The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The Arrival Of BlackRock

As most readers are possible conscious, ripples have been despatched via the bitcoin funding area with the announcement of a spot bitcoin ETF software from BlackRock, the world’s largest asset supervisor. The transfer from the $10 trillion asset supervisor stoked loads of pleasure and considerations alike from bitcoin proponents, with many championing the potential for enormous inflows from legacy institutional traders, whereas others pushed again, citing the dangers that such a product construction may pose to the bitcoin market. The introduction of such a product may bolster bitcoin’s profile amongst conventional traders, but it surely’s important to grasp the potential implications.

This text delves into the BlackRock proposal, evaluating it with present bitcoin funding autos, assessing the potential dangers and advantages and drawing parallels with the introduction of liquid funding autos into the gold market, which many analogize as bitcoin’s financial predecessor. The purpose is to judge the implications of such a product on the broader bitcoin market and institutional adoption, whereas conserving in thoughts the rules that underpin the potential of bitcoin to function a world impartial reserve asset and settlement layer.

BlackRock’s Bitcoin Belief Proposal: An In-Depth Examination

BlackRock’s submission of an S-1 with the SEC marks a big improvement within the bitcoin funding panorama. Though not an ETF in title, BlackRock’s iShares Bitcoin Belief software bears placing resemblance to an ETF in operate by permitting for day by day subscriptions and redemptions, distinguishing it from present bitcoin funding autos like Grayscale Bitcoin Belief (GBTC).

In distinction to the present main bitcoin funding product, Grayscale’s GBTC, BlackRock’s belief proposes an in-kind redemption characteristic. This implies traders aren’t tied to promoting their shares and making a taxable occasion; as a substitute, they will go for withdrawing bitcoin from the belief. This circumvents the tax implications that Grayscale traders face when promoting their shares for fiat after which buying bitcoin.

Nonetheless, it’s essential to notice that the proposed in-kind redemptions include an enormous caveat: Solely BlackRock’s approved members, basically funding corporations in good standing with BlackRock, can withdraw bitcoin from the product. This suggests that the advantage of in-kind redemptions is basically restricted to large-scale traders and establishments.

The belief is slated to undertake the grantor belief mannequin, aligning its construction nearer to the likes of gold funding trusts. This suggests that proudly owning shares of BlackRock’s belief would, for tax functions, equate to proudly owning the underlying asset, e.g., bitcoin.

Questions begin to come up relating to potential dangers with BlackRock’s proposed belief construction, notably with the opportunity of rehypothecation. A typical observe amongst conventional asset ETFs, rehypothecation entails lending out property to market members. If prolonged to the Bitcoin Belief, it may result in a scenario the place traders solely have a declare to bitcoin that has been lent out, a scenario that would result in traders proudly owning paper claims to bitcoin moderately than the asset itself.

Moreover, the proposal offers BlackRock appreciable latitude in case of a Bitcoin fork, permitting them to find out which Bitcoin model to again. This opens up the likelihood for potential manipulation and will current dangers to traders who might not align with BlackRock’s selections.

The Present Panorama Of Bitcoin Funding Merchandise

Delving into the present panorama of bitcoin funding merchandise, let’s concentrate on two main autos: the ProShares Bitcoin Technique ETF (BITO) and the Grayscale Bitcoin Belief (GBTC).

First, there’s the Grayscale Bitcoin Belief, which has lengthy served as a main avenue for legacy monetary establishments to realize liquid publicity to bitcoin. Working as a closed-end fund buying and selling over-the-counter, GBTC noticed billions of {dollars} circulation into it over time. The product carries a hefty 2% annual price as a % of internet asset worth and doesn’t provide redemption again into bitcoin, thus making a one-way road for provide. This construction was as soon as very interesting to traders seeking to exploit a seemingly automated arbitrage commerce, particularly when the premium for GBTC shares reached as excessive as 40%, resulting in a reflexive dynamic between inflows into the belief and demand for spot bitcoin.

