newbie

Within the crypto sphere, the place monetary independence and safety are among the many high priorities, decentralized exchanges have turn into a major innovation. In contrast to their centralized counterparts, these exchanges supply a special method to buying and selling digital property.

On this article, I’ll briefly overview the most effective decentralized exchanges and speak about what to search for in a DEX. Let’s dive in!

What Is a Decentralized Crypto Alternate?

A decentralized change (DEX) is a platform that allows cryptocurrency buying and selling straight between customers with out intermediaries or centralized authorities. That is finished with the assistance of blockchain know-how, particularly good contracts, due to which transactions and trades may be carried out in a trustless method. This structure permits for a variety of cryptocurrencies to be exchanged, like Ethereum, USDT, and plenty of extra.

One outstanding characteristic of DEXs is their non-custodial nature. Merely put, it signifies that customers preserve full management of their digital property, which eliminates the chance of dropping them if the platform is compromised.

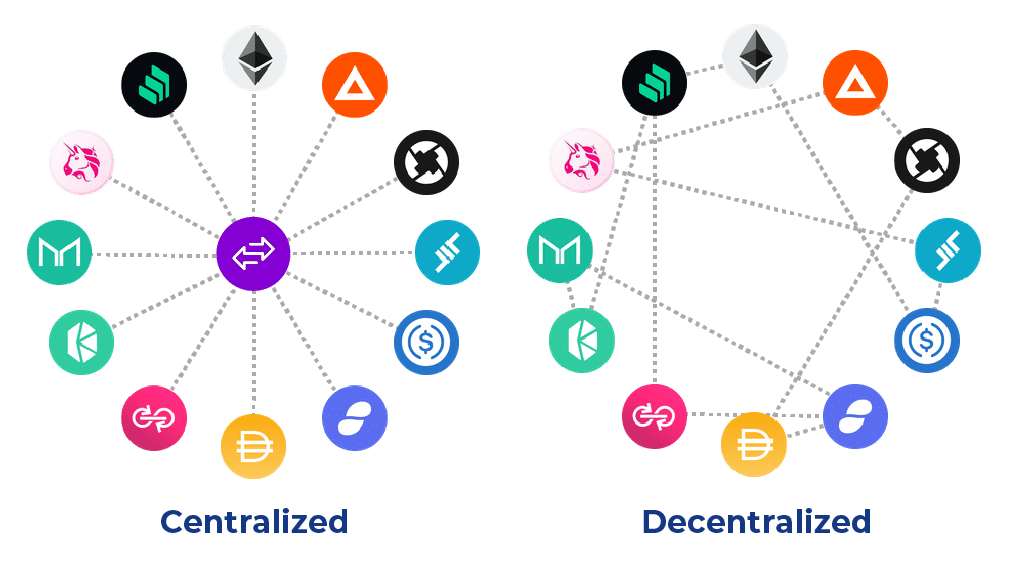

Decentralized vs. Centralized Exchanges

Centralized platforms like Binance and Coinbase have dominated the crypto market for a very long time, providing an easy-to-use interface, a variety of cryptocurrencies, and excessive buying and selling volumes. Nevertheless, they function very similar to conventional banks, utilizing order books and storing person property and private info, thus changing into enticing targets for hackers. Moreover, centralized exchanges typically have excessive buying and selling charges and might impose restrictions on buying and selling pairs or the withdrawal of funds.

Decentralized exchanges, alternatively, function by way of Automated Market Maker (AMM) protocols and good contract know-how (usually, on blockchain platforms such because the Ethereum community or the Binance Sensible Chain). AMMs and good contracts assist DEXs handle asset buying and selling, implement buying and selling guidelines, and facilitate direct interplay between customers and the blockchain.

The Professionals and Cons of Utilizing a Decentralized Crypto Alternate

Most customers can get the whole lot they want within the crypto world from a centralized change. Nevertheless, as I’ve already outlined above, DEXs have a number of tangible advantages over their centralized counterparts. Many crypto merchants will have the ability to admire the larger safety they will present.

