A extensively adopted crypto strategist says a brief squeeze may materialize for an altcoin mission that simply suffered a $41 million hack.

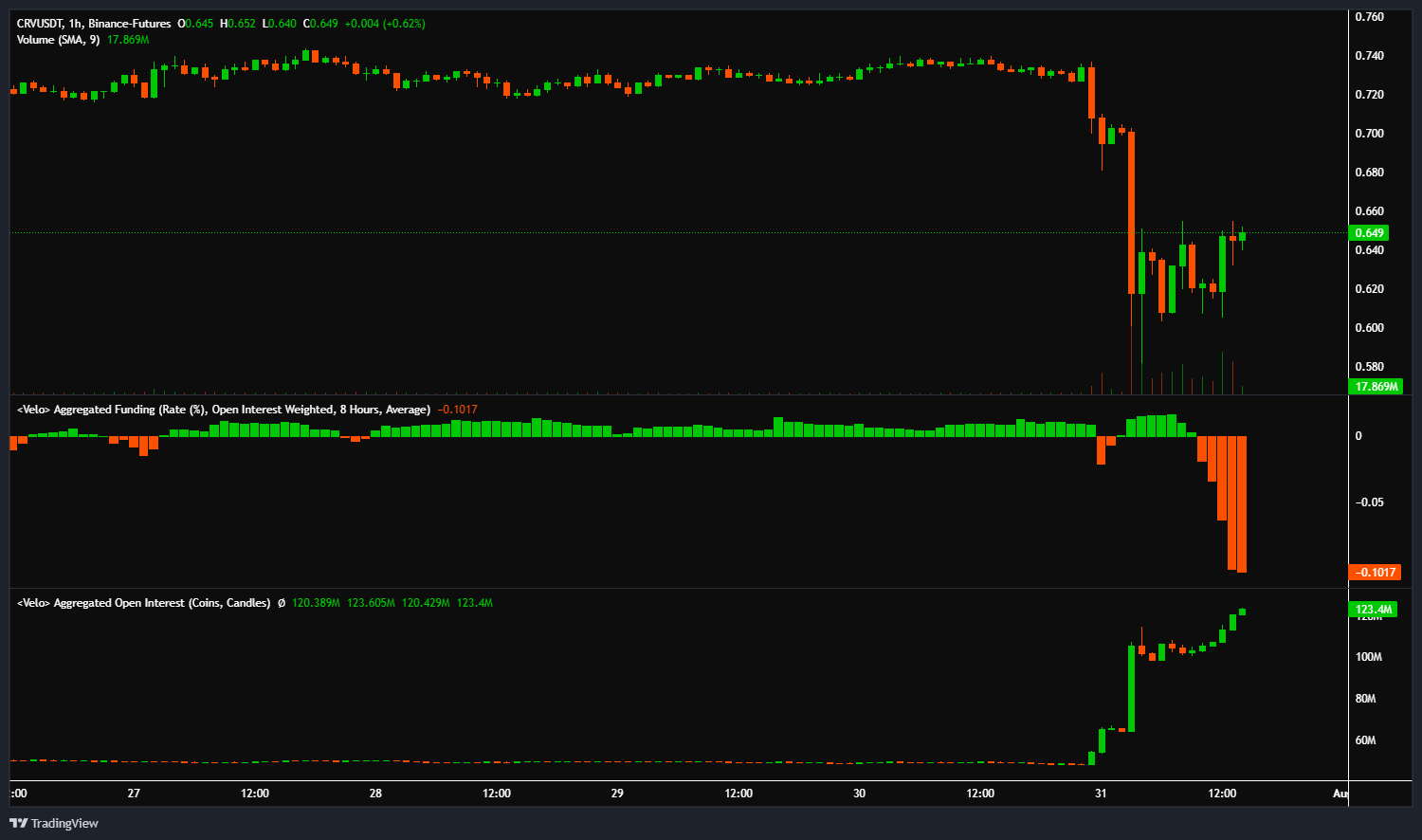

Pseudonymous analyst Credible Crypto tells his 343,200 Twitter followers that Curve (CRV) is experiencing a large quantity of quick curiosity.

Nevertheless, the analyst says that if the native token on the decentralized finance (DeFi) Curve platform doesn’t quickly transfer additional down from its present worth it could set off a brief squeeze.

A brief squeeze occurs when merchants who borrow an asset at a sure value in hopes of promoting it for decrease to pocket the distinction are compelled to purchase again the property they borrowed as momentum strikes in opposition to them, triggering additional rallies.

“Additionally value noting the huge improve in shorts down at these ranges. Whereas one other swing down looks like the apparent transfer to me (and clearly many others) the excessive quick curiosity right here may facilitate a squeeze in the wrong way if we don’t transfer down quickly. The subsequent couple of days might be attention-grabbing to say the least.”