Nonetheless, this suggestions loop reversed as demand for GBTC shares wavered when establishments started to try to unwind the arbitrage trades that they had placed on — which means promoting GBTC to appreciate the acquire — which brought about the premium to show into a reduction, with shares buying and selling lower than the web asset worth of the bitcoin inside the belief. The dislocation of GBTC from its internet asset worth alongside its inferior liquidity profile relative to identify bitcoin itself resulted in a market that liquidated all overleveraged members who have been utilizing GBTC as collateral.

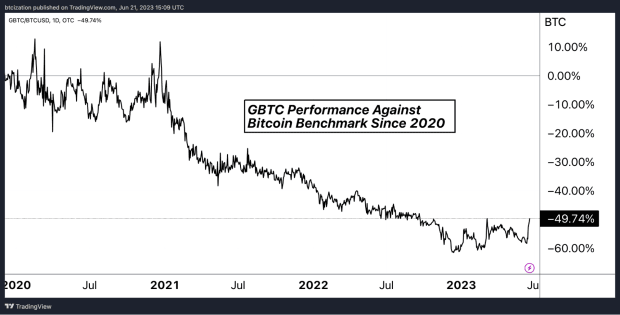

GBTC’s comparatively excessive 2% annual price has additionally come underneath scrutiny, particularly as cheaper funding autos have emerged. In consequence, GBTC shares got here underneath immense strain in the course of the later months of 2021 and all through 2022, with the low cost to internet asset worth plummeting to nearly damaging 50%.

Moreover GBTC, there may be additionally BITO, which marked a big milestone within the historical past of bitcoin funding merchandise. As the primary bitcoin-linked ETF accessible on a U.S. change, BITO opened the doorways for traders to realize easy, oblique entry to bitcoin publicity via a securitized ETF that has publicity to bitcoin futures contracts. Nonetheless, as a futures ETF, BITO would not maintain bitcoin straight. Because of the nature of futures contracts, the fund exposes traders to rollover danger, notably when the futures curve is in contango — which means futures costs are larger than present spot market costs — which causes their holdings to decay relative to the value of bitcoin over lengthy intervals of time.

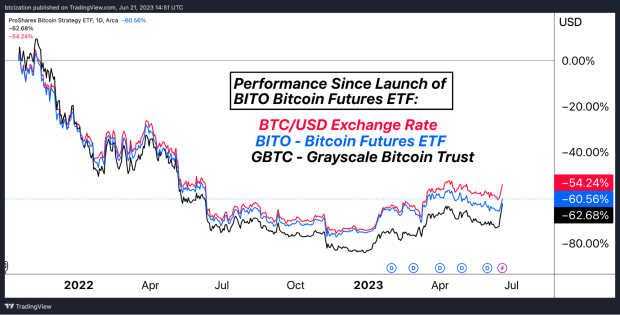

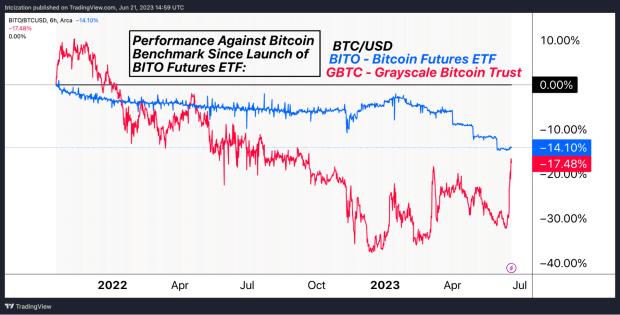

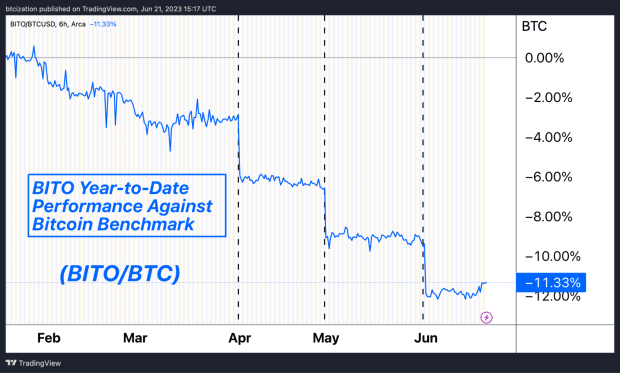

Displayed under is the relative returns of GBTC and BITO shares towards bitcoin because the launch of BITO, and because the begin of 2020.

