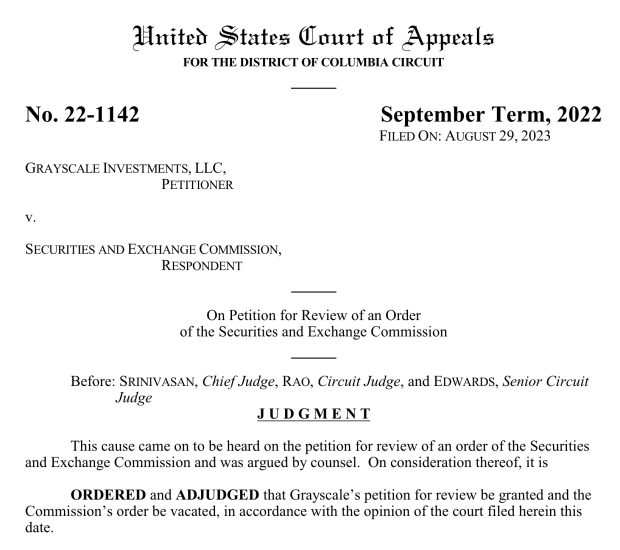

In the present day, it was introduced that the DC Circuit court docket of appeals is vacating SEC’s denial of Grayscale’s $GBTC conversion right into a spot Bitcoin ETF.

“We agree,” mentioned Circuit Choose RAO. “The denial of Grayscale’s proposal was arbitrary and capricious as a result of the Fee failed to elucidate its completely different therapy of comparable merchandise. We due to this fact grant Grayscale’s petition and vacate the order.”

You will need to notice that this doesn’t imply GBTC is robotically being transformed to a spot Bitcoin ETF, though this victory does convey us one step nearer to that actuality. The order is being vacated and despatched again to the SEC. The SEC now has 45 days to attraction and file for an en banc listening to, which implies the case will likely be heard by all 17 judges on the court docket as an alternative of simply the three that had been concerned in right this moment’s determination, according to Bloomberg ETF analyst James Seyffart.

“The Fee neither disputed Grayscale’s proof that the spot and future markets for bitcoin are 99.9% correlated, nor advised that market inefficiencies or different elements would undermine the correlation…The Fee’s unexplained discounting of the plain monetary and mathematical relationship between the spot and futures markets falls in need of the usual for reasoned determination making,” Circuit Choose RAO. continued.

The value of GBTC pumped over 19% on the information and Bitcoin rose above 5%.