On this difficulty

- Ethereum: Improve anxieties

- Apple: Bitcoin hideout

- Hong Kong: Wooing Web3

From the editor’s desk

Pricey Reader,

In terms of displaying the extent to which digital property have turn out to be built-in into our lives, the metaphors don’t come rather more vivid than the information that the Bitcoin white paper has been hidden in Apple’s MacOS working system for the previous six or so years.

And the truth that the white paper has been slipped into an Apple know-how somewhat than into one other type of tech doubles down on that message: Like cryptocurrencies at the moment are to conventional finance, Apple was as soon as an underdog in its business. Its evolution into one of many world’s most respected corporations demonstrates the transformative energy of innovation, and an analogous sense of pioneering innovation hints on the prospects for crypto and different digital property.

But regulators are nonetheless enjoying catch-up. Maybe nowhere is that this extra evident than in the US, the place the Securities and Change Fee, alongside different authorities, has this 12 months launched a sequence of often controversial enforcement actions towards crypto corporations, regardless of a slew of unanswered questions and official disagreements on methods to regulate digital property.

Bitcoin is a wonderful instance of the regulatory muddle. The unique crypto was outlined as a digital foreign money and a way of cost by the U.S. Treasury a decade in the past, categorised as a commodity by the Commodity Futures Buying and selling Fee a 12 months later — when the Inside Income Service designated it as property — and handled as bodily money within the Biden Administration’s infrastructure invoice, which turned legislation in 2021.

If Apple’s know-how had been topic to such complicated, conflicting regulatory reasoning, alongside enforcement motion that some within the crypto business — and even some within the regulatory group — contemplate little greater than arbitrary, would it not ever have grown into one of the crucial profitable corporations of all time?

For digital property to develop to the extent that their untapped potential is totally realized, the regulatory roadblocks should be cleared and guidelines should be made rational and predictable — as is required for the event of any younger business. A superb place to begin can be settling the continuing deadlock between the SEC and the CFTC over whether or not cryptocurrencies are securities or commodities.

We’re the custodians of a courageous new period within the evolution of finance that’s already embedded in our monetary ecosystem. We should not let its promise be diminished as a result of regulating it’s difficult. Digital property current authorities within the U.S. and elsewhere with a problem, however, extra importantly, a chance. They should step ahead and take it.

Till the following time,

Angie Lau,

Founder and Editor-in-Chief

Forkast

1. Fork up

Ethereum’s long-awaited Shapella improve, also referred to as the Shanghai onerous fork, is scheduled for mainnet activation on Thursday, April 13, at 6:27 a.m. Hong Kong time, at epoch 194048, in keeping with an announcement by the Ethereum Basis.

- Ethereum holders have been trying ahead to the Shapella improve, which guarantees to allow stakers to withdraw their ETH from the Beacon Chain for the primary time whereas claiming staking rewards.

- The improve is probably the most important since The Merge transitioned Ethereum from a proof-of-work consensus mechanism to its present proof-of-stake setup final September.

- Day by day ETH staking deposits shrunk from 55,456 ETH on March 31, to as little as 11,728 ETH on April 11, in keeping with BeaconScan knowledge.

- Traders fear that the improve might considerably enhance promoting strain on ETH, since greater than 18.2 million ETH price US$34.16 billion is staked on the Beacon Chain, or 15.15% of the token’s whole provide, in keeping with Dune.

- “The voluntary [validator] exit rely surges increased as Shanghai approaches,” tweeted James Straten, an information analyst at CryptoSlate, including that there could also be “a number of potential promote strain,” because of the massive sum of staked ETH.

- Nevertheless, crypto trade Gate.io said the affect of gross sales “may be small,” as only one% of the circulating ETH provide consists of staking rewards, with a excessive likelihood of withdrawal.

- Lido Finance, the most important liquid staking protocol, will allow staking withdrawals solely from early Could, Lido developer Kadmil.eth mentioned in a Twitter space on April 6. That might additional scale back promoting strain as a result of greater than 31% of whole staked ETH was staked by the protocol.

- Ether fell 2.4% previously 24 hours to US$1,874 and is total flat for the previous week, in keeping with CoinGecko. ETH stays 37.4% decrease than its costs a 12 months in the past and is down 61.6% from its all-time excessive in November 2021.

Forkast.Insights | What does it imply?

Most Ethereum upgrades are strictly crypto affairs, however the upcoming Shanghai improve has exacerbated a break up between regulators in the US.

That’s as a result of ETH’s transfer to a proof-of-stake consensus mechanism, permitting customers to stake and earn curiosity on their holdings, is now thought-about — by the Securities and Change Fee, not less than — to make it a safety.

