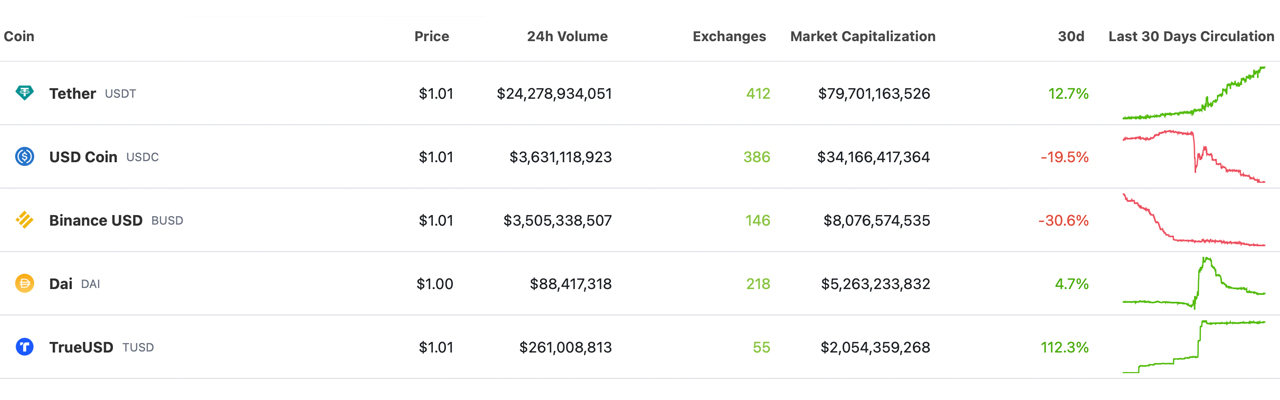

In accordance with statistics, on March 26, the stablecoin economic system was valued at $135 billion, with the highest stablecoins representing $31.8 billion or 75% of the $42.17 billion in 24-hour international commerce quantity throughout the complete crypto market. Within the final two weeks since March 11, 7.06 billion USDC and 351.57 million BUSD have been redeemed. In the meantime, from March 14 to March 26, the variety of tether stablecoins in circulation elevated by 6.12 billion.

Stablecoin Circulation Modifications

In current weeks, the provides of some stablecoins have decreased whereas others have elevated. At this time’s high ten stablecoins embody USDT, USDC, BUSD, DAI, TUSD, FRAX, USDP, USDD, GUSD, and LUSD. In accordance with statistics for the final month, USDC, BUSD, and GUSD skilled double-digit reductions in provide. The opposite high ten stablecoin property recorded provide will increase, with TUSD’s provide doubling or rising 112.3% greater than it was 30 days in the past.

Amongst different stablecoin property, liquity usd (LUSD) rose 16.2% and tether (USDT) elevated by 12.7% during the last month. LUSD now has a market valuation of round $267.70 million, USDT’s market capitalization has risen to $79.70 billion, and TUSD’s market valuation has grown to $2.05 billion. Alternatively, USDC’s variety of cash in circulation has dropped by 6.12 billion since March 11. Statistics for the final 30 days point out that USDC misplaced 19.5% of its provide in comparison with final month.

BUSD and GUSD skilled the most important reductions, with GUSD shedding 31.6% of its provide during the last 30 days. BUSD has diminished its provide by 30.6% since final month, and its market valuation is simply above $8 billion. In accordance with Nansen’s proof-of-reserves software, $7.3 billion BUSD is held by Binance. The stablecoin DAI issued by Makerdao has seen a 4.7% enhance in circulation. Over the past month, FRAX recorded a 1.9% enhance, and USDP has risen 8.5%.

What do you suppose the long run holds for stablecoins and their position within the crypto market? Will we see continued development and adoption or will they face new challenges and obstacles? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.