Listed below are a few of the advantages and dangers of utilizing decentralized exchanges you must think about earlier than deciding what sort of platform you wish to go for.

Professionals

Decentralized cryptocurrency exchanges supply a number of benefits, together with however not restricted to:

- Management Over Funds. Customers retain management of their digital property, which mitigates the chance of hacks.

- Privateness. Most DEXs protect person anonymity as they don’t require private info.

- Broad Vary of Buying and selling Pairs. DEXs supply entry to a broader array of cryptocurrencies, together with new and area of interest ones.

- Modern Options. Many DEXs incorporate decentralized finance (DeFi) options resembling staking, yield farming, and liquidity swimming pools, offering alternatives for passive earnings.

Cons

Nevertheless, it’s important to pay attention to the challenges:

- Scalability Points. At peak instances, the blockchain community might turn into congested, leading to slower transactions and better charges.

- Sensible Contract Vulnerabilities. Bugs or vulnerabilities in good contracts can probably result in monetary losses.

- Liquidity Points. Some DEXs might lack the liquidity suppliers mandatory for easy buying and selling, which can result in value slippage.

- No Margin Buying and selling or Spot Markets. Many DEXs don’t supply margin buying and selling or spot markets, limiting their performance in comparison with centralized platforms.

Regardless of these challenges, the rising commerce volumes on decentralized exchanges point out rising person confidence and enhancements in know-how. Because the crypto market continues to evolve, DEXs may pave the best way for a very decentralized economic system, empowering customers and redefining how we understand digital asset buying and selling.

Whether or not you’re a seasoned market maker or a novice within the crypto buying and selling world, understanding the dynamics of decentralized exchanges is important on this quickly altering setting. Whereas the decentralized area may appear daunting at first, the potential rewards and the evolution of economic management are making it an more and more enticing possibility for merchants worldwide.

Prime 10 Decentralized Exchanges

Now, let’s check out the checklist of the most effective decentralized crypto exchanges (in no specific order).

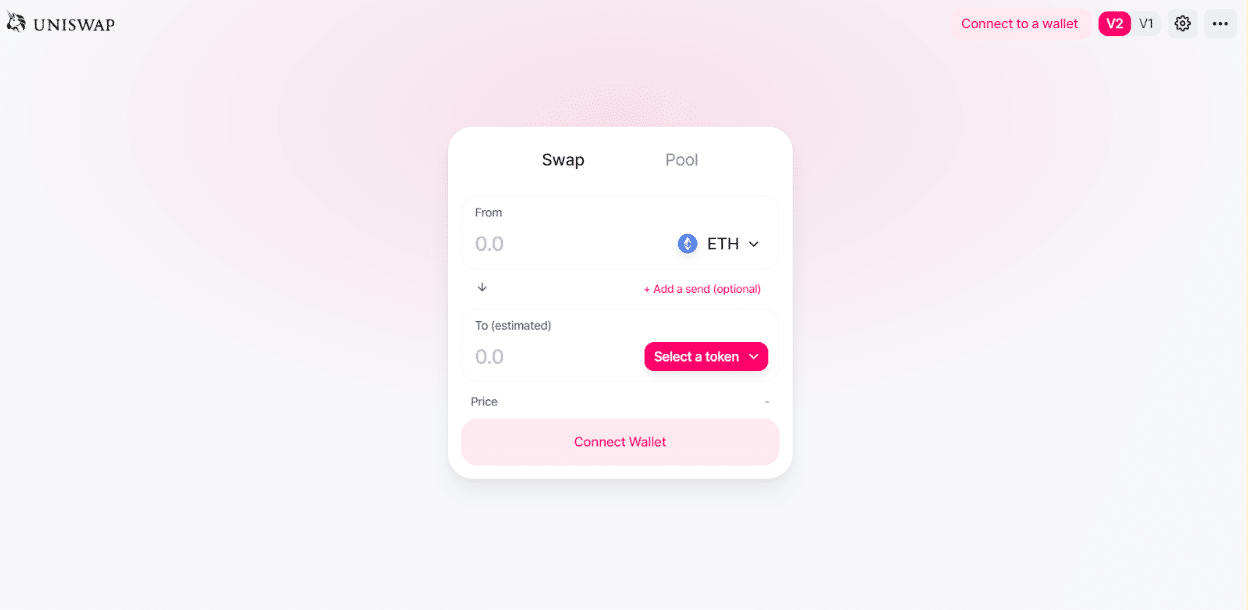

Uniswap

Uniswap is arguably probably the most well-liked exchanges within the DeFi area. Constructed on the Ethereum blockchain, it offers a easy but highly effective platform for customers to commerce all kinds of crypto property straight from their crypto wallets.

With a person interface that’s intuitive sufficient even for novices, Uniswap has made a reputation for itself as a go-to change. In contrast to conventional exchanges, Uniswap doesn’t depend on order books to match patrons and sellers. As an alternative, it makes use of automated market makers (AMMs), permitting for sooner transaction speeds and aggressive costs, albeit with potential value slippage throughout instances of excessive volatility.

Uniswap’s native token, UNI, acts as a governance token, giving holders the ability to vote on proposals associated to the platform’s improvement. Regardless of the comparatively excessive Ethereum community transaction charges, Uniswap stays a favourite amongst each new and skilled merchants.

SushiSwap

SushiSwap is a decentralized change that originally began as a fork of Uniswap however has since developed right into a full-fledged DeFi platform. Providing a collection of options, together with yield farming and staking, SushiSwap allows customers to earn passive earnings on their crypto property.

The SUSHI token, aside from being tradable, grants holders governance rights, enabling them to take part within the decision-making strategy of the platform. Moreover, SushiSwap’s Onsen characteristic provides boosted rewards for particular buying and selling pairs, making it a beautiful possibility for merchants trying to maximize their returns.

Whereas SushiSwap operates totally on the Ethereum community, it has expanded to different networks, such because the Binance Sensible Chain, lowering transaction charges and enhancing accessibility for its customers.

