The abstract judgment within the Ripple vs. the US Securities and Change Fee (SEC) case is widely known as an enormous victory for XRP and the whole crypto house. Whereas the court docket decided that Ripple’s sale of XRP to institutional buyers constituted an illegal safety sale, it discovered that XRP didn’t qualify as a safety when bought to most people.

Influence Of The Ripple Ruling On Ethereum

Bryan Jacoutot, Associate at Election Regulation Group, delved into the intricacies of the ruling, expressing skepticism about its reasoning. In a Twitter thread he argues that the court docket’s distinction between institutional buyers and programmatic patrons is flawed. The court docket held that because the programmatic patrons didn’t know who was promoting them XRP, they may not have anticipated income from the efforts of Ripple.

Nonetheless, Jacoutot contends that underneath the well-known Howey check, the main target ought to be on whether or not patrons anticipated income from the efforts of a 3rd celebration, no matter realizing the particular vendor. He questions why the court docket emphasised the funding of the widespread enterprise somewhat than the patrons’ expectation of income.

Jacoutot additional factors out that the court docket’s ruling is proscribed to the particular context of institutional buyers and doesn’t handle the problem of whether or not secondary gross sales, corresponding to peer-to-peer transactions via exchanges, represent securities. Due to this fact, even when the ruling is upheld, it doesn’t present readability for different cryptocurrency tasks.

Furthermore, the implications prolong past Ripple to the Ethereum Basis, to ETH and all different pre-minded cash. Jacoutot wrote:

I’ve reviewed the district court docket ruling on XRP and it rests on very shaky floor. Anticipate an enchantment. AND Ethereum Basis stays in danger even whether it is upheld due to vital distinctions within the strategies utilized by Ripple to promote the pre-mine.

The lawyer highlights the similarities between the pre-sale of Ethereum and Ripple Labs’ sale to institutional buyers. He notes that within the Ethereum presale, patrons have been conscious they have been buying ETH from the Ethereum Basis, which the court docket discovered vital within the Ripple case.

Moreover, the Ether bought in the course of the pre-sale have been topic to a lockup interval, additional paralleling the circumstances that led the court docket to deem Ripple’s sale to institutional buyers as a safety providing. This implies that Ethereum can also face authorized challenges concerning its pre-sale actions, in response to the lawyer.

Chia Jeng Yang, Principal at American hedge fund Pantera Capital, echoes this opinion. Through Twitter Yang acknowledged that “Ripple’s ruling appears to be optimistic information for market makers, and for tokens which might be decentralized sufficient,” including that it’s “dangerous information for anybody who held a non-public sale/ICO, even to institutional buyers.”

General, the Ripple ruling represents a big improvement within the regulatory panorama for cryptocurrencies. Whereas it’s undoubtedly a victory for Ripple, the potential repercussions prolong past the corporate itself. The Ethereum Basis and different tasks face lingering uncertainties, and the court docket’s resolution leaves many different advanced securities questions unanswered. An act of the U.S. Congress may change that.

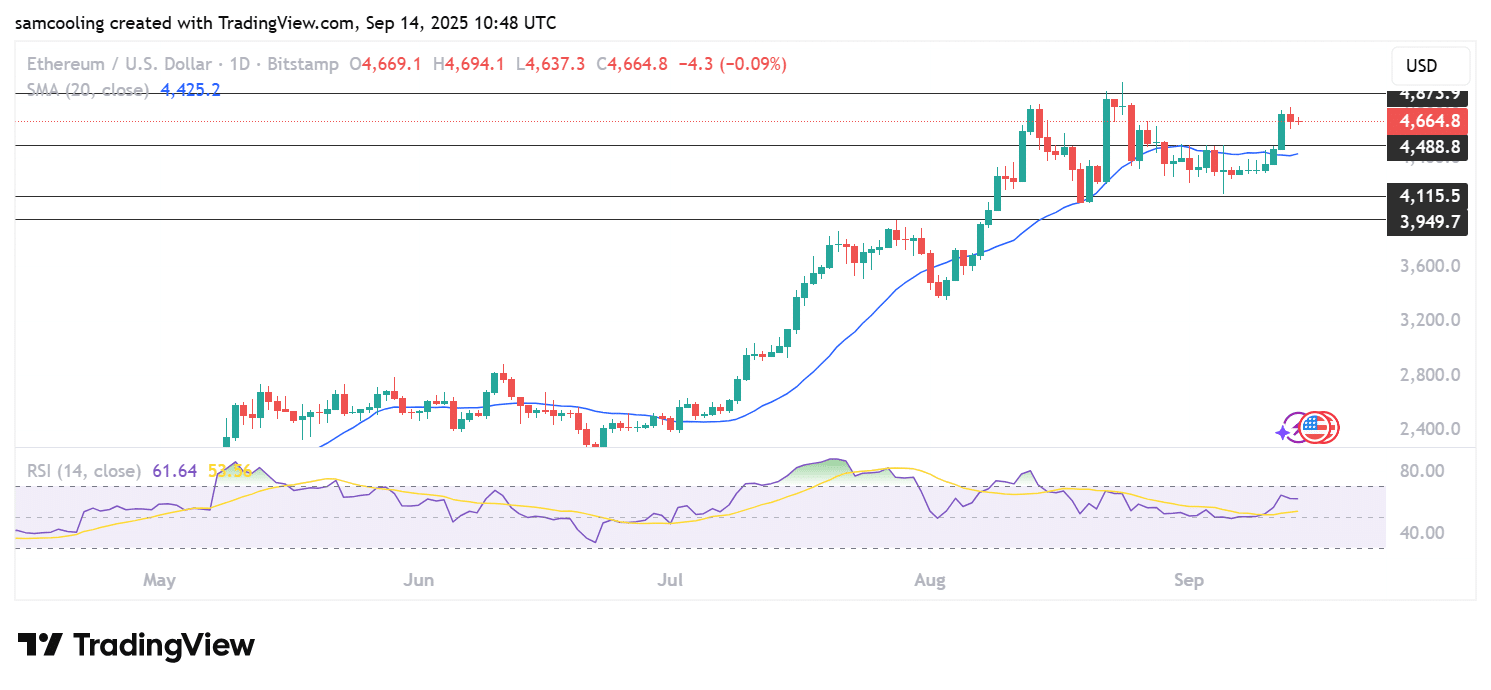

At press time, the Ether worth stood at $2,000.

Featured picture from rc.xyz NFT gallery / Unsplash, chart from TradingView.com