Traditionally, the SEC was glad with ETH’s designation as a commodity. However the arrival of staking rewards has modified that.

SEC Chairman Gary Gensler has publicly acknowledged that interest-bearing contracts basically change what ETH is, as a result of these contracts are basically monetary providers, making them securities devices.

However the Commodity Futures Buying and selling Fee begs to vary. It has held the view since 2014 that ETH is a commodity and has been saying as a lot in Senate hearings. CFTC Chair Rostin Behnam has burdened that the derivatives watchdog wouldn’t have allowed ETH futures merchandise to be listed on exchanges it regulates “if we didn’t really feel strongly that it was a commodity asset.”

The end result of this regulatory rift is more likely to form the way forward for crypto extra broadly. If ETH is designated a safety, all the businesses providing staking providers — reminiscent of Coinbase, Binance, Ledger and eToro — are more likely to have damaged the legislation. Some have already confronted authorized challenges for providing these providers.

If ETH is classed with certainty as a commodity, it’s more likely to turn out to be a magnet for hedge funds and different massive finance sector gamers awaiting regulatory readability. For now, nevertheless, ETH’s future stays topic to some uncertainty.

2. Buried treasure

The Bitcoin white paper, the theoretical define of the community underpinning the world’s first cryptocurrency, has been hidden inside each model of the working system utilized by Apple’s Mac computer systems shipped since not less than 2018.

- The white paper was hidden inside MacBook’s Digital Scanner II, a perform disabled by default.

- Though it’s unclear who hid the paper within the system, it was first found by MacOS group discussion board consumer bernd178 and shared in April 2021. Nevertheless, the doc’s concealment solely got here to widespread consideration with its re-discovery by blogger Andy Baio, who wrote a weblog publish about it final week.

- Baio mentioned he didn’t know why the paper was hidden within the working system, however prompt that an engineer had put it there.

- “Just a little fowl tells me that somebody internally filed it as a difficulty practically a 12 months in the past, assigned to the identical engineer who put the PDF there within the first place, and that individual hasn’t taken motion or commented on the difficulty since. They’ve indicated it’s going to doubtless be eliminated in future variations,” Baio wrote.

- The world’s first cryptocurrency has risen 6.6% since every week in the past, to US$30,029, and has climbed 36% over the previous 30 days, in keeping with CoinGecko. However it’s nonetheless 24.1% decrease in comparison with a 12 months in the past, and greater than 56% decrease than its all-time excessive of US$69,045 in November 2021.

Forkast.Insights | What does it imply?

Bitcoin has all the time had admirers, and it appears an engineer at Apple is considered one of them. Whereas some are decoding this as additional proof of the wild idea that Steve Jobs was Bitcoin inventor Satoshi Nakamoto, the reply might be rather less thrilling.

Software program engineers have lengthy hidden issues inside working techniques for different engineers or curious customers to find. Jokes by program designers have been inserted into the code of MS-DOS as way back because the Nineteen Eighties,

It appears the white paper, positioned inside a folder with property used for inner testing by Apple engineers, was a prank in the identical vein.

The identical folder additionally accommodates different random photographs and PDF recordsdata which can be used to simulate the method of scanning and exporting paperwork and pictures with the app, with out really needing a scanner.

Though Apple was conscious of the difficulty, it appears the engineer accountable for eradicating the white paper hasn’t gotten round to the duty of eradicating it but. Is it an indication of Nakamoto’s return? Don’t wager your BTC on it.