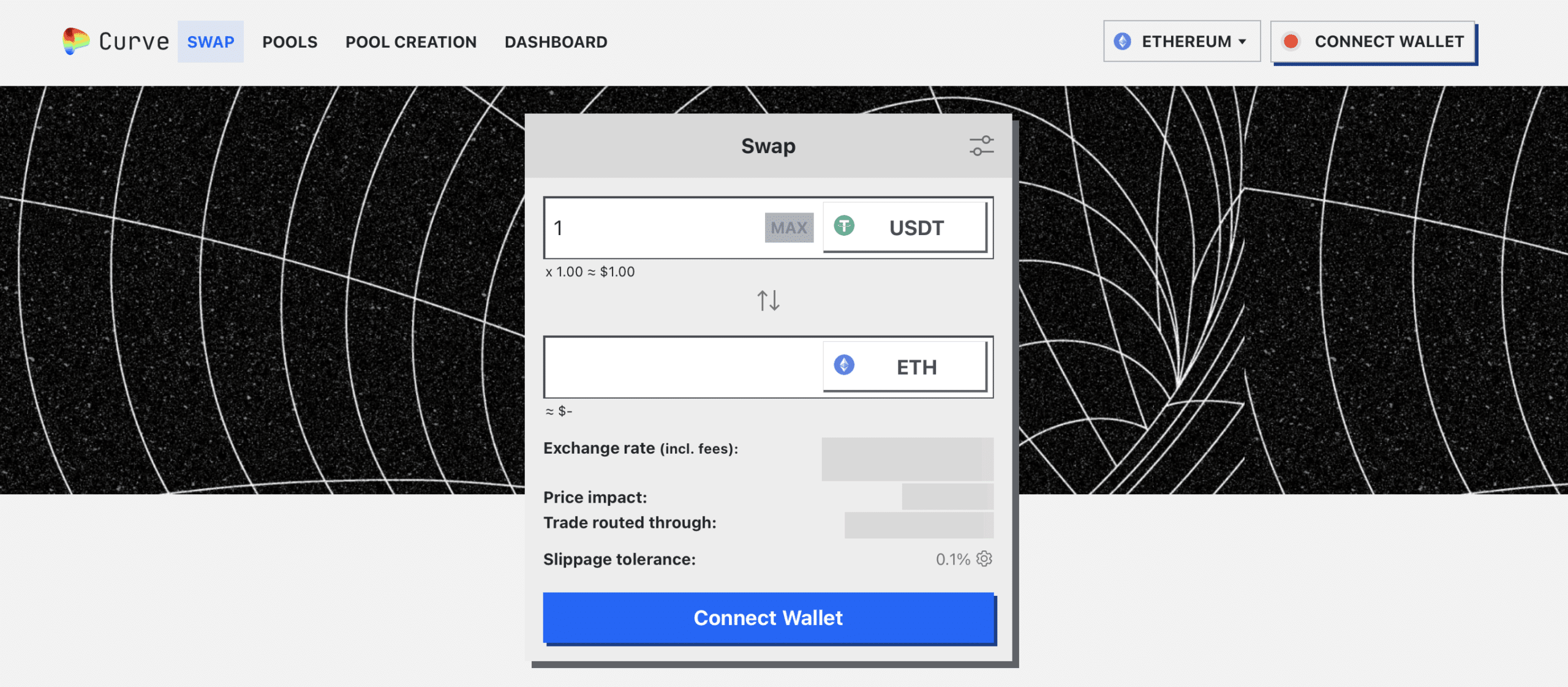

Curve Finance

Curve Finance, a standout within the realm of stablecoin exchanges, optimizes for low slippage and low charges, making it a most well-liked selection for giant trades. It’s not simply an change; Curve additionally provides yield farming alternatives, permitting customers to earn passive earnings on their crypto property.

What units Curve Finance aside from the gang is its environment friendly bonding curve that empowers customers to commerce stablecoins at a close to 1:1 ratio. This, mixed with its low transaction charges, makes Curve a extremely aggressive platform for stablecoin buying and selling.

CRV, Curve’s governance token, permits holders to take part in governance selections. By staking CRV, customers may also increase their rewards, additional rising the potential for passive earnings.

