Buying and selling volumes throughout main centralized cryptocurrency exchanges (CEXes) continued to contract all through Might as regulators cracked the whip within the U.S. and worldwide. In a report compiled by CCData, data present that the mixed spot and derivatives buying and selling volumes throughout platforms like Binance and OKX fell 15.7% to $2.41 trillion.

It represented the second month of buying and selling volumes dropping when crypto asset costs largely moved sideways and basic volatility at early 2023 ranges.

Buying and selling Volumes Drop Double Digits in Might

A notable improvement is that spot buying and selling volumes dropped by 21.8% in Might to $495 billion.

At this charge, buying and selling volumes fell to ranges final seen in March 2019. In the meantime, derivatives crypto buying and selling volumes crashed to a six-month low after they contracted 15.7% to $1.95 trillion in Might.

The market share of Binance, the world’s largest crypto change by buying and selling volumes, additionally fell to 43% in Might. This improvement follows the announcement by the change that they had been halting zero-fee spot buying and selling for USDT pairs.

Nonetheless, at this degree, Binance stays dominant and comparatively extra energetic than rivals like Coinbase, Kraken, and Bitfinex.

CCData notes that the final drop in Binance’s market share and buying and selling volumes is also attributed to basic market weak point and elevated scrutiny from regulators, particularly in america.

Market weak point was seen in Might as Bitcoin costs failed to interrupt above $31,000 registered in April. As an alternative, Bitcoin continued to trace decrease, dropping to as little as $25,800 in some unspecified time in the future in Might. Costs are presently struggling under $30,000.

With america Securities and Change Fee (SEC) suing Binance and Coinbase, claiming that they provide unregistered securities, buying and selling volumes might proceed dropping in June 2023, probably impacting liquidity.

Crypto Sentiment Deteriorating?

Spot buying and selling signifies the pure demand for a specific crypto asset within the cryptocurrency market. Spot consumers usually don’t take part in margin buying and selling actions that could be obtainable on the identical platform.

When buying and selling volumes decline quickly, it suggests a possible shift in demand, indicating that consumers could also be hesitant as a result of present market situations.

Falling buying and selling volumes, subsequently, replicate a cautious sentiment amongst merchants. Subsequently, this could have an effect on the general buying and selling exercise and, thus, liquidity out there.

However, spinoff crypto merchants have interaction in market hypothesis, aiming to revenue from crypto asset volatility. Cryptocurrency platforms like Bybit, Binance, and OKX allow the buying and selling of varied crypto derivatives. Right here, merchants can place positions utilizing leverage.

Whereas spot buying and selling volumes fell the quickest in Might, the variety of crypto derivatives contracts positioned contracted at a slower tempo.

This might recommend that although potential crypto consumers steered clear from centralized cryptocurrency exchanges, centralized cryptocurrency derivatives platforms’ comparatively excessive liquidity allowed some merchants to maintain posting trades capitalizing on gyrating crypto costs in Might.

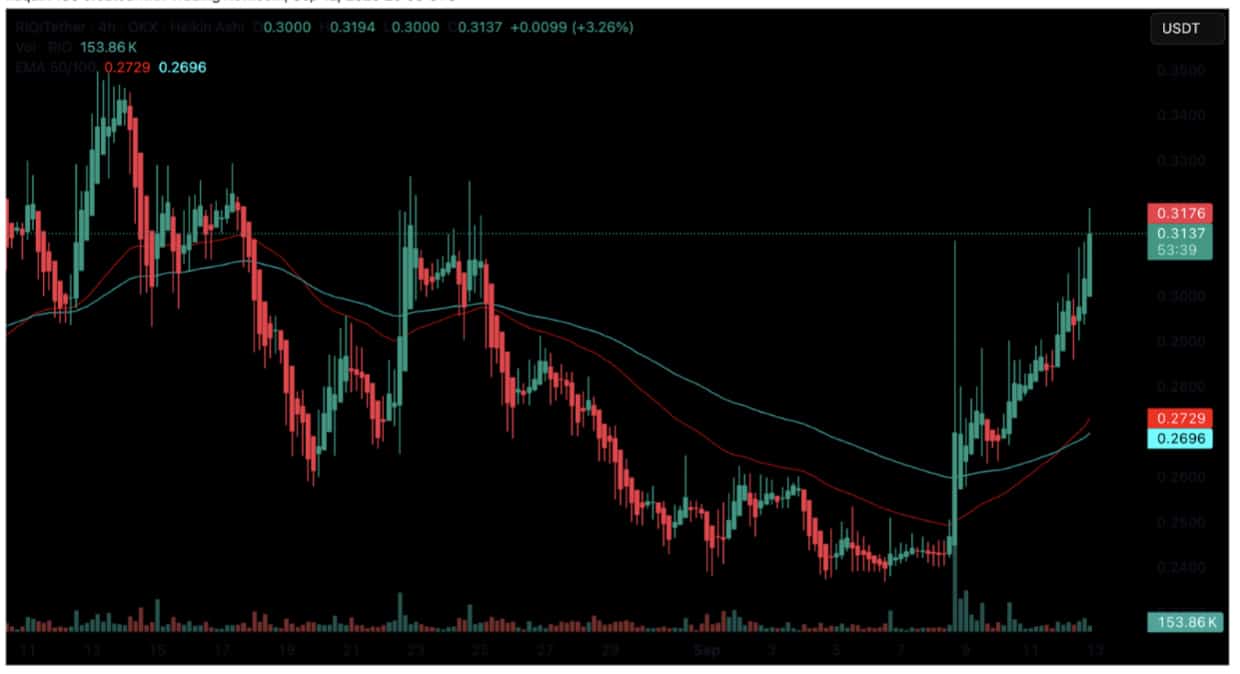

Characteristic Picture From Canva, Chart From TradingView