On-chain knowledge exhibits that spending from Bitcoin long-term holders has spiked not too long ago. Right here’s how the present ranges evaluate with the 2021 bull run.

Bitcoin 1+ Years Cash Have Been On The Transfer Just lately

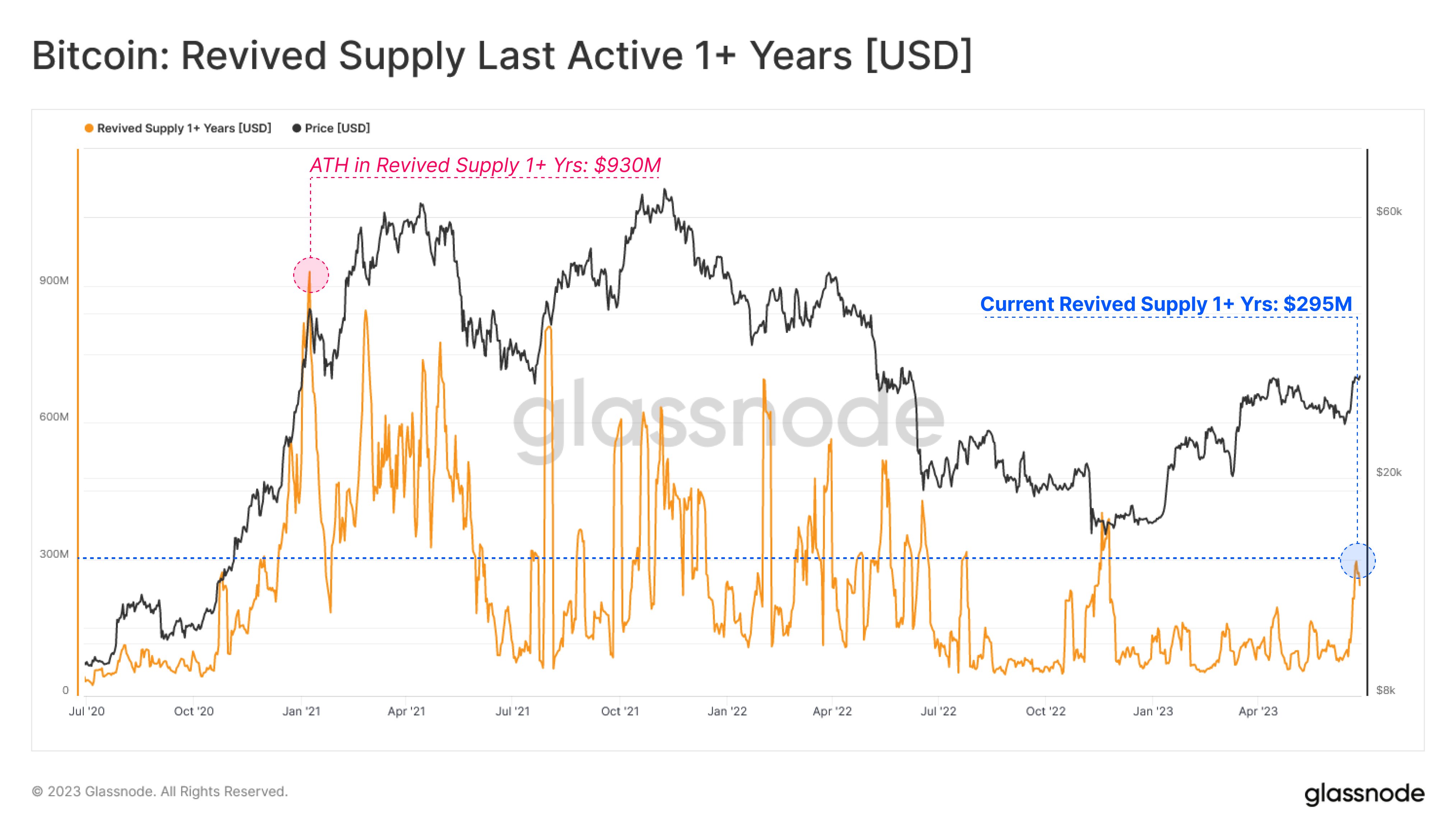

In accordance with knowledge from the on-chain analytics agency Glassnode, previous palms have spent $295 million price of the asset in current days. The related indicator right here is the “revived provide final lively 1+ years,” which measures the full quantity of tokens (in USD) that Bitcoin buyers holding since not less than one 12 months in the past are transferring/shifting on the blockchain proper now.

The 1+ years group kinds a phase of a bigger cohort: the “long-term holders” (LTHs). The LTHs embody all buyers who purchased their cash greater than 155 days in the past. Due to this fact, the 1+ years group contains the extra skilled buyers even among the many LTHs.

Typically, the longer an investor holds onto their cash, the much less probably they change into to promote them at any level. As such, the LTHs often maintain for lengthy intervals (therefore their identify) and don’t promote simply even when the market goes via a panic.

Assuming that the actions being made by these buyers are for promoting (which is often the case when dormant cash transfer), the revived provide final lively 1+ years indicator tells us concerning the instances that these skilled palms do find yourself collaborating in some promoting.

Now, here’s a chart that exhibits the development on this Bitcoin indicator over the previous few years:

Seems to be like the worth of the metric has registered a pointy enhance in current days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin revived provide final lively 1+ years has noticed a spike not too long ago. This is able to counsel that the LTHs have moved a few of their cash.

This rise within the indicator has come because the cryptocurrency’s worth has displayed a pointy rally past the $30,000 degree. As a result of this timing, it could seem probably that these transactions have been made for selling-related functions, as these skilled palms could also be trying to benefit from the profit-taking alternative.

As talked about earlier than, these buyers don’t promote too usually, so moments like these could be those to observe for after they do distribute. From the chart, nevertheless, it’s seen that whereas the most recent spike within the metric has been sizeable (at its peak, the indicator’s worth had reached $295 million), its degree continues to be considerably decrease than the surges noticed all through 2021 bull market.

Numerous the spikes throughout that bull run had coincided with native tops, however for the reason that scale of the present spike continues to be decrease, it’s potential that the rally could not but really feel the impact of this promoting.

In actual fact, the extent of the present spike is much like those seen through the build-up to the bull run, which the market had breezed previous because the Bitcoin worth had continued to go up again then.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,600, up 2% within the final week.

BTC hasn't budged in the previous few days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com