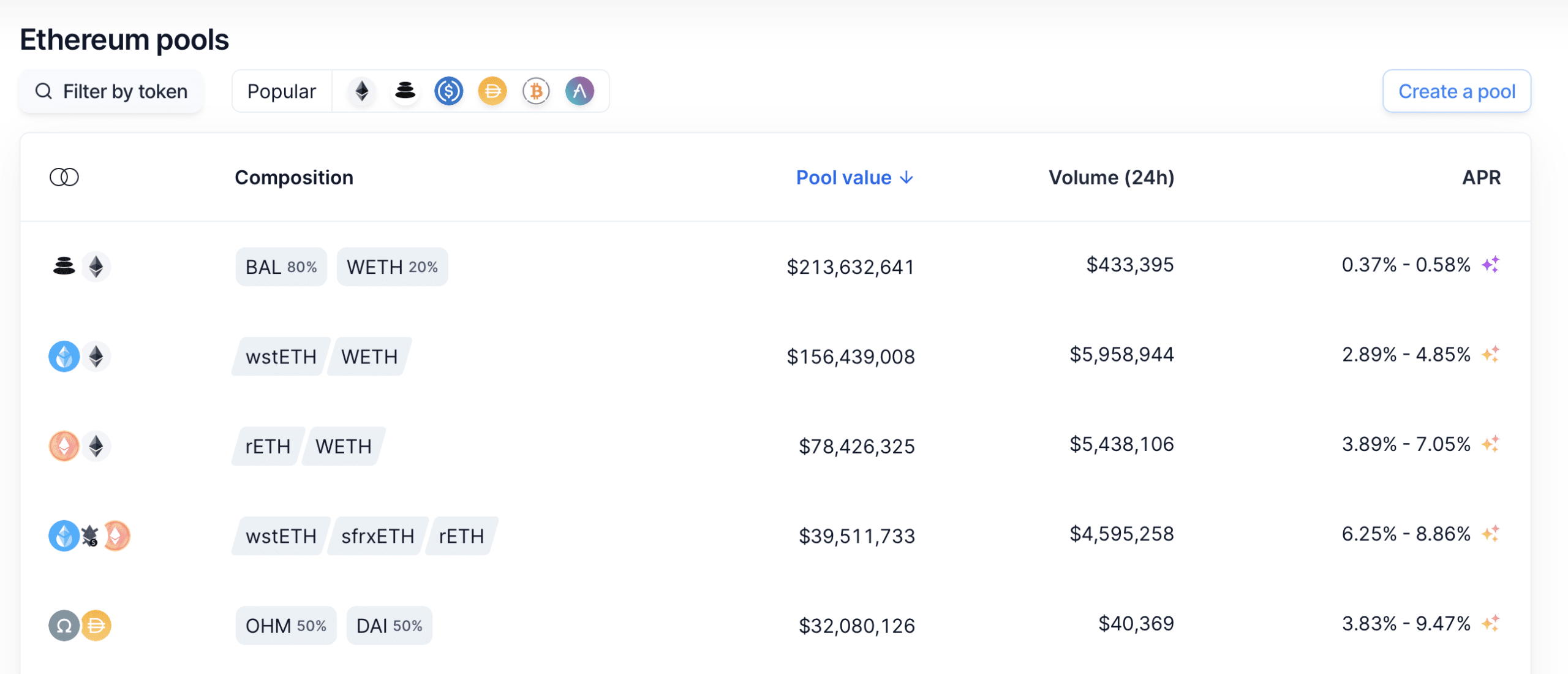

Balancer

Balancer operates as each a decentralized change and an automatic portfolio supervisor. It’s designed to regulate the ratios of tokens in liquidity swimming pools primarily based on programmable guidelines, providing a extra versatile expertise for liquidity suppliers.

In contrast to conventional exchanges that preserve a hard and fast ratio of their liquidity swimming pools, Balancer permits the creation of swimming pools with as much as eight tokens, their weightings customizable. This progressive method opens up extra alternatives for distinctive buying and selling pairs and arbitrage.

The BAL token serves as a governance token, letting holders vote on proposals. Furthermore, liquidity suppliers can earn BAL tokens as rewards, that means they will profit from one other earnings stream on high of buying and selling charges.

PancakeSwap

As one of many main DEXs on the Binance Sensible Chain, PancakeSwap provides the same AMM mannequin to Uniswap however with decrease transaction charges, due to the effectivity of the Binance Sensible Chain. Its humorous and fascinating person interface, coupled with a plethora of yield farming and staking choices, has made it a preferred selection amongst crypto customers.

The CAKE token is PancakeSwap’s native token, which may be staked to earn rewards or used to take part within the platform’s lottery. Regardless of its playful exterior, PancakeSwap is a strong platform that has attracted a big person base and vital liquidity.

