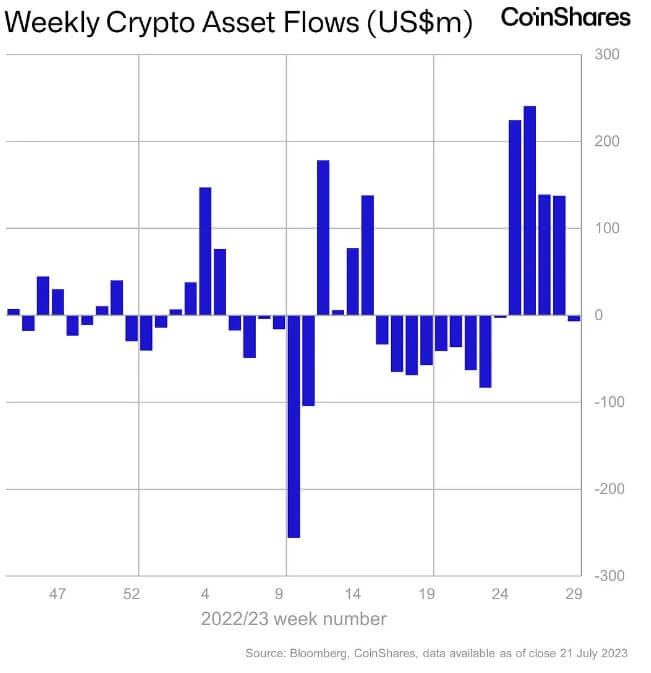

Digital belongings funding merchandise recorded $6.5 million in outflows this week after 4 consecutive weeks of inflows totaling $742 million, Coinshares reported on July 24.

This week’s outflows break the longest streak of inflows since late 2021, coinciding with the latest market downturn that noticed Bitcoin’s (BTC) worth dump to its lowest worth since June 21.

Coinshares additional reported that the buying and selling quantity for the week ending July 21 was $1.2 billion, under the 12 months’s weekly common of $1.4 billion and considerably decrease than the $2.4 billion recorded within the week ending July 14.

Ethereum, and XRP see inflows.

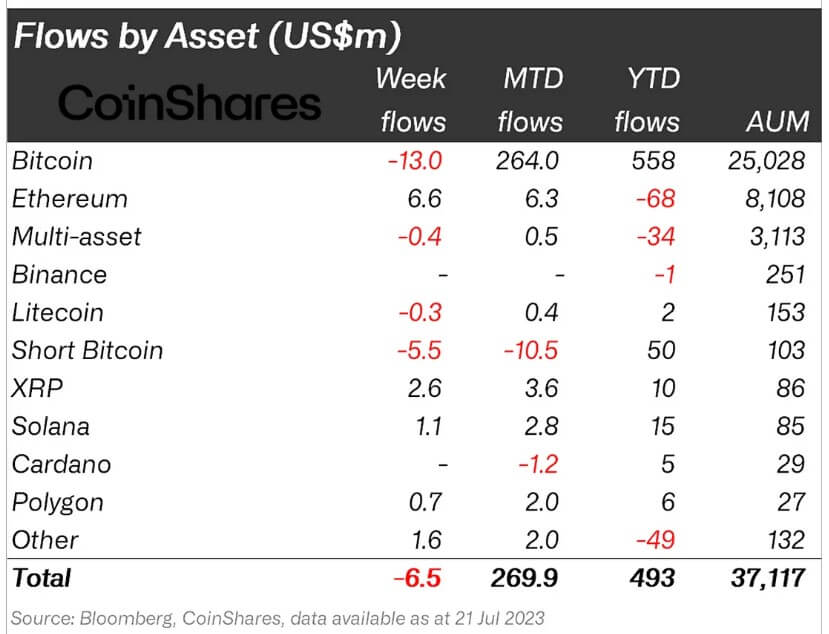

Through the previous week, Ethereum (ETH) funding merchandise topped the leaderboard for inflows seeing $6.5 million in influx.

James Butterfill, the pinnacle of Coinshares analysis, wrote that the inflows counsel that sentiments surrounding the asset may change. Because the starting of the 12 months, ETH has seen outflows of $68 million on the year-to-date metric.

In the meantime, XRP noticed inflows of $2.6 million in the course of the interval, taking its year-to-date influx to $10 million.

Coinshares famous that buyers’ confidence in XRP has grown following Ripple’s partial victory towards the U.S. Securities and Alternate Fee (SEC). In keeping with the agency, the digital asset funding merchandise noticed a $6.8 million influx over 11 weeks.

Different altcoins, together with Solana (SOL), Polygon (MATIC), and Uniswap (UNI), recorded minor inflows at $1.1 million, $0.7 million, and $0.7 million, respectively.

Bitcoin dominates outflows

After weeks of dominating inflows, buyers withdrew $13 million from Bitcoin funding merchandise. Compared, the brief BTC funding product continued its streak of outflows with $5.5 million flows to mark the thirteenth consecutive week.

The belongings beneath administration for brief bitcoin investments now stand at $103 million. At its peak, it accounted for 1.4% of all Bitcoin funding merchandise. It has now dropped to 0.4%.

Coinshares said that the outflows have been primarily as a consequence of damaging sentiment within the North American market, the place 99% of the $21 million outflows got here from. However inflows of $12 million in Switzerland and $1.9 million in Germany have been in a position to offset the influence.

The submit Bitcoin sees first outflows in a month as Ethereum, XRP get pleasure from buyers’ confidence appeared first on CryptoSlate.