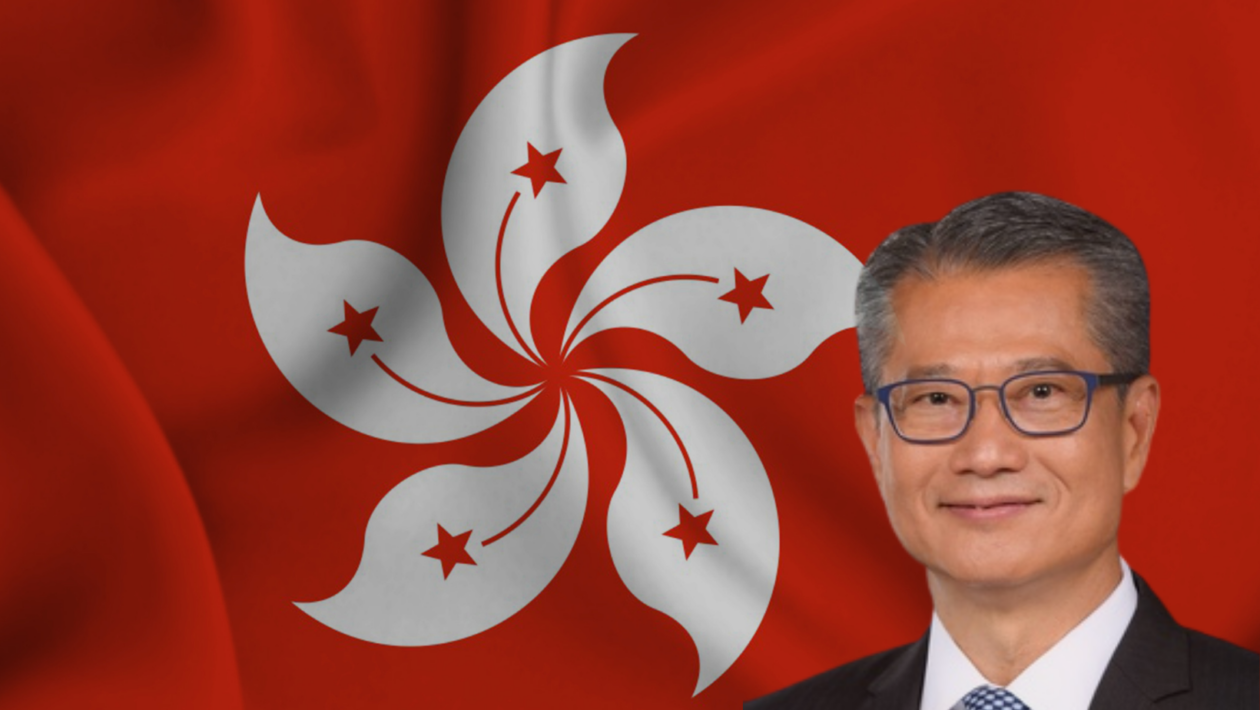

3. Chan-neling positivity

Paul Chan, Hong Kong’s monetary secretary, has proposed additional Web3 improvement as considered one of three key themes within the metropolis’s fiscal finances and that now’s the “greatest time” to take action, in keeping with a weblog publish printed on the web site of his workplace.

- “The digital financial system and the appliance of Web3 have nice potential for improvement and have triggered a constructive response from society,” Chan wrote.

- Chan added that he’s optimistic about Web3 improvement regardless of “digital property having fluctuated considerably” and the current closures of digital asset exchanges.

- Chan’s feedback come two months after Hong Kong detailed a brand new licensing regime for crypto service suppliers that’s set to take impact in June. The framework might finally lengthen to retail crypto buying and selling, which has been restricted within the territory.

- The finance secretary added that the Web3 push will prioritize growing business laws whereas specializing in real-world use circumstances such because the tokenization of inexperienced bonds and utilizing blockchain to “simplify the provision chain course of and scale back prices.”

- Chan made his remarks forward of a busy week for town’s Web3 business, with the Hong Kong Web3 Competition underneath method on Wednesday, and the federal government internet hosting a two-day Digital Economic system Summit beginning Thursday.

Forkast.Insights | What does it imply?

Hong Kong is sparing no effort to indicate that it’s pouring sources into growing Web3, an space of innovation that seems to have gained backing from Chinese language authorities.

Along with growing a regulatory framework for crypto buying and selling platforms that may come into impact in two months, the federal government is ensuring town’s Web3 business will get assist, setting apart HK$50 million (US$6.4 million) in a brand new a part of its finances for Cyberport, a government-backed know-how incubator undertaking, to “enhance the event of Web3 ecosystems.”

In the meantime, Norman Chan, a former chief government of the Hong Kong Financial Authority, town’s de facto central financial institution, will head newly-formed business group the Institute of Internet 3.0 Hong Kong, established to facilitate Web3 improvement within the metropolis, in keeping with a report by the Hong Kong China Information Company.

The record of members becoming a member of the brand new Web3 business group underscores the extent to which Beijing is backing Hong Kong’s Web3 improvement plans. It consists of a number of Chinese language tech heavyweights, together with Li Feng, chairman of state-owned telecommunications large China Cellular Hong Kong, who will function one of many institute’s honorary chairpersons.

It’s vital to notice that though China has banned crypto buying and selling on the mainland, it’s turn out to be clear that it intends to develop the previous British colony into a world Web3 hub. Hong Kong Monetary Secretary Paul Chan wrote in a weblog publish on Sunday that town’s authorities will work to discover a steadiness between sound regulation and modern improvement.

When Hong Kong’s authorities begins issuing crypto-trading licenses later this 12 months, will probably be telling how bold its plans are of their measurement and scope.