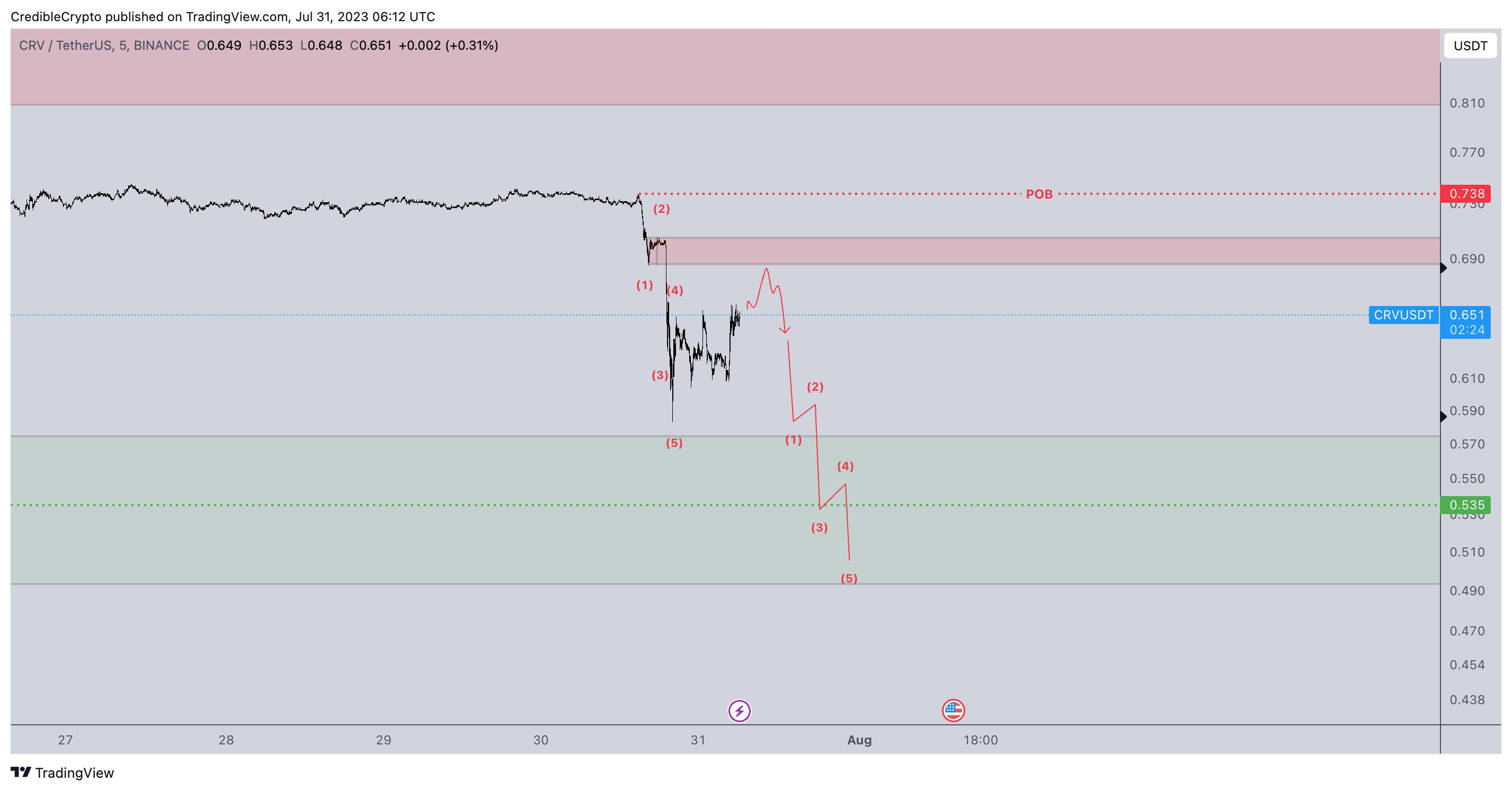

In accordance with the dealer, CRV may decline from its present worth at time of writing of $0.59 to $0.49, a 17% lower. He makes use of the Elliott Wave idea, which states that the principle development of the worth motion of an asset happens in a five-wave sample to reach at his backside value goal.

“Whereas the mud could also be beginning to choose the current CRV occasions, we’re nonetheless ready on a few wild playing cards that have to be addressed earlier than we are able to return to focusing completely on the charts. These points are most likely addressed within the subsequent 48-72 hours.

Within the meantime and from a purely technical perspective, I don’t assume our drop is finished but. If we are able to get again above the RED ZONE and level of breakdown (POB) then it probably is, however till then I anticipate that this transfer down isn’t but full – and on the lookout for a push into the GREEN zone under for now. This is identical zone I highlighted in my prior chart a few month in the past – so the degrees haven’t modified. Let’s see how issues develop over the following couple days.”

Curve said on Sunday that due to a vulnerability with the programming language Vyper 0.2.15, a number of liquidity swimming pools on the platform had been exploited. Customers within the affected swimming pools had been informed to withdraw their funds.

Blockchain safety infrastructure agency BlockSec estimates the hack resulted in a theft of greater than $41 million.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney