Knowledge reveals the Bitcoin month-to-month common buying and selling quantity has now surpassed the yearly common one. Right here’s why this can be bullish for the asset.

Bitcoin 30-Day SMA Quantity Has Crossed Above The 365-Day SMA

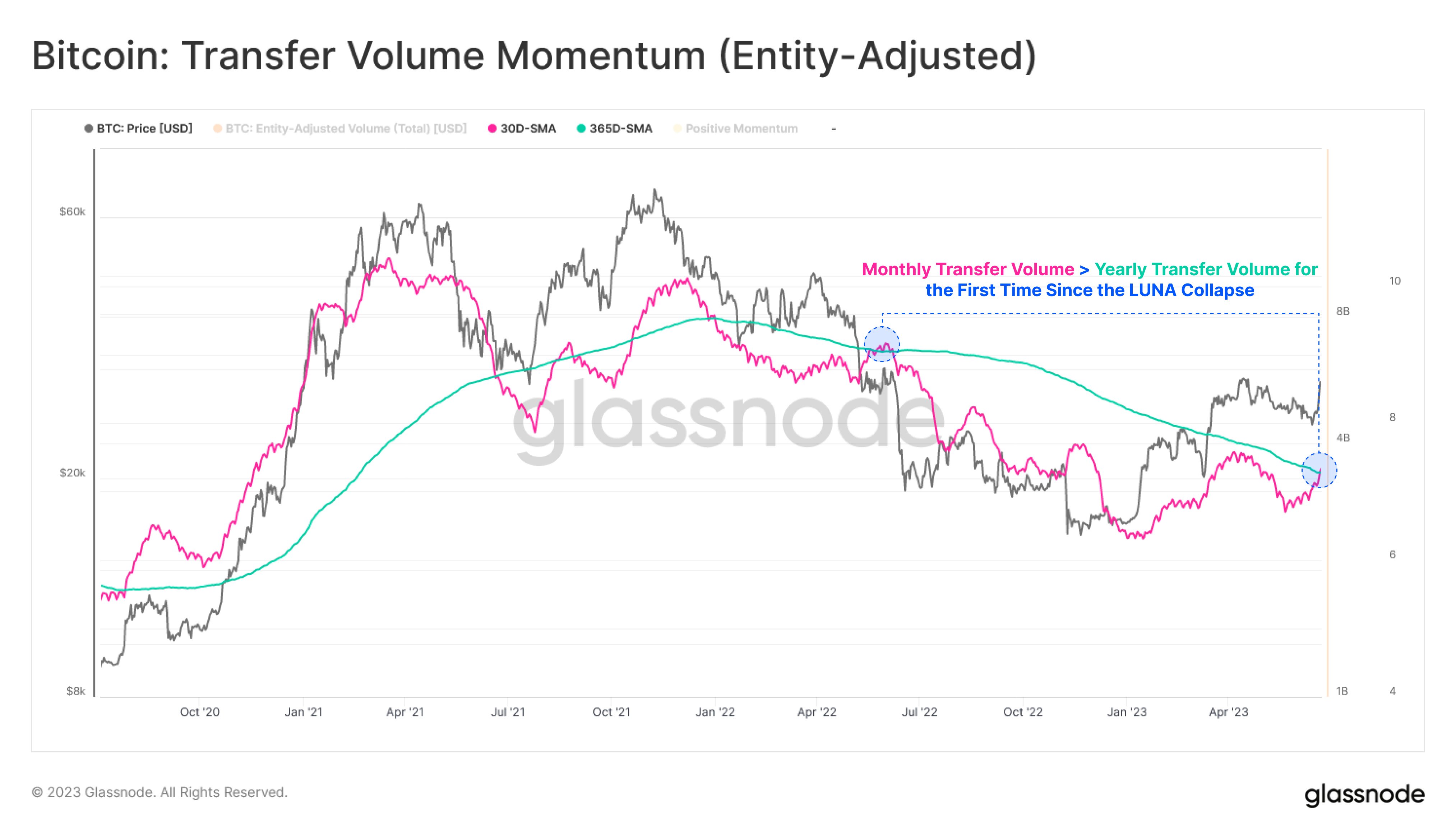

Based on information from the on-chain analytics agency Glassnode, that is the primary time for the reason that LUNA collapse that this sample has fashioned for the cryptocurrency. The “buying and selling quantity” right here refers back to the complete quantity of Bitcoin the buyers are shifting round on the blockchain.

When the worth of this metric is excessive, it signifies that many cash are getting concerned in transactions on the community. Such a pattern is normally an indication that the merchants are at the moment energetic out there.

However, low indicator values suggest that the chain is observing little exercise at the moment. This pattern can trace that the overall curiosity within the asset is low amongst buyers.

Now, here’s a chart that reveals the pattern within the 30-day easy shifting common (SMA) Bitcoin buying and selling quantity, in addition to the 365-day SMA of the identical, over the previous few years:

Appears just like the traces of the 2 metrics have come collectively in latest days | Supply: Glassnode on Twitter

The above graph reveals that the 30-day SMA Bitcoin buying and selling quantity has risen not too long ago. This may counsel that the exercise on the community has been seeing an uplift.

The ramp-up within the variety of cash being shifted across the community has come because the cryptocurrency has noticed a pointy rally, which has now taken the value above the $31,000 degree.

Usually, rallies entice consideration to the asset, as buyers normally discover such worth motion thrilling. Thus, it’s not surprising that the quantity has gone up with this worth surge.

With this newest rise, the metric has caught up with the 365-day SMA and has simply barely crossed above it. The formation of this sample implies that the month-to-month common buying and selling quantity of the asset has lastly surpassed the typical for the previous 12 months.

The chart reveals that the final time the 2 traces confirmed this habits was across the time of the LUNA collapse. Aside from this temporary interval, the 30-day SMA of the indicator has been underneath the 365-day SMA for the whole thing of the bear market and the rally up to now, displaying how low the asset’s exercise has been on this interval.

Nonetheless, this pattern would possibly lastly be altering if the most recent crossover between these two traces sticks this time, in contrast to the one seen across the time of the LUNA crash.

Growing community exercise is normally a constructive signal for Bitcoin, because it suggests development in utilization. Notable rallies within the asset have traditionally accompanied rising volumes, as such worth strikes require many energetic merchants to be sustainable.

Because the chart reveals, the month-to-month and yearly SMAs of the BTC buying and selling quantity additionally confirmed an analogous crossover through the buildup in direction of the 2021 bull run.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $31,200, down 18% within the final week.

BTC has been sharply going up not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com