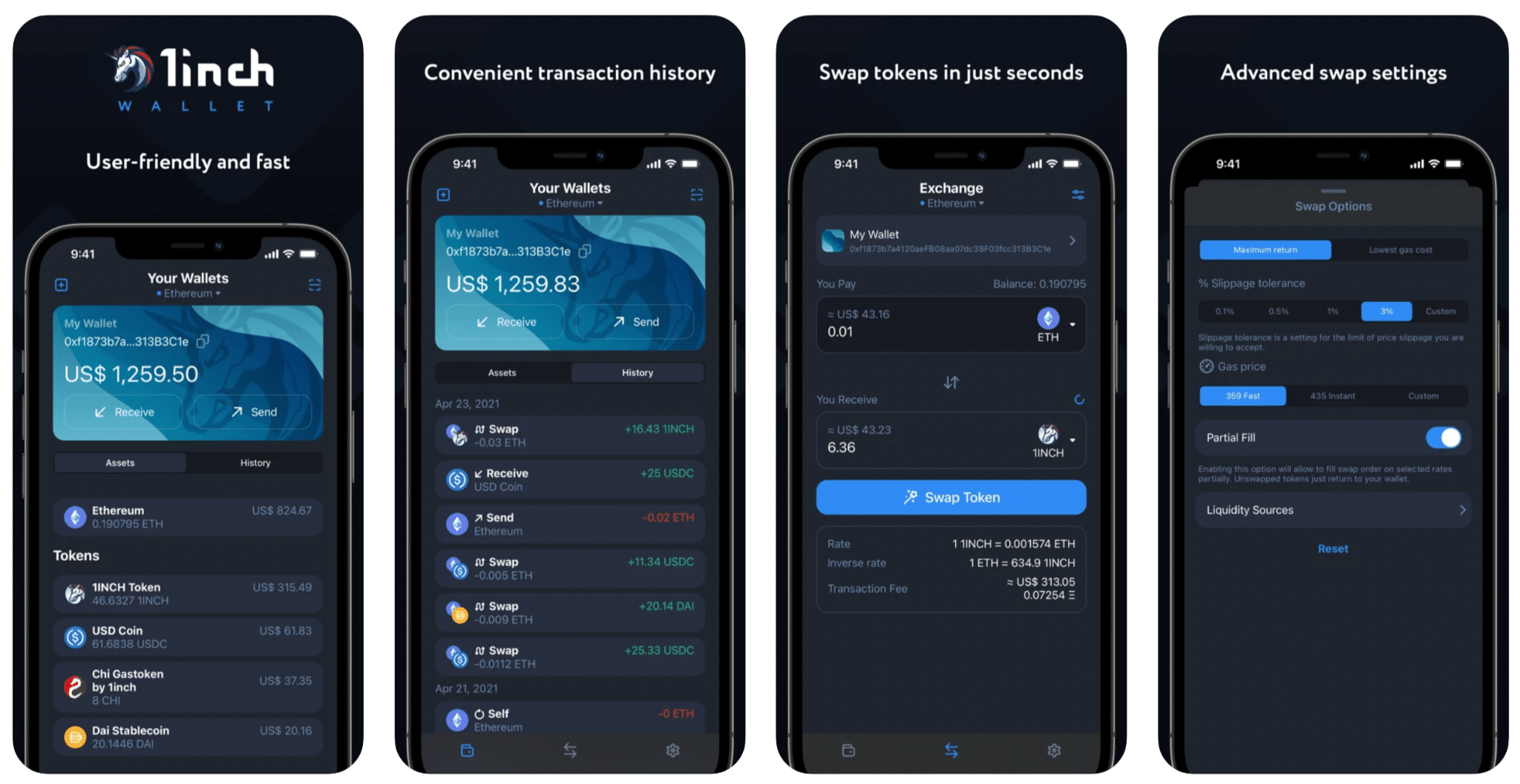

1inch

1inch stands out as a decentralized change aggregator that sources liquidity from varied exchanges to supply the very best buying and selling charges. For merchants trying to get essentially the most aggressive value, 1inch is a wonderful selection because it mitigates the necessity to manually evaluate costs throughout a number of platforms.

1inch’s token, 1INCH, serves a number of functions, together with price reductions and governance. By holding and staking these tokens, customers can affect the platform’s future improvement and decrease their buying and selling charges. Regardless of being comparatively new, 1inch has already confirmed to be a considerable participant within the DEX area.

Kyber Community

Kyber Community provides a easy and environment friendly technique to swap tokens straight from a person’s crypto pockets. By integrating with different platforms and aggregating liquidity from varied sources, Kyber Community offers aggressive charges for token swaps.

The native token, KNC (Kyber Community Crystal), permits holders to take part in governance and earn rewards from buying and selling charges. Its Dynamic Market Making mannequin makes it doable for merchants and liquidity suppliers to customise their buying and selling parameters, making it a beautiful platform for extra superior merchants.

Bancor

Bancor was one of many first platforms to introduce the idea of automated market makers to the crypto world. Its distinctive single-sided liquidity provision and impermanent loss safety are options which were significantly enticing to liquidity suppliers.

The BNT is Bancor’s native token, and it serves a number of functions on the platform, together with governance, liquidity provision, and staking rewards. Bancor’s give attention to guaranteeing a good and environment friendly buying and selling setting has earned it a strong status within the DeFi area.

