On April 27, Coinbase, the crypto change based mostly in San Francisco, made public the disclosure of its response to the Wells discover it had obtained from the U.S. Securities and Trade Fee (SEC) again in March. The corporate maintained that the regulatory physique’s enforcement actions had been in direct distinction to the company’s earlier approval of the agency’s public itemizing through its S-1 submitting. Coinbase asserted in its response to the SEC that it’s the “harmless buyers who stand to lose probably the most from the fee’s abrupt about-face.”

Coinbase Responds to U.S. Securities Watchdog’s Wells Discover

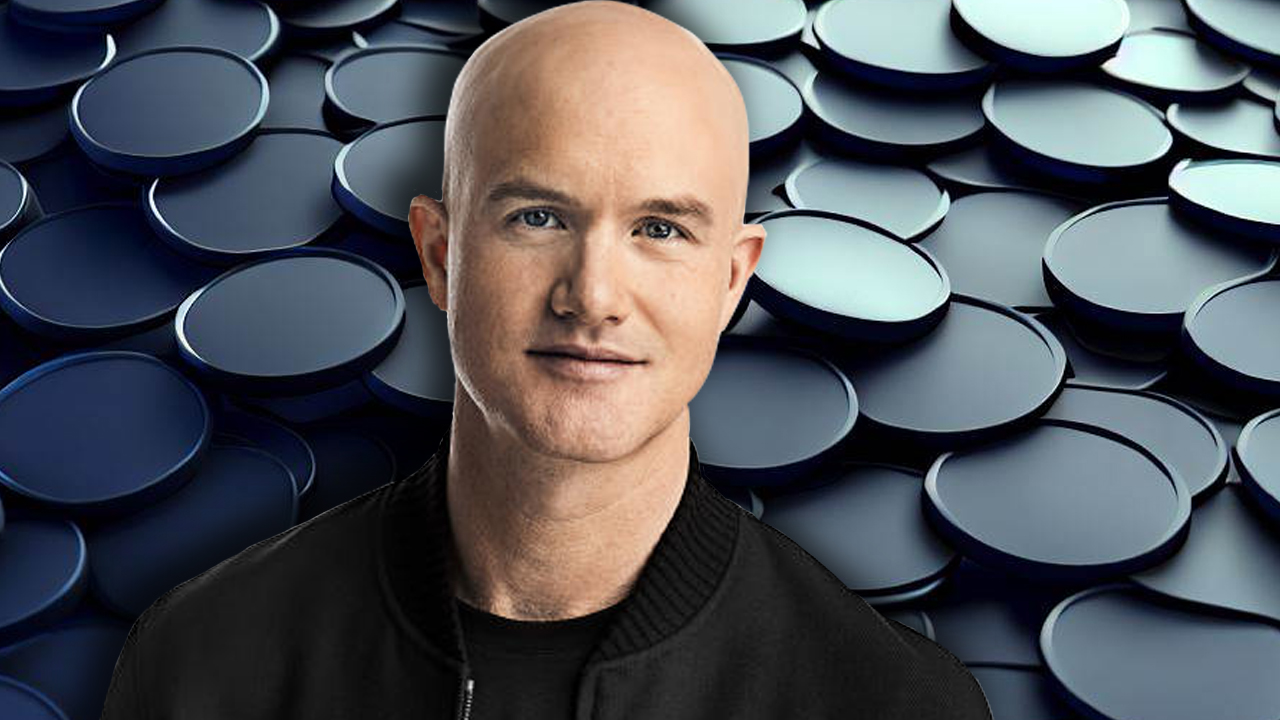

Coinbase’s CEO, Brian Armstrong, presented his firm’s response to the U.S. securities regulator on Thursday, divulging their Wells response. In direct opposition to the SEC’s enforcement actions, Coinbase maintains a agency disagreement, whereas the correspondence made it clear that the regulator ought to have been conscious of this stance when Coinbase went public.

The animosity between the 2 entities was additional highlighted in Coinbase’s response, the place the change defined that the SEC had uncared for to offer clear pointers for the regulator’s current enforcement actions.

“If the fee had believed in April 2021 that Coinbase’s core companies violated securities regulation, it could have been required by its personal mandate to stop the S-1 from changing into efficient to guard the investing public,” the response says. “As an alternative, it allowed the providing to proceed, and tens of millions of members of the general public invested their financial savings in Coinbase. Traders may solely infer by this approval that the Fee didn’t suppose Coinbase’s core enterprise was illegal.”

Coinbase CEO: ‘We’re Assured within the Information and on the Regulation’

On Thursday, Armstrong reaffirmed Coinbase’s dedication to creating revolutionary merchandise that promote financial freedom. “We’re dedicated to constructing within the U.S. and all over the world,” declared the Coinbase CEO. “We’ll defend ourselves and get up for the rule of regulation.”

Coinbase’s Wells response conveyed its bewilderment on the regulatory physique’s abrupt change in angle, significantly given the change’s in depth interplay with the SEC throughout its public itemizing course of. “The workers’s laundry checklist of proposed fees all relaxation on three major authorized theories, every of which is flawed and untested,” asserted the missive.

Coinbase’s Wells response comes on the heels of the corporate’s announcement that it had initiated authorized proceedings in federal courtroom, demanding that the SEC reply to their petition filed in July of 2022. Equally, the Wells response pledged to proceed cooperating with the SEC within the hopes of amicably resolving the matter.

What are your ideas on Coinbase’s response to the SEC’s Wells discover and its stance on the regulatory physique’s enforcement actions? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.