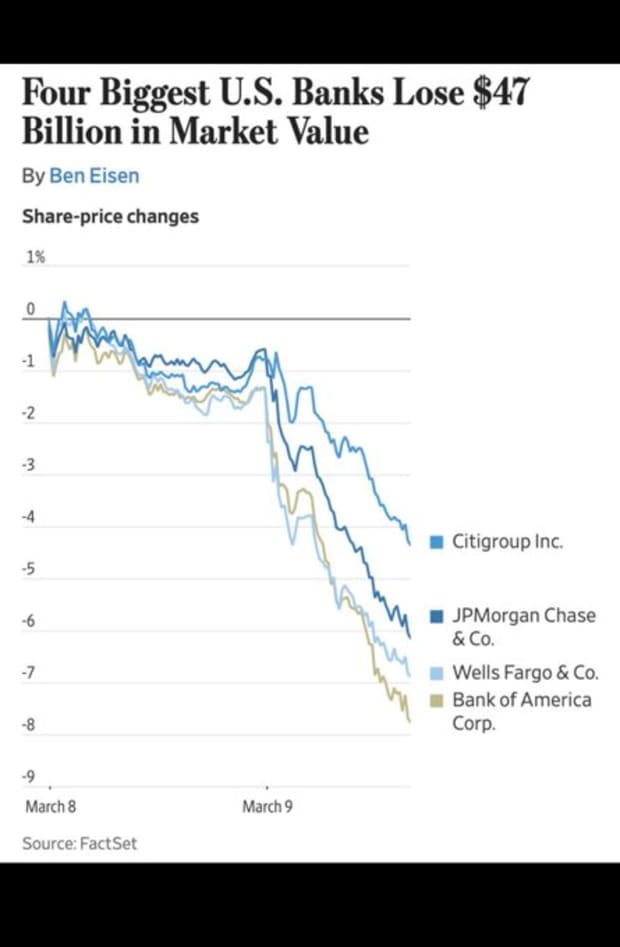

Belief in banks was deteriorating quickly as most publicly-traded corporations tumbled.

With the SVB unwind taking place consideration as soon as once more turned to Circle’s USDC, the second largest stablecoin with a $43 billion market capitalization, because it was reported that Circle had an undisclosed a part of its $9.8 billion money reserves on the now collapsed Silicon Valley Financial institution.

Throughout March 11 the USDC/USD peg started to interrupt reaching $0.87.

Over the weekend worry continued to unfold, hundreds of start-ups banked at SVB wouldn’t have entry to their funds or payroll on Monday. Signature Financial institution was additionally formally closed by U.S. regulators.

By Sunday the Fed, together with the FDIC and U.S. Treasury, stepped in with a press release:

“Depositors may have entry to all of their cash beginning Monday, March 13. No losses related to the decision of Silicon Valley Financial institution might be borne by the taxpayer.”

Amidst all the contagion, there have been experiences of Signature Financial institution being particularly focused by anti-crypto regulators. “I feel a part of what occurred was that regulators needed to ship a really robust anti-crypto message,” mentioned Signature Financial institution board member Barney Frank.

The obfuscated bailout allowed the failing banks to borrow in opposition to their damaging collateral worth at par as an alternative of at market worth.

The week opened with the brand new authorities financial institution deposit backstop in place, and issues are on-going round what banks warrant counterparty danger for each people and companies. Within the wake of a number of fractional reserve banking collapses, bitcoin appeared to commerce on fundamentals quite than hypothesis for the primary time shortly.

The dangers related to fractional reserve banking mixed with centralized financial coverage and unstable rates of interest are on full show, in the meantime fully-backed banking options are seemingly actively blocked by the Fed.

The occasions of the previous couple of weeks ought to serve to teach individuals on the hazards introduced on by a centrally-controlled financial system reliant on credit score and leverage. I extremely suggest that individuals excited by studying how Bitcoin operates outdoors of this method attend Bitcoin 2023 in Miami on Could 18-20, the place the subject might be mentioned in depth.

It is a visitor put up by Dillon Healy. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

![[LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now? [LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now?](https://sbcryptogurunews.com/wp-content/themes/jnews/assets/img/jeg-empty.png)