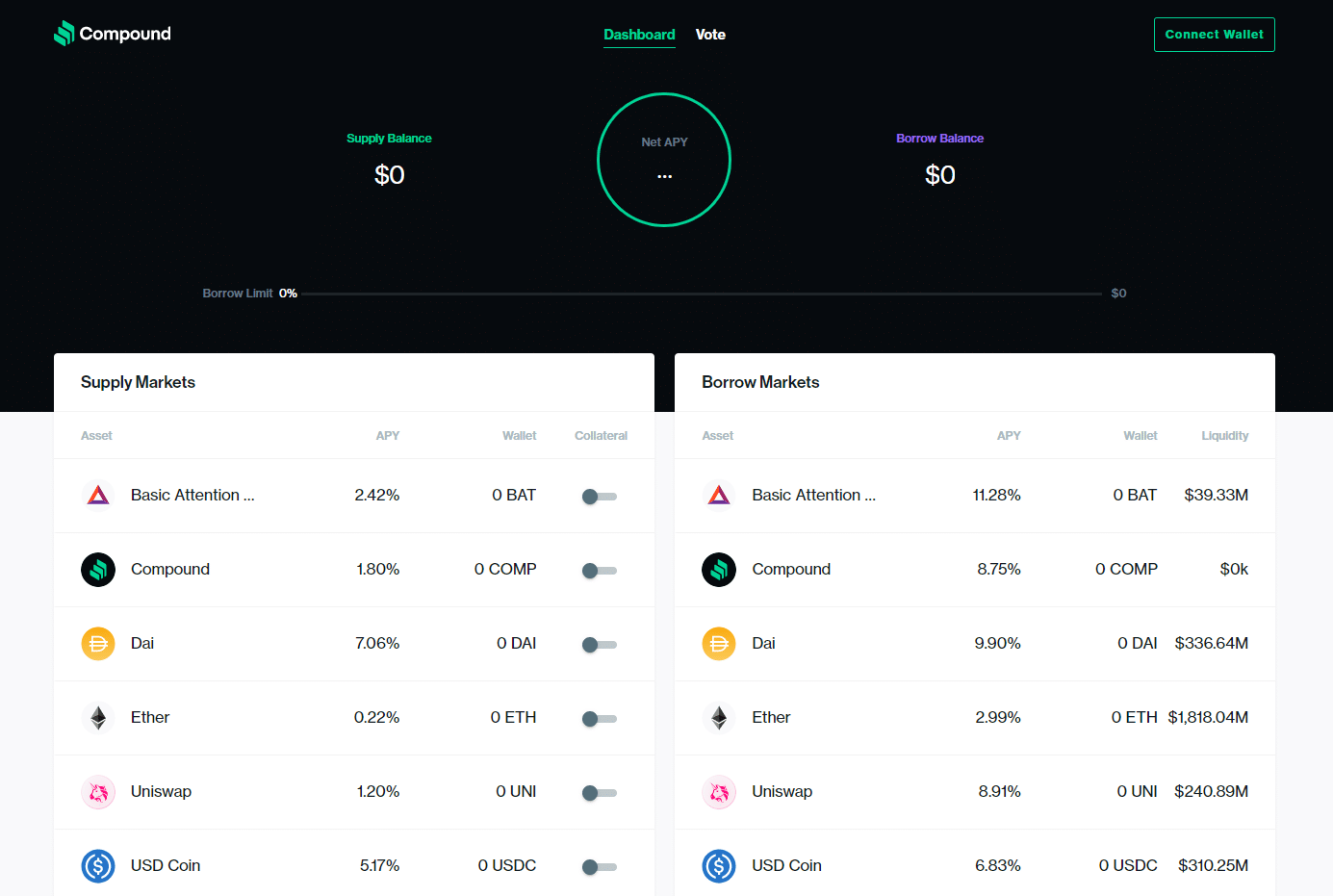

Compound

Whereas Compound is extra generally often called a lending platform, it has decentralized change performance constructed into its system. Customers can earn curiosity on their deposited property and borrow towards them. On this sense, Compound serves as a cash market and change hybrid.

