That is an opinion editorial by Bitcoms, a Bitcoin-focused author and licensed accountant.

With mainstream monetary administration titans equivalent to BlackRock, Constancy and Vanguard all legitimizing BTC as a monetary asset by way of their curiosity in providing associated merchandise to purchasers, the “massive cash” worldwide could be poised to extend its publicity to bitcoin. These vital buyers might not but see the liberating, world-improving, hard-money features of the know-how that I see, however they’re prone to have an effect on bitcoin as a retailer of worth all the identical.

And, if something, I imagine the possible worth impact of great quantities of capital being interested in bitcoin is underestimated by most Bitcoiners. It’s now widespread to explain bitcoin’s potential worth ceiling as “everything divided by 21 million” — a reference to all saved worth divided by the entire attainable provide of bitcoin. However, in my opinion, an affordable heuristic for predicting bitcoin’s worth is “every part divided by 7 million” (the place “every part” is the entire reallocated of capital to bitcoin, nonetheless excessive that could be). This implies, for instance, that bitcoin may hit $1 million with solely one-third of the redirected capital generally considered wanted.

To indicate why it is a extra useful yardstick, I’ll develop on some current methods of estimating newly-allocated capital’s impact on bitcoin’s worth, adjusting the outcomes for what I see as three important however uncared for components.

Current Instruments For Predicting Bitcoin’s Worth

For an preliminary bitcoin worth projection, we’ll use two current instruments, each born of deep analysis and thorough evaluation: a framework proposed by Onramp COO Jesse Myers (also known as Croesus) and a mannequin produced by Swan CIO Alpha Zeta.

For our instance state of affairs, we’ll presume $20 trillion of funding capital flowing out of conventional property and into bitcoin (the precise quantity isn’t too essential, as we’ll flex the numbers up and down later). For the sake of simplicity and comparability, our instance state of affairs is timeframe agnostic (so, all figures are in immediately’s {dollars}).

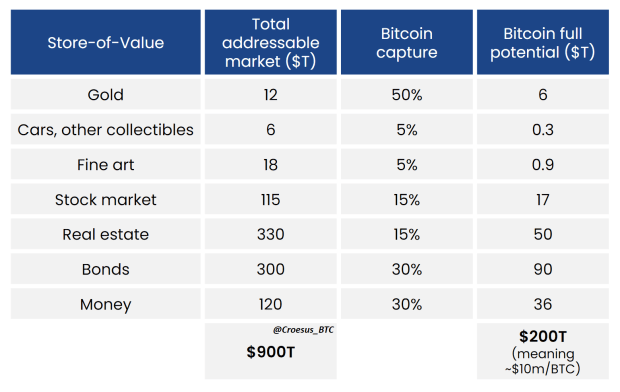

Myers’ framework, revealed earlier this 12 months, posits a most potential bitcoin market capitalization of $200 trillion, estimated by capturing that quantity from his personal $900 trillion estimate of the entire of current store-of-value property and assuming bitcoin will seize some share of every class.

As indicated within the backside proper of the above desk, the framework suggests a most potential bitcoin seize of $200 trillion, resulting in an approximate bitcoin worth of $10 million ($200 trillion divided by about 20 million equals about $10 million per BTC.)

In his commentary, Myers means that “you possibly can run your personal numbers right here for the ‘Bitcoin seize’ column and see what you give you.” So, if we scale every part down by an order of magnitude for our extra modest bitcoin seize of $20 trillion (roughly 2.2% of Myers’ $900 trillion “whole addressable market”), the identical arithmetic offers us an anticipated worth of about $1 million per BTC.

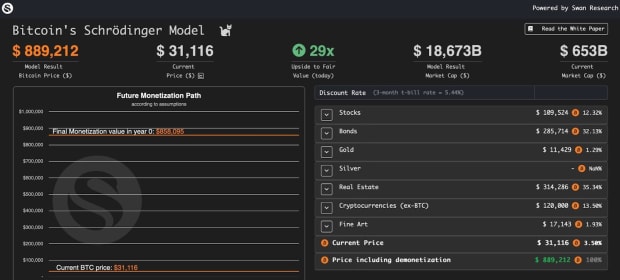

In the meantime, Alpha Zeta’s mannequin is a complicated, interactive instrument with a configurable set of enter parameters, which (with apologies to its creator) I crudely manipulated to approximate the values we used with Myers’ framework. As a result of the instrument permits just for spherical percentages, I modeled Bitcoin’s asset seize at solely 2% (not the roughly 2.2% used with Myers’ mannequin) of $900 trillion. This leads to precisely what I might have anticipated: the same, however barely decrease, BTC worth projection of round $900,000 per coin.

For the sake of coping with spherical numbers, let’s say that in capturing about $20 trillion in world funding capital, each instruments would counsel an anticipated bitcoin greenback worth of about $1 million. These instruments will not be solely logical, but additionally in line with one another. So, what may they miss?

Ignored Issue One: Misplaced Bitcoin

Each instruments appear to base their worth predictions on a reallocated greenback worth divided by a tough whole variety of bitcoin in situation (about 20 million). Nevertheless, this ignores the truth that some issued bitcoins are unavailable.