The rollover impact of the BITO bitcoin futures ETF is especially noticeable in 2023. The dotted traces present intervals when the month-to-month calendar bitcoin futures contract expires and the next entrance month roll over takes place.

A Nearer Look At BlackRock’s Bitcoin Belief: Potential Implications & Dangers

Given the intricate design of BlackRock’s Bitcoin Belief, its implications and potential dangers elevate critical considerations. There is a superb publish written by Allen Farrington, aptly named Belief Me, Bro, which particulars a number of the advantageous print and seemingly opaque danger fashions that an in any other case “bullish” ETF software from BlackRock incorporates. Beneath is a abstract of a few of his factors on this part, however Farrington’s piece is properly price a learn.

From a broader perspective, BlackRock’s belief may amass a substantial quantity of Bitcoin, which isn’t essentially an issue in and of itself, however bitcoin traders ought to pay shut consideration and stay vigilant of the attainable second-order results. BlackRock may in concept “promote bitcoin” to many monetary establishments within the type of its iShares ETF, which is topic to rehypothecation and opaque possession, in contrast to bitcoin UTXOs which exist on a clear and immutable ledger.

Second, when it comes to monopolistic pricing, it’s possible that the existence of an ETF will place important strain on bitcoin exchanges, the place the buying and selling prices of an ETF are a mere few foundation factors in comparison with the charges of fifty bps to 100 bps charged by many exchanges for spot purchases. This might result in consolidation of liquidity and put price-setting into the fingers of BlackRock (or one other entity with the dominant ETF).

Along with accumulating a big share of the circulating bitcoin and having a heavy hand in setting the value, BlackRock may create a story round any particular bitcoin that has but to enter or has left the perceived security internet of the belief. This may increasingly appear to be spreading tales of soiled cash that would have been utilized by criminals, terrorists, drug sellers, and many others., and would have a damaging influence on fungibility of the asset as a result of it will basically create two tiers of bitcoin.

If BlackRock paints the image of unpolluted bitcoin inside their belief versus the soiled bitcoin outdoors of it, they will then flip to banks to encourage opting into the belief’s model of Bitcoin since it will likely be considered as “secure” from a regulatory perspective, additional consolidating the possession of bitcoin and permitting banks to supply their shoppers entry to “bitcoin” which can truly be paper claims to the underlying asset as talked about earlier.

Additionally inside the belief submitting is a bit that gives BlackRock an possibility to decide on the “applicable community” ought to there be a time when Bitcoin faces an adversarial change in consensus and undergoes a tough fork. The submitting specifies that BlackRock’s alternative might not essentially be consistent with essentially the most helpful fork. Whereas that is possible a easy type of due diligence, by amassing a considerably giant share of bitcoin that has the backing of equally giant banking establishments and is held by a big portion of retail traders on the lookout for easy publicity to bitcoin, it’s attainable that BlackRock may instigate a tough fork or facet with a consensus proposal that adjustments the basic facets of Bitcoin which make it distinctive and helpful within the first place.

As talked about above, there are additionally redemption considerations with the best way this belief is structured. Solely approved members, which means funding corporations, can withdraw bitcoin from the belief. Common, on a regular basis traders won’t be those capable of redeem bitcoin from the belief within the first place, and because the approved members need to be in good standing with the agency, it’s attainable that BlackRock may refuse redemptions — even to institutional traders.

All these considerations however, there are historic examples of the creation of ETFs, particularly gold, and their influence in the marketplace.

