The primary quarter of 2023 has been vital for the crypto business, with the market making a robust comeback after a turbulent finish of 2022. In keeping with Coingecko’s first-quarter report, the crypto market has outperformed conventional belongings, with Bitcoin main the cost.

Crypto – The Finest Performing Sector Of The International Financial system

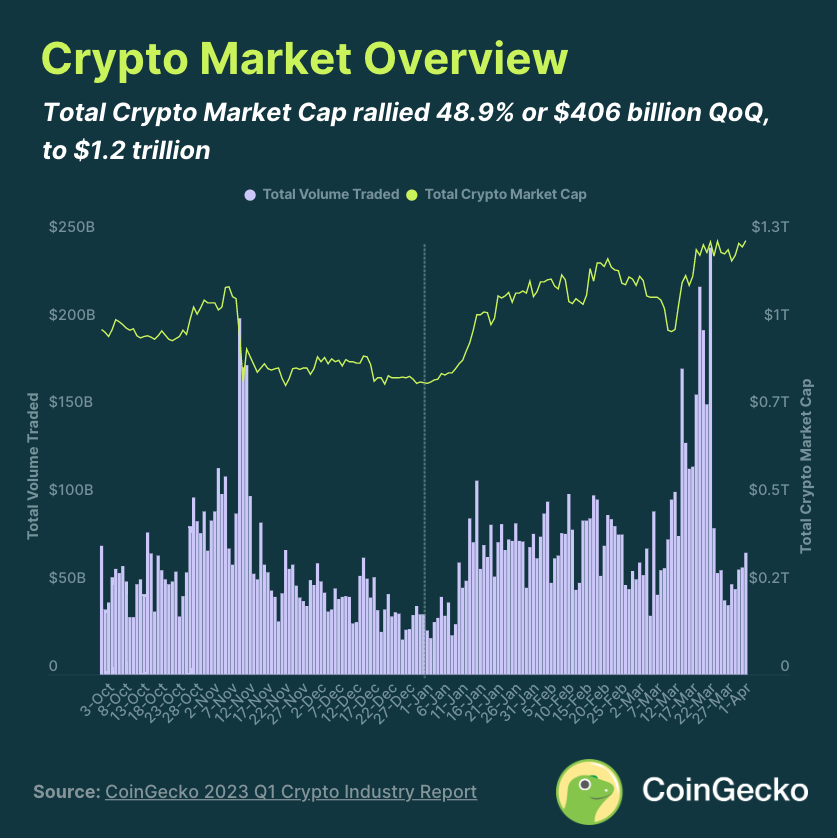

The primary quarter of 2023 has been an thrilling time for the cryptocurrency market, because it began robust with a 48.9% achieve within the general market cap. In keeping with the Coingecko report, the whole market capitalization of cryptocurrencies elevated from $800 billion to $1.2 trillion in simply three months, exhibiting a outstanding restoration from the 2022 turbulence.

Together with the expansion in market cap, the Coingecko report additionally highlights the rise in common day by day buying and selling quantity, which rose by 30% quarter-over-quarter. The report notes that the buying and selling quantity peaked in early March, coinciding with the banking disaster that noticed a number of banks collapse as a result of insolvency.

On the identical word, Bitcoin, the most important cryptocurrency by market capitalization, has outperformed conventional belongings like gold and the S&P 500, with a achieve of over 70% throughout Q1 2023. The report attributes this success to a number of elements, together with the growing acceptance of Bitcoin as a respectable funding asset and its rising adoption by establishments and retail buyers.

One other report spotlight is the resurgence of non-fungible tokens (NFTs), which noticed a big improve in buying and selling quantity throughout Q1 2023. NFTs are distinctive digital belongings verified on a blockchain, making them distinctive and beneficial. The report means that the resurgence in NFT buying and selling quantity outcomes from elevated curiosity and adoption of decentralized purposes (dApps) and gaming.

The Coingecko report additionally notes the rising recognition of decentralized finance (DeFi) protocols, which have seen a surge in adoption and utilization throughout Q1 2023, fueled by liquid staking, which led to an increase of 65% for the DeFi market.

