With yesterday’s hunch in Bitcoin and crypto markets, the uncertainty returns. Bitcoin, because the lead foreign money of the crypto market, is at the moment struggling to regain help at $29,100.

At press time, Bitcoin has not but been in a position to initialize an uptrend. BTC was buying and selling at $28,680, down -5.5% because the value was rejected on the $30,500 stage on Tuesday. The vast majority of altcoins are following this development, writing even larger losses for probably the most half.

Purchase The Bitcoin And Crypto Dip?

The co-founders of on-chain knowledge supplier Glassnode, Jan Happel and Yann Allemann write of their newest market update “don’t get spooked” and clarify {that a} $900+ transfer in Bitcoin is according to expectations, “keep away from shake outs”.

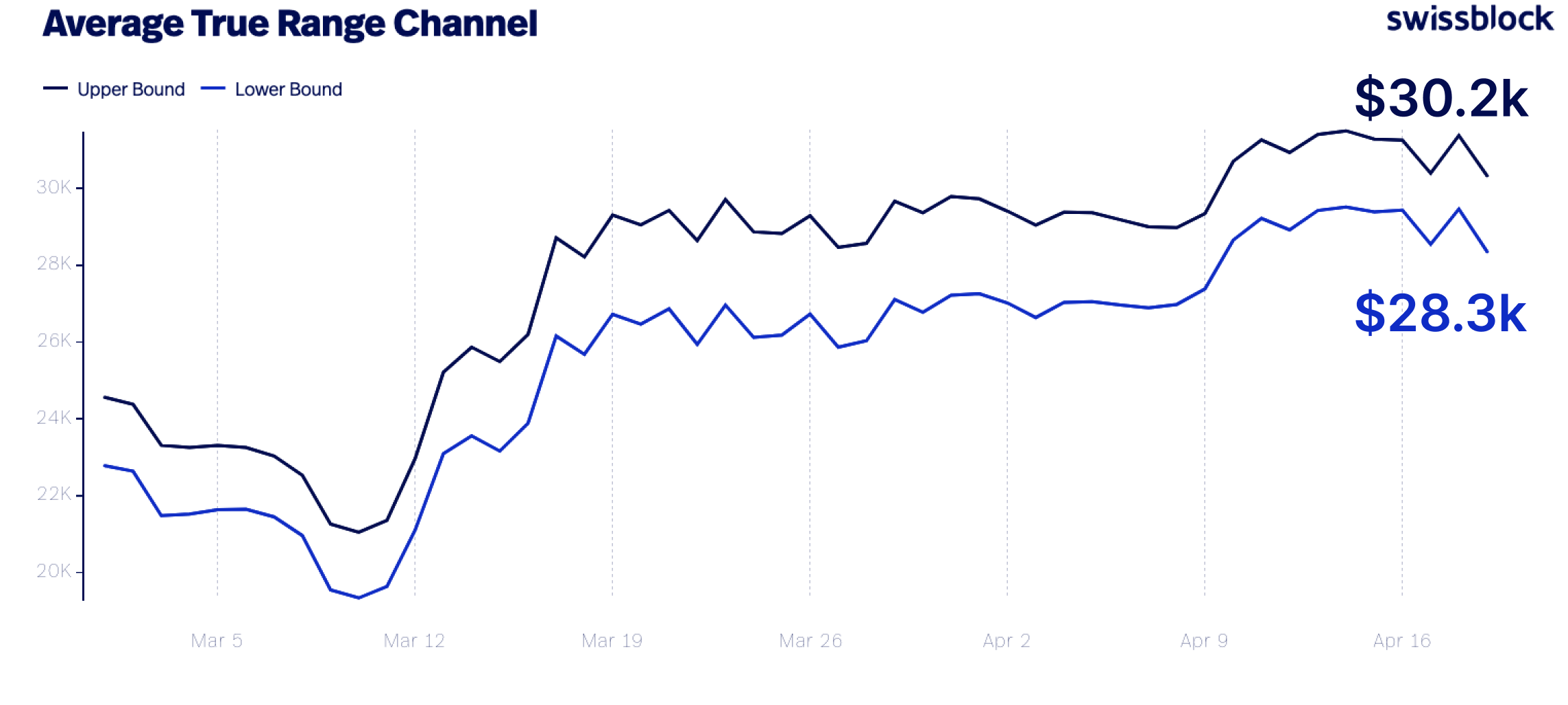

In accordance with the analysts, the market sentiment stays intact. Each the concern and greed index and the on-chain knowledge (NUPL) proceed to look bullish. Bitcoin’s common true vary is between $28,300 and $30,200, in keeping with Glassnode founders.

Sentiment has not turned unfavourable both. The concern and greed index continues to sign greed out there, which needs to be thought-about bullish. Moreover, the 2 analysts comment:

Immediately’s retrace to the decrease finish of $29k is an efficient alternative to purchase. Our mid-term outlook stays bullish, order books present extra liquidity, and the Bitcoin Threat Sign is at 0.

Web Unrealized Revenue and Loss (NUPL), the distinction between market cap and realized cap divided by market cap, signifies that unrealized positive factors exceed unrealized losses, which can be bullish.

