The Bitcoin and crypto markets have seen a powerful weekly shut. Bitcoin’s value moved straight up into the present key resistance at $28,600. After seven failed makes an attempt, this places the value as soon as once more just under the present key stage that separates BTC from $30,000.

A strong value transfer may even profit the broader crypto market because the rotation in altcoins aka altcoin season has nonetheless did not materialize. Bitcoin and crypto traders ought to subsequently keep watch over key macro knowledge within the week forward.

Bitcoin And Crypto Face These Key Occasions

After a quiet begin to the week, one of the crucial necessary macro metrics for the monetary markets is arising on Wednesday, April 12, with the US Client Worth Index (CPI). When the CPI knowledge is launched at 8:30 am EST, count on to see extra volatility within the Bitcoin and crypto markets.

Traders shall be evaluating whether or not the Federal Reserve can push by way of one other fee hike or whether or not it’s going to hit the pause button within the face of stronger-than-expected falling inflation mixed with the most recent US labor market knowledge. The earlier month’s CPI was 6.0% on a year-over-year (YoY) foundation and 0.4% month-over-month (MoM).

In March, the expectations are for CPI YoY at 5.2% and 0.3% (MoM). A miss on expectations is prone to push the Bitcoin value decrease as markets value in the next likelihood of one other Fed fee hike in Could.

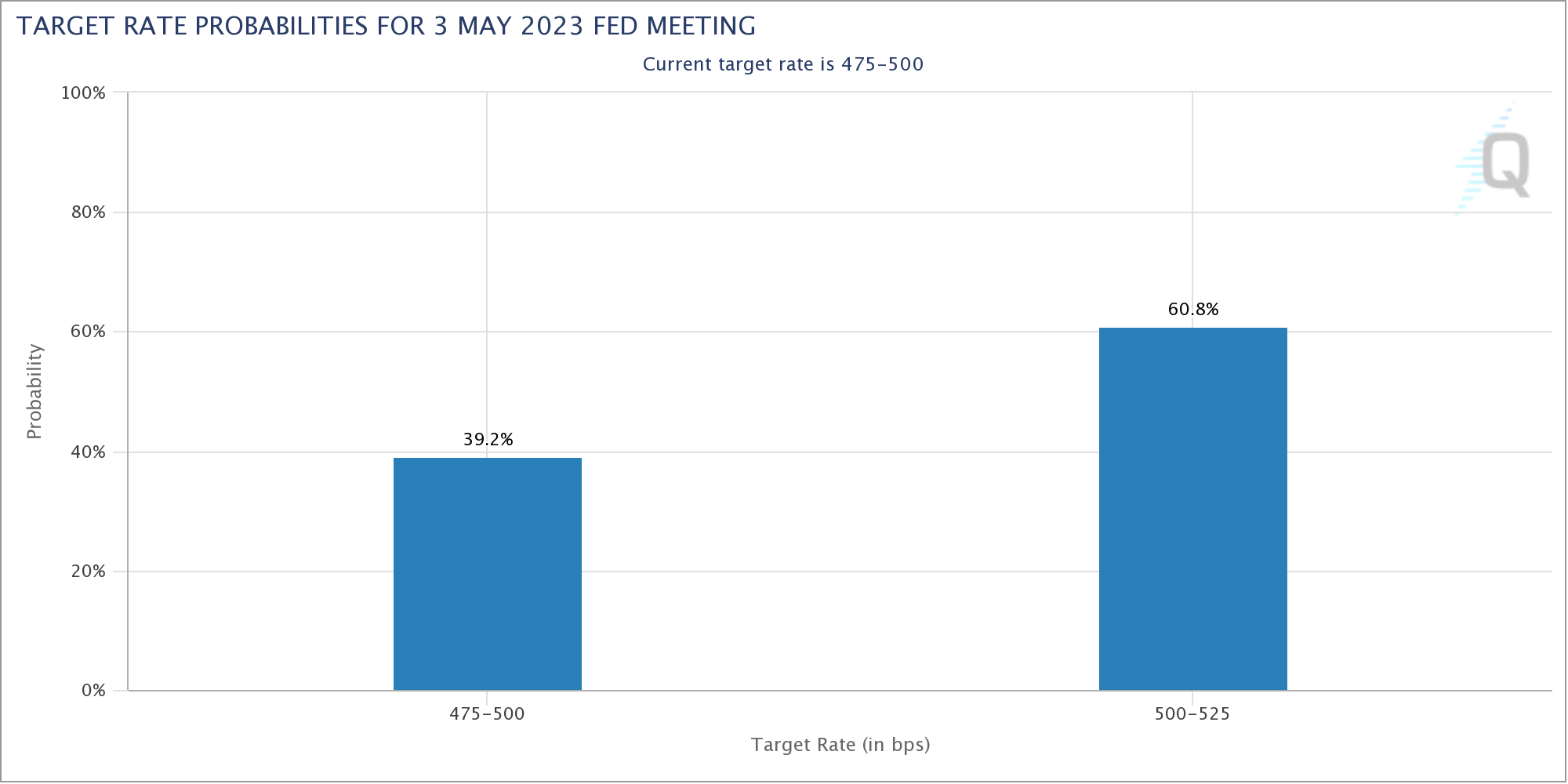

The CME’s FedWatch instrument presently exhibits a 61% likelihood of a 0.25% fee hike in Could. If expectations are met and even exceeded, Bitcoin is prone to head north.

Later that day, on Wednesday, the FOMC minutes shall be launched at 2:00 pm EST. The assembly minutes will reveal extra particulars on the Fed’s projections and concerns for the most recent rate of interest resolution. This makes Wednesday an important day of the week.

On Thursday, April 13, each the US Producer Worth Index (PPI) and preliminary jobless claims shall be launched at 8:30 am EST. The PPI MoM is forecasted to return in at 0.0% (beforehand -0.1%), whereas the core PPI MoM: is forecast to rise once more to 0.3% (beforehand 0.0%).

Preliminary jobless claims are forecast at 216,000, and have been beforehand 228,000. Already final week, the US labor market and ISM personal sector buying managers index figures confirmed small cracks within the US economic system, whereas (the lagging indicator) the US unemployment fee despatched a blended sign and marginally fell (from 3.6% to three.5%).

On Friday, April 14 at 8:30 am, the US retail gross sales shall be launched. March retail gross sales are anticipated to fall 0.5% MoM (beforehand -0.4%), whereas core retail gross sales are anticipated to fall 0.4% MoM (beforehand -0.1%). The information should be seen within the context of slowing financial progress momentum and fears of recession.

At press time, the BTC value was buying and selling at $28,258. A each day and even weekly shut of Bitcoin above $28,600 could be extraordinarily bullish.

Featured picture from iStock, chart from TradingView.com