In lower than two weeks, the full worth locked (TVL) in liquid staking derivatives has elevated by 441,110 ether, price roughly $793 million. Whereas Lido Finance dominates the market with 74.35% of the TVL, competing liquid staking protocols Rocket Pool and Frax Ether have recorded double-digit features of 34% to 42% prior to now 30 days.

Variety of Ethereum Locked in Liquid Staking Derivatives Nears 9 Million

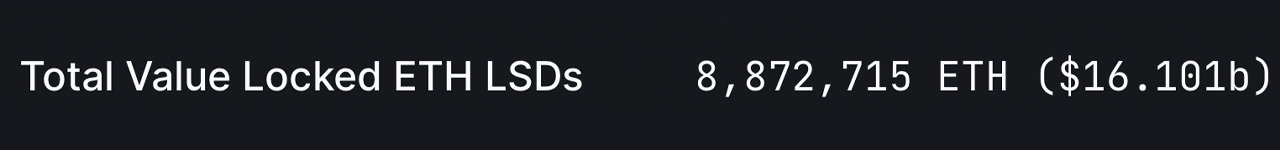

Liquid staking protocols proceed to develop, with the highest decentralized finance (defi) protocols recording a further 441,110 ethereum (ETH). As of Might 12, 2023, the full worth locked (TVL) in liquid staking derivatives (LSDs) stands at 8,872,715 ether, equal to $16.101 billion. This marks a big improve from the 8,431,605 ethereum locked in liquid staking protocols on April 30. In simply 12 days, the variety of ether deposits surged by a formidable 5.23%.

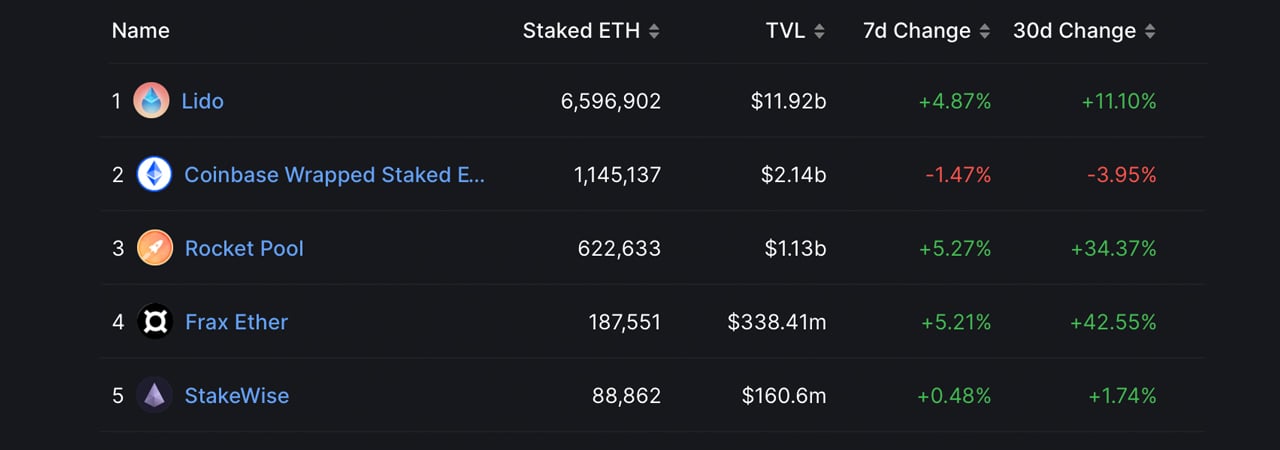

Regardless of the current addition of 441,110 ethereum, the TVL in LSDs is at present price lower than it was on April 30, owing to ethereum’s decline in market worth. Again then, the TVL held in LSDs was valued at $16.139 billion, making immediately’s numbers a 0.235% loss, standing at $16.101 billion. Notably, Lido dominates the market with a 74.3596% share, accounting for six.59 million ETH of the 8,872,715 ether locked in immediately. The second-largest LSD protocol is Coinbase Wrapped Staked Ether, with 1,145,137 staked ether.

This week, Lido’s TVL jumped by 4.87%, whereas Coinbase’s staked ETH worth dipped by 1.47%. Rocket Pool witnessed a rise, with its TVL leaping by 5.27%. Frax Ether and Stakewise additionally noticed features, recording a 5.21% and 0.48% improve, respectively, in simply seven days. Trying on the 30-day metrics, Lido’s worth locked rose by 11.10%, whereas Coinbase’s staked ETH TVL noticed a 3.95% discount. Frax and Rocket Pool emerged because the 30-day leaders, with Rocket Pool surging by 34.37%, and Frax recording a 42.55% improve.

Rocket Pool is closing in on Coinbase when it comes to the variety of staked ETH, with 622,633 ETH locked, whereas Frax Ether solely has 187,551 ETH locked. Nevertheless, Rocket Pool’s deposits must develop by 84%, or greater than 523,000 ETH, to surpass Coinbase’s variety of staked ETH locked into the protocol.

What do you suppose the long run holds for liquid staking protocols? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.