The Influence of Trade-Traded Merchandise: The GLD Analogy

There’s many comparisons and contrasts between gold and bitcoin as funding autos. This text doesn’t dig into these however moderately highlights the analogy and market impacts of a gold ETF up to now. By far, the largest query of a bitcoin BlackRock ETF is: What does it imply for the value, market cap, liquidity, adoption, demand, and many others.? This isn’t a brand new bitcoin-centric startup launching an funding automobile, however moderately the biggest monetary establishment on the earth that carries weight for market adoption within the age of passive funding autos.

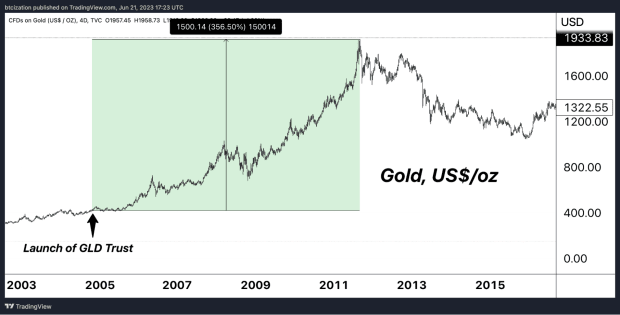

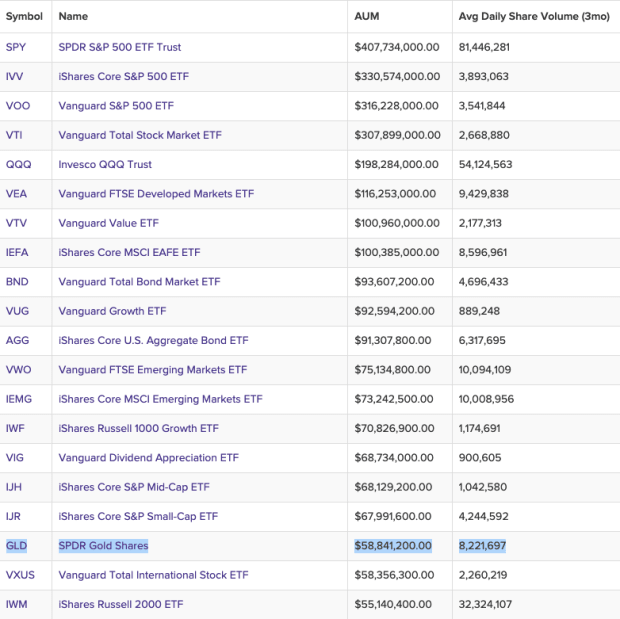

For comparability, let’s have a look at the SPDR Gold Shares (GLD), the biggest gold ETF by property underneath administration (AUM) that began in 2004. It’s nonetheless one of many largest ETFs available in the market right this moment with $58 billion AUM. In November 2004, the ETF had over $1 billion in whole asset worth within the first few days after which hit $50 billion by 2010.

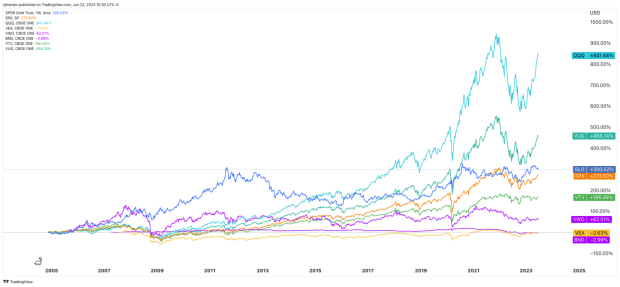

In comparison with lots of the high ETFs available in the market, GLD has been among the best performing ETFs since its inception, solely behind QQQ and Vanguard’s Development ETF. This solely accounts for ETF efficiency since GLD’s begin date versus evaluating comparable begin dates of different ETFs.

GLD is only one of some giant gold ETFs in the marketplace. Complete gold ETF merchandise are estimated to have $220 billion in AUM as of final month. In 2022, gold in tonnes held by ETFs accounted for 1.66% of estimated above floor gold provide. A a lot bigger share of gold provide, round 15%, resides in central financial institution reserves closely dominated by the US, Germany, Italy, France, Russia, China and Switzerland.