First, take into account misplaced cash. The variety of bitcoin which were misplaced is not possible to quantify with precision, however it has been estimated at almost 4 million in a 2020 report by Chainalysis. Cane Island Digital’s 2020 report “There Will By no means Be Extra Than 14 Million Bitcoins” suggests the next variety of about 5.4 million misplaced cash. I sought a 3rd opinion from main on-chain analyst Checkmate for this text, who kindly shared an preliminary estimate of “round 3.942 million BTC.”

Utilizing a mean of those three information factors, we are able to justifiably posit that, of the 19.4 million bitcoin issued up to now, round 4.4 million are misplaced, leaving 15 million accessible by their house owners. That is considerably lower than the roughly 20 million sometimes utilized in bitcoin pricing fashions.

Ignored Issue Two: Hardcore HODLers

Second, take into account what quantity of this accessible 15 million bitcoin may by no means be bought for fiat. The obvious existence of “hardcore HODLers” — true believers who’re unwilling to sell at any price — signifies that the overall aphorism that “everybody has their worth” might not essentially apply to Bitcoin.

Doubtlessly-useful analysis on this neglected issue is a Glassnode report from 2020, which concluded that “14.5 million BTC might be categorized as being illiquid.” This was constructed upon by Rational Root in his 2023 “HODL Mannequin,” which hypothesizes that by “2024, the illiquid provide… might be… 14.3 million bitcoin.” Subtracting our earlier estimate of 4.4 million misplaced cash from this whole illiquid provide determine (which incorporates misplaced bitcoin), these sources counsel that about 10 million of the roughly 15 million accessible bitcoin are on this “illiquid” class, i.e., their HODLers are unwilling to promote.

However quantifying what number of of these 10 million illiquid cash might be “hardcore HODL’d” by the diamond handed within the face of unprecedented bitcoin worth appreciation is actually past the boundaries of research and firmly within the realms of conjecture. It appears completely rational to me to anticipate many current HODLers to half with a minimum of a portion of their stack if the fiat worth rises to new all-time highs. Recognizing that any “guesstimate” is extra smart than ignoring this phenomenon altogether, I’m going to suppose simply half of these 10 million illiquid bitcoin might be “hardcore HODL’d” as the worth goes up.

The Worth Impact Of Unavailable Cash

So, as soon as we’ve allowed for 4.4 million misplaced and 5 million “hardcore HODL’d” bitcoin, that leaves round 10 million cash accessible for the $20 trillion of captured worth in our instance state of affairs. $20 trillion divided by 10 million offers us a $2 million imply worth paid per BTC.

That imply of $2 million is double the valuation instruments’ unadjusted worth estimate of $1 million. So, for me, at this level an affordable heuristic for gauging the imply bitcoin worth is: “every part divided by 10 million” (the place “every part” is the entire fiat newly allotted to bitcoin, nonetheless a lot that could be).

Ignored Issue Three: Volatility

However $2 million is the imply worth in our instance state of affairs, and the worth at any given time throughout bitcoin’s absorption of the $20 trillion may very well be considerably increased or decrease. So, we additionally must predict the vary inside which the worth may transfer.

Utilizing historical past as a information, we see that the dollar-BTC worth has turn out to be much less risky as bitcoin has grown up from toddler to a young person, with the ratio of the major USD price tops to subsequent bottoms shrinking as follows:

Presuming that this development towards decrease volatility continues, over the subsequent few years we’d plausibly anticipate a high-to-low ratio of round three. Towards our instance state of affairs’s longer-term shifting common worth of $2 million, that may translate to short-term lows of about $1 million and short-lived highs of about $3 million.

That prime of $3 million is triple the valuation instruments’ unadjusted worth estimate of $1 million. So, for me, an affordable present heuristic for gauging the most worth is: “every part divided by 7 million” (the place “every part” is the entire fiat newly allotted to bitcoin, nonetheless a lot that could be).

Scaling The Instance State of affairs

Subsequent, we’ll regulate the quantity of latest capital being reallocated to bitcoin to create various eventualities, as follows:

Primarily based on this, for bitcoin’s worth to hit $1 million, somewhat than requiring the roughly $20 trillion reallocation of world funding capital advised by the uncooked instruments, solely round one third of that quantity could be wanted.

Though modest-sounding within the context of world wealth, such a reallocation would nonetheless contain vital participation by massive, slow-moving and conservative swimming pools of capital. For my part, whereas that is attainable over the medium- or long run, this appears inconceivable inside the subsequent few years with out seismic disruption in monetary markets (equivalent to a significant sovereign debt disaster, banking system collapse or persistently vertiginous inflation) accelerating the mandatory paradigm shift away from “fiat considering.”

Within the absence of such an occasion inside that point, I see one thing like the primary and most modest state of affairs within the desk as extra possible, with momentary highs within the low lots of of hundreds of {dollars} as “massive capital” slowly reallocates to bitcoin.

You might after all have your own opinion on an applicable heuristic. However, having thought of the function of volatility and accounted for unavailable bitcoin (each misplaced and “hardcore HODL’d”), I feel “every part divided by 7 million” is an affordable gauge for the doubtless peak worth affect of capital redirected to bitcoin. Whereas “every part” right here is the entire of that capital — which may theoretically be as a lot as all of the saved worth on this planet — any credible guess at a future worth must be primarily based on a sensible degree of reallocation to bitcoin.

It is a visitor publish by Bitcoms. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.