DeFi protocols are constructed on blockchain expertise and supply customers a decentralized different to conventional monetary providers. The report means that the expansion of DeFi is because of the growing demand for decentralized providers and the potential for prime returns.

Elevated Demand For Stablecoins And DEXs

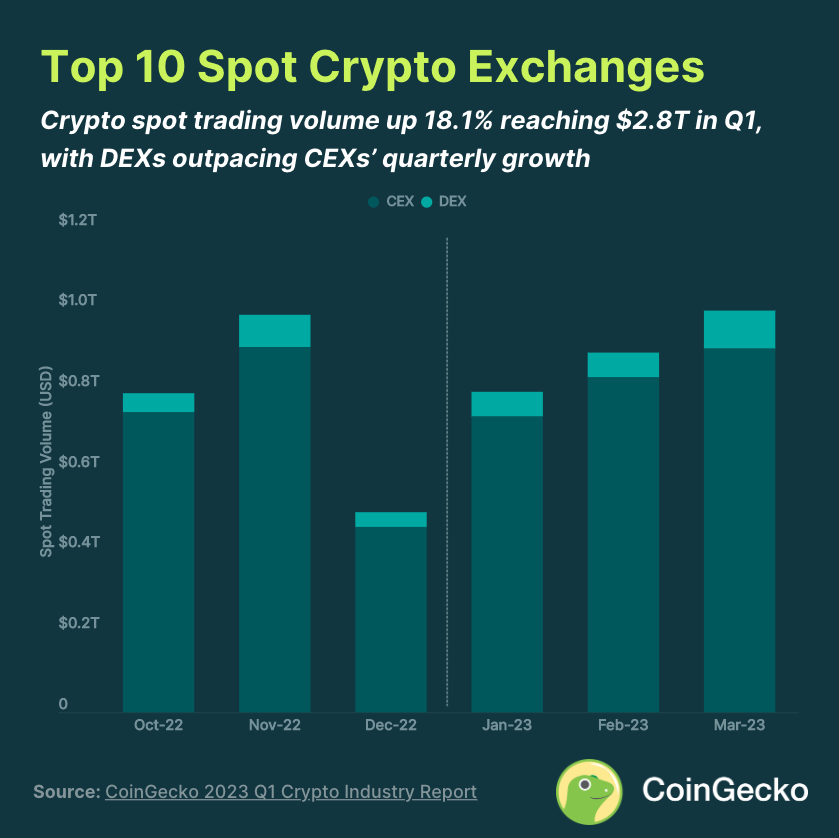

The primary quarter of 2023 has seen a surge in crypto spot buying and selling quantity, with an 18.1% improve in comparison with the earlier quarter. In keeping with Coingecko, the whole spot buying and selling quantity reached $2.8 trillion, a big improve from the earlier quarter’s quantity.

Apparently, the report notes that decentralized exchanges (DEXs) outpaced centralized exchanges (CEXs) in development, with DEXs experiencing a bigger improve in buying and selling quantity than their centralized counterparts. This development signifies the rising recognition of DeFi protocols, which supply customers a extra decentralized and clear different to conventional monetary providers.

Regardless of the rise in buying and selling quantity, the report notes that the month-to-month buying and selling quantity has but to succeed in the heights of the primary half of 2022, the place the typical month-to-month buying and selling quantity exceeded $1 trillion. Nevertheless, the report means that that is doubtless because of the market correction and turbulence that occurred within the latter half of 2022, which decreased buying and selling exercise.

Moreover, The primary quarter of 2023 has seen a shakeup within the stablecoin market, as the highest 15 stablecoins shed $6.2 billion in market capitalization. In keeping with Coingecko, stablecoins comparable to USDC and BUSD skilled the most important declines in market cap, whereas Tether (USDT) gained dominance with a 20.5% improve in market cap.

General, the Coingecko Q1 Crypto Trade Report paints a optimistic image of the cryptocurrency market, with a robust market cap and buying and selling quantity positive factors. Because the business continues to develop and evolve, will probably be fascinating to see how these developments develop and what new alternatives and challenges come up.

Featured picture from Unsplash, chart from TradingView.com