In current months, 19 cryptocurrencies, notably deemed unregistered securities by the Securities and Change Fee (SEC), skilled a dramatic dip of their mixed market worth, shedding roughly $20 billion.

These tokens included Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), Chiliz (CHZ), Close to (NEAR), Stream (FLOW), Web Pc (ICP), Voyager Token (VGX), Sprint (DASH), Cosmos (ATOM), Binance Coin (BNB), Binance USD (BUSD), COTI (COTI), and Nexo (NEXO).

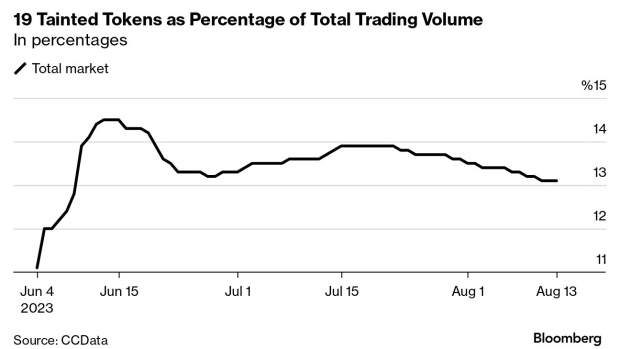

Nevertheless, opposite to expectations, these tokens have witnessed a noticeable upswing in buying and selling volumes since mid-June. The backdrop of this surprising rise lies within the June lawsuits that the SEC filed in opposition to prime exchanges, Binance and Coinbase International Inc.

The repercussions had been extreme, and the implicated tokens bore the brunt. However the crypto realm usually defies the norm.

Resilient Restoration Amid Regulatory Woes

Simply two months after the numerous blow to their market cap, these 19 digital tokens have began exhibiting indicators of restoration, no less than in buying and selling volumes. Bloomberg reported citing Knowledge from CCData which means that their cumulative buying and selling share has escalated by roughly two proportion factors, pegging it at about 13%.

This revival comes though their general market value has diminished by roughly 20% for the reason that graduation of the lawsuits.

Curiously, platforms equivalent to Bakkt, Robinhood Markets Inc., and Bitstamp have delisted a few of these tokens. Nevertheless, the ambivalence stemming from a court docket ruling relating to XRP – a case specializing in classifying what constitutes safety – has inspired merchants to wager on these tokens.

Kyle Doane, a dealer at Arca, remarked:

The tokens which were named as securities are being traded as a proxy for regulatory readability. For the reason that XRP ruling, regulatory readability has theoretically worsened, leading to poor value motion.

Various Fortunes For Totally different Tokens

Notably, not all tokens had been destined for a constant path. The Solana blockchain’s native forex, SOL, took a considerable preliminary hit of round 35% up to now two months. Nevertheless, it has since rallied to register a virtually 10% achieve over the previous 14 days. This value motion has introduced its value to commerce barely under $25 on the time of writing.

In distinction, ADA, Cardano’s native token, continues to wrestle, declining about 20% for the reason that begin of June. The asset has continued to swim in pink, with a buying and selling value of $0.289, on the time of writing.

In line with Bloomberg, the improved buying and selling quantity might be attributed to merchants’ inherent attraction to potential value volatility in comparison with the broader crypto market.

As an illustration, Bitcoin’s value has remained comparatively secure for months. Gavin Michael, the CEO of Bakkt, noticed, “Many preliminary supporters stay energetic, persistently buying and selling out and in.”

Moreover, whereas some cash encountered a major value setback submit the lawsuit, most have recouped their losses. Jacob Joseph, a analysis analyst at CCData, emphasised the waning influence of the SEC’s authorized actions on a number of property.

Bloomberg identified one other important facet: the unwavering assist these “tainted” cash obtain internationally. International exchanges proceed to again them, with US exchanges representing a mere 10% of whole crypto buying and selling quantity. Notably, Binance and Coinbase, among the many most outstanding international and US exchanges, have stored these tokens listed.

Featured picture from Unsplash, Chart from TradingView