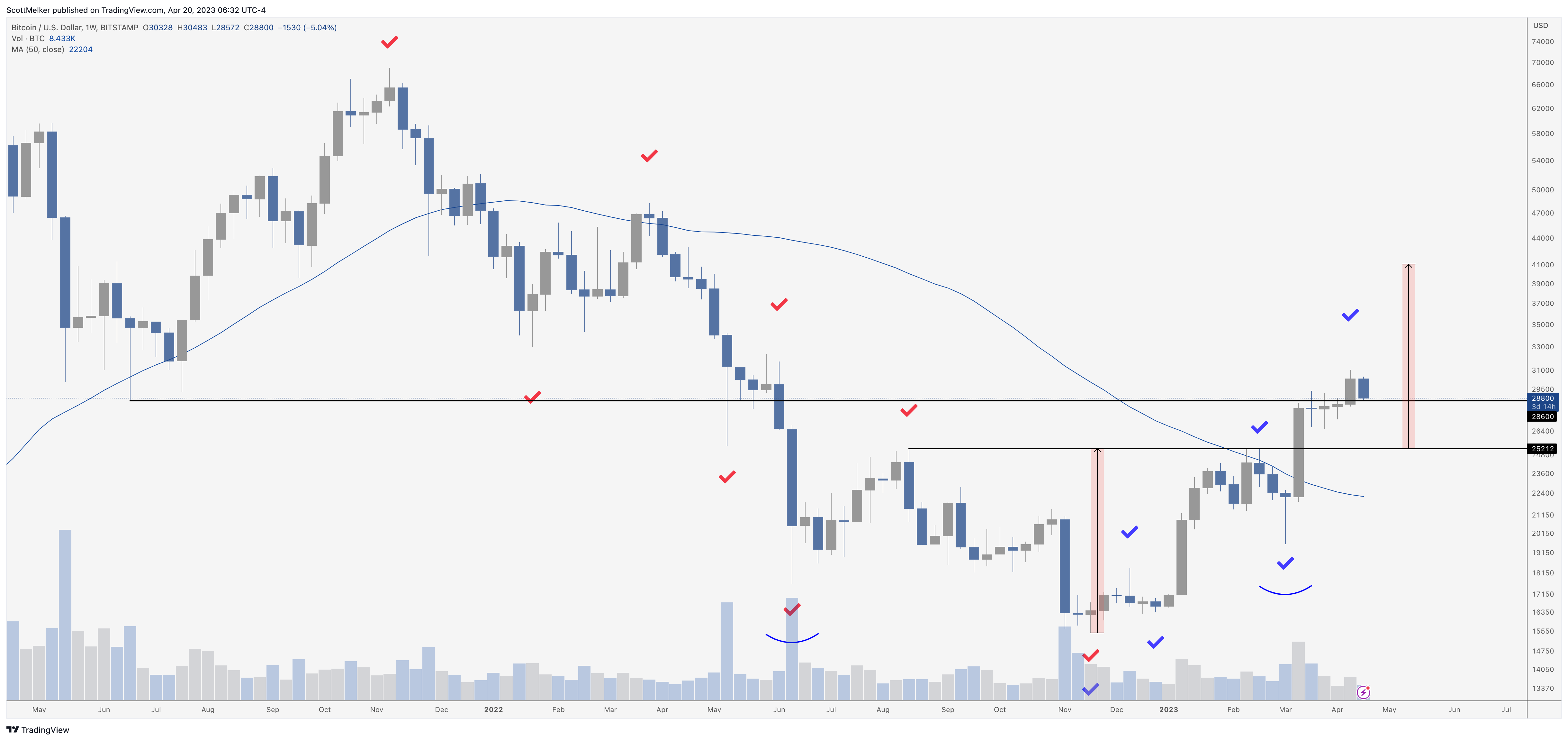

Analyst Scott Melker thinks it stays to be seen whether or not this correction will proceed. Nonetheless, he’s assured that Bitcoin has discovered some help on the “most predictable stage” at $28,600:

I’ve been screaming this quantity from the mountaintop, so there needs to be no shock right here. […] That is theoretically sturdy help. If it breaks, we glance to $25,212. Play it stage by stage.

The famend dealer @52kskew, referring to the 4-hour chart of Bitcoin, notes that there’s a retest of the earlier resistance. In his opinion, a weak RSI divergence and the stochastic RSI sign that there might be a reduction bounce.

A bullish state of affairs, in keeping with him, could be a reclaim of $29,500 and the 4-hour/ 1-day trendline. The bearish state of affairs is a rejection at $29,500 and the 1-day EMA development, in addition to a development in the direction of $27,000.

Concerning the decrease timeframe mixture CVDs and delta of Bitcoin, he notes, “Worth transferring larger right here; whereas CVDs transferring decrease = restrict shopping for & some absorption of sellers beneath $28.6K. Market shopping for but to comply with (which is the market momentum required for larger costs).”

The Binance Open curiosity may be an indicator that BTC will see a reduction bounce:

Some excessive quick float right here & funding transferring decrease. Ideally for a reduction bounce there’s continued spot shopping for & funding goes unfavourable later.

At press time, the Bitcoin value stood at $28,680, bouncing up from one other leg down.

Featured picture from iStock, chart from TradingView.com