Chapter Choose Martin Glenn of the US Southern District Court docket of New York on Friday ordered that bankrupt crypto lender Celsius can start to promote or convert altcoins to Bitcoin (BTC) and Ether (ETH).

The worth of CEL, the native Celsius Community token, rose sharply on Friday, buying and selling above $0.15 with 33% beneficial properties prior to now 24 hours.

Celsius can promote altcoins for BTC, ETH from July 1

The liquidating of the mentioned altcoins comes forward of a deliberate distribution of property to collectors and can begin on or after July 1, the decide ordered.

“The Debtors, in session with the advisors to the Committee, might promote or convert any non-BTC and non-ETH cryptocurrency, crypto tokens, or different cryptocurrency property aside from such tokens which can be related to Withhold or Custody accounts (collectively, the “Altcoins”) to BTC or ETH commencing on or after July 1, 2023,” reads a part of the ruling.

Celsius is anticipated to make use of “commercially affordable efforts to maximise the worth of the Altcoins to be offered or transformed to BTC or ETH.” Nonetheless, with the SEC having lately alleged among the altcoins held by the crypto lender as securities, the gross sales are anticipated to adjust to the “relevant exemptions to the US securities legal guidelines.”

Among the many tokens the US regulator lately highlighted as securities in its instances towards Binance and Coinbase embrace Cardano (ADA), Polygon (MATIC) and Close to (NEAR). Celsius holds these and different alts resembling Bitcoin Money (BCH), Litecoin (LTC) and Chainlink (LINK).

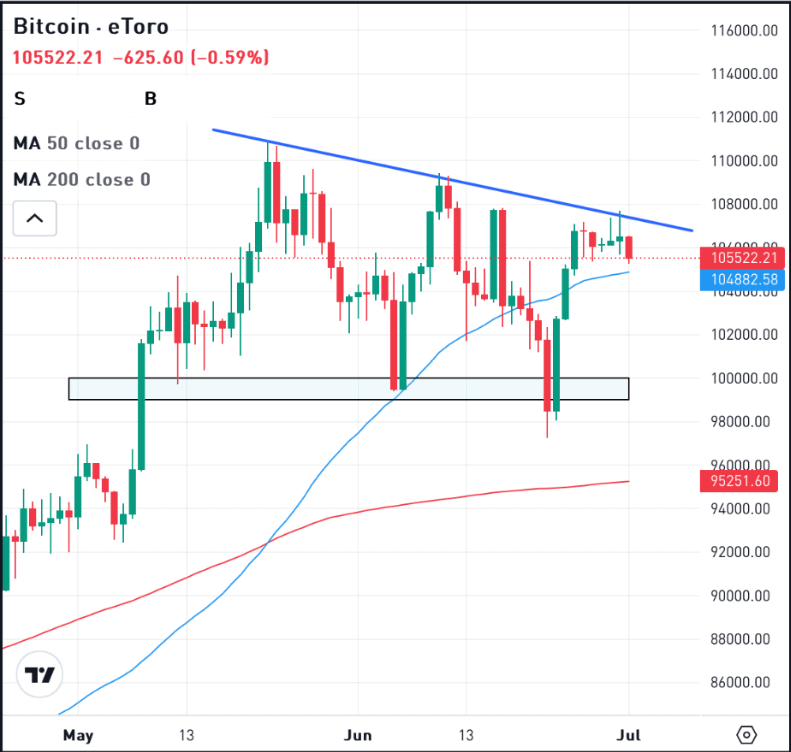

The tokens have lately traded greater alongside the broader crypto market and it stays to be seen what impression, if any, the offloading could have on costs.

Listed below are the Celsius alts FWIW, these might be offered and the proceeds used to purchase BTC and ETH. https://t.co/Bp7MWUhstB

— Hal Press (@NorthRockLP) June 30, 2023

Celsius filed for chapter in July 2022 after pausing buyer withdrawals amid crypto contagion from the collapse of Terra and Three Arrows Capital.

In keeping with courtroom paperwork, the corporate has been in dialogue with the SEC and state regulators because it appeared to replace its restructuring plan to solely distribute crypto to collectors in bitcoin and ether.