Whereas different regulators, comparable to the US Securities Change and Fee (SEC), appear to have turned their again on crypto, Hong Kong has continued to help the business’s standing firmly on its dedication to change into a crypto hub.

Over the previous few months, the Hong Kong authorities has initiated a number of plans showcasing the area’s help for the crypto business. Not too long ago, Hong Kong’s Monetary Secretary, Paul Chan, disclosed the federal government’s plan to spend money on the growing Web3 ecosystem.

Hong Kong Categorical Help For Crypto

To be a part of the early core contributor of Web3, the Hong Kong authorities invested HK$50 million ($6.5 million) into the island metropolis’s 2023-24 finances – a transfer focused on the Web3 ecosystem.

The invested funds had been stated for use to spice up a number of essential sectors that would foster Web3 adoption, together with cross-sector enterprise cooperation, organizing workshops, and so forth.

To this point, the Island Metropolis challenge has aided Hong Kong’s effort to help rising expertise, strengthening its standing as Asia’s main monetary heart.

In a current report printed by Barron, the Hong Kong Financial Authority plans to provoke a spherical desk by April 28, 2023, to facilitate straight dialogue alongside the crypto business.

Hong Kong’s strategy in the direction of crypto has been considerably completely different from different Asia monetary facilities, comparable to Singapore, which have been fairly discreet with their strikes on crypto.

Paul Chan commented on Hong Kong’s effort in the direction of selling the crypto business and stated:

To ensure that Web3 to steadily take the highway of revolutionary growth, we’ll undertake a technique that emphasizes each ‘correct regulation’ and selling growth.

Chan additional talked about “monetary safety, investor training, and anti-money laundering measures.” Kishore Bhindhi, an lawyer primarily based in Hong Kong, added and advised Barron that Hong Kong’s strikes are showcasing the area’s intention to change into a house to cryptocurrency.

Bhindh famous that sooner or later, the Island Metropolis challenge might flip to crypto’s software to conventional monetary providers, for instance, tokenized bonds and securities.

US Regulator Continues Crackdown

In the meantime, the US regulator has expressed an extra crackdown on the crypto business. In February, the SEC ordered Paxos, the issuer of Binance branded stablecoin, BUSD, to halt the issuance of the stablecoin.

Moreover, the SEC has since pursued staking providers, deeming these belongings securities. Not too long ago, the US Commodity Futures Buying and selling Fee (CFTC) additionally filed a lawsuit towards Binance, one of many main crypto exchanges within the business.

Whatever the information circulating within the business, the worldwide crypto market has maintained composure. Over the previous 24 hours, the worldwide crypto market capitalization has surged by 3.2% on the time of writing, with a worth nonetheless above $1.2 trillion.

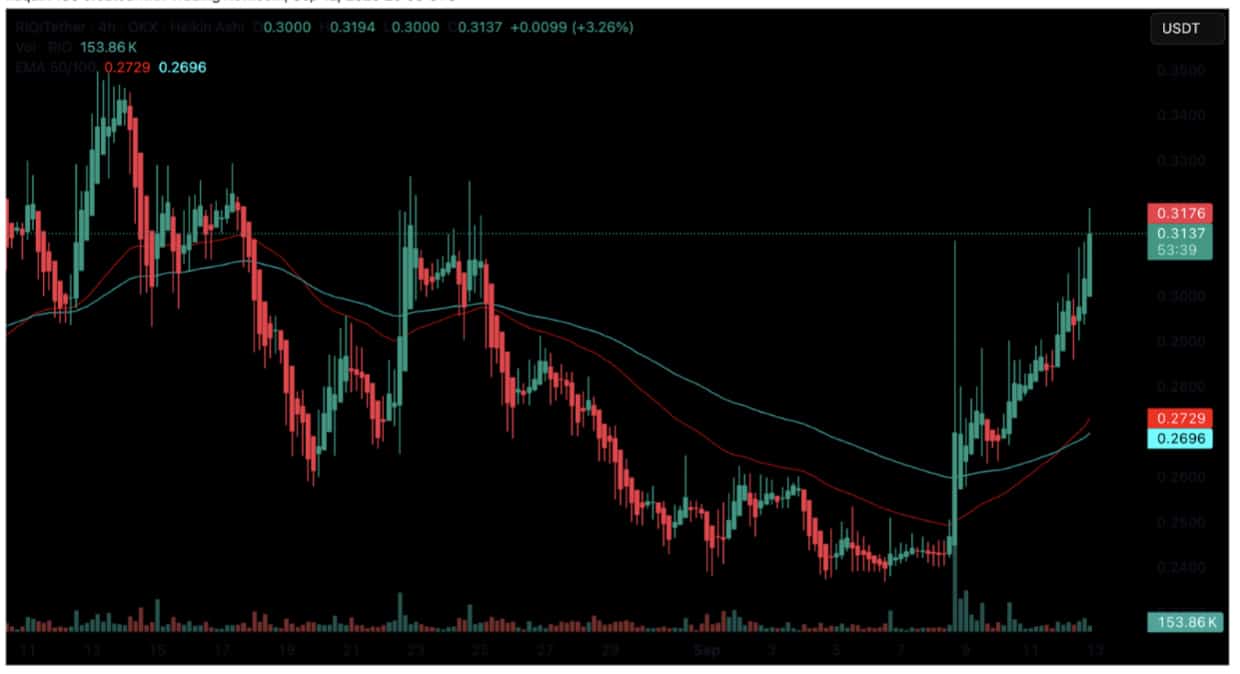

Featured picture from Shutterstock, Chart from TradingView