Clearly, it’s not straightforward to separate the influence of a broadly adopted gold ETF on gold’s worth over the past twenty years, but it surely’s clear that the ETFs, even accounting for less than a small quantity of gold provide, have had a big influence in the marketplace. The GLD ETF was a significant shift in how traders may buy gold and basically opened up gold shopping for to the lots whereas growing gold market volumes and total liquidity. In a restricted method, there’s already been a few of that influence through the GBTC belief with all its limitations. In comparison with bitcoin right this moment, GBTC’s 3.2% of circulating provide was a main driver of bull market mania regardless of locking up solely a small share of bitcoin provide.

Coupled with new narratives and a little bit of gold mania into 2011, the GLD ETF was a key spark for a 350% rise over 6 years. Bitcoin is on a path to undergo an analogous shift the place a extra complete ETF with extra regulatory readability will provide it to the lots, each institutional cash and 401K or IRA model accounts. It’s not the self-custody bitcoin this publication advocates for, however it’s a important improvement available in the market that many will possible go for because it’s a market want for these wanting monetary publicity to bitcoin on a bigger scale, with out the accountability of holding their very own keys.

However what about worth suppression schemes, just like those that huge banks have traditionally used to tamper the value of gold? Bitcoin’s design traits largely protect it from the kind of worth manipulation that conventional property like gold have traditionally skilled. In contrast to gold, whose bodily nature makes it laborious to confirm, assay, safe and transport — resulting in dependency on futures contracts that may be manipulated — bitcoin exists on a clear and immutable ledger.

Moreover, Bitcoin’s digital nature and decentralized construction allow just about cost-free and close to on the spot settlement of transactions, which permits for manipulation and worth dislocations within the futures market to be settled with ease in comparison with gold, which is far more expensive to retailer and transport. Therefore, the kind of worth suppression seen within the gold market is essentially difficult to duplicate within the bitcoin market.

Conclusion: The Future Of Bitcoin ETFs And The Path Ahead

After all the Bitcoin ETF battle and regulatory debate over time, it’s turning into clear that BlackRock is probably going a number one candidate to advance some form of new bitcoin funding automobile in the US. The SEC’s delay in readability and regulation over time, all however appears a part of a broader plan to get the market’s dominant bitcoin ETF funding possibility into the fingers of certainly one of America’s largest conventional finance establishments. Though different ETFs might get accepted, it’s possible a winner-takes-all market or an oligopoly when it comes to preliminary flows, competitors and dimension of AUM.

Primarily based on the usual procedural timelines, the very best guess is that an ETF approval is on the horizon for someday in early 2024. It’s a well timed transfer as it is going to coincide in the identical 12 months as Bitcoin’s subsequent halving. Ideally, that is the proper time for institutional traders to get publicity to bitcoin whereas additionally enjoying right into a gold-like-mania narrative, to drive elevated market curiosity proper earlier than Bitcoin’s deliberate provide issuance schedule will get minimize in half.

Though useful for worth and boosting institutional demand and entry, be cautious of the second- and third-order results of this ETF. Broad adoption of BlackRock’s ETF, full with bitcoin IOUs, will provide extra paper bitcoin variants to emerge. This might result in a small cohort of establishments having a big influence on total worth and market liquidity due to the massive dimension of their monetary flows. Different results might embrace rehypothecation, figuring out “clear” versus “soiled” bitcoin and affect of recent establishments on future hard-fork eventualities.

In abstract, the sort of funding automobile is an inevitable path for an asset that’s gaining institutional adoption similtaneously the market expands with many others demanding bitcoin publicity. BlackRock is free to buy bitcoin like anybody else. Finally, it’s as much as the market to resolve and create higher bitcoin custody options over time that may outcompete pseudo-bitcoin ETFs and IOU-like merchandise.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

- Earlier Than You Suppose: An Goal Look At Bitcoin Adoption

- Grayscale’s SEC Listening to Provides New Hope For GBTC Traders

- The State Of GBTC: Low cost Shrinks For The First Time In Over A 12 months