Gary Gensler, Chairman of the U.S. Securities and Change Fee (SEC), addressed the XRP case and the latest verdict. A U.S. court docket dominated that the token will not be a safety, granting a win for cost firm Ripple.

Associated Studying: Ripple CEO Garlinghouse Takes On SEC, Calls Them A ‘Bully’ In Wake Of XRP Ruling

The SEC sued Ripple Labs in 2020, accusing the corporate of violating the regulator’s guidelines by promoting XRP with out registering it as a safety. The end result of this case is essential for the crypto trade setting a precedent that would have penalties for years to come back.

Gensler Dissatisfied Over XRP Case?

Whereas addressing the Nationwide Press Membership occasion, Gensler authorised the court docket’s judgment about institutional traders. Nevertheless, he overtly expressed his disappointment with the ruling regarding retail traders. “We’re nonetheless it and assessing that opinion,” Gensler stated, signaling the SEC’s ongoing deliberation.

Whatever the court docket’s ruling, SEC Chair Gary Gensler assured that the regulator’s mission to make sure compliance throughout the crypto trade stays “undeterred.” He said that the SEC would persist in its efforts to convey enforcement actions and facilitate the registration of crypto corporations, thereby sustaining the “trade’s integrity.” Gensler reiterated:

We’re going to proceed to attempt to convey corporations that is probably not in compliance into compliance — with out prejudging any considered one of them — and check out to make sure that we defend the investing public.

Ripple Ruling – A Combined Bag For The SEC And The Crypto Trade

As Bitcoinist reported lately, a federal choose in New York delivered a ruling concerning the standing of Ripple Labs Inc.’s XRP token that has garnered vital consideration. The choose declared that XRP was a safety when offered on to institutional traders below particular written contracts.

Nevertheless, when the token was offered to retail traders on crypto exchanges, XRP was not deemed a safety. The decision has not categorized such transactions as securities, inflicting a divergence within the token’s authorized standing primarily based on the investor’s nature.

This differential ruling has evoked diverse responses. The crypto neighborhood has interpreted this determination as a win for the trade, asserting that it may set a precedent for comparable circumstances. In distinction, SEC Chair Gary Gensler has expressed his reservations in regards to the court docket’s determination.

This regulatory saga has undoubtedly garnered the eye of traders, corporations, and spectators throughout the crypto house. Significantly, the developments on this case and their ensuing affect on the regulatory panorama of the crypto trade will stay below scrutiny.

In the meantime, XRP, within the final 24 hours, has seen a slight retracement of 1.3% following its enormous spike of greater than 50% over the previous week. This modest downturn can also be mirrored in its market cap. Over $1 billion has been wiped off in the identical timeframe, bringing XRP’s market cap to a present $38.5 billion as of writing.

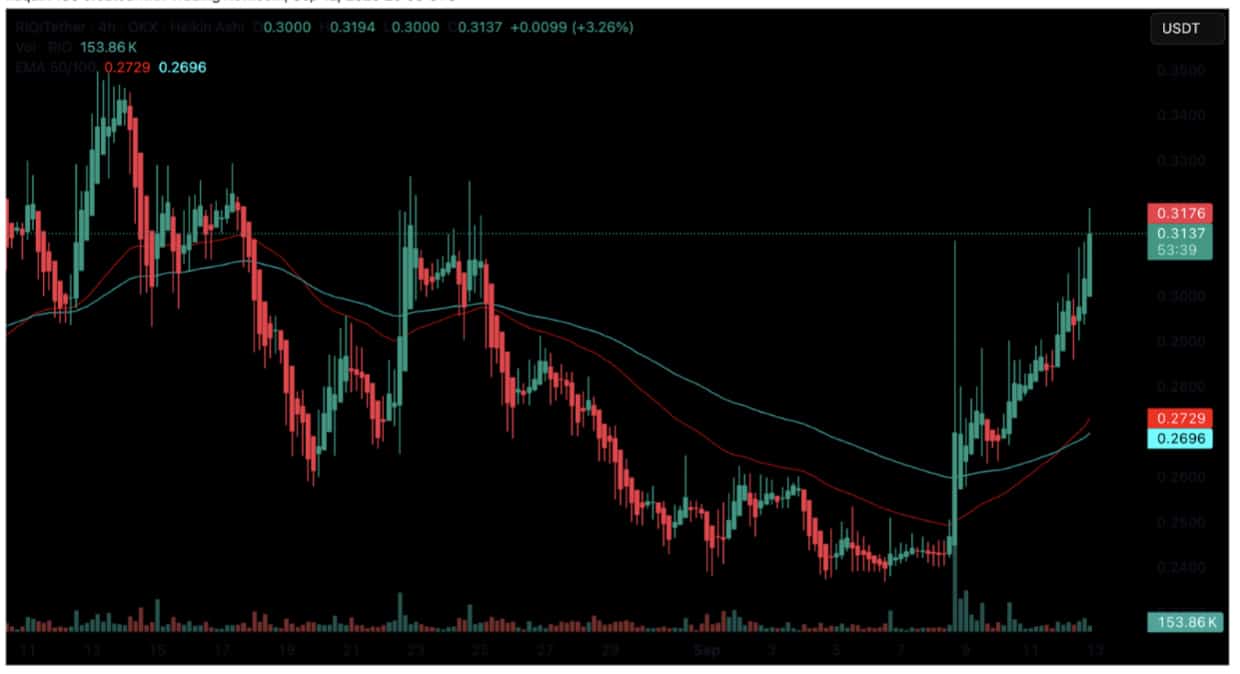

Featured picture from CoinDesk, Chart from TradingView