The controversy round whether or not or not this coverage is a type of quantitative easing misses the purpose: Liquidity is the secret for world monetary markets.

The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

QE Or Not QE?

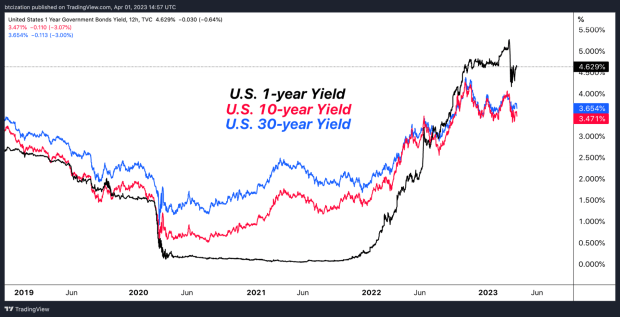

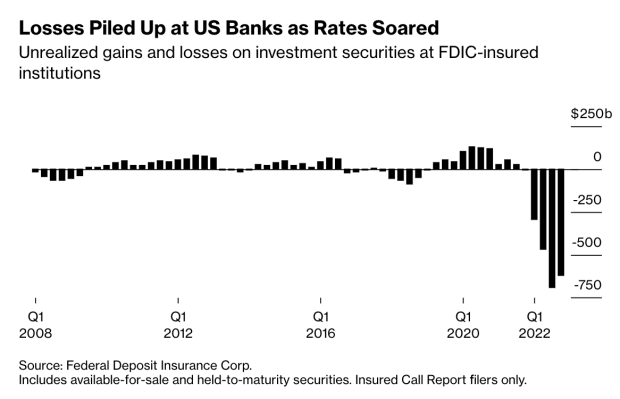

The Financial institution Time period Funding Program (BTFP) is a facility launched by the Federal Reserve to offer banks a secure supply of funding throughout instances of financial stress. The BTFP permits banks to borrow cash from the Fed at a predetermined rate of interest with the objective of making certain that banks can proceed to lend cash to households and companies. Particularly, the BTFP permits certified lenders to pledge Treasury bonds and mortgage-backed securities to the Fed at par, which permits banks to keep away from realizing present unrealized losses on their bond portfolios, regardless of the historic rise in rates of interest over the previous 18 months. Finally, this helps help financial development and protects banks within the course of.

The trigger for the super quantity of unrealized losses within the banking sector, significantly for regional banks, is because of the historic spike in deposits that got here because of the COVID-induced stimulus, simply as bond yields had been at historic lows.

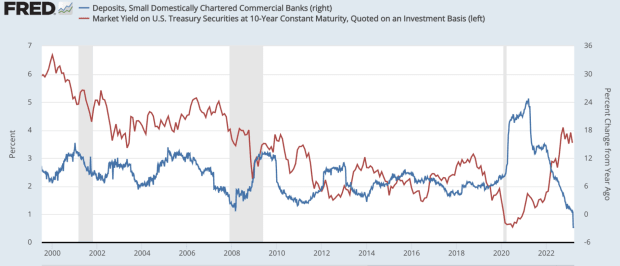

Proven under is the year-over-year change in small, domestically chartered industrial banks (blue), and the 10-year U.S. Treasury yield (pink).

TLDR: Historic relative spike in deposits with short-term rates of interest at 0% and long-duration rates of interest close to their generational lows.

The rationale that these unrealized losses on the financial institution’s safety portfolios haven’t been broadly mentioned earlier is because of the opaque accounting practices within the business that permit unrealized losses to be basically hidden, except the banks wanted to lift money.

The BTFP allows banks to proceed to carry these property to maturity (at the very least quickly), and permit for these establishments to borrow from the Federal Reserve with the usage of their at present underwater bonds as collateral.

The impacts of this facility — plus the current spike of borrowing on the Fed’s low cost window — has led to a hotly debated matter in monetary circles: Is the newest Fed intervention one other type of quantitative easing?

In the simplest phrases, quantitative easing (QE) is an asset swap, the place the central financial institution purchases a safety from the banking system and in return, the financial institution will get new financial institution reserves on their steadiness sheet. The meant impact is to inject new liquidity into the monetary system whereas supporting asset costs by decreasing yields. In brief, QE is a financial coverage software the place a central financial institution purchases a hard and fast quantity of bonds at any worth.

Although the Fed has tried to speak that these new insurance policies will not be steadiness sheet growth within the conventional sense, many market individuals have come to query the validity of such a declare.