The native COMP token is used for governance, giving holders the correct to suggest and vote on adjustments to the platform. It’s additionally distributed to customers as a reward for interacting with the platform, offering an additional supply of passive earnings.

Loopring

Loopring offers a singular answer to Ethereum’s scaling points by utilizing zkRollups. This know-how batch processes a number of transactions off-chain, rising transaction speeds and lowering prices whereas nonetheless guaranteeing the safety of the Ethereum community.

Loopring’s native token, LRC, may be staked to earn rewards and decrease buying and selling charges. The mix of quick, low-cost transactions and a safe, user-friendly interface has made Loopring a most well-liked selection for merchants who prioritize velocity and safety.

Decentralized exchanges are shaping the way forward for crypto buying and selling, providing options to conventional monetary methods and offering customers with larger management over their property. Whether or not you’re a newbie or an skilled dealer, these high ten DEXs supply a wide range of distinctive options that cater to a variety of buying and selling wants.

Tips on how to Discover the Finest Decentralized Alternate (DEX)

The crypto business, in addition to different digital entities, attracts dangerous actors with fraudulent cyber methods. We kindly remind you to do your personal analysis earlier than placing your funds into any cryptocurrency undertaking. There are a number of factors that ought to be examined.

The Popularity of an Alternate

Learn person evaluations on the Web to determine whether or not a DEX platform is price your belief. Most frequently, person opinions are essentially the most dependable criterion for search. Nevertheless, let’s face it: customers often write detrimental suggestions if the service fails them. In these phrases, one ought to attempt to consider a platform with an unbiased but attentive look.

Cost Strategies

This parameter is essential. For instance, not all cryptocurrency exchanges work with Visa and Mastercard. As well as, when utilizing a financial institution card, you could undergo multi-level verification. Due to this fact, when selecting a decentralized cryptocurrency change, all the time take note of cost in an effort to keep away from additional issues.

Fee Charges

Most exchanges, together with decentralized ones, cost charges. This can be very vital to learn about them earlier than depositing crypto property and making transactions. Ethereum-based DEXs cost fuel charges, so one ought to fastidiously study all of the situations earlier than interacting with an change.

Alternate Charges

Every change has its personal change charge. Since these change charges are set for themselves, generally they are often very completely different. Naturally, it is sensible to check them and select essentially the most worthwhile ones for your self.

Restrictions on the Geographic Location

Cryptocurrency exchanges might have geographical restrictions, that are essentially indicated on the official web site of the change (within the Phrases of Use). Some crypto exchanges don’t function in the US, however some do. Decentralized exchanges try to be accessible to any human being on the earth no matter their nationality and residence. Nevertheless, few DEXs underline that they can’t be accessed by customers from specific international locations.

FAQ

What’s a DEX?

A DEX, or Decentralized Alternate, is a platform that permits for peer-to-peer buying and selling of cryptocurrencies straight between customers with out intermediaries. DEXs function utilizing blockchain know-how and good contracts, guaranteeing that customers preserve full management over their digital property. Examples of DEXs embrace Uniswap, SushiSwap, and PancakeSwap.

What’s a multi-chain decentralized change?

A multi-chain decentralized change (DEX) is a buying and selling platform that operates throughout a number of blockchain networks. It combines the liquidity and property from completely different chains, permitting customers to swap tokens from one blockchain to a different. Other than rising the vary of accessible buying and selling pairs, this could additionally assist cut back transaction charges, as customers can select to function on the blockchain with the bottom prices at any given time.

What number of crypto exchanges are there?

There are a whole bunch of crypto exchanges in operation worldwide, each centralized and decentralized.

Is KuCoin a decentralized change?

No, KuCoin is just not a decentralized change. It’s a centralized change, which suggests it operates very similar to a conventional monetary establishment, holding person funds and facilitating trades on their behalf. Customers must deposit their property right into a KuCoin account earlier than they will start buying and selling, and the change maintains management over these funds till they’re withdrawn. Whereas centralized exchanges like KuCoin typically supply greater buying and selling volumes and extra options, in addition they contain a level of belief within the platform to safe person property.

Disclaimer: Please word that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.