On April 13, a C6 Financial institution buyer in Brazil shared screenshots of his on-line checking account, revealing that the monetary establishment was monitoring CO2 emissions from his purchases and urging him to compensate monetarily. C6 Financial institution states that the brand new software goals to encourage Brazilians to undertake extra sustainable behaviors.

‘CBDC Preview’ — Financial institution Buyer Explains How His Brazilian Financial institution Displays Transactions for CO2 Emissions

Lately, politicians have pushed banks to stick to environmental, social, and company governance (ESG) targets. This has led monetary establishments to give attention to local weather change, equality, and social justice. On Thursday, Dr. Simon Goddek, CEO of Sunfluencer and a C6 Financial institution buyer, described how his financial institution is already using instruments that monitor buyer transactions associated to CO2 emissions. The financial institution calculates the estimated carbon footprint for every transaction performed with the account.

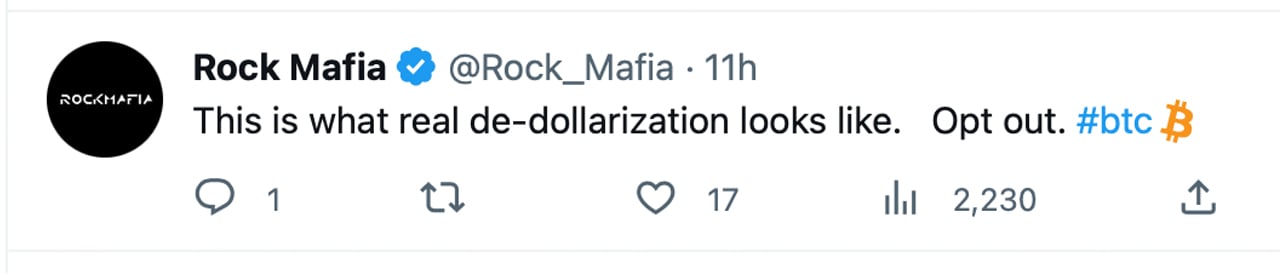

Dr. Goddek tweeted, “My Brazilian financial institution, C6 Financial institution, is now monitoring my CO2 emissions from purchases, journey, and so forth., and strongly encouraging me to compensate monetarily for them. I predicted this improvement two years in the past, and now it appears to be slowly coming true. Welcome to the dystopian world we stay in.” He additionally noted that JPMorgan has a big stake in C6 Financial institution and urged it might foreshadow related developments in the US. JPMorgan Chase owns a 40% stake in C6 Financial institution, a Brazilian digital monetary establishment established in 2019.

C6 Financial institution launched the brand new CO2 banking software on April 3 and detailed its major perform: to investigate the implications of CO2 emissions into the ambiance whereas serving as an indicator for implementing sustainable measures. Named “Carbon Extract,” the software displays CO2 emissions from on a regular basis bills made with debit and bank cards in addition to transfers and Pix transactions.

At the side of asserting this banking software, C6 Financial institution declared that it had “zeroed its carbon emissions.” Dr. Goddek’s Twitter thread sparked appreciable criticism towards the banking trade’s method to local weather change options. On the Reddit r/bitcoin discussion board, the software was known as a “preview” of central financial institution digital forex (CBDC).

A number of Monetary Establishments Are Adopting Local weather Change Monitoring Instruments to Monitor Spending

Within the Reddit submit, a consumer talked about that Turkey’s Garanti Financial institution additionally provides a CO2 emissions banking software. “It’s coming,” the Redditor warned, “They only must create the mandatory crises to introduce it on a worldwide scale.” In Could 2022, Garanti BBVA launched its carbon footprint software, which calculates prospects’ carbon emissions based mostly on their banking transactions. A number of banks and main fee providers worldwide have developed instruments to measure prospects’ transactional carbon footprints. For instance, Mastercard created a carbon calculator software for this objective.

Moneythor analyzes buyer transaction information to estimate CO2 output, whereas Personetics has developed a customer-based carbon footprint monitoring software. Bud, an open banking fintech firm, provides a carbon emissions software, and fintech agency Cogo’s analysis means that 75% of banking prospects want info associated to such information. Digital financial institution Meniga additionally argues that banks ought to present estimates of their prospects’ CO2 output. Critics of those applied sciences declare they might in the end result in transaction censorship and account closures. This comes at a time when banks globally are already closing buyer accounts with out a lot clarification, as reported by The New York Occasions on April 8, 2023.

What do you consider banks monitoring their prospects’ carbon footprints by transactional information? Do you imagine it is a obligatory step in the direction of a extra sustainable future, or an invasion of privateness and potential censorship of monetary exercise? Share your ideas within the feedback beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.