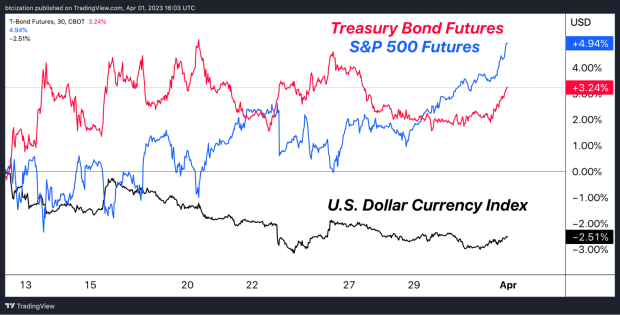

If we merely take a look at the response from varied asset courses because the introduction of this liquidity provision and the brand new central financial institution credit score facility, we get fairly an fascinating image: Treasury bonds and equities have caught a bid, the greenback has weakened and bitcoin has soared.

On the floor, the power is only to “present liquidity” to monetary establishments with constrained steadiness sheets (learn: mark-to-market insolvency), but when we carefully study the impact of BTFP from first rules, it’s clear that the power gives liquidity to establishments experiencing steadiness sheet constraint, whereas concurrently protecting these establishments from liquidating long-duration treasuries on the open market in a firesale.

Lecturers and economists can debate the nuances and intricacies of Fed coverage motion till they’re blue within the face, however the response operate from the market is greater than clear: Steadiness sheet quantity go up = Purchase threat property.

Make no mistake about it, your entire sport is now about liquidity in world monetary markets. It didn’t was once this fashion, however central financial institution largesse has created a monstrosity that is aware of nothing apart from fiscal and financial help throughout instances of even the slightest misery. Whereas the short-to-medium time period seems to be unsure, market individuals and sidelined onlookers needs to be properly conscious as to how this all ends.

Perpetual financial growth is an absolute certainty. The flowery dance performed by politicians and central bankers within the meantime is an try and make it look as if they’ll preserve the ship afloat, however in actuality, the worldwide fiat financial system is like an irreversibly broken ship that’s already struck an iceberg.

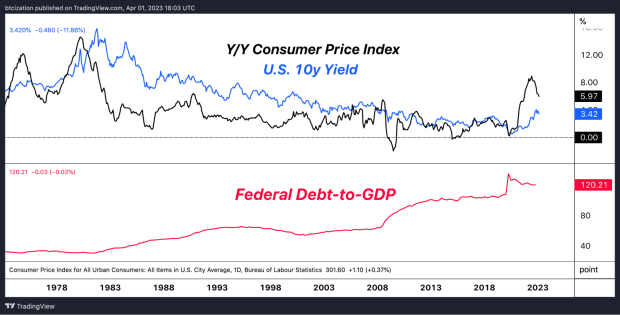

Allow us to not neglect that there is no such thing as a method out of 120% debt-to-GDP as a sovereign with out both a large unexpected and unlikely productiveness growth, or a sustained interval of inflation above the extent of rates of interest — which might crash the economic system. On condition that the latter is awfully unlikely to happen in actual phrases, monetary repression, i.e., inflation above the extent of rates of interest, seems to be the trail going ahead.

Ultimate Observe

For the layman, there is no such thing as a dire must get caught up within the schematics of the controversy whether or not current Fed coverage is quantitative easing or not. As a substitute, the query that deserves to be requested is what would have occurred to the monetary system if the Federal Reserve didn’t conjure up $360 billion price of liquidity from skinny air during the last month? Widespread financial institution runs? Collapsing monetary establishments? Hovering bond yields that ship world markets spiraling downwards? All had been potential and even seemingly and this highlights the rising fragility of the system.

Bitcoin presents an engineering answer to peacefully choose out of the politically corrupted assemble colloquially referred to as fiat cash. Volatility will persist, change fee fluctuations needs to be anticipated, however the finish sport is as clear as ever.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

- One other Fed Intervention: Lender Of Final Resort

- Banking Disaster Survival Information

- PRO Market Keys Of The Week: Market Says Tightening Is Over

- Largest Financial institution Failure Since 2008 Sparks Market-Large Concern

- A Story of Tail Dangers: The Fiat Prisoner’s Dilemma

- The Every thing Bubble: Markets At A Crossroads

- Not Your Common Recession: Unwinding The Largest Monetary Bubble In Historical past

- Simply How Massive Is The Every thing Bubble?